报道称美司法部调查超微电脑,股价跳水 18% 几度跌停,英伟达涨超 3% 后转跌

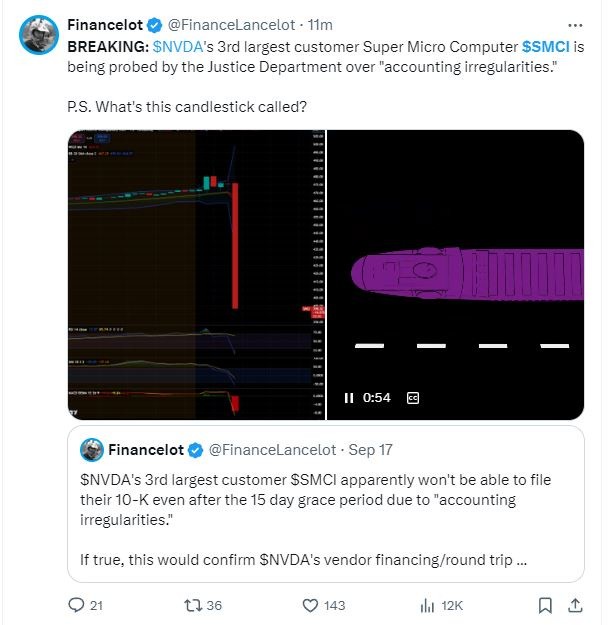

針對英偉達的股價短線跳水,有社交媒體網友稱,英偉達第三大客户超微電腦正因 “會計違規” 接受司法部調查,很難不讓人聯想到負面消息會波及英偉達。美國司法部正尋求 4 月指控超微電腦及其 CEO 會計違規行為的 “吹哨人” 信息。

9 月 26 日週四美股午盤前,據華爾街日報獨家報道,在興登堡研究公司(Hindenburg Research)發佈了做空報告之後,美國司法部正調查 “AI 妖股”、服務器製造商超微電腦,調查處於初步階段。

