This week's heavy schedule: November non-farm payrolls are coming! China's November Caixin PMI, two important OPEC meetings, and Powell's speech

下周重点关注:美国 11 月非农数据、中国 11 月财新 PMI、OPEC 会议减产与增产博弈加剧。此外,美国将公布 11 月 ISM 制造业、非制造业指数,美联储公布经济状况褐皮书,包括鲍威尔在内的欧美央行多票委密集发声。中国光伏行业召开 2024 光伏行业年度大会。

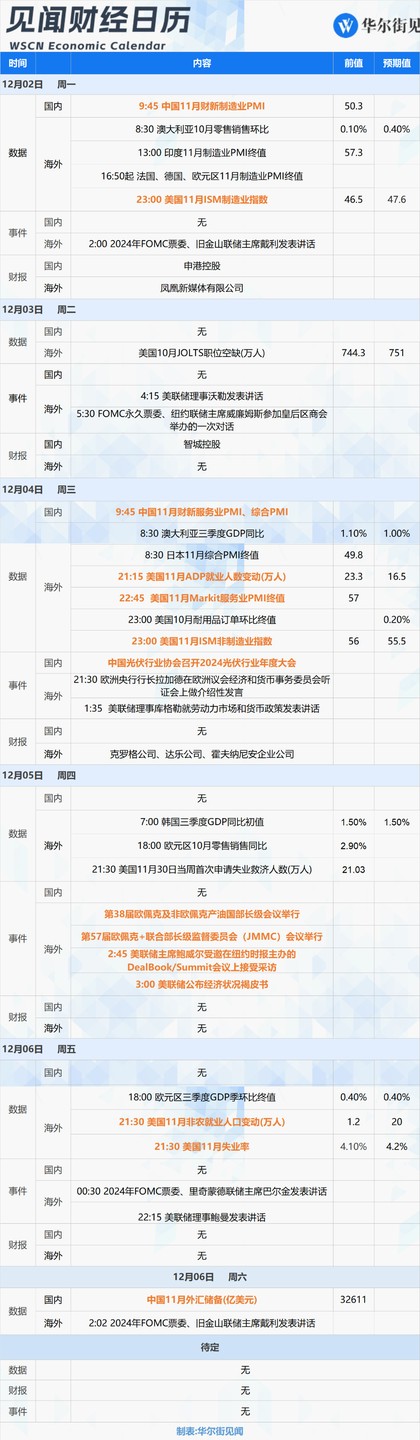

12 月 2 日至 12 月 8 日当周重磅财经事件一览,以下均为北京时间:

本周重点关注:美国 11 月非农数据、中国 11 月财新 PMI、OPEC 会议。

此外,美国将公布 11 月 “小非农” 数据,ISM 制造业、非制造业指数,美联储公布经济状况褐皮书,包括鲍威尔在内的欧美央行多票委密集发声。欧元区公布三季度 GDP 季环比终值,中国光伏行业召开 2024 光伏行业年度大会。

11 月非农公布!美联储下月会降吗、降多少?

周五(6 日),美国公布 11 月非农就业人口变动、11 月失业率。

周三(4 日),美国公布 11 月 ADP 就业人数变动。

上月,因两场飓风和波音罢工,美国非农新增就业人数骤降至 1.2 万人,为 2020 年以来最低水平,且远不及预期的 10 万人。

失业率在四舍五入后保持不变,维持在 4.1% 的水平,持平预期和前值。但在未四舍五入的基础上为 4.14%,较上月上行了 0.09 个百分点。

有 “新美联储通讯社” 之称的华尔街日报记者 Nick Timiraos 表示,对于这份就业报告的分析可以 “见仁见智”,大部分华尔街分析师则认为,数据不佳主要由于 10 月的两场飓风及波音罢工导致,但也有分析师担忧就业市场的确在恶化之中。几乎所有分析师都认为,这份报告不会影响美联储本月降息 25 基点的预期。

但本月初特朗普当选总统后,美联储的风向变了,称多人支持 “渐进” 降息,官员提出暂停行动可能:

因中性利率不确定而认为适合循序渐进降息的决策者由 “一些” 变为 “多名”;几乎所有决策者认为,就业和通胀的风险依然大体均衡,一些人认为经济活动和劳动力市场下行风险已减少,多人认为 9 月会议以来劳动力市场过渡降温的风险已下降;一些人认为应考虑 ON RRP 利率调整为联邦基金利率下限。

