Eli Lilly places double bets on muscle gain and fat loss, brewing a super BD

Eli Lilly collaborates with Laka Pharmaceuticals to conduct Phase I clinical trials for the LAE102 muscle gain and fat loss drug. It is expected that sales of the GLP-1 dual champions semaglutide and tirzepatide will exceed $40 billion in 2024, driving demand in the muscle gain drug market. ActRII antibodies are regarded as the best companion drugs, and if the Phase I clinical data for LAE102 meets expectations, it could lead to significant BD transactions

Standing on the shoulders of giants.

The two GLP-1 drugs, semaglutide and tirzepatide, are expected to surpass $40 billion in total sales in 2024, creating a huge demand for muscle-building drugs.

Eli Lilly holds the next-generation drug tirzepatide, and its partnered CDMOs and Biotechs are all winners. Eli Lilly (LLY.US) is eagerly looking for companion drugs for tirzepatide, with ActRII antibodies being one of the best options.

A Chinese biotech is standing on the shoulders of Eli Lilly.

Eli Lilly will be responsible for conducting a Phase I clinical trial for the muscle-building and fat-reducing drug LAE102 from LaiKai Pharmaceuticals in the United States and will bear the related costs, while LaiKai Pharmaceuticals retains global rights to LAE102. There is a lot of information here, which is overwhelming at first.

Why does Eli Lilly value the ActRII muscle-building and fat-reducing drug so much? After heavily acquiring the globally leading Bimagrumab (ActRIIA/B monoclonal antibody), it is now investing resources for the globally second-ranked LAE102 (ActRIIA monoclonal antibody) to conduct Phase I clinical trials. Is the ActRIIA/B dual target not as good as the ActRIIA single target?

The fate of LAE102 hinges on the Phase I clinical data. If it meets expectations, how much will LaiKai Pharmaceuticals (02105) gain from the BD deal?

Key drugs in the ActRII pathway according to Zhihuiya.

01 The Secret of Super Bodies

Is ActRII powerful? Let's first look at the Belgian Blue cattle.

The secret of the Belgian Blue cattle's super physique lies in a mutation that inactivates the gene responsible for producing myostatin (GDF-8), resulting in more muscle fibers. ActRII is the main receptor for GDF-8, and inhibiting ActRII is expected to achieve muscle growth effects similar to or better than simply inhibiting GDF-8.

ActRII exists in fat and muscle cells, and signals emitted through the ActRII receptor can lead to fat accumulation and muscle atrophy. In adipose tissue, the activin signals through the ActRII receptor directly promote lipid storage, which is a key driver of visceral fat accumulation and obesity. Therefore, blocking ActRII signaling in fat cells can promote fat metabolism; in muscle tissue, signals emitted through the ActRII receptor inhibit muscle growth and promote muscle atrophy, so blocking activin signaling in skeletal muscle can promote muscle regeneration. In summary, blocking ActRII signaling is expected to reduce fat accumulation while promoting muscle gain.

ActRII antibodies are a perfect match for tirzepatide, enhancing weight loss effects while patching the drawback of muscle loss caused by GLP-1RA drugs. Multiple clinical studies and retrospective studies have shown that nearly 20-40% of the weight lost by GLP-1RA drug participants consists of lean body mass (also known as fat-free mass), and muscle loss increases the risk of cardiovascular diseases and osteoporosis In July 2023, Eli Lilly acquired Versanis Bio for $1.925 billion to obtain the ActRII muscle-building and fat-reducing drug Bimagrumab. In October of this year, Eli Lilly officially launched a Phase II clinical trial of Bimagrumab in combination with tirzepatide for muscle gain and fat reduction.

Before being acquired by Eli Lilly, the Phase IIa clinical trial data at week 48 showed that Bimagrumab could reduce the fat mass of subjects by 20.5% (weight loss effect comparable to tirzepatide), decrease waist circumference by 9.0 cm, and increase lean body mass by 3.6%, with no observed weight rebound within 12 weeks after stopping treatment.

Dr. Lü Xiangyang, founder of LKai Pharmaceuticals, is a co-inventor of Bimagrumab.

02 The Drug King is Urgently Seeking Partners

Dr. Lü Xiangyang has accumulated over 20 years of experience in ActRII target research and is a global authority in the field. According to the characteristics of drug iterative research and development, compared to Bimagrumab, LKai Pharmaceuticals' LAE102 should have improvements in safety and drug mechanism, which may also be the reason for Eli Lilly's dual investment.

Improved Version

Although targeting the ActRII receptor can comprehensively block skeletal muscle growth inhibition signals, it can also cause broad-spectrum inhibition of multiple ligands, potentially posing safety risks.

