The Japanese yen to US dollar exchange rate hovers near a key level, with the risk of Japanese authorities intervening once again becoming a focus of attention

日元兑美元匯率接近關鍵水平,投資者擔心可能跌至 1 美元兑 150 日元。日元在過去兩週內貶值,週一一度跌至 149.98 日元,創下 2009 年以來最大單週跌幅。日本當局干預的風險加大,尤其是在美日利差收窄的背景下。日本新首相的言論緩解了加息擔憂,導致日元下跌。市場對美聯儲降息的預期也可能影響日元走勢。

智通財經 APP 獲悉 ,隨着投資者準備好迎接日元兑美元匯率跌回 1 美元兑 150 日元甚至更低的水平,日本當局下場干預的風險再次成為關注焦點。

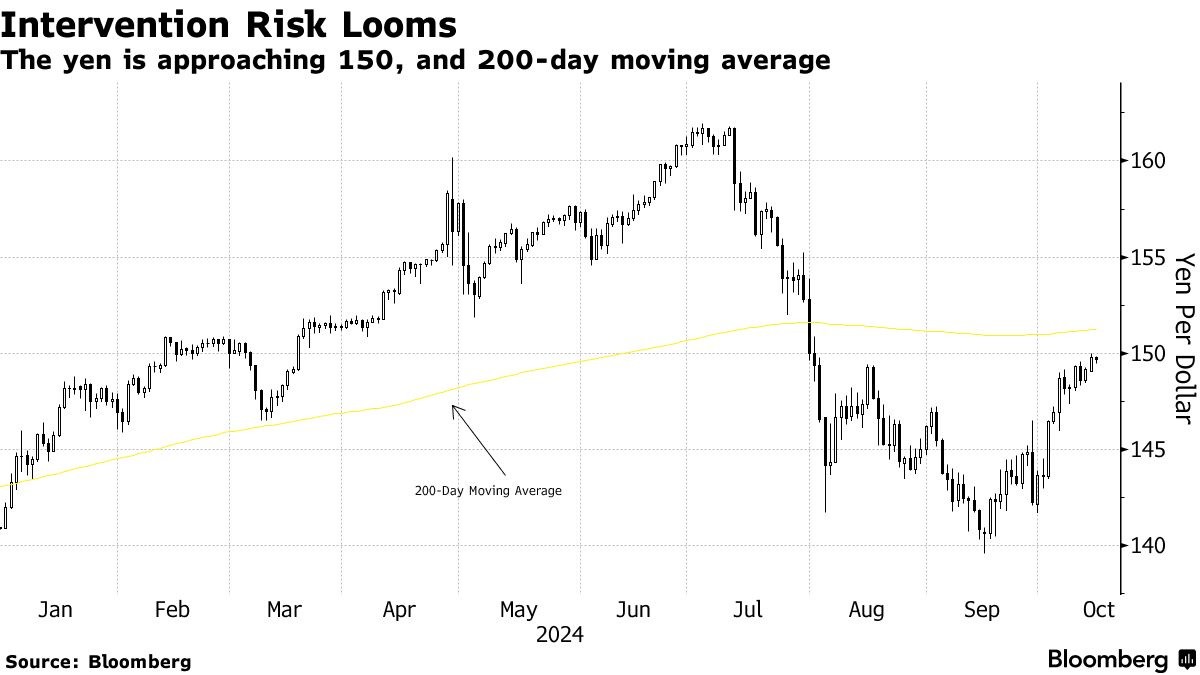

日元在連續兩週走軟後,週一一度跌至 1 美元兑 149.98 日元。數據顯示,日元兑美元匯率在截至 10 月 5 日的一週內下跌約 4.4%,為 2009 年 12 月以來的最大單週跌幅。日元進一步貶值的前景促使策略師警告稱,日本當局在 1 美元兑 150 日元附近 (200 日移動均線為 1 美元兑 151.25 日元) 干預的風險加大。

日本官員近期發出的警告意味着,市場目前認為美日利差收窄的速度不會像此前預期的那麼快。日本新任首相石破茂本月早些時候發表了 “日本經濟尚未準備好接受日本央行的再次加息” 的言論,這緩解了市場對日本央行加息的擔憂,並導致日元迅速下挫。與此同時,美聯儲理事沃勒週一表示,美聯儲應該謹慎降息。

東京 Gaitame.com 研究所的研究主管 Takuya Kanda 表示:“關鍵是日元是否會跌破 1 美元兑 152 日元。” 他指出,這是日元的一個關鍵水平,因為上次日元跌破這一水平時很快就跌向了 1 美元兑 160 日元。

今年 7 月,當日元兑美元匯率跌至 38 年低點時,日本當局進行了干預。在此之後,日元兑美元匯率由 7 月初觸及的 1 美元兑 161.95 日元大幅反彈至 7 月底的 1 美元兑 149.98 日元。

根據美國商品期貨交易委員會 (CFTC) 的數據,截至 10 月 8 日,槓桿基金的日元淨多頭頭寸連續第二週回落,表明它們不太看好日元。Resona Holdings 高級策略師 Keiichi Iguchi 表示,如果對美聯儲降息的預期被修正,日元仍有可能面臨拋售壓力。

不過,也有一些策略師認為,日本當局在決定再度干預之前還有很長的路要走。Nissay 資產管理公司戰略投資部門負責人 Eiichiro Miura 表示:“除非日元跌破 1 美元兑 160 日元,否則 (日本當局) 不會進行干預。”