The selling wave of US Treasury bonds intensifies, betting on a 50 basis point rate cut to prevent a collapse

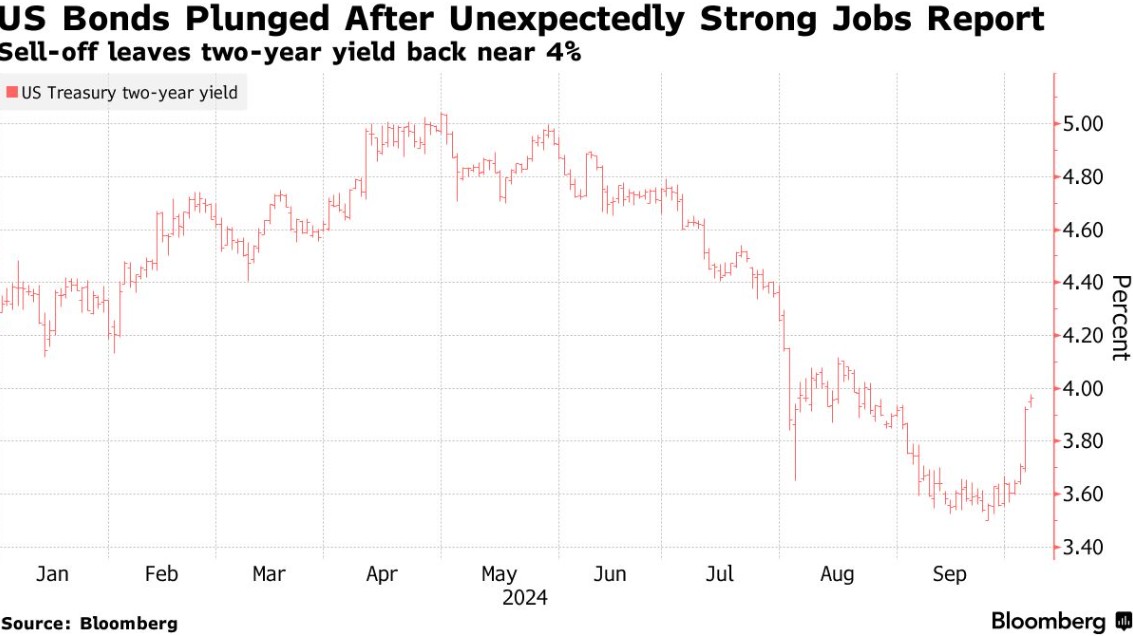

美國債券市場週一大幅下跌,因強勁的勞動力市場數據引發拋售潮,交易員削減對美聯儲降息的押注。10 年期美債收益率升至 4.03%,2 年期收益率升至 4.02%。市場對美聯儲在 11 月降息 25 個基點的可能性為 80%。分析師指出,經濟狀況改善導致市場重新評估美聯儲的政策,預計收益率將進一步上升。

美國債券週一大幅下跌,深化了由強勁勞動力市場數據引發的拋售潮,導致交易員大幅削減對美聯儲大幅降息的押注。

因投資者放棄對美國國債的看漲押注,主要收益率被推高至 4% 以上,這是自 8 月以來的最高水平。自 8 月 1 日以來,貨幣市場首次暗示到年底降息不到 50 個基點。交易員現在認為美聯儲在 11 月降息 25 個基點的可能性為 80%。

“討論正轉向是否還會有任何降息,” TD 證券的利率策略師 Jan Nevruzi 説。“從經濟角度來看,情況並不像之前那麼糟糕,這導致市場重新定價美聯儲。” TD 繼續預計 11 月會有 25 個基點的降息。

10 年期美債收益率週一最多上漲 6 個基點至 4.03%,而 2 年期美債收益率最多上漲 10 個基點至 4.02%。較短期美債的表現不佳導致收益率曲線的關鍵部分短暫重新倒掛。歷史上,美債收益率曲線呈向上傾斜,較長期限的債券支付較高的收益率,這一常態在美聯儲大幅加息近兩年後被打破。

最新的波動反映了債券市場對美聯儲將實現 “無着陸” 情景的預期復甦——即美國經濟持續增長、通脹再次升温、而美聯儲幾乎沒有降息的空間。上週五的非農報告重新引發了一系列關於經濟過熱的擔憂,破壞了美債連續五個月的漲勢。

“我們預計到收益率會升得更高,但也預料到會有一定程度的逐步調整,” 高盛策略師 George Cole 等人在一份備忘錄中寫道。“9 月就業報告的強勁程度可能加速了這一過程,重新引發了關於政策限制程度以及美聯儲降息幅度的討論。”

週一追蹤期貨市場持倉情況的未平倉合約數據顯示,與有擔保隔夜融資利率(Secured Overnight Financing Rate)相關的多個合約大幅下跌,表明多頭頭寸出現投降。

與此同時,在期權市場上,有大量的新鷹派對沖,針對的是今年僅再降息 25 個基點。

週一,花旗集團的經濟學家在一份報告中表示,他們預計美聯儲將在 11 月份降息 25 個基點,與其他華爾街銀行一道放棄了對 50 個基點降息的預測。

“11 月不降息的門檻很高,因為一個月的勞動力市場數據並沒有令人信服地減少了多個月以來不斷增長的下行風險,這些風險涉及多個數據集,導致官員在 9 月降息了 50 個基點,” Veronica Clark 和 Andrew Hollenhorst 寫道。“我們認為,未來幾個月勞動力市場將再次出現疲軟,整體通脹趨勢仍在放緩,美聯儲官員到 12 月還會降息 50 個基點。 ”

交易員們現在正在期待美聯儲決策者的一系列講話,以進一步瞭解利率走勢。市場也在等待本週晚些時候公佈的美國通脹數據。

TS Lombard 董事總經理 Dario Perkins 表示:“不需要衰退就能讓通脹達到可容忍的水平,因此美聯儲正在放鬆政策,而不是等待真正的經濟疲軟。到目前為止,每個人都應該意識到,美聯儲正在先發制人地降息。”

彭博美國利率策略師 Alyce Andres 説:“在 11 月的 FOMC 會議上,不再有降息 50 個基點的路徑。債券市場仍在適應新的定價現實。”