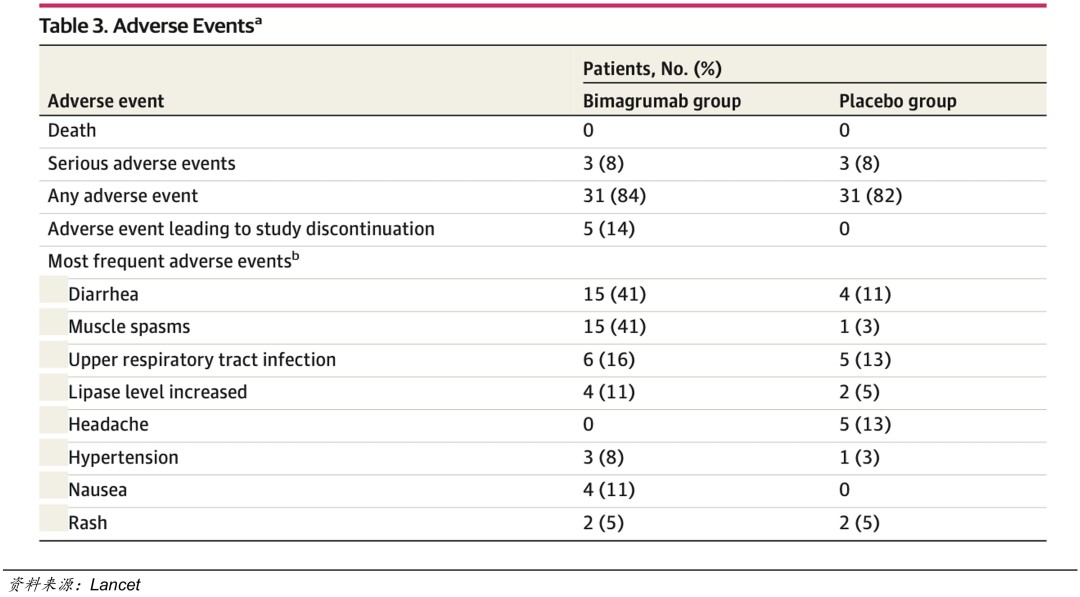

Bimagrumab Phase II Clinical Safety Data

The side effects of Bimagrumab include muscle cramps and diarrhea, occurring early in treatment. In the Phase IIa clinical trial, 5 patients (14%) discontinued the study due to adverse events. Bimagrumab is a dual-target inhibitor of ActRIIA and ActRIIB; it remains to be seen which target caused these adverse reactions. Eli Lilly is likely very interested in further validation and intends to compare through clinical trials.

LKai Pharmaceuticals has laid out three ActRII-targeted drugs based on the activity differences of the two type II receptors ActRIIA/ActRIIB against four ligands (ActivinA, ActivinB, GDF8, GDF11) and the role of the entire pathway in different diseases. LAE102 (ActRIIA monoclonal antibody) primarily targets muscle gain and fat reduction, while LAE103 (ActRIIB monoclonal antibody) and LAE123 (ActRIIA/B monoclonal antibody) are mainly indicated for muscle atrophy and other diseases.

