Awaiting the Federal Reserve's decision, pre-market stock index futures in the US are relatively stable, while international oil prices have dropped by 1%

美聯儲降息後,美股指刷新日高,鮑威爾發佈會後轉跌,標普終結七連漲,道指兩連跌,英偉達反彈失利收跌近 2%,蘋果逆市漲近 2%。美聯儲降息後,兩年期美債收益率一度跳水超 10 個基點,鮑威爾發佈會後轉升。美聯儲降息後,美元指數跌至 14 個月新低,鮑威爾發佈會後轉漲;美聯儲降息後,離岸人民幣盤中漲超 400 點突破 7.07 創 15 個月新高。原油止步兩連漲,美油跌落本月內高位,美聯儲降息後短線轉漲。

美聯儲宣佈大幅降息 50 個基點,並暗示今年還會降 50 個基點,但金融市場未能保持降息決議公佈後的走勢,美股衝高回落,主要股指盤中轉跌,黃金拉昇超 1% 至歷史新高後也轉跌,美債價格轉跌,盤中跳水的美債收益率轉升。

美聯儲週三會後宣佈四年來首次降息,且超常規降息 50 個基點,票委中僅一人反對如此幅度降息。點陣圖顯示,略為過半決策者預計,今年剩餘兩次會議至少每次降息 25 個基點。決議聲明新增堅定致力於支持充分就業、對通脹降至目標更有信心,改稱就業和通脹的風險大體均衡、就業增長已放慢。“新美聯儲通訊社” 評論稱,此次降幅超過幾天前多數分析師預期,美聯儲進入抗通脹新階段,要阻止此前加息進一步削弱勞動力市場。

但在美聯儲宣佈降息後,美聯儲主席鮑威爾在發佈會上的表態並未提供強力的鴿派信號,而是對繼續大幅降息表示警惕,警告不要將大幅降息視為未來的常規節奏,稱聯儲不急於完成降息,數據將推動貨幣政策選擇,降息將根據需要加快、放慢或暫停。有評論稱,此後美股回落源於交易者 “賣事實”,並且鮑威爾暗示不急於放鬆貨幣。不過,鑑於激進寬鬆往往和經濟壓力有關,聯儲不急於行動未必是壞消息。

美聯儲宣佈降息 50 基點後,三大股指跳漲,刷新日高時,納指漲近 1.2%,道指漲超 370 點、漲 0.9%,鮑威爾發佈會期間逐步回吐漲幅,發佈會後美股尾盤時三大指數齊轉跌,標普終結七日連漲,道指繼續跌離週二所創的收盤紀錄高位,週二反彈的納指回落,小盤股指驚險六連漲。

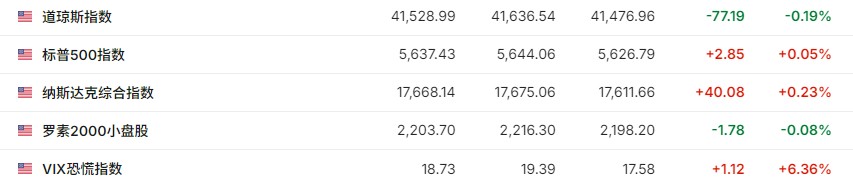

- 美股三大指數:標普 500 指數收跌 0.29%,報 5618.26 點。與經濟週期密切相關的道指收跌 103.08 點,跌幅 0.25%,報 41503.10 點。科技股居多的納斯達克綜合指數(納指)收跌 54.76 點,跌幅 0.31%,報 17573.30 點。

三大美股指在美聯儲公佈降息後刷新日高,鮑威爾發佈會期間回吐逐步漲幅,發佈會後齊轉跌

- 小盤股和科技股指:價值股為主的小盤股指羅素 2000 收漲 0.04%,六連漲,兩日刷新 8 月 30 日以來高位。科技股為重的納斯達克 100 指數收跌 0.45%,衡量納斯達克 100 指數中科技業成份股表現的納斯達克科技市值加權指數(NDXTMC)也跌 0.45%,均在週二反彈後回落。恐慌指數 VIX 收漲 3.52%,報 18.23。

