大摩:市场不待见,谷歌管理层有责任,应该这么干!

大摩認為,谷歌應當增加生成式 AI 的披露;提供 AI 的資本支出、自由現金流的具體指引,並對季度指引進行上修;披露 YouTube 和 GCP 更全面的業務板塊;強調谷歌對社會的積極影響。這些措施能夠幫助谷歌增強投資者信心,提升估值倍數。

反壟斷案纏身、拆分風險大增的谷歌估值倍數降至谷底,在管理層變動之際,谷歌應該怎樣利用這一變革機遇挽回投資者?

9 月 18 日,摩根士丹利策略分析師 Brian Nowak 及其團隊發佈報告,列出谷歌新任 CFO 可以做的四件事情以提升估值倍數:增加生成式 AI 的披露;提供收入、運營費用和資本支出指引並進行上修;披露 YouTube 和 GCP 更全面的業務板塊;強調谷歌對社會的積極影響。

大摩指出,谷歌多年的反壟斷官司可能會破壞其在在線渠道的地位。此外,谷歌還面臨着諸多壓力,如生成式 AI 搜索的中斷風險、增大的資本支出、高不確定性的生成式 AI 邊際投資回報率(ROIC)、如何通過運營費用管理來保護利潤……與此同時,市場預期谷歌不會上修收入等指引,導致投資者缺乏關注谷歌積極面的興趣。

