Most Asia-Pacific stock indices fell, COMEX gold futures broke above $2800, and spot gold hit a new high again

美國經濟數據好壞參半,市場下調對 12 月歐洲央行大幅降息和英國降息預期。美股齊跌,芯片指數跌超 3%,英偉達一度跌超 3%,中概指數跌超 2% 後跌幅砍半,理想汽車轉漲近 2%。歐股普跌超 1%。減肥藥銷售不佳令禮來一度跌近 15% 為十六年最差。10 年期美債收益率尾盤轉漲徘徊三個月高位,美元衝高回落,政府預算公佈後英鎊波動轉跌、英債收益率 V 型反彈。離岸人民幣漲近 200 點升破 7.13 元。

美國經濟數據好壞參半,雖然消費支出猛增,但美國三季度實際 GDP 增速低於預期,核心 PCE 通脹環比漲 2.2%,雖繼續降温但仍高於預期。勞動力市場強於預期,美國 10 月 ADP 就業人數超預期增至 23.3 萬人,企業招聘速度創一年多以來新高。美國樓市領先指標成屋簽約銷售 9 月環比上升 7.4%,創四年來最大升幅,美國抵押貸款利率升至 7 月底以來最高水平。同時,美國財政部季度再融資指引維持不變。

國際方面,歐元區三季度 GDP 同比初值 0.9% 增速超預期,德國經濟意外避免衰退,法國經濟增長提速,西班牙經濟持穩。歐洲央行管委兼德國央行行長 Joachim Nagel 表示,歐元區服務通脹仍然偏高。歐洲央行仍然應當對通脹風險保持警惕,而不要匆忙地調整政策利率。另外,英國財政大臣裏夫斯提交預算報告,到 2030 年將增税 412 億英鎊,以填補工黨政府所説的國家公共財政 “黑洞”。

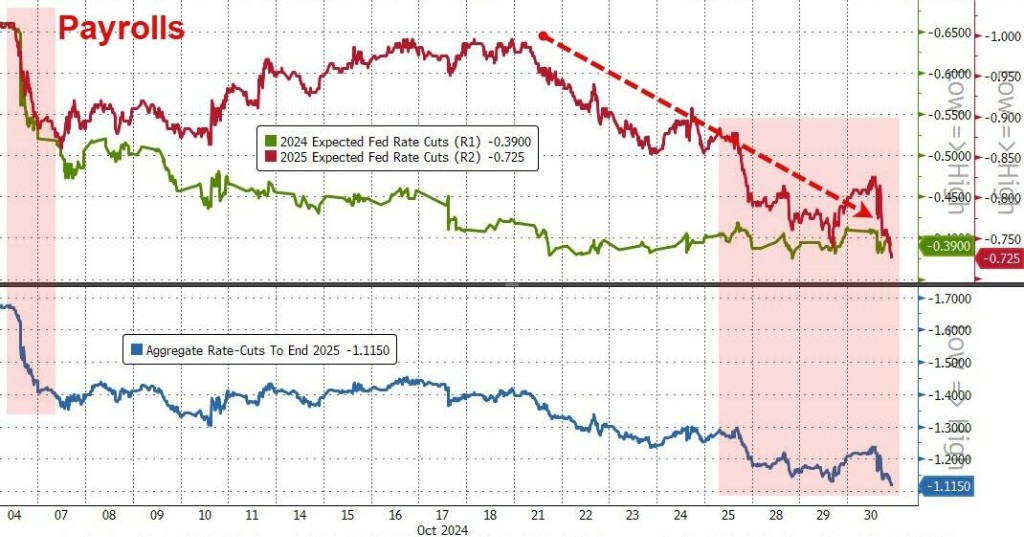

數據公佈後,歐美英降息預期均降温,歐美英國債收益率最終集體走高,市場目前預計美聯儲 11 月降息 25 基點概率從接近 100% 降至 94.7%,預計歐洲央行 12 月降息 50 基點的概率大約為 25%,而非本月早些時候的 50%。有分析師預警稱,週五非農就業若強勁可能令美聯儲 12 月暫停降息。

10月30日週三,市場聚焦財報季,美股早盤時一度齊漲,但隨後急轉直下最終齊跌,納指創盤中新高後領跌。AMD財報指引欠佳、安永審查超微電腦後離職,引發芯片股和AI股拋售潮,令英偉達承壓一度跌超3%。“科技七巨頭”中,“元宇宙” Meta三季報整體勉強好於預期, “AI領頭羊”微軟三季度盈利歷史新高:

