美聯儲貨幣政策四十年:“沃克爾治通脹”—“格林斯潘奇蹟”—“伯南克 QE”,鮑威爾準備留下什麼?

從沃克爾的鐵腕加息遏制通脹,到格林斯潘帶領美國度過經濟繁榮,再到伯南克的量化寬鬆重塑金融危機後的經濟環境。如今,美聯儲正面臨着歷史上最為複雜的全球經濟局勢。鮑威爾能夠複製昔日領袖的成功經驗,帶領美國經濟走向軟着陸?

四十年來,美聯儲的貨幣政策歷經多位主席的掌舵,每一位都以獨特的方式應對時代的挑戰。

從沃克爾的鐵腕加息遏制通脹,到格林斯潘帶領美國度過經濟繁榮,再到伯南克的量化寬鬆重塑金融危機後的經濟環境、耶倫進入加息週期。如今,美聯儲正面臨着歷史上最為複雜的全球經濟局勢。

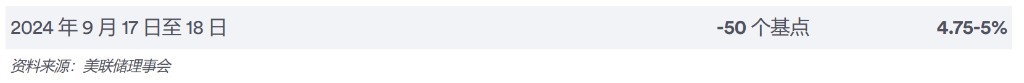

本週四,鮑威爾歷史性地宣佈降息 50 個基點,再度開啓新一輪寬鬆週期。他能夠複製昔日領袖的成功經驗,帶領美國經濟走向軟着陸?他又將為歷史進程留下怎樣的印記?

“沃爾克時刻”:堅定地抑制通脹,即使以經濟衰退作為代價

上世紀 70 年代末,美國深陷滯脹泥潭,通貨膨脹居高不下。面對嚴峻形勢,時任美聯儲主席保羅·沃爾克採取了史無前例的激進加息政策。

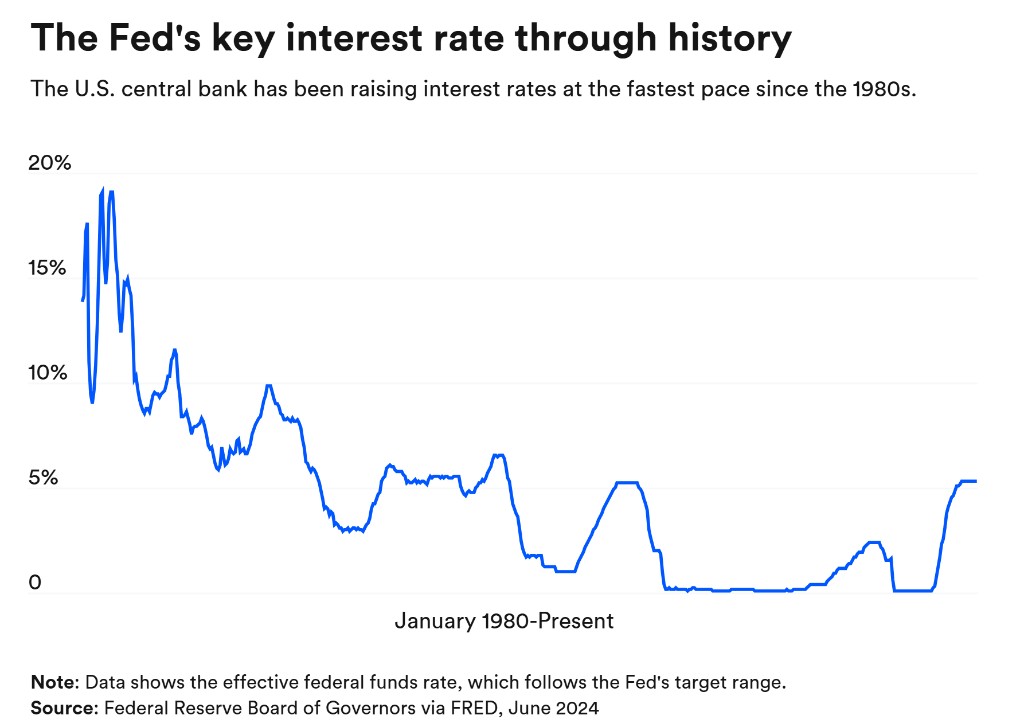

1981 年至 1990 年間,聯邦基金利率一度飆升至 19-20% 的歷史高點。儘管這一舉措成功遏制了通脹,但也引發了經濟衰退,失業率飆升至近 11%,為大蕭條以來最高。