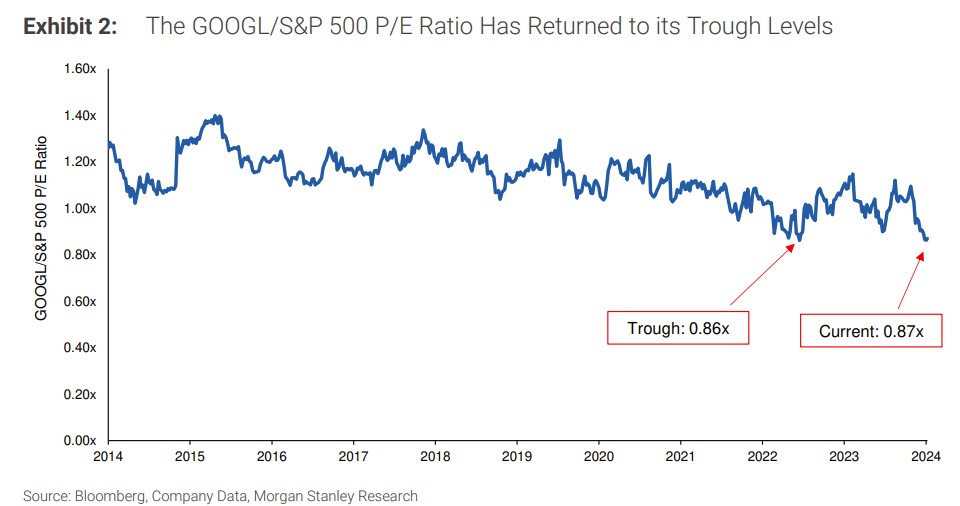

目前,谷歌相對於標普 500 的估值倍數約為 0.87 倍,為十年來低點,而長期平均水平為 1.1 倍。

01 幫助投資者更好地瞭解生成式 AI 帶來的增量機會

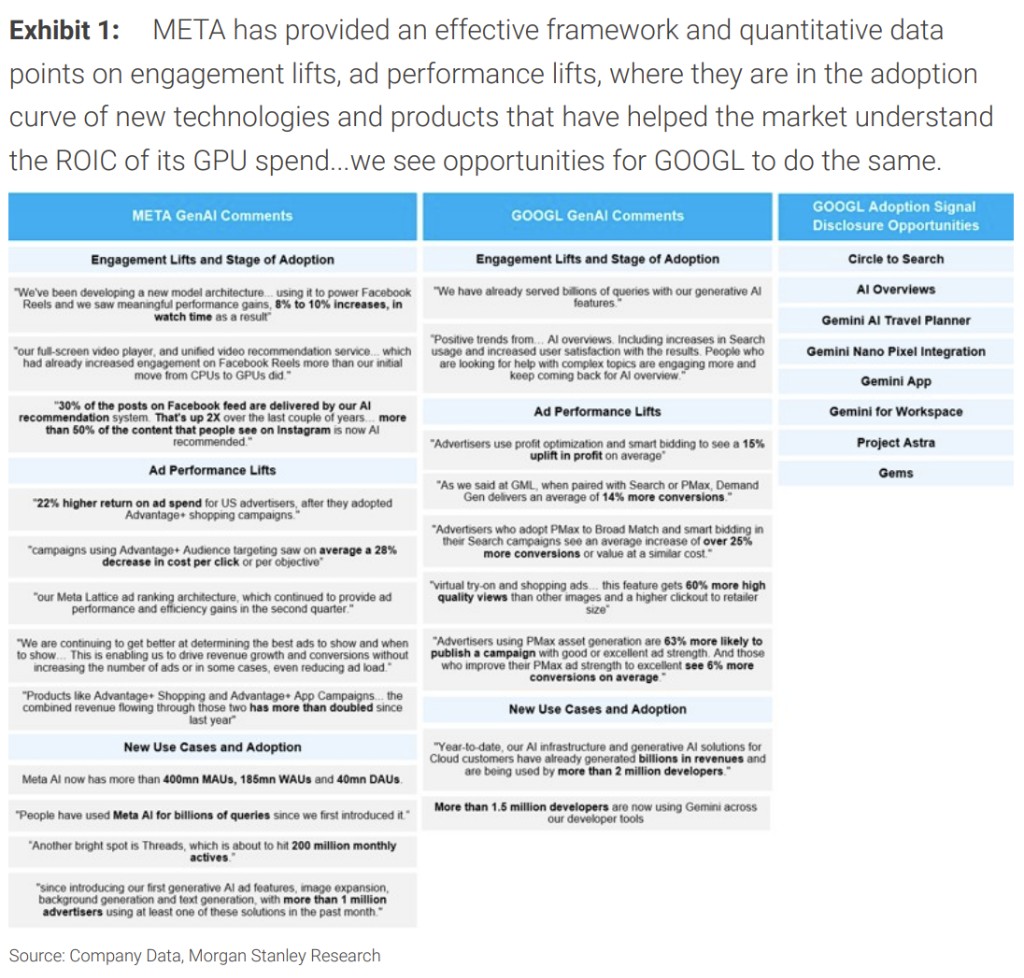

首先,大摩認為谷歌應當考慮提供更多關於增量用户參與度、收入機會、生成式 AI 早期信號的披露。

披露將幫助投資者更好地理解谷歌的資本支出增長和收入增長的持續性。雖然谷歌已經分享了關於提升廣告效果的評論,但市場需要更深入地瞭解谷歌新技術和產品採用情況,以便量化這些收益對損益表(P&L)的潛在影響。

其次,大摩認為谷歌應當保持高水平的創新速度,並展示產品組合中新的創新來源。

下表展示了谷歌在搜索、YouTube 和雲計算等領域可能推動投資回報率(ROIC)的產品,還展示了谷歌正在開發、進入測試階段、逐步推廣的新產品和工具。由於反壟斷監管可能會持續數年,大摩認為谷歌開發創新、擴展新用户和廣告主的能力,對於保持谷歌保持在線渠道中的領導地位至關重要。

02 提供並上修指引,增強投資者對自由現金流的信心

首先,大摩認為谷歌應當提供 AI 資本支出、自由現金流的具體指引。

伴隨着 AI 泡沫爭議,市場密切關注大型科技公司在今年及明後兩年對生成式 AI 的資本支出增長。META 提供了未來資本支出指引,微軟提供了後續季度的資本支出評論,亞馬遜則提供了全年資本支出評論。相比之下,谷歌的資本支出評論過於模糊:“展望未來,我們預計今年每季度的資本支出大致持平或高於第一季度的 120 億美元。”

這種模糊性,再加上谷歌高管之前表示 “投資不足的風險遠大於投資過度的風險”,導致了投資者對谷歌自由現金流(FCF)感到很強的不確定性。大摩預期,谷歌 2025 年資本支出約為 570 億美元,這意味着每股將產生約 8.20 美元的自由現金流。按照這個自由現金流估算,谷歌在 2025 年的市盈率約為 19.5 倍,估值相對較低,特別是考慮到公司在 2023-2026 年期間自由現金流預期增長率約為 21%。