- 美股三大指數齊跌。標普 500 指數收跌 19.25 點,跌幅 0.33%,報 5813.67 點。與經濟週期密切相關的道指收跌 91.51 點,跌幅 0.22%,報 42141.54 點。科技股居多的納指收跌 104.82 點,跌幅 0.56%,報 18607.93 點。納指 100 指數收跌 0.79%。衡量納指 100 科技業成份股表現的納斯達克科技市值加權指數(NDXTMC)收跌 1.02%。對經濟週期更敏感的羅素 2000 小盤股指數收跌 0.23%。恐慌指數 VIX 收漲 5.43%,報 20.39。

美股扭轉早盤齊漲態勢,納指領跌

- 美股行業 ETF 收盤漲跌互現。全球航空業 ETF 與區域銀行 ETF 各漲超 1%,銀行業 ETF 漲幅接近 1%,金融業 ETF 漲不足 0.5%。而半導體 ETF 跌近 2.5%,科技行業 ETF 與全球科技股 ETF 各跌近 1.5%。

- 標普 500 指數的 11 個板塊漲跌不一。 信息技術/科技板塊跌 1.34%,必選消費板塊跌 0.26%,公用事業板塊跌 0.24%,醫療保健板塊跌 0.19%,工業板塊跌 0.19%,可選消費板塊漲 0.01%,能源板塊漲 0.04%,原材料板塊漲 0.37%,房地產板塊漲 0.39%,金融板塊漲 0.42%,電信板塊漲 0.99%。

- 投研策略上:花旗集團策略師認為,若特朗普勝選且共和黨在國會大獲全勝,可能是賣出美股的信號,建議在大選後任何上漲行情中減倉。

- “科技七姐妹” 多數下跌。蘋果收跌 1.53%,發佈搭載 M4 芯片的 MacBook Pro,具有 Apple Intelligence 功能。英偉達收跌 1.36%,特斯拉收跌 0.76%,比亞迪登頂電車之王,季度營收首次超越特斯拉。“元宇宙” Meta 收跌 0.25% 且盤後一度跌超 3%,三季報整體勉強好於預期,上調四季度資本開支指引區間的上限。谷歌 A 收漲 2.82%,Q3 雲收入勁增 35%,總營收意外提速。亞馬遜收漲 1%,“AI 領頭羊” 微軟收漲 0.13%,三季度盈利歷史新高,Azure 雲收入增超 30%,盤後漲近 2%。

- 芯片股全線下跌。費城半導體指數收跌 3.35%。行業 ETF SOXX 收跌 3.53%;英偉達兩倍做多 ETF 收跌 2.67%。AMD 收跌 10.62%,公司上調 AI 芯片年銷售預期,但 Q4 指引欠佳。同樣四季度指引欠佳的果鏈 Qorvo 跌超 27% 至四年半低位。科磊收跌 0.64%。安森美半導體收跌 1.43%,Arm 控股收跌 1.76%,高通收跌 4.76%。阿斯麥 ADR 收跌 4.38%,股價跌破 700 美元大關。博通收跌 1.45%。台積電 ADR 收跌 1.25%,美光科技收跌 3.79%,應用材料收跌 2.54%,英特爾收跌 2.62%。

半導體行業普遍走弱

- AI概念股多數下跌。超微電腦收跌 32.68%,創下 2018 年以來最大跌幅,超微電腦表示,審計機構安永在審查過程中辭職,而超微電腦競爭對手——戴爾科技收漲 6.39%。英偉達持股的 AI 語音公司 SoundHound AI 收跌 9.32%,BigBear.ai 收跌 5.08%,CrowdStrike 收跌 1.12%,BullFrog AI 收跌 2.89%,Serve Robotics 收跌 2.65%,Palantir 收跌 2.76%,C3.ai 收跌 1.52%,而 Snowflake 收漲 0.51%,甲骨文收漲 0.65%。

- 中概股普遍回落。納斯達克金龍中國指數跌 2.2% 後收跌 0.96%。ETF 中,中國科技指數 ETF(CQQQ)收跌 0.82%。中概互聯網指數 ETF(KWEB)收跌 1.25%。富時中國 3 倍做多 ETF(YINN)收跌 3.67%。富時中國 3 倍做空 ETF(YANG)收漲 3.41%。“中國龍” ETF RONDHL CHINA ETF(DRAG)收跌 1.49%。富時 A50 期指連續夜盤收漲 0.29%,報 13330.000 點。

