After the Federal Reserve significantly cut interest rates, market expectations for easing still outpaced, leading to a decline in US bond yields

美聯儲降息後,市場對未來寬鬆政策的預期依然強烈,導致美國國債收益率下滑。交易員關注勞動力市場狀況,短期美債表現優異。儘管鮑威爾稱降息為政策 “重新調整”,市場仍預計年底前將再降息三次。分析師指出,未來經濟數據將決定市場預期與美聯儲政策的對抗。

智通財經 APP 獲悉,隨着交易員將注意力從備受期待的美聯儲首次降息轉向勞動力市場狀況,美國國債小幅上漲。各期限美債收益率下滑,較短期美債表現優異。其中,兩年期美債收益率下降 3 個基點至 3.59%。

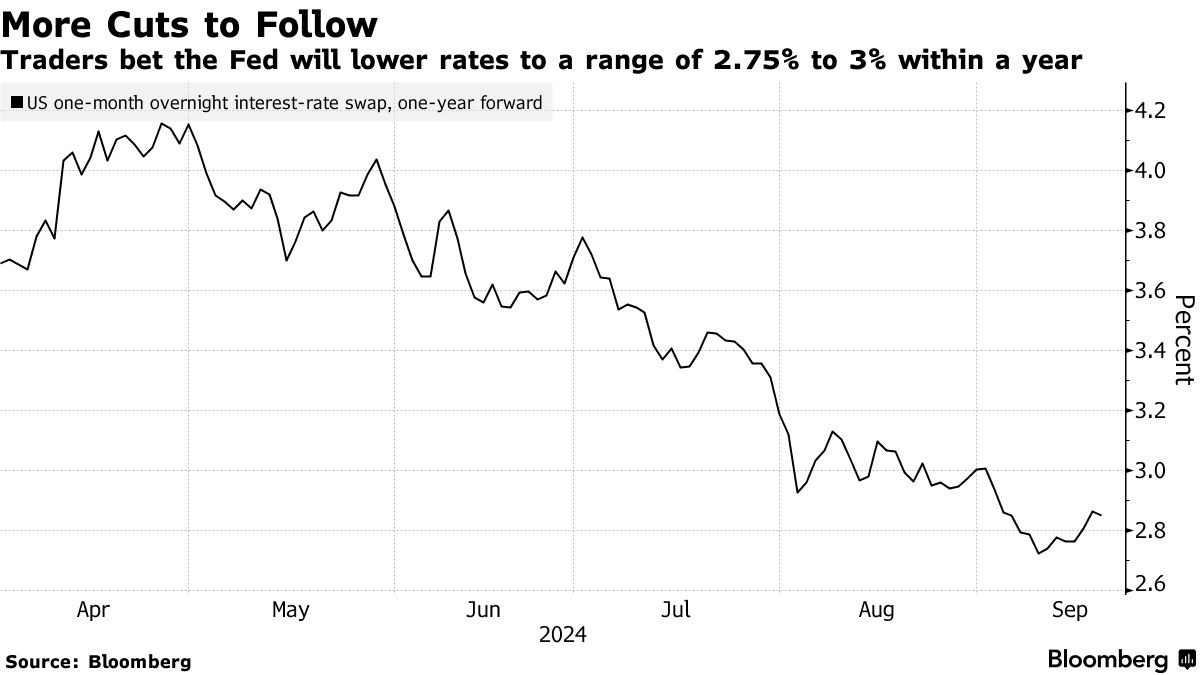

儘管美聯儲主席鮑威爾將週三降息 50 個基點的決議描述為對政策的 “重新調整”,但市場對今年及以後進一步寬鬆的速度和幅度的押注幾乎沒有變化。貨幣市場傾向於認為,美聯儲在年底前還將進行三次各 25 個基點的降息,預計明年還將降息 200 個基點。這樣的預期比美聯儲最新公佈的點陣圖所顯示的利率路徑要更激進,點陣圖只顯示今年還會再降息 50 個基點。

Brandywine Global 投資組合經理 Jack McIntyre 表示:“現在將是市場預期與美聯儲之間的較量,就業數據——而非通脹數據——將決定哪一方是正確的。”“由於這一政策主要是傳遞信號,因此金融市場沒有出現過大的波動。現在,每個人都回到了依賴數據的階段。”

鮑威爾表示,美聯儲的降息幅度大於許多市場參與者預計的 25 個基點,這將有助於在美國經濟仍然強勁的情況下限制經濟衰退的可能性。他補充稱,他認為政策制定者採取行動還不算太晚。不過,美聯儲更新的經濟預測摘要中將 2024 年底的失業率預期中值從 6 月的 4% 上調至 4.4%,而鮑威爾上個月曾表示,勞動力市場的進一步降温將是 “不受歡迎的”。

貝萊德投資研究所主管 Jean Boivin 表示:“美聯儲週三的舉措出人意料,短期內可能對市場有利。但我們認為,這加大了未來出現進一步波動的可能性,尤其是如果經濟增長和通脹走勢不符合美聯儲最新預測中的軟着陸情形的話。”