與此同時,美聯儲利率頻繁波動,1981 年 11 月 2 日,利率急劇下降至 13-14% 的目標區間,然後在 1982 年前四個月回升至 15%,隨後在 1982 年 7 月 20 日回落至 11.5-12%。移動記錄顯示,在這 10 年期間,“有效” 聯邦基金利率平均為 9.97%。自 1984 年 11 月以來,利率從未超過 10%。

與今天通過直接調整利率控制通脹的方法不同,沃爾克的貨幣政策以限制貨幣供應增長為核心。他的策略雖備受批評,但最終使通脹在 1986 年降至 2% 以下。

艾倫·格林斯潘:成功引導美國經濟實現軟着陸

艾倫·格林斯潘作為美聯儲主席期間(1987-2006 年),在美國的貨幣政策、經濟管理和全球經濟事務中發揮了重要作用。

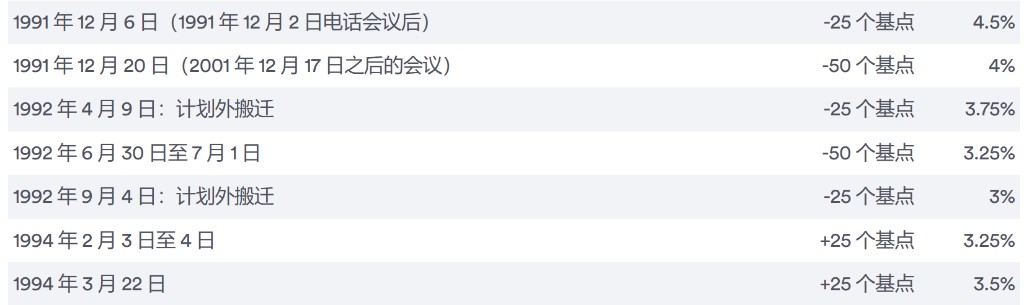

1990 年 8 月,美國經濟陷入了一場為期 8 個月的衰退,格林斯潘帶領美聯儲成功應對,最終在 2000 年 5 月將聯邦基金利率提升至 6.5% 的高點,創下當時的紀錄。而在 1992 年 9 月,利率曾降至 3%,為十年來的最低點。

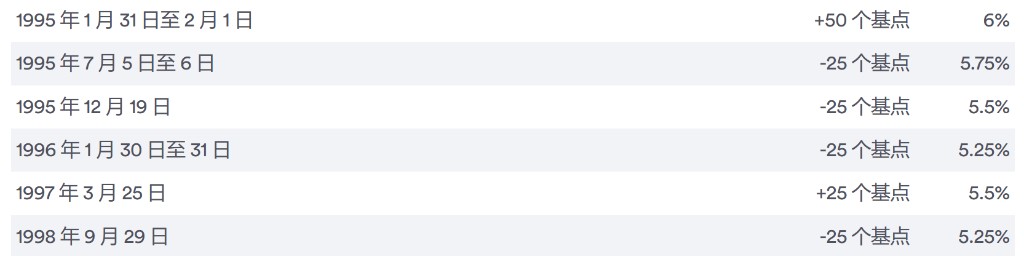

1995 年,格林斯潘成功引導美國經濟實現軟着陸,為隨後的經濟繁榮鋪平了道路。

1994 年,美聯儲大幅加息以應對通脹壓力。到 1995 年,勞動力市場明顯降温。但 1995 年 5 月,月度就業人數出現負增長。

美聯儲在 1995 年和 1996 年初,三次分別降息 25 個基點並取得了成功。到 1996 年中期,平均每月新增就業反彈至約 25 萬個,此後很長一段時間內,通脹都沒有成為美國經濟的主要問題。

格林斯潘的任期是美聯儲歷史上最長的,他因成功引領美國經濟度過當時歷史上最長的經濟擴張期,被外界尊稱為 “經濟大師”。在他領導下,美聯儲也首次非正式地確立了 2% 的通脹目標,這一決定對現代貨幣政策產生了深遠影響。