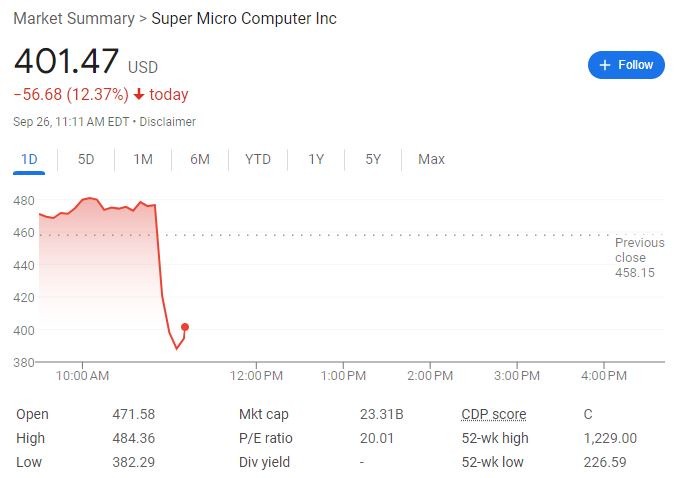

這一消息令超微電腦短線跳水,由盤初漲 5.7% 迅速轉跌,而且因波動性過大而數度臨時停牌。費城半導體指數漲幅從盤初的 4.4% 一度收窄至不足 1%。

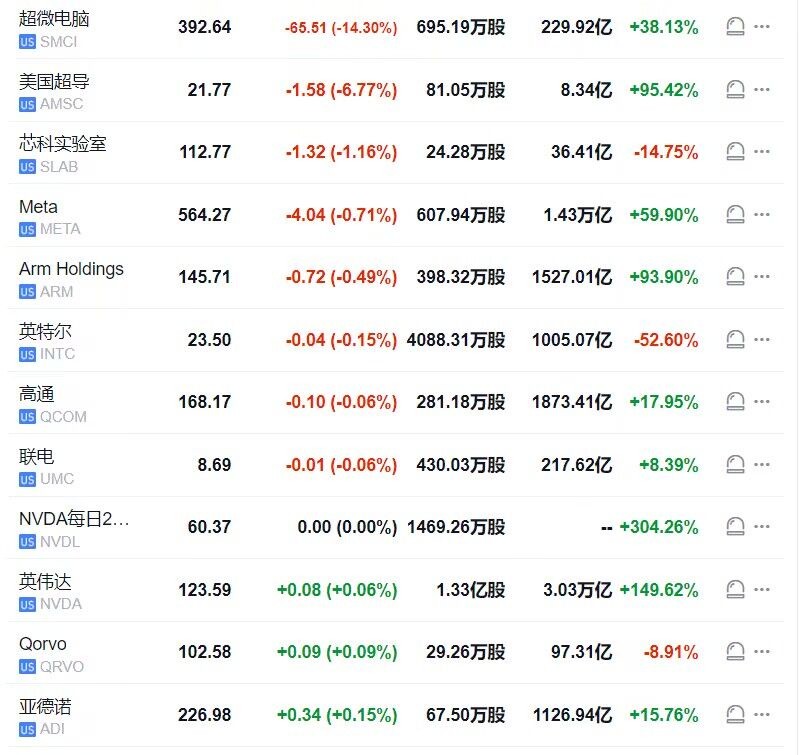

當超微電腦恢復交易後,其股價跌幅最深擴大至 18.6%,創近一個月最大跌幅,且逼近 9 月 6 日所創的八個月低位。熱門芯片股也紛紛跳水,英偉達從盤初漲 3.4% 一度轉跌並跌 1%。

盤初芯片股齊漲,主要受到美光科技週三盤後財報顯示 AI 需求旺盛的提振。

據知情人士透露,舊金山美國聯邦檢察官辦公室的一名檢察官最近聯繫了一些人士,尋求與一位在今年 4 月指控超微電腦公司及其 CEO 會計違規行為的前僱員信息。

此前在 8 月底,超微電腦申請推遲向美國證監會 SEC 提交 2024 財年的 10-K 年報,稱各方正竭力完成評估。在這一申請之前幾天,興登堡研究發佈了針對該公司的做空報告,稱其存在 “會計操作、未披露的關聯方交易的證據、違反出口禁令以及客户流失” 等一系列問題。

而針對英偉達的股價短線跳水,有社交媒體網友稱,英偉達的第三大客户超微電腦正因 “會計違規”(accounting irregularities)接受司法部調查,很難不讓人聯想到負面消息會波及英偉達,“如果屬實,這將證實英偉達的供應商融資/往返融資正在崩潰。”

興登堡研究的做空報告也提到了超微電腦前員工 Bob Luong 提出的指控,在 “吹哨人訴訟” 中,Bob Luong 提到超微電腦解僱了幾名與過去會計違規行為有關的員工,隨後又重新聘用這些人。Bob Luong 曾擔任公司 “為全球服務團隊提供指導的總經理職務”,去年 4 月被解僱。

他還指控超微電腦在某些情況下不恰當地確認了 2020 財年至 2022 財年的收入。例如,在某些情況下,公司將尚未完成的銷售收入記入賬目,另一種提前記入收入的方法是 “向某些客户發貨並收取尚未準備好出售的不完整設備的費用”。

此外,興登堡做空報告還質疑超微電腦與 CEO Charles Liang 家族經營的其他公司存在關聯交易,並違反了美國在俄烏衝突爆發後對俄羅斯的制裁禁令。

而超微電腦 CEO 在 9 月 3 日致信客户稱,做空報告 “包含有關我們公司的虛假或不準確陳述”,而且預計不會對之前發佈的 2024 財年財務業績做出任何重大改變。

據悉,超微電腦已向法院申請暫緩 Bob Luong 的訴訟,並將他的索賠提交仲裁。而在 2020 年,超微電腦曾支付了 1750 萬美元來和解 SEC 對其普遍存在會計違規行為的指控,公司 CEO 也與 SEC 達成和解,向公司返還了 210 萬美元的股票銷售利潤,不過公司和 CEO 都沒有被指控不當行為。

值得注意的是,超微電腦曾在 8 月初宣佈,將於 10 月 1 日執行 10 比 1 拆股計劃,這主要是由於公司股價在較短時間內迅速上漲,拆股後不再 “過於昂貴” 有利於刺激新的購買活動。從 2023 年初到今年 3 月份,該股巔峯時期曾上漲了 14 倍,公司市值達到 660 億美元。

美股研投機構 The Motley Fool 指出,超微電腦自 3 月創新高後已跌價近 70%,持續拋售可能是由於喜憂參半的財報以及興登堡賣空報告:

“鉅額資本支出已對該公司的毛利率產生了明顯拖累,導致人們對其流動性和長期盈利潛力感到擔憂。但管理層將利潤率惡化描述為與新產品推出和供應鏈問題相關的短期問題。”