但是,每 10% 的資本支出增長將導致每股自由現金流減少約 6%。因此,更詳細的資本支出指引將幫助投資者更好地掌握谷歌自由現金流的範圍。

其次,大摩認為谷歌應當量化進一步優化運營費用(Opex)的好處,並承諾擴大利潤率。

過去 20 個月裏,谷歌成功實施了多個工作流程,重新設計了運營支出結構,並通過投資實現了槓桿效應。這些變革取得了進展,2023 年穀歌運營費用增長約 6%,利潤率提升約 230 個基點。與互聯網同行相比,在每位員工的運營費用方面,谷歌處於中間水平,而在每位員工的收入方面,谷歌接近上限。

問題在於,未來谷歌管理層將如何平衡,在提高效率、保護每股收益(EPS)和自由現金流的同時,增加生成式 AI 的投資。

大摩認為,谷歌還有進一步提高效率的空間。儘管谷歌在 2023 年實現了槓桿效應,但在此之前的 6 年裏,儘管收入增長了約 3 倍,谷歌利潤率總共只擴張了約 10 個基點。因此,提供更清楚的運營費用、利潤率等量化指導,能夠幫助投資者瞭解谷歌後續在優化運營費用等方面的計劃。

最後,大摩認為谷歌應當發佈季度指引並爭取上調預期。

谷歌的大部分同行公司如 META、蘋果、微軟等都發布了季度指引,以幫助投資者更好地瞭解市場最新趨勢,掌握公司未來增長和盈利能力的合理範圍。有些公司甚至提供了年度指引。

發佈指引並在指引的基礎上進行持續的上修,將增強投資者對公司業務運營等的信心,有助於推動估值倍數增長,減少估值倍數波動。

03 改善 YouTube 和 GCP 的業務披露,幫助投資者瞭解關鍵增長領域

首先,大摩認為谷歌應當細分 YouTube 的廣告和訂閲收入。

YouTube 的現有披露表明其在 2023 年大約產生了 315 億美元的年度廣告收入,並預計 2024 年同比增長 12.5%。但是,YouTube 的訂閲情況並不清晰。谷歌一直在內部推動 YouTube 訂閲業務的增長,由於披露有限,投資者只能估計 YouTube 在 2023 年的年度訂閲收入約為 150 億美元。

但是大摩認為,當前 YouTube 的披露低估了其約 50% 的訂閲業務規模,也忽視了其更高的估值倍數、更具持續性和穩定性的業務特徵。因此,大摩建議谷歌對該業務進行持續的利潤披露,以幫助市場更好地評估這一業務與其他領先的在線視頻平台如 Netflix 的比較。

其次,大摩認為谷歌也應當細分谷歌雲業務中的 Workspace 和 GCP 業務。

谷歌雲業務的現有披露表明其在 2023 年大約產生了 330 億美元的年度廣告收入,並預計 2024 年同比增長 31%。然而,這一業務板塊同時包含了 Workspace 業務和增長更快且至關重要的超大規模雲計算業務(GCP)。雖然市場有關於 GCP 與 Workspace 的估算,但在目前生成式 AI 的關鍵時期,持續的披露將有助於市場更好地理解谷歌相較於 AWS 和 Azure 的發展情況。

大摩認為,在這個領域的執行力和披露水平是谷歌估值倍數擴張的最大機會之一,也是投資者更好理解資本支出回報率的一個機會。

04 強調谷歌對社會的積極影響,重新掌握公眾敍事的主導權

大摩認為,谷歌應當通過多種方式更積極地宣傳谷歌對社會的正面影響,重新掌握公眾敍事的主導權。

上文提到,谷歌未來可能存在多年的反壟斷監管,雖然在法律訴訟過程中披露信息可能較為複雜,但大摩認為谷歌至少有機會通過發佈簡報、博客評論等,更積極地表達其立場,以及其對社會、用户、廣告商、開發者、中小企業和大型企業的正面影響。

具體來説,谷歌可以借鑑亞馬遜的做法,更好地宣傳其對整個經濟體系的正面影響。亞馬遜經常發佈新聞稿,詳細説明其創造的就業崗位數量、對當地社區的投資,以及其為第三方賣家帶來的收入等。

對於谷歌而言,數百萬中小企業利用谷歌的平台構建業務,安卓生態系統和應用商店使設備製造商和開發者能夠建立價值數十億美元的企業,全球有超過 10 億人使用免費的谷歌地圖,谷歌翻譯改善了全球溝通,甚至被醫生用於挽救生命……這樣的例子還有很多。谷歌的產品為社會提供了巨大的公益性和效用,但其當前的估值倍數並沒有反映這些價值。