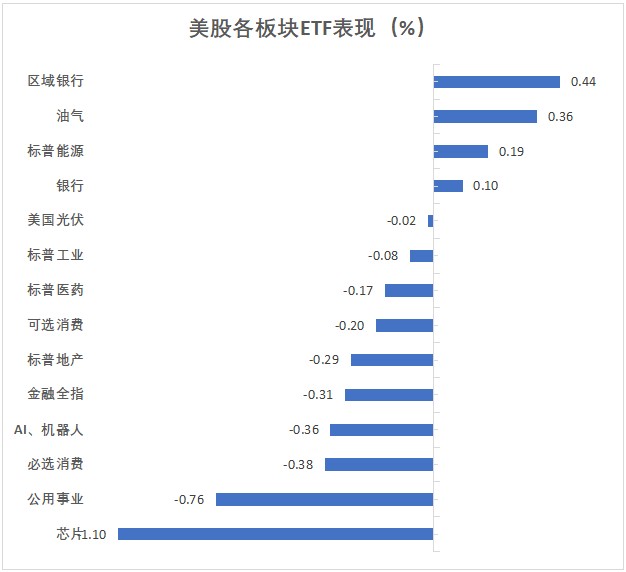

- 道指成分股和標普各板塊:道指成份股中,英特爾跌超 3% 領跌,霍尼韋爾、Visa、美國運通、寶潔跌超 1%,而蘋果漲 1.8%,表現最好。標普 500 各大板塊中,週三只有漲近 0.3% 的能源和微幅收漲的通信服務未收跌,公用事業跌近 0.8% 領跌,英偉達等芯片股所在的 IT 板塊跌逾 0.5%。

- ETF:美股行業 ETF 和大類資產 ETF 收盤多數下跌收盤多數下跌。區域銀行 ETF 與銀行業 ETF 各漲不足 0.5%,農產品基金與大豆基金各漲超 0.5%,而半導體 ETF 跌逾 1%,科技行業 ETF 與公用事業 ETF 各跌接近 1%,全球科技股 ETF 跌超 0.5%,美國布倫特油價基金與美國國債 20+ 年 ETF 各跌超 1%,恐慌指數做多-iPath 與黃金 ETF-SPDR 跌幅接近 1%,美國國債 7-10 年 ETF、納指 100ETF 及美國投資級公司債 ETF 跌幅接近 0.5%。

- 美股 “七姐妹”:包括微軟、蘋果、英偉達、谷歌母公司 Alphabet、亞馬遜、Facebook 母公司 Meta、特斯拉在內,科技巨頭 “七姐妹” 收盤漲跌各異。英偉達收跌約 1.9%,連跌四日,兩日刷新 9 月 10 日上週二以來低位,微軟跌 1%,特斯拉、亞馬遜至多跌 0.29%,Meta 和谷歌 A 則至少收漲 0.3%,蘋果漲 1.8%。

- 芯片股:週二艱難反彈的費城半導體指數收跌 1.08%,報 4859.29 點。成分股中,英特爾領跌,Wolfspeed 跌 3.02%,阿斯麥 ADR 跌幅第三大,英偉達、AMD、美光科技跌幅靠前,在收漲的四隻成分股裏,格芯漲 0.18%,LSCC 漲 1.66% 表現第二,COHR 漲 3.93%。

- 中概股:中概股總體回落,納斯達克金龍中國指數收跌 0.86%,報 5639.37 點。熱門中概股中,蔚來收跌 7%,極氪跌 6%,小鵬跌 4%,理想跌 3%,B 站跌 2%。ETF 中,中國科技指數 ETF(CQQQ)收跌 1.04%、中概互聯網指數 ETF(KWEB)收跌 0.58%。

