The truth that subverts cognition: Since the epidemic, the US economy has been incredibly strong! With a background of interest rate cuts, is a "soft landing" imminent?

美国经济自疫情以来表现强劲,2020 年第二季度至 2023 年 GDP 年均增长 5.5%。消费者支出推动经济复苏,预计美联储降息将助力实现 “软着陆”。修订数据显示,经济增长比之前报告多出 2942 亿美元,主要源于消费者支出增加。2022 年和 2023 年消费支出显著增长,提升了对经济稳定增长的信心。

智通财经 APP 获悉,根据修订后的美国政府统计数据,美国经济从新冠疫情导致的短期衰退中反弹的势头比经济学家们预期以及美国政府此前公布的数据强劲得多,主要受 2022 年和 2023 年美国消费者推动的更大规模消费支出增长的强力推动。消费者支出韧性无疑将大力推动美国经济巨轮继续远航,毕竟美国 GDP 成分中 70%-80% 的项目与消费密切相关。展望未来美国经济,在美联储降息 50 个基点拉开降息周期帷幕之后,包括高盛在内的诸多机构认为美国经济离 “软着陆”——即通过激进加息周期成功拉低通胀的同时经济仍稳定增长,已经越来越近。

美国经济分析局的综合年度更新显示,从 2020 年第二季度到 2023 年结束,美国国内生产总值 (GDP) 经通胀调整后的平均增长率为 5.5%。与之前公布的 5.1% 的涨幅相比,修订后的数字明显更加乐观。

对于美国第二季度实际 GDP 年化季率终值,则维持前段时间公布的 3% 乐观增速,较上一季度的回升主要反映出美国消费者支出、库存投资和商业支出的加速增长,意味着美国 Q2 经济产出仍然实现强劲增长。在今年第一季度,美国政府对于美国 GDP 增长率从之前报告的 1.4% 向上修正为 1.6% 这一最新终值。Q1 与 Q2 强劲的经济增长数据,叠加美联储以 50 个基点开启降息周期,大幅提升投资者们对于美国经济成功实现 “软着陆” 的信心。

总体而言,修订后的年度数据显示,在截至 2023 年的五年中,经济增长比此前美国政府报告的数字多出 2942 亿美元。其中约三分之二的修订是由于消费者支出大幅增加。

美国经济分析局对于去年一整年的美国经济增速的则从 2.5% 上调至 2.9%,尽管调整的来源集中在上半年。整体而言,美国国内生产总值 (GDP) 的扩张步伐仍然韧性十足,但在第三季度和第四季度的年化季率被向下修正。

2022 年美国实际国内生产总值增长 2.5%,比此前公布数据的强 0.6 个百分点。此外,最新数据显示,在这一年中,只有第一季度 GDP 年化季率出现下降,而不是最初 GDP 数据报告的连续两个季度下降所显示的技术性经济衰退。

政府修正后的最终数据还显示,2023 年的美国国内总收入 (即 GDI,生产商品和服务所产生的收入和成本) 向上修正。经通胀调整后的去年 GDI 增长率从 0.4% 大幅提高到 1.7%。

美国 GDP 整体趋势经过最新修正后,自新冠疫情以来处于强劲复苏态势

在更新的 GDP 数据这一部分中,有两件事引人注目,一是 2022 年第二季度 GDP 向上修正,二是去年下半年经济增长略有放缓。虽然仍然强劲,但 2023 年第三季度 GDP 增长速度下调 0.5 个百分点至 4.4%,第四季度 GDP 增速则下调 0.2 个百分点至 3.2%,表明美国经济进入 2024 年的势头有所减弱,但好消息在于最新的 2024 年第二季度美国实际 GDP 年化季率终值仍然为 3%,没有出现任何修正,2024 Q1 则小幅向上修正。

GDP 修订——GDP 整体趋势向上修正,但 2023 年底势头有所下滑

对于 2022 年,美国政府将第二季度美国国内生产总值从下降 0.6% 意外大幅上调至增长 0.3%。此前,数据显示 GDP 连续两个季度环比下降,符合一般意义上经济技术性衰退的传统定义,但在美国,只有美国国家经济研究局 (即 NBER) 的经济学家团队认为美国经济衰退,才算是正式的官方认证的经济衰退。

值得注意的是,这份最新的年度修订终值使 GDI 指标 (即经济中所有部门获得的总收入,包括薪资、企业利润、税收和租金收入,但不包括政府补贴) 更接近 GDP。美国经济分析局的更新后数据显示,该政府部门将 2022 年美国国民收入提高了 2400 亿美元,2023 年则提高了近 5590 亿美元。

理论上,GDP 和 GDI 应该大致上相等,但实际上,这些指标偶尔会提供截然不同的经济状况。最新修订有助于缩小两者之间的分歧。2023 年,美国 GDI 增长速度从 0.4% 上调至 1.7%。2022 年 GDI 的增长率则从 2.1% 上调至 2.8%,2021 年则上调了 0.5 个百分点。

修订结果显示,一些美国居民获得的辅助收入也比以前测量指标的更强劲。这些类型的个人收入,其中包括利息收入、股息和业主收入,在 2023 年都有所增加。这种强势可能有助于解释为什么美国消费者自新冠疫情以来,有能力比许多经济学家们想象的更自由地进行消费。