- 熱門中概股中,理想汽車收漲 1.83%,極氪收跌 0.57%,小鵬汽車收跌 2.16%,蔚來收跌 4.46%,房多多收跌 4.31%,拼多多收跌 3.5%,京東收跌 2.7%,唯品會收跌 2.26%,網易收跌 1.97%,老虎證券收跌 1.55%,阿里巴巴收跌 1.13%,美團 ADR 收跌 1.84%,百度收跌 1.46%。新東方收漲 1.11%,攜程網收漲 0.26%,B 站收漲 1.32%。

- 其他重點個股:(1)瑞銀收跌 4.48%,Q3 淨利潤幾乎為預期的兩倍,投行業務強勁。(2)大眾汽車 ADR 收漲 2.63%,第三季度營業利潤同比下降 42%。(3)減肥藥銷售不佳,禮來 Q3 營收低於預期,大幅下調全年利潤指引,股價跌近 15% 後收跌 6.28%。(4)Reddit 收漲 41.97% 至新高,今年三季度意外實現盈利,為其成立近 20 年來首次,四季度營收和 EBITDA 指引超預期。(5)麥當勞競爭對手 Shake Shack 收漲 7.79%,第三季度同店銷售超預期。(6)卡特彼勒收跌 2.13%,此前公佈的第三季度調整後每股收益低於市場預估。(7)特朗普媒體科技(DJT)收跌 22.29%,最近一個月累計漲幅收窄至 157%。(8)麥當勞收跌 1.18%。大腸桿菌感染事故 “受害者們” 現在就此食品安全事故在美國一家聯邦法庭提出集體訴訟。(9)網紅券商 Robinhood 收漲 0.64% 但盤後一度跌超 16.8%,三季度業績全面遜於預期。(10)Coinbase 收跌 3.61% 且盤後一度跌超 6.8%,三季報遜於市場預期。(11)eBay 四季度收入預期不及預期,股價盤後一度跌超 20%。(12)涉及導航的通信公司佳明財報利好且上調全年指引,漲超 23% 至新高。

受科技股普跌拖累,歐股低開低走收跌逾 1.2%,多國股指收跌超 1%。工黨政府未提及對銀行業利潤徵税,英國銀行股普漲。由於禮來下調指引和美國藥監部門調查結果帶來雙重打擊,諾和諾德一度跌約 5.7% 至九個月低點,但尾盤逆風翻盤收漲 0.35%:

- 歐洲 STOXX 600 指數收跌 1.25%,報 517.99 點。歐元區 STOXX 50 指數收跌 1.28%。富時泛歐績優 300 指數收跌 1.21%。

奢侈品概念股多數下跌,保樂力加收跌 4.35%,人頭馬君度跌 3.57%,博柏利則漲 1.58%。半導體概念股普跌,阿斯麥控股跌 3.24%,Soitec 收跌 6.7%,意法半導體跌 3.56%,ASM 國際則漲 5.42%。

- 德國 DAX 30 指數收跌 1.13%。法國 CAC 40 指數收跌 1.10%。荷蘭 AEX 指數收跌 1.49%。意大利富時 MIB 指數收跌 1.21%。英國富時 100 指數收跌 0.73%,英國預算報告發布後一度短暫地轉漲, 英國中盤股一度漲 1.5%。西班牙 IBEX 35 指數收跌 0.68%。

市場衡量好壞參半的經濟數據,並靜待週五公佈的10月大非農就業數據,10年期美債收益率尾盤轉漲、徘徊3個月高點附近,短債收益率漲幅居前。歐元區第三季度經濟增速超預期,德國意外避免衰退,壓低降息預期,兩年期德債收益率漲約12個基點。財相Reeves預算方案暗示英國債務和財政刺激都將擴大,10年期英債券收益率先跌後漲,盤中一度漲9 個基點至去年 11 月以來最高:

美債:尾盤時,美國 10 年期基準國債收益率漲 2.01 個基點,報 4.2742%,北京時間 21:56(美國 GDP 數據出爐後、英國財政大臣 Reeves 已經開始披露秋季預算報告)刷新日低至 4.1962%,隨後反彈,03:18 漲至 4.2883%,29 日曾漲至 4.3365% 創 7 月初以來新高。兩年期美債收益率漲 7.19 個基點,報 4.1682%,也逼近三個月高位。

