The depreciation of the ruble triggers inflation, and a significant interest rate hike by the Central Bank of Russia has become inevitable?

The depreciation of the ruble has increased the pressure on the Central Bank of Russia to raise interest rates, with market expectations that the rate hike could reach its highest level since the Russia-Ukraine conflict. Since the U.S. sanctioned about 50 Russian banks on November 21, the ruble has fallen nearly 8% against the dollar. The Central Bank of Russia is prepared to raise the interest rate to 25% to address inflationary pressures. Although officials emphasize that the ruble's depreciation is beneficial for exporters, the inflation rate has exceeded twice the central bank's target, which may force the central bank to take action

According to Zhitong Finance APP, the recent plunge of the ruble has increased the pressure on the Central Bank of Russia to raise key interest rates, with market expectations that the rate hike could reach its highest level since the outbreak of the Russia-Ukraine conflict.

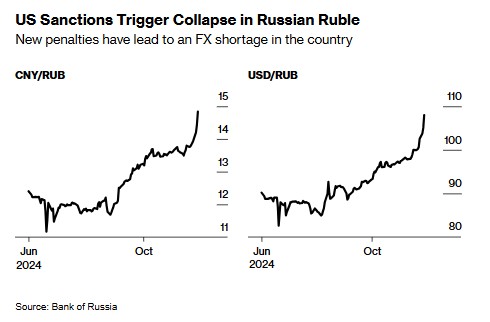

According to data from the Central Bank of Russia, since the U.S. sanctioned about 50 Russian banks on November 21, the ruble has depreciated nearly 8% against the dollar. This could exacerbate inflation, and the Central Bank of Russia has been striving to curb inflation by raising interest rates to historical highs.

The Central Bank of Russia stated that it is prepared to further increase borrowing costs (currently at 21%) to bring next year's inflation rate back to the target level of 4%. According to Bloomberg Economics, this could mean a rate hike to 25% next.

Alex Isakov, a Russian economist at Bloomberg Economics, stated: "The central bank is facing a dilemma: whether to raise rates further, even if it increases the risk of economic recession, or simply accept higher inflation pressures. Policymakers may choose the former."

Due to concerns that new restrictions will significantly limit capital inflows, local demand for foreign currency has surged. Officials have been trying to downplay the impact of the ruble's depreciation, particularly emphasizing that it is a boon for exporters. However, as inflation rates exceed twice the central bank's target, the collapse of the exchange rate may force rate setters to take action under already painful lending conditions.

Since the beginning of this year, the ruble has depreciated 19% against the dollar, making it one of the worst-performing emerging market currencies. Since June, the Central Bank of Russia has been using interbank transactions to calculate the exchange rate, after the U.S. sanctioned the Moscow Exchange, which immediately halted trading in dollars and euros.

Since the end of 2023, Russian exporters and importers have faced difficulties in international payments, when the U.S. threatened secondary sanctions against financial institutions cooperating with Russia. A new round of restrictions could complicate foreign trade transactions further and reduce exporters' motivation to bring foreign exchange liquidity into Russia.

In response, the Central Bank of Russia announced later on Wednesday that it would stop purchasing foreign currency in the domestic market before the end of 2024.

Evgeny Loktyukhov from Promsvyazbank stated that this could alleviate the current foreign exchange shortage, but it would not be enough to trigger a significant rebound of the ruble.

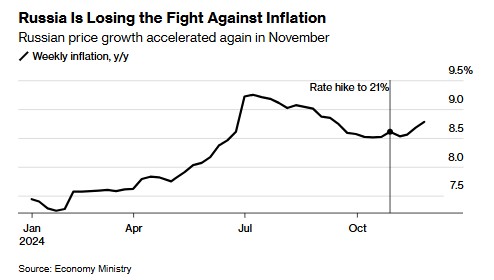

Despite the interest rate hike in October, inflation in Russia has accelerated for the third consecutive week. The official forecast from the central bank was calculated before the recent depreciation of the ruble, indicating that price growth will reach 8%-8.5% by the end of 2024. Kirill Tremasov, an advisor to the Central Bank of Russia, acknowledged that inflation could exceed this expectation.

Despite the interest rate hike in October, inflation in Russia has accelerated for the third consecutive week. The official forecast from the central bank was calculated before the recent depreciation of the ruble, indicating that price growth will reach 8%-8.5% by the end of 2024. Kirill Tremasov, an advisor to the Central Bank of Russia, acknowledged that inflation could exceed this expectation.

Iskander Lutsko, chief investment strategist at ITI Capital Ltd, stated that the ruble's depreciation alone is insufficient for the central bank to take significant action in December. He mentioned that more time is needed since the last interest rate hike for it to have a cooling effect on inflation.

However, Natalia Milchakova, an analyst at Kazakhstan's Freedom Finance Global, disagreed, pointing out that with demand continuously growing ahead of the New Year holidays, weekly inflation will continue to accelerate.

Milchakova stated, "In any case, a key interest rate hike in December is inevitable, but the current hike should be at least twice the previously expected 100 basis points."

The Central Bank of Russia estimates that the ruble's depreciation will raise the inflation rate by 0.5-0.6 percentage points. However, Russia's second-largest bank, VTB bank PJSC, estimates that this impact is five times greater and believes that the sharp decline in the exchange rate has increased inflationary pressures beyond what policymakers anticipated.

Reportedly, Dmitriy Pianov, the first deputy chairman of VTB, stated that recent events could "lead to a revision of the future key interest rate trajectory. This is a strong inflationary factor."