How large was the scale of the three rounds of debt-for-equity swaps in history?

第一轮化债(2015-2018 年)发行共约 12.2 万亿置换债置换存量政府债务;第二轮(2019 年)发行 1579 亿置换债置换隐性债务;第三轮(2020 年 12 月-2022 年 6 月)累计发行 1.13 万亿特殊再融资债。

近年来支持化债力度最大的措施即将出台!

财政部部长蓝佛安 12 日在国新办新闻发布会上表示,拟一次性增加较大规模债务限额,置换地方政府存量隐性债务,加大力度支持地方化解债务风险,这项政策是近年来出台的支持化债力度最大措施。

蓝佛安表示,政策 “及时雨” 将大大减轻地方化债压力,腾出更多资源发展经济,提振经营主体信心,巩固基层 “三保”。

化债规模究竟有多大,是本次发布会的全场最大焦点,虽然财政部没有提及具体数字,但可以从历史上的三轮化债行动寻找蛛丝马迹。

根据中信期货固收团队此前的梳理,财政部历史上曾主导完成了三次大规模化债行动,主要情况如下:

第一轮(2015-2018 年)化债发行共约 12.2 万亿置换债置换存量政府债务;

第二轮(2019 年)发行 1579 亿置换债置换隐性债务;

第三轮(2020 年 12 月-2022 年 6 月)累计发行 1.13 万亿特殊再融资债。

2015-2018 年第一轮化债:规范举债融资机制

本轮化债主要是在地方融资平台债务快速膨胀、潜在违约风险增大的背景下进行的。从过程来看,先规范地方政府举债融资机制、并对地方政府债务进行清理和甄别后,在 2015-2018 年发行共约 12.2 万亿置换债置换存量政府债务。

正式化债从 2015 年开始,由财政部下达置换债额度,地方政府按额度发行。据 21 世纪经济报道,地方政府先向财政部报告 2016 年及以后年度的债务到期情况,财政部再根据全国情况统筹协同,向各省下发置换债上限额度。2016-2018 年,地方政府发行置换债的规模分别为 4.9 万亿、2.8 万亿、1.3 万亿。

2019 年第二轮化债:隐性债务减量

本轮化债主要是在债务压力较大省市选择建制县作为隐性债务化解试点,发行 1579 亿置换债置换隐性债务。

2019 年 6 月 26 日,贵州省率先发行 115 亿置换债,拉开第二轮置换债发行序幕。截至 2019 年底,累计规模仅为 1579 亿元。其中,贵州、湖南发行规模超 300 亿,分别占比 24% 和 23%,甘肃省发行规模最少,仅 60 亿,占比约 4%。从债券类型来看,专项债规模 956 亿,占比约 61%,一般债发行 623 亿,占比约 39%。

除了 6 个试点省市外,江苏也发行了 150 亿专项债置换隐性债务。

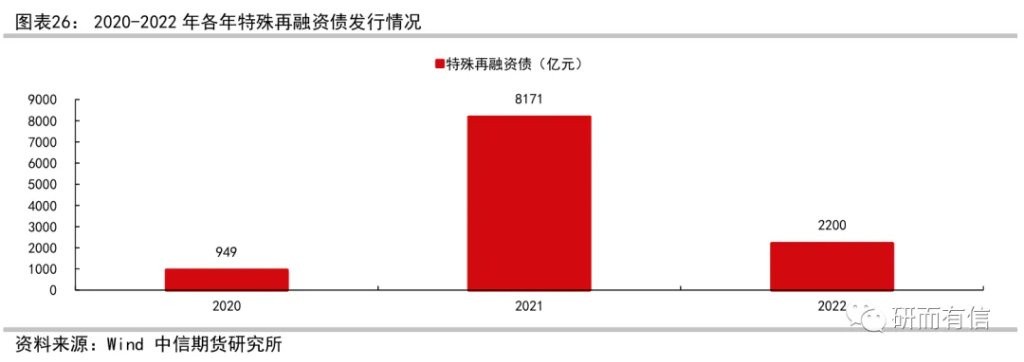

2020-2022 年第三轮化债:开启隐债清零

2020 年 12 月-2022 年 6 月,财政部进行了第三轮化债工作。通过将隐性债务化解试点扩容,并在北上广试点 “全域无隐性债务”,本轮化债累计发行 1.13 万亿特殊再融资债。

地方化债主要经历了 “规范举债融资机制→隐性债务减量→隐性债务清零” 的历程:

第一阶段(2020/12-2021/9)建制县隐性债务化解试点扩容。2020 年,建制县隐性债务试点范围扩容至 26 个省市,并于 12 月开始发行特殊再融资债偿还存量债务。该阶段累计发行 6278 亿特殊再融资债券。其中一般债 3387 亿,占比约 54%;专项债 2891 亿,占比约 46%。

第二阶段(2021/10-2022/6)北上广全域无隐性债务试点。自 2021 年 10 月起,经国务院批准,广东、上海、北京陆续启动 “全域无隐性债务试点” 工作。这一阶段,北京、上海、广东(含深圳)分别发行约 3252.3 亿、654.8 亿以及 1134.8 亿特殊再融资债,三地区累计发行特殊再融资债约 5041.8 亿元。

最终广东省、北京市、上海的多个区宣布完成全域无隐性债务试点工作。

与第二轮相比,本轮化债的范围及规模均有所扩大,而且在债务管控较好的广东、上海及北京启动了全域无隐性债务试点,开启了 “隐性债务清零” 的早期阶段。发债类型也从置换债改为特殊再融资债。

第四轮化债正在进行中,2023 年-2024 年已安排 3.4 万亿地方债额度支持化债

第四轮化债从 2023 年启动,目前仍在进行当中。中信期货固收团队认为,当前正处于债务压力较大地区 “隐性债务减量” 与债务压力较小地区 “隐性债务清零” 共同推进的阶段。

根据财政部 12 日介绍,中央财政在 2023 年安排地方政府债务限额超过 2.2 万亿元的基础上,2024 年又安排 1.2 万亿元的额度,支持地方特别是高风险地区化解存量债务风险和清理拖欠企业账款等。地方债务风险整体缓释,化债工作取得阶段性成效。

蓝佛安还说,专项债券方面,待发额度加上已发未用的资金,后三个月各地共有 2.3 万亿元专项债券资金可安排使用。我们将督促地方切实用好各类债券资金,加快项目实施进度,根据实际需要及时拨付资金,尽快形成实物工作量,发挥对投资的拉动作用。