- 歐債:尾盤時,10 年期德債收益率漲 5.1 個基點,報 2.388%。兩年期德債收益率漲 11.8 個基點。10 年期英債收益率漲 3.7 個基點,報 4.352%,英國財政大臣開始介紹秋季預算後曾刷新日低至 4.196%。兩年期英債收益率漲 6.0 個基點。10 年期法債收益率漲 4.0 個基點,10 年期意債收益率漲 6.9 個基點。

美債收益率齊漲,短端升幅更高

美元指數跌超 0.2% 一度失守104,脱離昨日所創的三個月高位,英鎊在英國預算報告發布日大起大落、最終收跌失守1.30,日元在美股盤初轉漲、尾盤微跌,仍不足 153,離岸人民幣尾盤漲 173點升破7.13 元,澳洲 9月通脹三年半最低曾令澳元觸及兩個半月低位,比特幣期貨漲超 0.4%守住 7.3萬美元:

美元:美元指數 DXY 尾盤跌 0.21%,報 104.093 點,美國 “小非農” 發佈後出現一波顯著的拉昇,北京時間 20:31(GDP 數據發佈後)刷新日高至 104.436 點,隨後回吐這一波漲幅,並在 02:55 刷新日低至 103.976 點。彭博美元指數跌 0.14%,報 1261.16 點,日內交投區間為 1264.07-1259.31 點,17:05 刷新日低。

美元回調

非美貨幣:英鎊兑美元跌 0.38%,報 1.2965,英國財政大臣 Reeves 開始發佈秋季預算報告之初,於 20:48 刷新日低至 1.2937,隨後反抽,於 22:27 刷新日高至 1.3043。歐元兑美元漲 0.35%、報 1.0857,美元兑瑞郎跌 0.09%;商品貨幣對中,澳元兑美元漲 0.19%,紐元兑美元漲 0.05%,美元兑加元跌 0.09%。瑞典克朗兑美元跌 0.33%,挪威克朗兑美元大致持平。

- 日元:日元兑美元尾盤漲 0.02%,報 153.38 日元。歐元兑日元漲 0.34%,報 166.48 日元;英鎊兑日元跌 0.40%,報 198.805 日元。

- 離岸人民幣(CNH):離岸人民幣兑美元尾盤漲 173 點,報 7.1255 元,日內整體交投於 7.1524-7.1235 元區間。

加密貨幣:市值最大的龍頭比特幣期貨尾盤漲 0.44%,報 73665.00 美元,因為特朗普誓言要將美國打造為 “地球的加密貨幣之都”,10 月 29 日曾達到 74485.00 美元。第二大的以太坊期貨漲 1.58%,報 2700.00 美元。特朗普交易抬升現貨比特幣週二逼近歷史最高,週三轉跌超 1% 徘徊 7.2 萬美元。

比特幣從歷史高點回落,但在 72000 美元左右獲得支撐

因美國EIA原油和庫存意外下降、汽油庫存降至兩年新低暗示需求利好、OPEC+考慮推遲增產,油價盤中一度漲近3%。歐洲天然氣市場近期持續上漲之後,高盛警告下行風險,英國天然氣期貨跌超3.1%:

- 美油:WTI 12 月原油期貨收漲 1.40 美元,漲幅超過 2.08%,報 68.61 美元/桶,脱離 9 月 26 日以來最低收盤位。美油持續拉昇,美股早盤最高漲近 2.9% 升破 69.10 美元。

- 布油:布倫特 12 月原油期貨收漲 1.56 美元,漲超 2.19%,報 72.68 美元/桶,也擺脱 9 月 26 日以來最低收盤位。布油持續拉昇,美股早盤最高漲近 2.7% 升破 73 美元。

- 消息面上,消息稱,歐佩克 + 可能會將原定於 12 月的增產計劃推遲一個月或更長時間。上週美國 EIA 原油庫存下降 51.5 萬桶,而市場預期增加 87.1 萬桶。中東緊張局勢緩解,據央視新聞報道,消息稱以政府已就結束以黎衝突並擬定停火協議達成共識。以黎停火協議草案曝光,若簽署,以軍將在一週內從黎南部撤離。