本·伯南克:親手開啓 QE

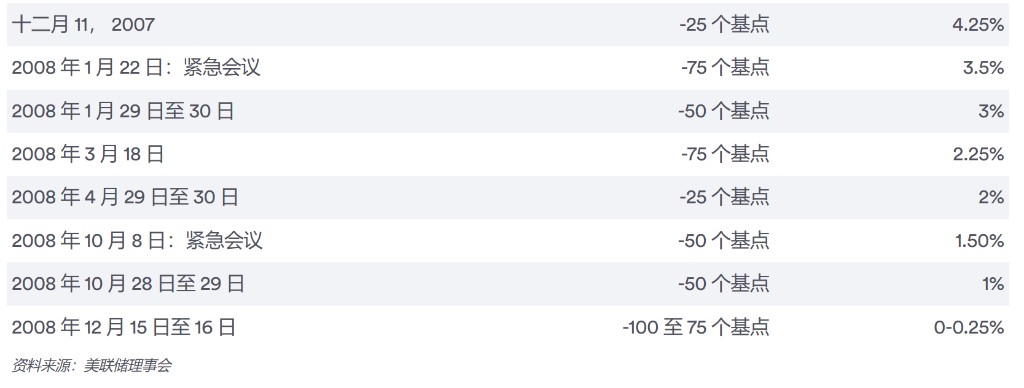

在天崩地裂的 2008 年金融危機爆發之際,本·伯南克率領美聯儲開啓 QE(量化寬鬆)和零利率,將美國經濟從深淵中救出。

此前,利率曾達到 5.25% 的高位,次貸危機發生後,美聯儲降利率下調了 100 個基點,將至接近零。

在這一時期,美國聯邦儲備委員會實施了量化寬鬆政策,即大規模資產購買 (LSAP)。這一旨在降低長期利率、刺激經濟增長的舉措導致美聯儲的資產負債表急劇膨脹,從最初的 8700 億美元猛增至 4.5 萬億美元。

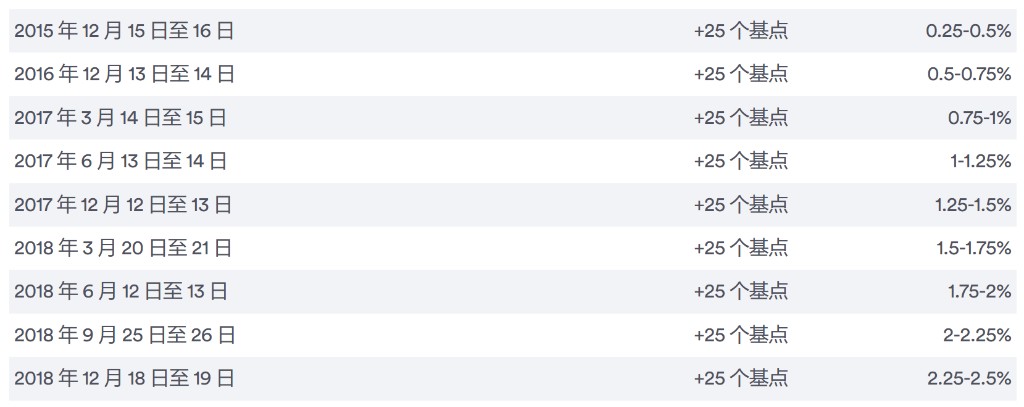

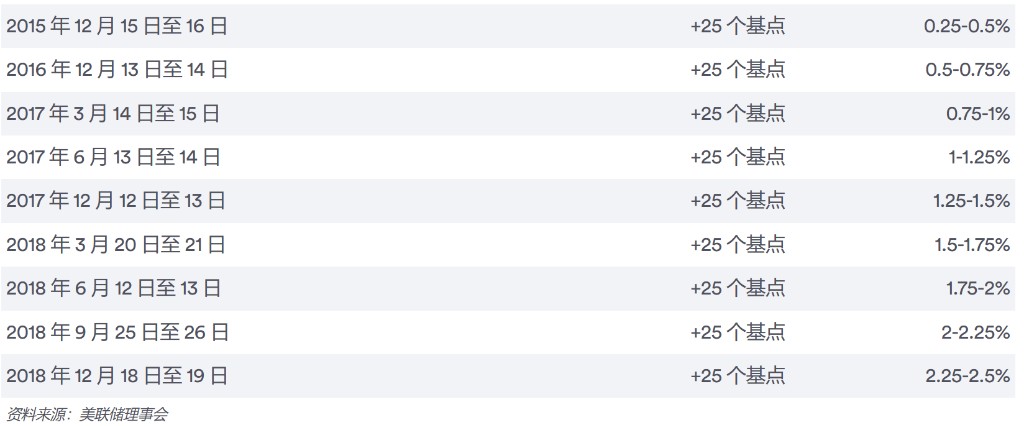

2015 年後,美聯儲才每次加息 25 個基點,利率於 2018 年達到 2.25-2.5%。

耶倫:從 QE 退出到加息週期

2014 年 2 月,美聯儲主席珍妮特·耶倫從伯南克手中接過美聯儲的掌舵人,並帶領經濟度過了大衰退復甦。

2015 年 12 月起,美聯儲每年只加息 25 個基點,直到 2017 年美聯儲加息了 3 次,而 2018 年又加息了 4 次。聯邦基金利率達到 2.25-2.5% 的峯值。

鮑威爾登場,美國經濟路在何方?

