Black Swan Fund founder raises alarm: US stock market "golden-haired girl" faces sudden end danger

I'm PortAI, I can summarize articles.

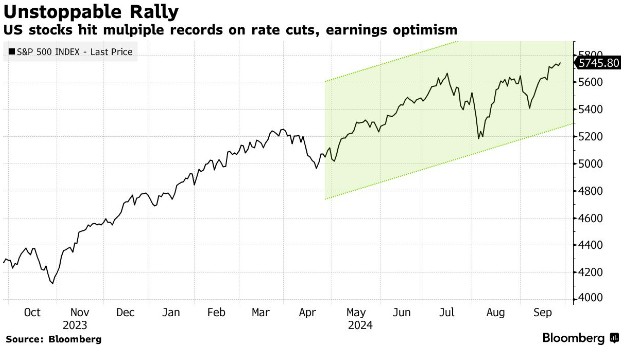

黑天鵝基金創始人馬克•斯皮茨納格爾警告稱,儘管美股創下歷史新高,市場似乎處於 “金髮姑娘地帶”,但投資者應警惕潛在風險。他預計全球市場將在年底前崩潰,可能由經濟放緩引發。他提到,美聯儲降息可能導致市場波動加劇,黃金和加密貨幣將下跌,而債券可能成為避風港。

智通財經 APP 獲悉,黑天鵝基金 Universa Investments 創始人兼首席投資官馬克•斯皮茨納格爾 (Mark Spitznagel) 表示,隨着股市創下歷史新高,交易員對經濟軟着陸的信心日益增強,股市似乎處於 “金髮姑娘地帶”,但在週四接受採訪時,他表示投資者應警惕二階效應,比如即使美聯儲降息,經濟放緩也可能導致市場突然崩潰。斯皮茨納格爾預計,全球市場在今年年底之前將出現 “崩潰”,這可能由經濟放緩所推動。

斯皮茨納格爾説:“當收益率曲線反轉,然後又反轉,時鐘開始轉動,那就是你進入黑天鵝領域的時候。” 他的公司由《黑天鵝》的作者 Nassim Nicholas Taleb 擔任顧問。“黑天鵝總是潛伏着,但現在我們進入了它們的領地。”

受到企業盈利彈性、美聯儲降息週期以及美國經濟將能夠避免衰退的預期的提振,標準普爾 500 指數在 2024 年創下 42 個歷史新高。但斯皮茨納格爾認為,美聯儲降低借貸成本將令投資者感到擔憂,並更多地考慮明年的股價走勢。

他説:“黃金將下跌,加密貨幣將與風險資產一起下跌。” 他認為債券或為一個藏身之處。他還預計,未來幾個月市場波動性將大幅上升。