- 天然氣:NYMEX 12 月天然氣期貨收跌約 0.49%,報 2.8450 美元/百萬英熱單位。TTF 基準荷蘭天然氣期貨跌 2.44%,報 41.220 歐元/兆瓦時。ICE 英國天然氣期貨下跌 3.16%,報 105.470 便士/千卡。

油價上漲

美國總統大選不確定性提振避險需求,紐約期金一度突破2800美元創歷史新高,現貨黃金一度突破2790美元再創新高,鈀金昨日創十個月新高後周三跌 5%,白銀一度跌超 3%,倫敦金屬多數下跌:

黃金:COMEX 12 月黃金期貨尾盤漲 0.67% 至 2799.50 美元/盎司,盤中刷新歷史高位至 2801.80 美元。現貨黃金全天維持漲勢,美股午盤後最高漲近 0.6% 升破 2790 美元創歷史新高,尾盤漲 0.43%,報 2786.58 美元/盎司。

白銀:COMEX 12 月白銀期貨尾盤跌 1.98%,報 33.935 美元/盎司。現貨白銀亞市早盤小幅漲近 0.2% 後持續走低,美股早盤最低跌超 3% 下逼 33.40 美元,尾盤跌 1.98%,報 33.7717 美元/盎司。

- 消息面上,世界黃金協會數據顯示,2024 年三季度全球黃金需求總量同比增長 5%,黃金 ETF 的大量流入是主要因素。

- 倫敦工業金屬:倫銅收漲 8 美元,報 9538 美元/噸。COMEX 銅期貨跌 0.01%,報 4.3600 美元/磅。倫鋁收跌 43 美元,跌幅將近 1.62%,報 2616 美元/噸。倫鋅收跌 36 美元,跌超 1.15%,報 3086 美元/噸。倫鉛收平,報 2004 美元/噸。倫鎳收跌 57 美元,報 15816 美元/噸。倫錫收跌 134 美元,報 30950 美元/噸。倫鈷收平,報 24300 美元/噸。

黃金創新高

以下為北京時間 10月 30日 22:00以前更新內容

市場還聚焦財報季,財報利好的谷歌力撐納指再創新高。科技七巨頭多數上漲,投資者期待接下來週三盤後公佈財報的微軟、Meta 和週四公佈財報的蘋果、亞馬遜均能創佳績。但芯片板塊普跌,英偉達一度跌超 3%,Q4 營收指引欠佳的 AMD 一度跌超 10%。值得注意的是,審計機構安永在審查超微電腦過程中辭職,股價一度暴跌超 34%:

美股三大指數一度齊漲:標普 500 大盤跌近 0.4% 後漲超 0.2%。與經濟週期密切相關的道指跌超 0.2% 後漲近 0.5%。科技股居多的納指跌超 0.4% 後漲近 0.4%。羅素小盤股指一度漲逾 1%。

- 美股盤初,主要行業 ETF 漲跌不一,半導體 ETF 跌逾 2%,醫療業 ETF 跌逾 1%,網絡股指數 ETF 漲近 1%。

“科技七姐妹” 多數上漲。谷歌 A 一度漲近 7.3%,Q3 雲收入勁增 35%,總營收意外提速。亞馬遜盤初漲超 2.5% 後漲幅砍半。微軟一度漲超 1.5%,“元宇宙” Meta 盤初一度漲超 1.3%。特斯拉跌超 1.4% 後漲近 1.3%,比亞迪登頂電車之王,季度營收首次超越特斯拉。蘋果一度跌超 1%,英偉達一度跌超 3.1%。

芯片股普遍下跌。費城半導體指數一度跌近 3.3%。AMD 一度跌超 10.3%,公司上調 AI 芯片年銷售預期,但 Q4 指引欠佳。阿斯麥 ADR 一度跌近 4%,股價跌破 700 美元大關。高通一度跌近 4.5%。

AI 概念股漲跌互異。超微電腦盤初大跌超 34.2%,創下 2018 年以來最大跌幅,超微電腦表示,審計機構安永在審查過程中辭職。超微電腦競爭對手——戴爾科技一度漲超 7.5%。英偉達持股的 AI 語音公司 SoundHound AI 一度跌超 7.1%。

- 中概股跌幅收窄。納斯達克金龍中國指數跌超 2.2% 後跌幅收漲。熱門中概股中,歐盟決定對中國電動汽車徵收為期五年的最終反補貼税,造車新勢力齊挫,蔚來一度跌超 4.8%,極氪跌近 6% 後抹平多數跌幅,小鵬汽車跌近 3.7% 後跌幅收窄,理想汽車跌近 4.3% 後抹平多數跌幅。昨日收跌 22.75% 的光伏股大全新能源一度漲近 12%。

- 其他重點個股:(1)瑞銀一度跌近 4.2%,投行業務強勁,瑞銀 Q3 淨利潤幾乎為預期的兩倍。(2)大眾汽車 ADR 第三季度營業利潤同比下降 42%,股價一度漲近 2.6%。(3)減肥藥銷售不佳,禮來 Q3 營收低於預期,大幅下調全年利潤指引 ,盤中一度跌近 14.9%。(4)Reddit 一度漲近 40.3%,三季度意外獲得淨利潤,四季度營收和 EBITDA 指引超預期。(5)Shake Shack 一度漲近 14.6%,第三季度同店銷售超預期。(5)卡特彼勒一度跌超 5.2%,此前公佈的第三季度調整後每股收益低於市場預估。

【以下為 22:00 以前更新內容】

10 月 30 日週三,美股開盤漲跌不一,道指跌 0.15%,納指漲 0.03%,標指跌 0.11%。超微電腦重挫 31%,REDDIT 飆升 29%,谷歌大漲 7.1%。中概股普跌,房多多、蔚來、小鵬汽車等跌超 3%。

美債多數上行,10 年期美債收益率跌 3 個基點報 4.240%。

歐股集體走低,歐洲斯托克 50 指數跌 1.58%。歐股財報中,大眾汽車 Q3 營業利潤大幅下滑 42%;瑞銀、渣打銀行業績超出預期。

亞太股市多數下跌,日經 225 指數收漲 0.96%,韓國首爾綜指收跌 0.92%。

美元、日元震盪,美元指數現報 104.34,美元兑日元現報 153.28。

COMEX 期金上破 2800 美元大關,現貨黃金再創新高,現報 2784.10 美元/盎司。美國大選前市場避險需求升高,經濟和地緣政治的不確定性給股市帶來衝擊的同時,推動了金價的上漲。

高盛預計,金價將攀升至高於此前預期的水平,這種樂觀情緒在很大程度上歸因於各國央行,尤其是新興市場央行的黃金購買量激增。此外,高盛預計,到 2025 年 12 月,黃金價格有望達到 3000 美元/盎司。

國際油價維持漲勢,美油、布油雙雙漲 1.5%。

今晚美國 GDP 數據將公佈,交易員還在等待本週晚些時候的通脹及非農就業數據,尋找美聯儲降息的線索。

- 美股開盤漲跌不一,道指跌 0.15%,納指漲 0.03%,標指跌 0.11%。

- 谷歌漲超 6%,Q3 雲收入勁增 35%;AMD 跌近 8%,Q4 業績指引欠佳;Reddit 漲超 23%,Q4 營收和 EBITDA 指引超預期;瑞銀漲超 4%,Q3 淨利潤超出預期。

- 美債多數上行,10 年期美債收益率跌 3 個基點報 4.240%。

- 歐股集體走低,歐洲斯托克 50 指數跌 1.58%。

- 亞太股市多數下跌,日經 225 指數收漲 0.96%,韓國首爾綜指收跌 0.92%。

- 美元、日元震盪,美元指數現報 104.34,美元兑日元現報 153.28。

- 國際金價持續攀升,COMEX 期金上破 2800 美元/盎司,日內漲 0.7%。現貨黃金再破前高,現報 2784.10 美元/盎司。

- 國際油價繼續上漲,美油、布油雙雙漲 1.5%。

美股開盤漲跌不一,道指跌 0.15%,納指漲 0.03%,標指跌 0.11%。

中概股普跌,房多多、蔚來、小鵬汽車等跌超 3%。

超微電腦重挫 32%,創下 2018 年以來最大跌幅。

REDDIT 股價飆升 34%,創下 3 月份以來的最大漲幅。

谷歌開盤大漲 7%,市值增加 1500 億美元。

美債多數上行,10 年期美債收益率跌 3 個基點報 4.240%。

美元、日元震盪,美元指數現報 104.34,美元兑日元現報 153.28。

歐股集體走低,歐洲斯托克 50 指數跌 1.58%。

COMEX 期金上破 2800 美元/盎司,日內漲 0.7%。

現貨黃金現報 2784.10 美元/盎司,今日再次創歷史新高。

國際油價繼續上行,美油、布油均漲 1.5%。