2018 年 2 月,現任美聯儲主席傑羅姆·鮑威爾登場。

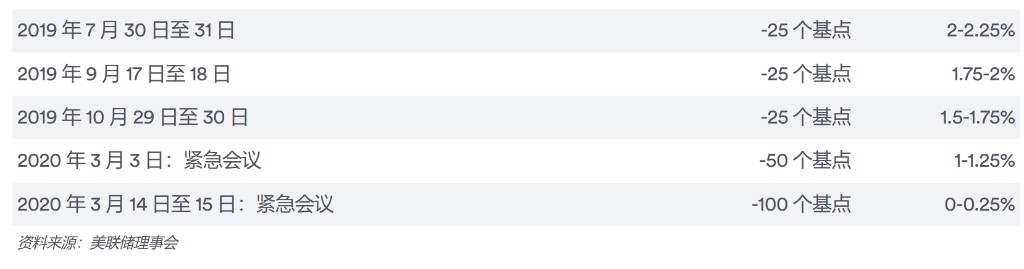

面對不温不火的通脹和放緩的增長,美聯儲在 2019 年決定降息 3 次,以重新提振經濟——類似於格林斯潘在 1990 年代的 “保險” 削減。

直到新冠疫情的出現,宣佈着一個新時代的開啓。美聯儲在 13 天內的兩次緊急會議上將利率下調至零。

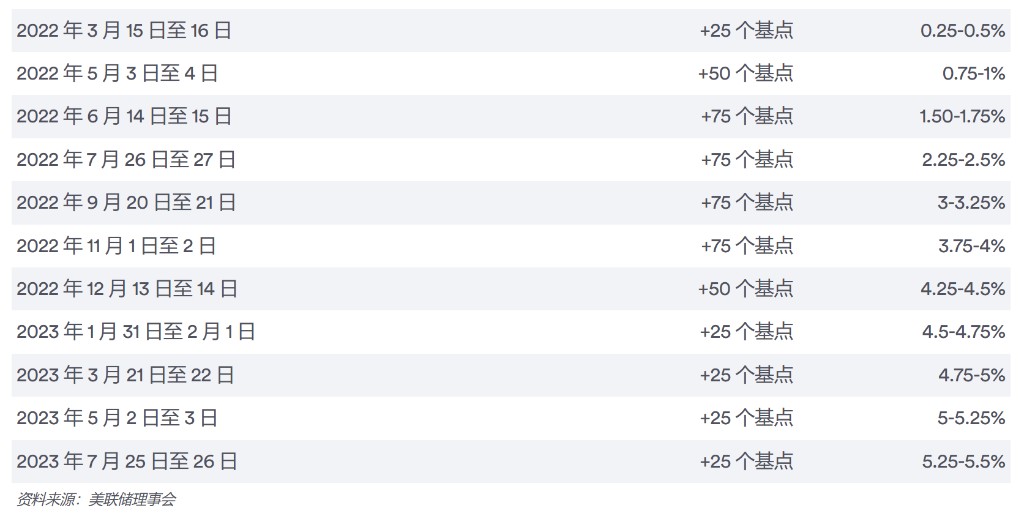

危機過後,通脹再次成為美國第一大經濟威脅。美聯儲在 2022 年 3 月首次加息 25 個基點,並在之後的一年多的時間裏 “油門踩到底”,將基準利率升至 5.25-5.5% 的高點。

本週,美聯儲終於迎來了 2022 年四月以來的首次降息,基準利率維持在 4.74%-5% 的水平。

“央行往往專注於打贏上一場戰爭。” 喬治梅森大學梅卡圖斯中心名譽貨幣政策主席 Scott Sumner 表示:

“如果通脹率很高,就會採取更加強硬的立場。如果通脹率低於目標,美聯儲就會想,‘好吧,也許我們應該採取更多的擴張性政策。’鮑威爾上任時就下定了決心,如果再出現一次經濟衰退,他們會採取更激進的政策。我個人認為,這一策略一開始相對成功,但推得太過了。”