2005 年以来第一次!美联储 “罕见分歧”,敏锐的交易员 “接下来有没有大幅降息不好说了”

十九年來首張 “理事反對票” 和不夠鴿派的點陣圖,讓成功預測本次降息幅度的交易員也感到茫然。而接下來的就業和通脹數據報告以及美聯儲褐皮書,將是決定降息節奏的重磅因素。

隔夜美聯儲大幅降息 50 基點,正式開啓寬鬆週期。然而該決議的內部投票過程,卻並不如外界預期的順利,美聯儲甚至上演 “罕見分歧”。

這讓此前成功預測本次降息幅度的交易員都開始懷疑,美聯儲後續降息節奏究竟如何?11 月和 12 月還會繼續大幅降息嗎?這也導致接下來的就業和通脹數據報告,或將成為左右美聯儲降息步伐的重磅因素。

11 月繼續大幅降息?失望的交易員:這真不好説

據彭博報道稱,花期交易員 Akshay Singal 雖然在數週前就準確預測本次將降息 50 基點。然而,在看到美聯儲決議罕見反對票和不夠鴿派的最新點陣圖後,他開始有些困惑:

本次降息 50 基點是一次相當鷹派的決議……總的來説,美聯儲可能對這個結果感到滿意,這並沒有被認為是過度寬鬆,但其負面影響是市場感到不解。

彭博評論稱,Singal 的態度也在很多方面反映出了更廣泛的市場情緒。

Singal 認為,雖然鮑威爾在推動政策方面掌握着很大的權力,他本人的態度也明顯比其他成員更偏鴿派,但是由於內部分歧的存在,後續降息幅度存疑:

鮑威爾掌握着很大的權力,接下來的幾個月,關鍵在於理解他到底有多鴿派。

交易員的困惑 “根源”:十九年來首張 “理事反對票”+ 不夠鴿派的點陣圖

讓 Singal 感到困惑的一大重要因素,便是十九年來首張 “理事反對票”。

本次決議聲明顯示,並非全體 FOMC 投票委員均支持降息 50 基點。其中總共 11 人贊成降息 50 基點,只有一人投票反對,那就是美聯儲理事米歇爾·鮑曼(Michelle Bowman),她主張通過小幅降息 25 基點的方式來開啓本輪寬鬆週期。

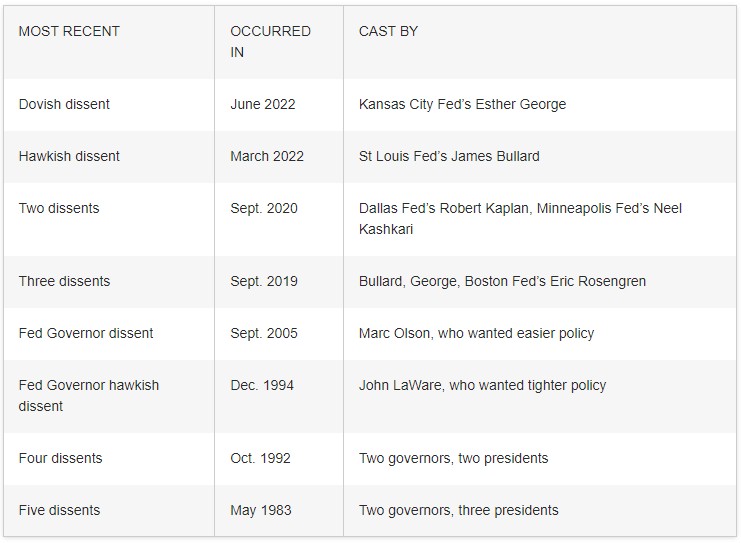

而鮑曼也由此成為 2005 年來首位在 FOMC 議息會議上,對大多數 FOMC 委員的決定投反對票的聯儲理事。

回顧歷史,美聯儲的會議決策極少遭遇異議,尤其在鮑威爾擔任主席期間更是少見。上一次有 FOMC 投票委員對總體決策持不同意見是在 2022 年 6 月,當時投票反對的是一位地區聯儲主席。時任堪薩斯城聯儲主席喬治(Esther George)當時主張小幅加息。

