"Weak US Dollar" Becomes the Theme of the Forex Market? The US Dollar Index is about to erase all gains by 2024

美元指數接近 1 月以來的最低水平,交易員普遍認為美聯儲在 11 月降息 50 個基點的概率為 50%。外匯交易員押注美聯儲將更快降息以支持經濟,導致美元兑多種貨幣匯率走低。分析師預計美元未來可能進一步走弱,儘管幅度較小。市場對美聯儲降息的預期加劇,華爾街大行高盛已下調美元匯率預期。

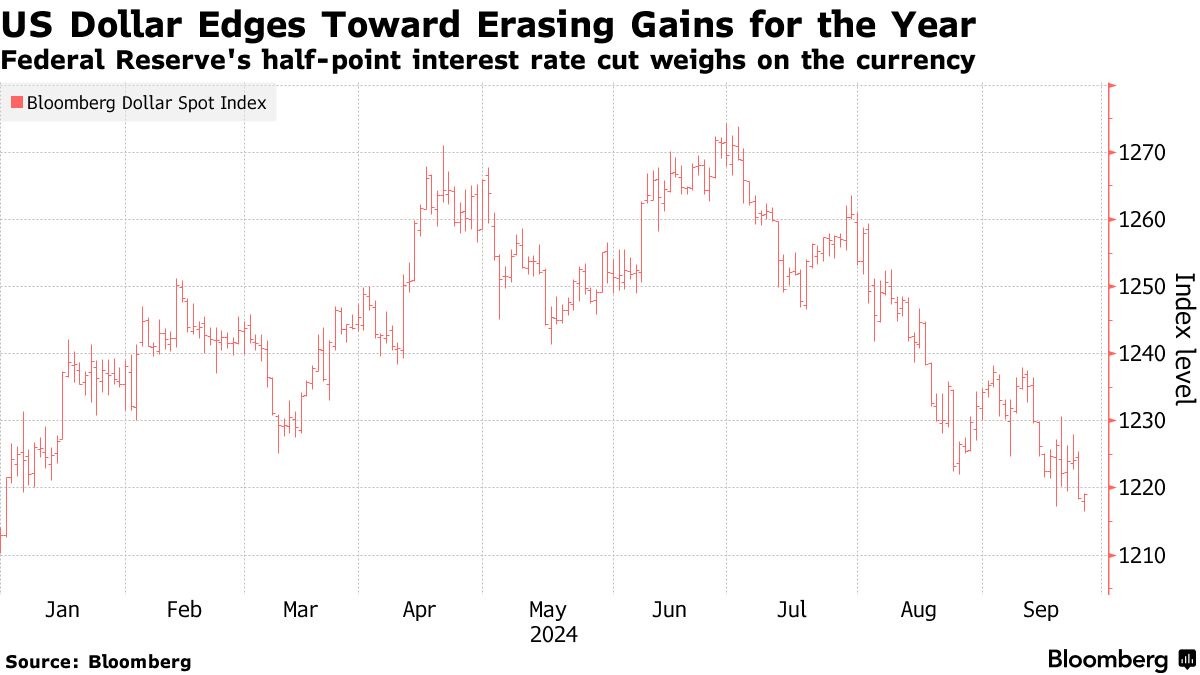

智通財經 APP 獲悉,衡量美元兑一籃子貨幣強弱基準的美元指數即將抹去今年以來的所有漲幅,因為外匯交易員們押注美聯儲將比此前預期的更快降息以支持美國經濟。儘管彭博美元指數 (Bloomberg Dollar Spot Index) 週三微小幅度上漲,但仍距離去年 12 月以來的最低水平僅僅不到一個百分點,意味着即將抹去全年漲幅。美元兑歐元匯率接近一年多來的最低水平,而美元兑英鎊匯率則處於至少兩年半以來的最低水平。

美聯儲決定以大幅降息 50 個基點啓動寬鬆貨幣政策,並且截至明年年底有望大幅降息 200 個基點,這無疑給美元帶來巨大壓力,關於近期降息幅度,即今年年底之前的降息幅度的市場爭論也在加劇。週二,利率期貨交易員們加大了對美聯儲進一步寬鬆政策的押注,CME“美聯儲觀察工具” 顯示 11 月美聯儲再次宣佈降息 50 個基點的可能性一度超過 50%。