- 波動較大的個股:與 NASA 前頂約 50 億美元太空網絡合約後,太空探索公司 Intuitive Machines(LUNR)收漲 38.3%;因風險/回報背景更均衡而被巴克萊將評級從減持上調至持有、預計股價上漲空間超 6% 後,內衣品牌維多利亞的秘密(VSCO)收漲 3.5%;媒體稱美國外國投資委員會批准新日鐵重新提交以 141 億美元收購該公司的計劃後,美國鋼鐵(X)收漲 1.5%;宣佈公開發行 4 億美元 A 類普通股後,固體廢物回收公司 Casella Waste Systems(CWST)收跌 5.8%;預計禮來 GLP-1 藥物帶來的競爭加劇將導致公司收入增長放緩、且被 Wolfe Research 將評級從持平同業降至低於同業水平後,醫療設備公司 ResMed(RMD)收跌 5.1%。

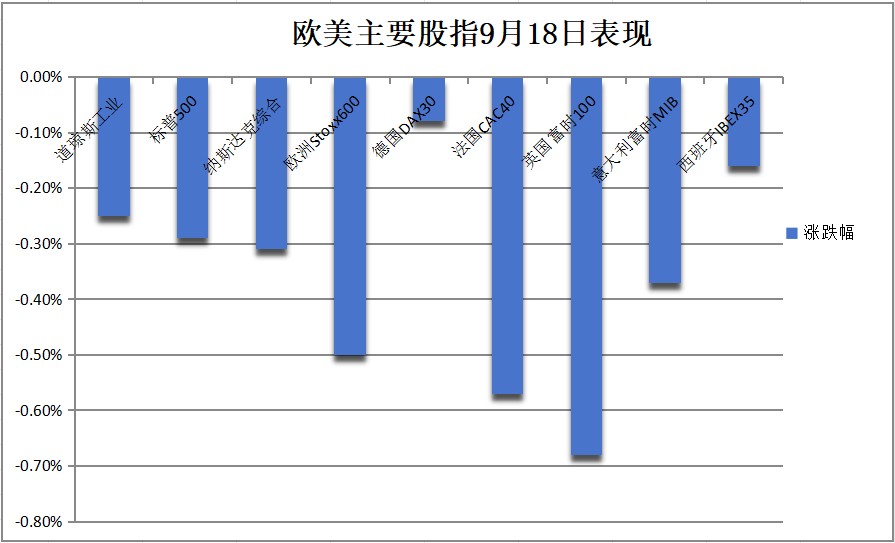

美聯儲公佈決議前,投資者遏制風險偏好,週二反彈的泛歐股指回落。

- 主要股指:週二刷新 9 月 3 日以來高位的歐洲斯托克 600 指數收跌 0.50%。主要歐洲國家股指週三齊跌。

- 板塊及個股:斯托克 600 各板塊中,食品與飲料跌 1% 領跌,受累於 CEO 上任五個月後突然宣佈因個人原因辭職的意大利酒業集團 Campari 跌 7.5%;醫療板塊跌約 0.7%,成分股中,在媒體稱其減肥神藥司美格魯肽很有可能在美國下一批降價藥物之列後,歐洲最高市值藥企諾和諾德跌約 2.4%。

美聯儲降息後,美債收益率集體下行,美聯儲主席鮑威爾隨後舉行新聞發佈會,迎來一波 V 型反轉,長期美債的收益率升幅居首。

- 10 年期美債:美國 10 年期基準國債收益率在美聯儲降息後迅速下破 3.70%、抹平日內升幅轉降,鮑威爾發佈會之初刷新日低至 3.6325%,發佈會期間重上 3.70%,美股尾盤刷新日高至 3.7188%,日內升超 7 個基點,脱離週二下破 3.60% 後刷新的 2022 年 6 月以來低位,到債市尾盤時約為 3.70%,日內升超 5 個基點,和其他期限美債的收益率均在連降兩日後連升兩日。