有交易員對此評論稱,從鮑威爾 “團結就是力量” 的整體風格來看,這種情況看起來其實相當 “奇怪”,特別是在美國大選前夕:

鮑威爾可能是有史以來最注重建立共識的美聯儲主席,自新冠疫情以來的每次會議上只有 1 次反對票。

從降息 50 個基點開始,肯定會導致至少一個(如鮑曼),甚至可能兩個(如巴爾金或博斯蒂克)的反對票,這與他的風格非常不符,特別是在大選前夕。

對於一個不希望被稱為 “阿瑟·伯恩斯 2.0” 的人來説,這將是一個相當奇怪的轉折。

注:阿瑟·伯恩斯在 1970 年代初擔任美聯儲主席,而他的政策立場被認為在應對通脹問題上過於寬鬆,為後來的 “滯脹” 埋下伏筆。

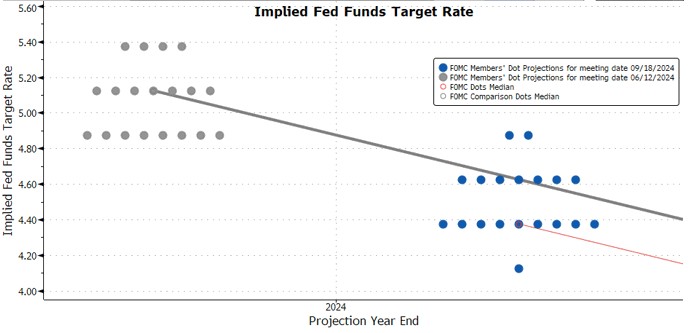

除此之外,不夠鴿派的最新點陣圖,也讓以 Singal 為代表的市場交易員難以判斷後續降息步伐,目前僅略微過半決策者預計今年至少還將共計降息 50 基點。

在 19 名提供預測的官員中,本次全體均預計利率低於 5.0%,上次只有八人這樣預計。本次只有兩人預計利率在 4.75% 至 5.0%,有 7 人預計利率在 4.5% 至 4.75%,有 9 人預計利率將在 4.25% 至 4.5%,有一人預計利率會低於 4.5%,在 4.0% 至 4.25%。

也就是説,在 19 人中,只有十人、佔比近 53% 預計,今年至少還將合計降息 50 個基點。略微過半的官員預計,今年 11 月和 12 月的剩餘兩次 FOMC 會議上,將至少每次降息 25 個基點,而這在一定程度上和市場預期的寬鬆步伐有所相悖。

接下來要關注什麼?數據、數據還是數據

既然美聯儲後續降息節奏目前仍難以判定,數據或許又要再度挑起大梁。

正如 Singal 表示:“美聯儲在 11 月會議上究竟是降息 25 或 50 個基點,就像拋硬幣一樣......這將取決於數據依賴性”。他認為接下來的兩次非農就業報告(10 月 4 日和 11 月 1 日)將對美聯儲的下一步行動產生重大影響。

在隔夜記者會講話中,當鮑威爾被問及從現在到 11 月之間應該瞭解哪些信息,從而確定下次會議的降息幅度時,他也進一步強調了非農就業和通脹數據報告:

你知道,更多的數據。和往常一樣。不要再尋找其他東西了。我們將看到兩份勞動力報告,我們還將獲得通脹數據,即所有這些我們將關注的數據。

你知道,這總是一個問題,看看傳入的數據,並問,這些數據對不斷變化的前景和風險平衡有何影響?然後通過我們的流程思考,什麼是正確的做法?政策是否符合我們的期望,是否有助於實現我們的目標。所以這就是我們要做的。

他還強調了關注美聯儲褐皮書的重要性:

自上次會議以來,我們收到了很多數據,有 7 月和 8 月的兩份非農就業報告,還有兩份通脹報告,其中一份是在美聯儲官員靜默期內發佈的。還有 QCW 報告表明我們非農新增就業數可能被人為抬高,將會被下調。

我們也看到了像美聯儲褐皮書這樣的軼事數據,所以我們收集了所有這些數據,然後進入公開發言的靜默期,我們思考該怎麼做,並明確了這對經濟、對我們服務的美國人民來説是正確的,這就是我們做出決定的方式。