“自 7 月底以來,隨着市場轉向美聯儲聯邦公開市場委員會 (FOMC) 更激進寬鬆政策的前景,美元顯著走弱。” 三菱日聯金融集團 (MUFG) 高級外匯分析師李·哈德曼表示。“我們認為美元未來很容易進一步走弱,儘管走弱的幅度可能較小。”

華爾街對於美元轉向看跌立場

長期以來看好美元,甚至在美聯儲降息前夕仍然看好美元的華爾街大行高盛集團,在上週意外下調了美元兑歐元、英鎊和日元等多種貨幣的匯率預期,該行分析師表示,美聯儲的超預期大幅降息決策表明,美聯儲願意比全球其他中央銀行更積極地應對潛在的經濟衰退。

來自摩根大通的外匯策略團隊則表示,他們將保持美元敞口 “輕微且偏向於淨中性”,直到美國勞動力市場數據進一步明確美聯儲的緩和利率路徑。

值得慶幸的是,目前沒有明確的跡象表明美國經濟處於衰退之中。儘管如此,提示經濟增速放緩的緊張跡象仍在不斷出現,包括失業人數增加,非農就業人數急劇放緩,以及儲蓄過剩趨勢逐漸枯竭,加之拖欠率上升。週二,最新調研數據顯示,美國消費者信心指數創下三年來的最大跌幅。

美聯儲主席傑羅姆·鮑威爾在美聯儲宣佈降息 50 基點後的發佈會上表示,市場不應假設 50 個基點是 “新的降息步伐”,但強調官員們將繼續監測經濟活動,以確定未來的利率政策舉措。尋找美元走勢線索的外匯交易員們,接下來大概率將密切關注本週晚些時候的美國經濟增長數據以及通脹數據,洞察美國經濟是否仍然韌性十足。

與美元指數相反的是,短期國債價格自 9 月以來不斷上漲,但都集中反應的是金融機構交易員們增加對美聯儲更激進寬鬆政策的押注。2 年期美國國債收益率對於利率預期最為敏感,持續下降表明市場降息預期不斷升温,目前 2 年期美債收益率降至 2022 年末以來的最低水平,並進一步拉動美債收益率曲線趨陡。

“弱美元” 成為外匯市場當前的交易主題?

隨着顯示美國經濟放緩的數據越來越多,金融市場目前所定價的美聯儲激進降息前景已經對美元匯率構成巨大壓力,兑換一籃子全球主要貨幣的美元指數在 8 月份可謂經歷了今年表現最糟糕的一個月,並且在 9 月持續走弱,顯示出 “弱美元” 趨勢已經是外匯交易員們的交易共識。

來自美國資產管理巨頭 Point72 Asset Management 的市場策略師兼經濟學家索菲婭·德洛索斯 (Sophia Drossos) 近日接受採訪時表示,隨着美聯儲即將開始新一輪降低借貸成本的週期,以及世界其他地區在降息預期驅動下陸續出現經濟樂觀跡象,美元兑其他主權國家貨幣匯率正在進入明顯的下行趨勢。德洛索斯的呼籲可謂與華爾街策略師們對於美元未來走向弱勢的觀點一致。

美元指數在美聯儲降息週期走弱,以美元計價的黃金價格在降息週期持續衝高,似乎已成為華爾街多數市場策略師以及經濟學家們的共識預期。來自全球頂級資管機構 Pimco 的策略團隊表示,自 20 世紀 90 年代以來,在美聯儲的歷次初步降息時,美元往往暫時走低,並且隨着政策正常化,美元可能失去高收益貨幣的地位,存在温和貶值壓力。

有着 “大宗商品旗手” 稱號的華爾街大行高盛在今年早些時候曾多次高喊大宗商品牛市行情已開啓,然而最近一段時間高盛卻頻繁改口,並表示今年 5 月末談論的 “大宗商品 5D 牛市” 難以出現,現在高盛看漲的只剩黃金這一全球大類資產。

來自國際大行瑞銀 (UBS) 的分析團隊則將 2025 年中期的金價目標定在 2700 美元/盎司,同時預計未來幾個月黃金 ETF 需求將加快步伐。另一華爾街大行花旗集團預計,受美聯儲降息週期、ETF 需求強勁和場外實物需求的推動,金價可能在 2025 年年中達到 3000 美元/盎司,到 2024 年底達到 2600 美元/盎司。