- 2 年期美債:對利率前景更敏感的 2 年期美債收益率在美聯儲公佈降息前先刷新日高至 3.6590%,公佈降息後迅速下破 3.60%,鮑威爾發佈會前曾下破 3.54% 至 3.5377%,較日高回落逾 12 個基點,鮑威爾發佈會期間重上 3.60% 後抹平日內降幅轉升,美股尾盤曾升破 3.63%,到債市尾盤時約為 3.62%,日內升近 2 個基點。

美債收益率在美聯儲降息後普遍下行、刷新日低,鮑威爾發佈會期間抹平降幅轉升

美聯儲降息後,美元指數跌至 14 個月新低,鮑威爾發佈會後轉漲;美聯儲降息後,離岸人民幣盤中漲超 400 點突破 7.07 創 15 個月新高,比特幣盤中漲超 2000 美元突破 6.1 萬關口、後轉跌。

- 美元指數:追蹤美元兑歐元等六種主要貨幣一籃子匯價的 ICE 美元指數(DXY)在美聯儲宣佈降息後跌幅迅速擴大,鮑威爾發佈會之初跌至 100.215,刷新 2023 年 7 月 20 日以來低位,日內跌近 0.7%,此後持續反彈,美股尾盤轉漲,刷新日高至 101.146,較日低漲超 0.9%,到匯市尾盤略低於 101.00。

彭博美元現貨指數盤中 V 形反彈

- 非美貨幣:週二結束四連漲的日元反彈,美聯儲降息後曾漲超 1%,美元兑日元在美聯儲決議後加速下跌,午盤跌至 140.45 刷新日低,日內跌近 1.4%,後反彈,一度轉漲並刷新日高至 142.71;歐元兑美元在美聯儲降息後曾逼近 1.1190,刷新 8 月 28 日以來高位,後回吐多數漲幅。

美聯儲降息後,美元兑日元盤中跌超 1%

- 人民幣:離岸人民幣(CNH)兑美元在美股午盤美聯儲降息後鮑威爾發佈會之初漲至 7.0696,刷新 2023 年 6 月 2 日以來高位,日內漲 414 點,此後逐步回吐過半漲幅,北京時間 9 月 19 日 4 點 59 分,離岸人民幣兑美元報 7.0954 元,較週二紐約尾盤漲 156 點,在週二結束四連漲後反彈。

- 比特幣:比特幣(BTC)在臨近午盤時跌破 5.93 萬美元刷新日低,美聯儲公佈降息後加速上漲,午盤漲破 6.13 萬美元刷新日高,逼近週二刷新的 8 月 27 日以來高位,較日低漲超 2000 美元、漲超 3%,後很快跌落 6.1 萬美元並回吐部分漲幅,美股收盤後處於至少 6.01 萬美元上方,最近 24 小時小幅轉跌。

原油止步兩連漲,美油跌落本月內高位,美股早盤美國能源部公佈上週美國 EIA 原油庫存超預期下降、以及美股午盤美聯儲宣佈降息後,油價均曾短線轉漲。

- 原油盤中:國際原油期貨週三多數時間下跌,歐股早盤刷新日低時,美國 WTI 原油跌至 69.73 美元,日內跌近 2.1%,布倫特原油跌至 72.31 美元,日內跌近 1.9%,此後震盪反彈,美股早盤和美聯儲宣佈降息後午盤曾短線轉漲。

- 原油收盤:連漲兩日的原油齊收跌。週二刷新 8 月 30 日以來收盤高位的 WTI 10 月原油期貨收跌 0.28 美元,跌幅超過 0.39%,報 70.91 美元/桶。,週二連續兩日刷新 9 月 3 日以來高位的布倫特 11 月原油期貨收跌 0.05 美元,跌幅大約 0.07%,報 73.65 美元/桶。