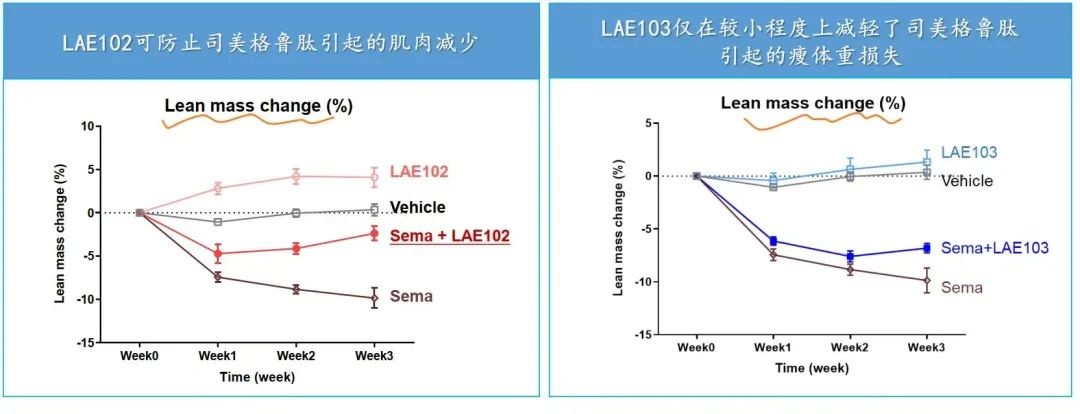

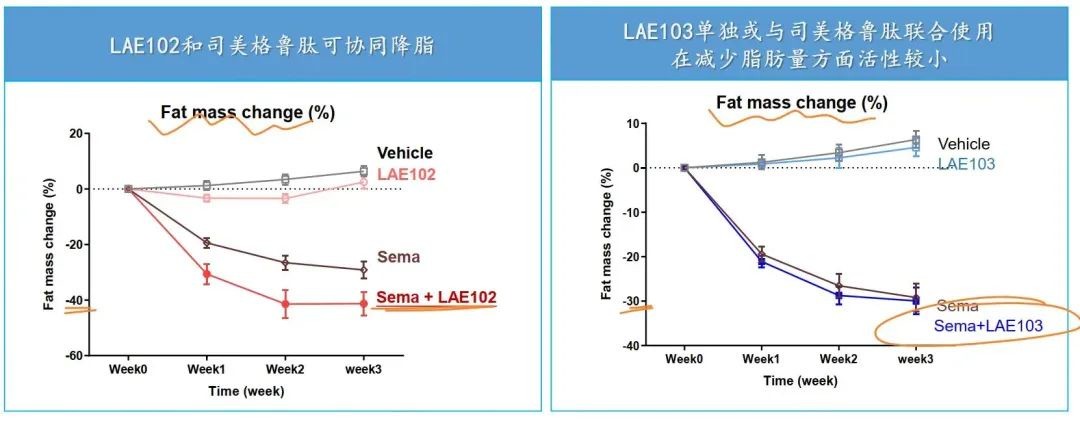

According to the DIO model published by LKai Pharmaceuticals, both LAE102 and LAE103 have effects on increasing lean body mass, with LAE102 showing more significant results, and LAE102 can synergistically reduce fat with semaglutide.

LAE102 selectively targets ActRIIA, and this differentiated design compared to Bimagrumab may achieve better safety while simultaneously promoting muscle gain and fat reduction

Subcutaneous Injection

ActRII antibodies, as companion drugs for GLP-1RA, should also be injectable subcutaneously.

LaiKai Pharmaceuticals launched the subcutaneous (SC) part of the LAE102 single-dose escalation study in October this year, aiming to complete the single-dose escalation study by the end of 2024.

Compared to intravenous administration, subcutaneous administration has advantages for chronic disease patients in long-term use and is easier to combine with GLP-1RA drugs, making it more attractive to large pharmaceutical companies that have GLP-1RA drugs.

BD Amount

In the first half of 2024, 25 biotech companies globally were acquired, with 6 mergers exceeding $2 billion and 15 mergers exceeding $1 billion. The goal of acquiring biotech companies is, of course, to obtain their core pipeline assets.

In the field of innovative weight loss therapies, MNCs are taking heavier and earlier actions. Last year, Bimagrumab was acquired by Eli Lilly at the stage of completing Phase IIa clinical trials and entering Phase IIb clinical trials; in October this year, Eli Lilly invested $1.4 billion in a dual-target weight loss therapy, acting before the new molecule DACRA (dual agonist of amylin/calcitonin receptor) from KeyBioscience completed Phase I and had not yet started Phase II.

The clinical stages of BD are moving forward, and the trend is also reflected in the overseas expansion of domestic innovative drug projects. According to Guosheng Securities statistics, in 2023, the proportion of preclinical projects in China's innovative drug license-outs was 34%, Phase I clinical projects accounted for 26%, and post-marketing projects accounted for 23%, while the proportions of Phase II/III clinical and application for marketing stages were both below 10%.

According to data from Zhihuiya, the only weight loss drugs targeting the ActRII pathway that have entered clinical stages globally are Bimagrumab and LAE102, making this a scarce resource that Eli Lilly is eager to secure.

In the post-GLP-1 era, the enormous demand for muscle gain is undeniable, and the muscle gain effect of ActRII antibodies has been validated by Bimagrumab, with the suspense being that safety still requires further clinical data validation.

The Phase I clinical data readout of LAE102 is crucial, and we look forward to a super BD.

LaiKai Pharmaceuticals is exploring a brand new overseas expansion model, where MNCs first place orders, then look at data to make payments, while high-potential pipeline assets in biotech, after receiving data endorsement, also qualify to be sold at a premium.

The GLP-1 track is becoming increasingly competitive, and LaiKai Pharmaceuticals demonstrates a correct way to participate in a hot track, with muscle gain and fat loss being the focus of differentiation and competitiveness for the next generation of products in the GLP-1 track This article is transferred from the WeChat public account "Archimedes Biotech," edited by Li Cheng of Zhitong Finance