“新美联储通讯社” 称,纪要暗示,若通胀进展停滞,会更谨慎降息;联储官员讨论了 “未来一次会议” 将 ON RRP 利率技术性下调 5 个基点。

标普全球公布 11 月财新制造业、服务业、综合 PMI

周一(2 日),公布中国 11 月财新制造业 PMI。

周三(4 日),公布中国 11 月财新服务业 PMI、综合 PMI。

9 月底以来,一系列增量政策陆续推出。从国家统计局公布的 11 月制造业和服务业 PMI 各项数据看,市场需求止跌回稳,乐观情绪有所恢复,政策效果开始显现。

国家统计局公布数据显示,11 月份,制造业采购经理指数为 50.3%,比上月上升 0.2 个百分点,为连续三个月回升,制造业扩张步伐小幅加快。

非制造业商务活动指数为 50.0%,比上月下降 0.2 个百分点;综合 PMI 产出指数为 50.8%,与上月持平,我国经济景气水平总体保持稳定扩张。

国家统计局服务业调查中心高级统计师赵庆河解读 11 月 PMI 数据表示:

“供需两端均有回升。生产指数和新订单指数分别为 52.4% 和 50.8%,比上月上升 0.4 和 0.8 个百分点,其中新订单指数自今年 5 月份以来首次升至扩张区间,表明制造业市场活跃度有所增强。从行业看,通用设备、汽车等行业生产指数和新订单指数均位于 54.0% 以上,产需较快释放;石油煤炭及其他燃料加工、专用设备等行业生产指数和新订单指数均低于临界点。

建筑业景气水平有所回落。受天气转冷户外施工逐渐进入淡季等因素影响,建筑业生产活动有所放缓,商务活动指数为 49.7%,比上月下降 0.7 个百分点。从市场预期看,业务活动预期指数为 55.6%,比上月上升 0.4 个百分点,建筑业企业对近期行业发展预期总体保持稳定。”

欧佩克两场重要会议来袭!减产与增产博弈加剧

周四(5 日),举行第 38 届欧佩克及非欧佩克产油国部长级会议、第 57 届欧佩克 + 联合部长级监督委员会(JMMC)会议。

当地时间 11 月 28 日,欧佩克宣布将这两场关键会议延期,至 12 月 5 日以视频会议方式举行。OPEC 官方声明指出,部分部长因需前往科威特市参加第 45 届波斯湾峰会,时间安排冲突,致使会议不得不延期。

这两场会议举足轻重,关系到欧佩克未来一整年的产油规划,因此紧紧牵动着全球油市的敏感神经。

月初的时候,包含沙特、俄罗斯、伊拉克、哈萨克斯坦在内的 8 个欧佩克 + 产油国决定将原定 11 月底到期的日均 220 万桶的自愿减产措施延长至 12 月底,下周四的会议可能会讨论未来是否回撤这部分减产力度。

当下,市场主流预期是欧佩克 + 大概率会在 12 月这场会议上再度推迟增产计划,至少将现行减产政策延续至明年第一季度末。

XTBMENA 市场分析师米拉德・阿扎尔在其分析报告中透露:

“鉴于石油需求比预想中疲软,而非欧佩克 + 国家石油产量却不断攀升,该组织正审慎权衡是否推迟原定于 2024 年 1 月的增产计划。”

这也是欧佩克 + 面临的另一个主要矛盾,回撤部分减产力度——增产可能会让原油市场陷入供过于求的风险,欧佩克月中公布的月报已经连续第四次下调 2025 年全球石油需求增长预期。

Onyx Commodities Ltd. 石油研究主管 Harry Tchilinguirian 认为,欧佩克 “陷入了进退维谷的境地”。如果组织宣布增产,油价可能会继续走低,影响成员国每桶油的收入,不增产也会有美国等抢夺市场份额。

其他重要数据、会议及事件

- 美国公布 11 月 ISM 制造业、非制造业指数。

周一(2 日),公布 11 月 ISM 制造业指数,周三,公布 11 月非制造业指数。

上月数据显示,美国 10 月 ISM 制造业 PMI 指数降至 46.5,创 2023 年 7 月以来的新低,不及预期的 47.6,9 月前值为 47.2。就业指数连续第五个月低于荣枯线,物价支付指数单月大涨 6.5 个点,生产活动急剧下降,库存进一步回落。

由于商业活动疲软以及雇主招聘速度放缓,美国 10 月 ISM 服务业指数意外降至 51.8。同日稍早公布的数据显示,美国 10 月 Markit 服务业 PMI 终值 50.6,预期 50.9;综合 PMI 终值 50.7,9 月时为 50.2。

- 周四(5 日),美联储公布经济状况褐皮书。

美联储在上月公布的褐皮书中表示,自 9 月初以来,美国大部分地区的经济活动变化不大,有两个美联储辖区报告了适度增长。关于消费者支出的报告不一,有些辖区指出了消费购买结构的变化,主要是转向了更便宜的替代品。

分析认为,褐皮书报告显示,尽管 9 月份官方就业、消费者价格和零售销售数据意外上扬,但美国经济仍在继续放缓。尽管最新的经济数据有所回升,美联储官员们最近引用了一些联系人的经济状况轶事,作为继续降息的理由。