美油在歐股盤中曾跌超 2%,美國能源部公佈上週原油庫存超預期下降和美聯儲降息後均曾短線轉漲

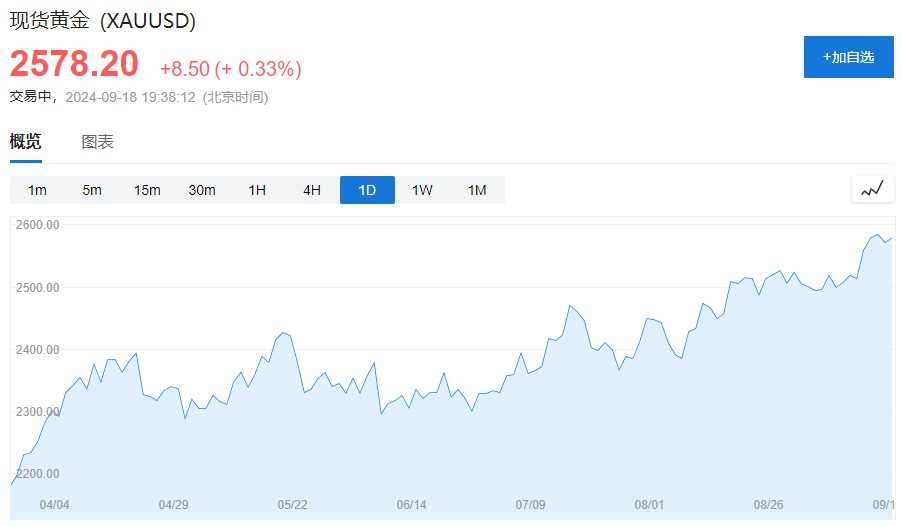

美聯儲降息後,黃金盤中漲超 1%,鮑威爾發佈會期間轉跌。

美聯儲公佈決議後,黃金均盤中拉昇、刷新週一所創的盤中歷史高位。紐約黃金期貨漲至 2627.2 美元,日內漲超 1.3%,現貨黃金漲至 2600.16 美元,日內漲近 1.2%,鮑威爾發佈會期間持續回落。到美股午盤期金收盤,兩連跌的 COMEX 12 月黃金期貨收漲 0.24%,報 2598.6 美元/盎司。

美股午盤金價轉跌,美股尾盤刷新日低時,期金跌至 2572.5 美元,日內跌近 0.8%,現貨黃金跌至 2547.16 美元,日內跌近 0.9%。

現貨黃金在美聯儲降息後盤中漲超 1% 創歷史新高,鮑威爾發佈會期間轉跌

【以下為北京時間 18 日 23:11 更新內容】

市場屏息等待凌晨 2 點的美聯儲利率決議,美股主要股指幾近持平:

- 美股三大指數波幅較小:標普 500 大盤幾近持平,曾一度跌超 0.1%。與經濟週期密切相關的道指一度跌超 0.3% 或 129 點。科技股居多的納指跌近 0.1% 後又漲超 0.2%。羅素 2000 指數漲超 0.3% 後又跌近 0.2%。

- 美股盤初,主要行業 ETF 漲跌不一,全球航空業 ETF、能源業 ETF 漲幅居前。

- “科技七姐妹” 多數上漲。蘋果一度漲超 2%,特斯拉盤初漲近 1.7% 後回吐多數漲幅,Meta 一度漲超 0.6%,谷歌 A 漲超 0.5% 後回吐幾近全部漲幅,而英偉達盤初漲近 0.7% 後轉跌,微軟一度跌近 0.9%。

- 芯片股漲跌不一。費城半導體指數漲超 0.5% 後又跌超 0.3%,後又短線轉漲;Arm 控股一度漲超 2.7%,台積電美股一度漲超 0.9%,博通一度漲超 1.2%,而 AMD 一度跌近 1.3%,美光科技一度跌近 1.2%,英特爾漲近 1.3% 後跌超 1.5%,

- AI 概念股漲跌不一。英偉達持股的 AI 語音公司 SoundHound AI 一度漲超 6.2%,BullFrog AI 一度漲超 7%,戴爾科技一度漲近 2.4%,超微電腦漲超 4.9% 後漲幅砍半,而甲骨文一度跌超 1.7%,Serve Robotics 漲超 3% 後又跌超 4.5%。

- 中概股跌多漲少。納斯達克金龍中國指數一度跌近 0.5%。熱門中概股中,蔚來一度跌超 5%,小鵬汽車一度跌超 2.5%,極氪漲超 0.7% 後又跌超 3.1%,嗶哩嗶哩一度跌超 1.9%,唯品會一度跌超 1.1%,百度一度跌超 0.7%,而網易盤初漲超 1.2% 後回吐幾近全部漲幅。

- 其他重點個股中:美國鋼鐵一度漲逾 4.2%,CEO 稱對收購交易最終獲批有信心。

【以下為 21:50 以前更新內容】

美聯儲本輪首次降息在即,儘管降息 50 基點的預期愈發高漲,但華爾街仍在就 25 基點還是 50 基點爭論不休。前有新債王 “喊話” 支持降息 50 基點,後有橋水創始人達利歐表態,“降息 25 個基點是正確之舉”。

明後兩天,美英日央行決議接連來襲。北京時間週四凌晨 02:00 美聯儲將發佈 FOMC 利率決議聲明和季度性經濟預期概要,隨後美聯儲主席鮑威爾舉行貨幣政策新聞發佈會。週四晚 19:00 點英國央行將公佈政策決議。週五日本央行將公佈目標利率(上限)。

今日美股開盤三大指數基本持平,科技股漲跌不一,日元走強、國際油價維持頹勢,布倫特原油、WTI 原油均跌約 1%。

- 美股盤初波動不大,標普微跌,阿斯麥跌約 1%,台積電漲 0.65%。

- 歐股低開低走,歐洲斯托克 50 指數跌 0.26%。

- 國際油價維持頹勢,目前布倫特原油、WTI 原油均跌約 1%。

- 日元一度上漲 0.8%,美元走弱,日本央行將於週五決定利率。

- 債市小幅走跌,英國 10 年期國債收益率上行近 9 個基點。

【21:30 更新】

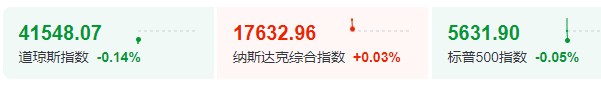

美股三大指數微幅高開,道指現跌 0.14%,標普 500 指數跌 0.05%,納指漲 0.03%。

中概股多數上漲,貝殼漲約 2%。半導體股漲跌不一,阿斯麥跌約 1%,台積電漲 0.65%。

【19:40 更新】

現貨黃金小幅上漲 0.3%,報 2578.20 美元/盎司。

債市小幅走跌,10 年期美債收益率日內上行 3 個基點,

英國 10 年期國債收益率日內上行近 9 個基點。稍早前數據顯示,英國 8 月通脹率持穩在 2.2% 的水平,好於央行預期,英國央行年內進一步降息的預期升温,但市場仍認為本週英國央行或維持利率不變。

【16:35 更新】

今日美股盤前,美股三大指數期貨窄幅波動。

半導體股漲跌不一,英特爾、美光科技微跌,英偉達微漲,台積電漲 0.68%,阿斯麥跌 0.66%。谷歌盤前小幅上漲 0.28%,谷歌母公司 Alphabet 贏得了對歐盟 14.9 億歐元廣告反壟斷罰款的訴訟。

部分中概股下跌,理想汽車跌逾 1%。

歐股主要股指多數低開,歐洲斯托克 50 指數跌 0.05%,德國 DAX 指數漲 0.07%,英國富時 100 指數跌 0.13%,法國 CAC40 指數跌 0.03%。目前走勢如下:

亞太股指漲跌不一。日經 225 指數收盤小幅上漲,印度股市小幅下跌 0.2%。

國際油價維持頹勢,目前布倫特原油、WTI 原油均跌約 1%。

日本央行將於週五決定利率。日元一度上漲 0.8%,美元小幅走弱,美國國債收益率小幅走高。