GDI 统计指标上调——最新修订缩小了测量中特别大的差距

美国政府的年度更新数据还显示,到 2023 年的五年内,美国企业的整体利润大幅增长。其中,2023 年企业整体利润上调高达 2885 亿美元。

2023 年通胀仅轻微上调,疫情之后美国经济实现二战以来最强扩张之一

美国经济分析局的更新修正数据还显示,美联储官员们最青睐的通胀衡量指标——个人消费支出价格指数 (也就是 PCE)——在去年美国通胀率仍然非常火热的这一年仅仅略微上调。2023 年 PCE 统计指标上涨 3.8%,高于此前估计的 3.7%。剔除食品和能源,所谓的核心个人消费支出价格指数 (即核心 PCE) 为 4.1%,未有任何修正,与前值完全一致。

从以上数据能够看出,在疫情导致美国经济突然下滑至短暂的经济衰退之后,随后即使经历高通胀后美联储激进加息进程,一举将美国基准利率推高到 5.25%-5.5% 这一 20 多年来最高水平,但是美国经济反弹相当强劲。这一无比强劲的反弹反映出数万亿美元的财政支出和疫情后一段时间内美联储全方位 QE 带来的史诗级刺激效应。

整体而言,自 2020 年第二季度开始的这一轮美国经济无与伦比的触底反弹进程,是自第二次世界大战以来美国经济最为强劲的经济扩张周期之一。

美国经济分析局的年度更新基于最新可用和修订后的最新数据,包括从 2019 年第一季度到 2023 年第四季度的最新修订。

随着美联储降息周期拉开帷幕,美国经济 “软着陆” 似乎近在眼前

经历自二战以来最为强劲经济扩张周期之一后,展望美国经济未来,高盛等华尔街顶级投行均认为美国经济距离实现美联储心心念念的 “软着陆” 非常接近。

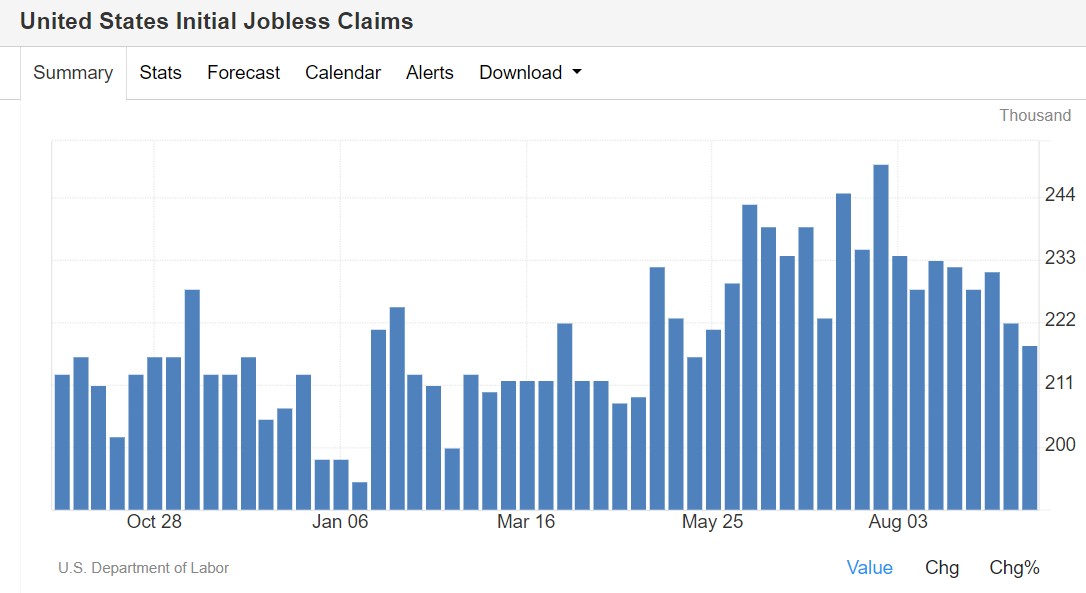

经济数据方面,最新公布的超预期上修的 GDP 增速,加上近几周的初请失业金人数基本符合预期且呈现降温态势——上周初请失业金人数降至四个月低点,以及对于美国经济至关重要的服务业继续呈现 PMI 增长扩张势头,再加之通胀持续下行,完美符合美联储官员们憧憬的美国经济 “软着陆” 前景。

随着美国通货膨胀率明显放缓,以及美联储意外降息 50 个基点开启降息周期,这可能会为住房和制造业等受借贷成本高企严重影响的行业提供显著的需求压力缓解,并且有可能为自疫情以来韧性十足的美国消费者支出添上助力增长的重磅催化剂,进而带动美国经济加速增长。

高盛首席财务官在美东时间周二表示,美联储降息 50 个基点的举措使美国经济真正意义上走上了 “软着陆” 的轨道。首席财务官 Denis Coleman 表示:“我认为首次降息 50 个基点是新方向的明确信号。希望这将释放出越来越多的信心,并明显降低资本成本——或许还能在今年年底前采取一些更具战略性的举措。”“在转向过程中管理经济一直是一项非常棘手的工作。但通胀正在下降,失业率处于可控水平,美联储开始实施降息,并在某种程度上保持软着陆的轨迹。”

美联储官员们近日纷纷表示,鉴于通货膨胀率担忧已基本消退,他们现在更关注双重使命中的劳动力市场方面。美联储主席鲍威尔多次表示,美联储官员们不寻求或欢迎劳动力市场状况进一步降温。鲍威尔等美联储官员在近期通过各种措辞暗示,美联储未来主要工作既要避免经济衰退,也要保证美国经济 “软着陆”。