- 包括鲍威尔在内的欧美央行多票委密集发声。

周二,美联储理事沃勒发表讲话。FOMC 永久票委、纽约联储主席威廉姆斯参加皇后区商会举办的一次对话。

周三,美联储理事库格勒就劳动力市场和货币政策发表讲话。欧洲央行行长拉加德在欧洲议会经济和货币事务委员会听证会上做介绍性发言。

周四,美联储主席鲍威尔受邀在纽约时报主办的 DealBook/Summit 会议上接受采访。

周五,2024 年 FOMC 票委、里奇蒙德联储主席巴尔金发表讲话。美联储理事鲍曼发表讲话。

周六,2024 年 FOMC 票委、旧金山联储主席戴利发表讲话。

- 中国光伏行业协会召开 2024 光伏行业年度大会

4—6 日,中国光伏行业协会将于四川省宜宾市召开 “2024 光伏行业年度大会”,邀请行业主管部门、行业组织、行业专家、光伏企业领袖等代表一起就行业发展热点问题进行探讨分析。

大会同期还将召开光伏供应链配套发展研讨会、光伏创新应用发展研讨会及各项专题会议等活动。

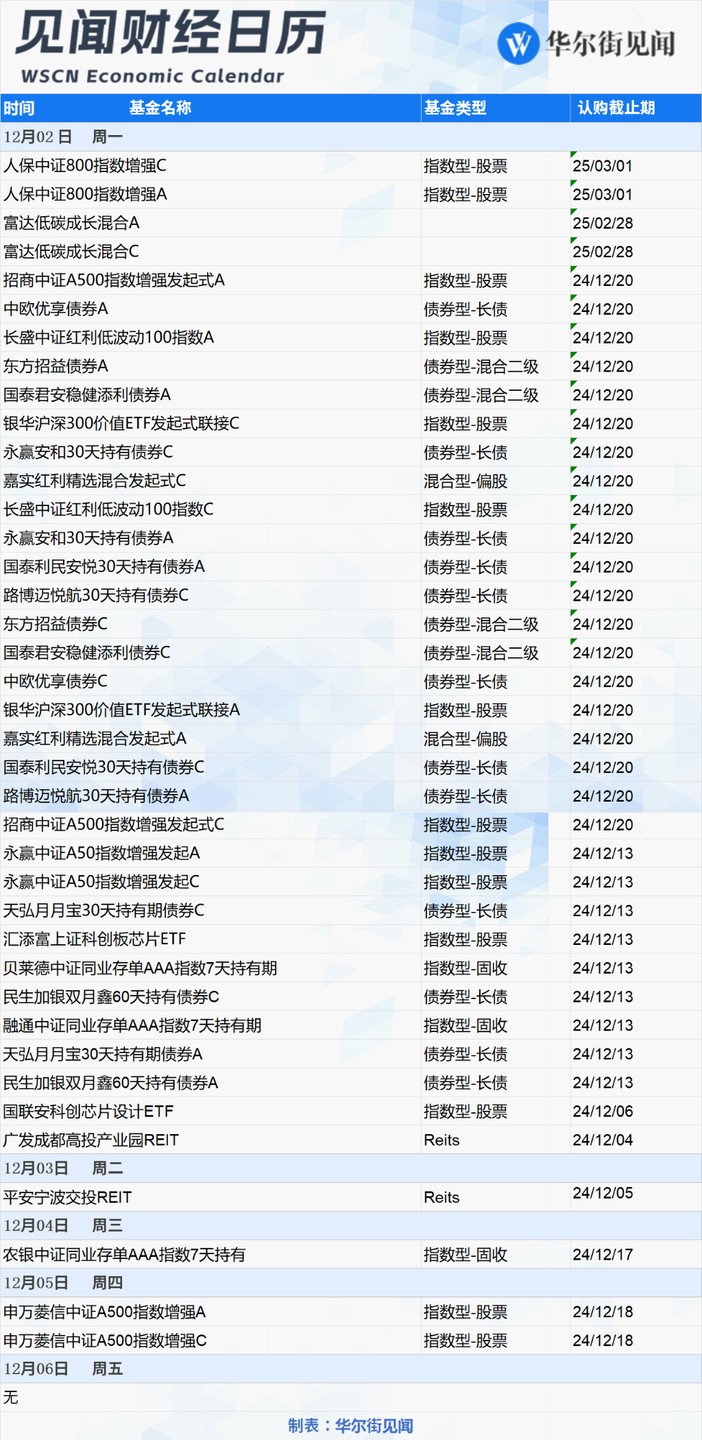

打新机会

当周(12 月 02 日-12 月 06 日)A 股有 2 只新股申购,0 只新股上市。

当周共计 22 只(A 类与 C 类合并统计)新基金发行,其中债券型基金 16 只,混合型基金 2 只,股票型 0 只,指数基金 16 只、Reits2 只。

本周每周重磅大事订阅国内二维码:

海外二维码: