S&P 500 Index hits a new high, institutions: Breaking through 6000 points is just around the corner

根据 DataTrek Research 的分析,标普 500 指数在未来一年可能会出现盈利动能,预计在 2024 年达到 6000 点。周一,标普 500 指数收于 5718.57 点,创下历史新高。分析师预计明年每股收益将增长 15.2%,多个行业将贡献盈利增长。美联储降息后,股票市场可能继续走高,标普 500 的市盈率为 22.1 倍,仍低于 2020 年的峰值。

智通财经 APP 获悉,根据 DataTrek Research 的最新分析,美国股市在未来一年中可能会出现 “盈利动能”,标普 500 指数在 2024 年达到 6000 点的目标并不遥远,尤其是在上周美联储开启降息周期之后。

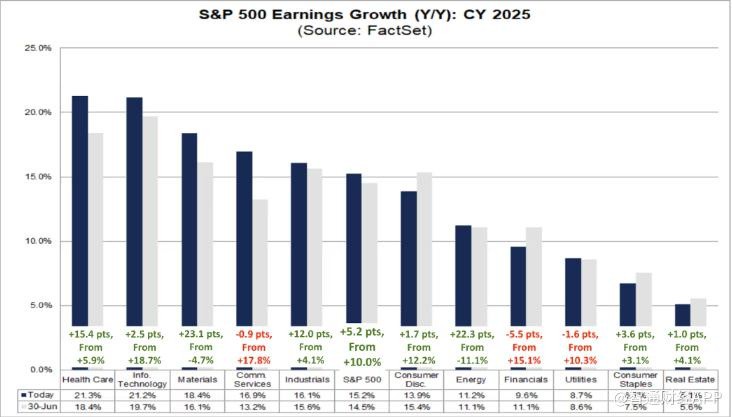

根据 FactSet 的数据,标普 500 指数周一收于 5718.57 点,创下了新的历史纪录。DataTrek 联合创始人 Nicholas Colas 在周一发送的邮件中指出:“与某些悲观派的观点相反,推动标普 500 盈利增长的不仅仅是科技和人工智能领域。未来一年内,多个行业都将贡献其力量,甚至可能超出预期。”

根据 DataTrek 的数据,华尔街分析师预计标普 500 指数的每股收益明年将增长 15.2%,这一增速高于今年的 10%。Colas 在引用 FactSet 的数据显示,明年盈利增长预期分布广泛,尤其在能源、材料和工业等周期性行业表现尤为突出。

Colas 还指出,随着美联储进入 “宽松模式”,即使美国经济仍在稳步增长,股票市场可能会继续走高。就企业盈利预期而言,华尔街分析师预计标普 500 指数在未来四个季度的每股收益将攀升至 258 美元,较过去四个季度增长约 12%。

与此同时,标普 500 指数目前的市盈率为 22.1 倍,较其过去五年平均的 19.5 倍和十年平均的 18 倍有所上升,但仍低于 2020 年创下的 23.2 倍峰值。Colas 总结道:“标普 500 指数达到 6000 点的目标代表了某种 ‘高峰信心’ 的价格预期,这是基于近期指数盈利能力的乐观但可实现的估计。”

标普 500 指数在美联储降息后创下历史新高

周一,标普 500 指数小幅上涨,突破了之前 9 月 19 日创下的历史高点。当天正是美联储宣布将利率下调 50 个基点,开启其降息周期的第二天。

先锋领航集团美国国债及 TIPS 高级投资组合经理 John Madziyire 在电话采访中表示:“软着陆的概率增加了。” 他指出,美国经济展现出韧性,通胀在 “紧缩” 货币政策的背景下有所缓和。他进一步指出,目前美联储正在将基准利率重新校准至一个中性水平,即既不会减缓也不会刺激经济的水平。

上周,美联储将基准利率降至 4.75% 至 5% 的目标区间。Madziyire 认为,所谓的中性利率可能接近 3%。

今年债券市场的利率出现了下降,10 年期和 2 年期美国国债的收益率本月和年初至今都有所下滑。周一,10 年期美国国债收益率小幅上升至 3.74%,而 2 年期国债收益率则维持在 3.576%,数据来源于道琼斯市场数据。

Colas 表示,在企业盈利增长和利率下降的环境下,标普 500 指数达到 6000 点 “并不难”,这相较于上周五的收盘价仅为 5.2% 的涨幅。