Failed to reach $100,000, Bitcoin fell below $95,000, MSTR supported by two Wall Street institutions

週一美股盤中,比特幣獲利了結情緒濃烈,延續週末的下跌。消息面上,貝森特獲美國財長提名,投資者預計他會優先考慮經濟和市場穩定,這令美元和比特幣下跌、美債漲。幣圈同日也有好的消息:華爾街準備推出新一代加密貨幣相關 ETF,迎合各類投資者口味,此外 “比特幣持倉大户” MSTR 受 Bernstein 等大幅提高目標價,MSTR 高開後收跌超 4%。

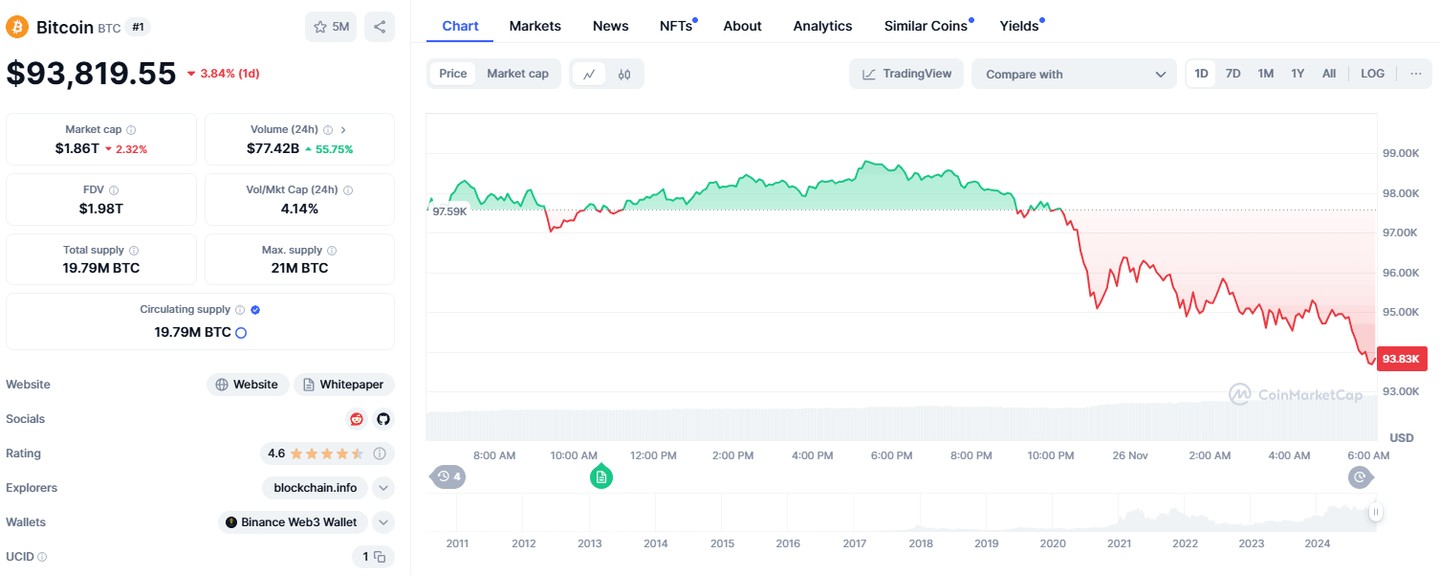

11 月 25 日週一,比特幣延續週末期間的下跌,繼續走低,盤中跌穿 9.4 萬美元。比特幣上週衝擊 10 萬美元大關未果,獲利了結情緒濃烈,目前已較歷史高點累計下跌約 6000 美元,跌破 11 月 21 日底部 93850.62 美元。

以太坊則相對堅挺,日內漲幅一度達到 3.9%,超過 3500 美元左右,不過此後也出現回落,追隨比特幣的走勢。

當天,區塊鏈概念股漲跌各異。柯達收漲 18.6%,Beyond Inc.漲超 9.4%,億邦國際 ADR 漲超 8.6%,Applied Digital 漲超 8.4%,以太幣 ETF FETH 漲 6.65%,Robinhood 漲約 3.3%,加密數字貨幣交易所巨頭 Coinbase 漲約 2.5%。“比特幣持倉大户” MSTR 跌超 4%,TeraWulf 跌超 6%,BTC Digital 跌超 8%。

消息面上,貝森特獲美國財長提名,投資者預計他會優先考慮經濟和市場穩定,打開 “姆努欽 2.0” 時代,知道紅線在哪裏,新政府的財政政策將採取循序漸進的方式,分階段實施關税政策,而非特朗普競選時承諾的那麼激進。這令美元和比特幣下跌、美債漲。

幣圈同日也有好的消息。當前,華爾街積極籌備推出新的加密貨幣相關的 ETF。隨着數字貨幣類資產的支持者特朗普當選下任美國總統,媒體稱,涉足 ETF 的高管和律師表示,他們正在制定策略,以全方位迎合不同投資者的偏好。

上述在籌備中的新的加密貨幣相關 ETF,既包括偏防禦型的 ETF,面向對加密貨幣有興趣的專業基金經理,也有高度投機性押注,面向相關風險偏好高的人羣。風險較高的加密貨幣 ETF 可能專注於各種各樣的數字代幣,有時會使用槓桿、期權或量化策略。

此前,一些單純追蹤比特幣的加密貨幣相關 ETF 自美國大選以來吸金數十億美元。

業內普遍預計,特朗普治下的美國證券交易委員會(SEC)對新的數字貨幣類產品的接受度會好於拜登政府。SEC 將迎來新領導,ETF 行業正在進入 “狂野西部” 時代。

當前,幾家數字資產公司已經向 SEC 申請推出追蹤 Solana、XRP 和 Litecoin 等加密貨幣的 ETF。這類 ETF 在 Gary Gensler 領導的 SEC 下獲批機會很小,但在新政府領導下,他們獲批概率要更高。此外,Aave、Uniswap、Maker 等代幣也適合 ETF 類產品。

同日,知名華爾街機構 Bernstein 大幅提高了對 “比特幣持倉大户” MSTR 的目標價,從 290 美元上調至 600 美元,預期還有 40% 上漲空間。這與近日香櫞看空正好相左。

Bernstein 預計,到 2033 年,MSTR 將擁有全球 4% 的比特幣供應量。目前,該公司持倉的比特幣為 1.7% 的供應量。Bernstein 認為,MSTR 的比特幣資金管理模式無與倫比。在 Bernstein 看來,比特幣正處於結構性牛市,監管有利,美國政府支持,機構採用,宏觀經濟有利。

此外,另一家經紀商 Canaccord 將其對 MSTR 的目標價從 300 美元上調至 510 美元,並重申買入評級。Canaccord 稱應採用新方法對 MSTR 進行估值。“傳統的損益表收益指標不再適用於 MSTR,因為該公司的軟件業務僅佔當前企業價值的個位數百分比。美元化的每股 BTC 增值反映了 MSTR 發生的一切。”

MSTR CEO Michael Saylor 談被做空時稱,香櫞不懂 MSTR 相對於比特幣的溢價來自哪裏。公司在通過波動性交易盈利的同時,還通過 ATM 操作加槓桿,因此只要比特幣還在漲,公司就依然可以賺到錢,這是做空者忽視的一個重要盈利點。“按照 80% 的比特幣價差計算,30 億美元的 ATM 融資 10 年內可以帶來每股 125 美元的收益。”

MSTR 週一美股盤前大漲 6%,但此後回落,最終收跌超 4%。