AI cloud infrastructure revenue failed to boost Oracle's performance in the second fiscal quarter, dropping over 9% in after-hours trading | Earnings report insights

上一財季甲骨文營收同比加快增長 9%,雲服務收入加快增長逾 24%,當季 EPS 增長放緩至 9.7%,均略低於預期。本財季營收指引中值和 EPS 指引區間均低於預期,增長較第二財季進一步放緩。CEO 稱上一財季甲骨文雲基礎設施收入增長 52%,超過其他對手,預計本財年雲計算收入超 250 億美元。

雖然雲基礎設施收入受益於人工智能(AI)熱潮帶來的需求,但甲骨文最近一個財季的收入未能像華爾街預期的那麼炸裂,本財季的指引依舊低於預期。

美東時間 12 月 9 日週一美股盤後,甲骨文公佈截至自然年 2024 年 11 月 30 日的公司 2025 財年第二財季(下稱二季度)財務數據,並提供第三財季(下稱三季度)的業績指引。

1)主要財務數據:

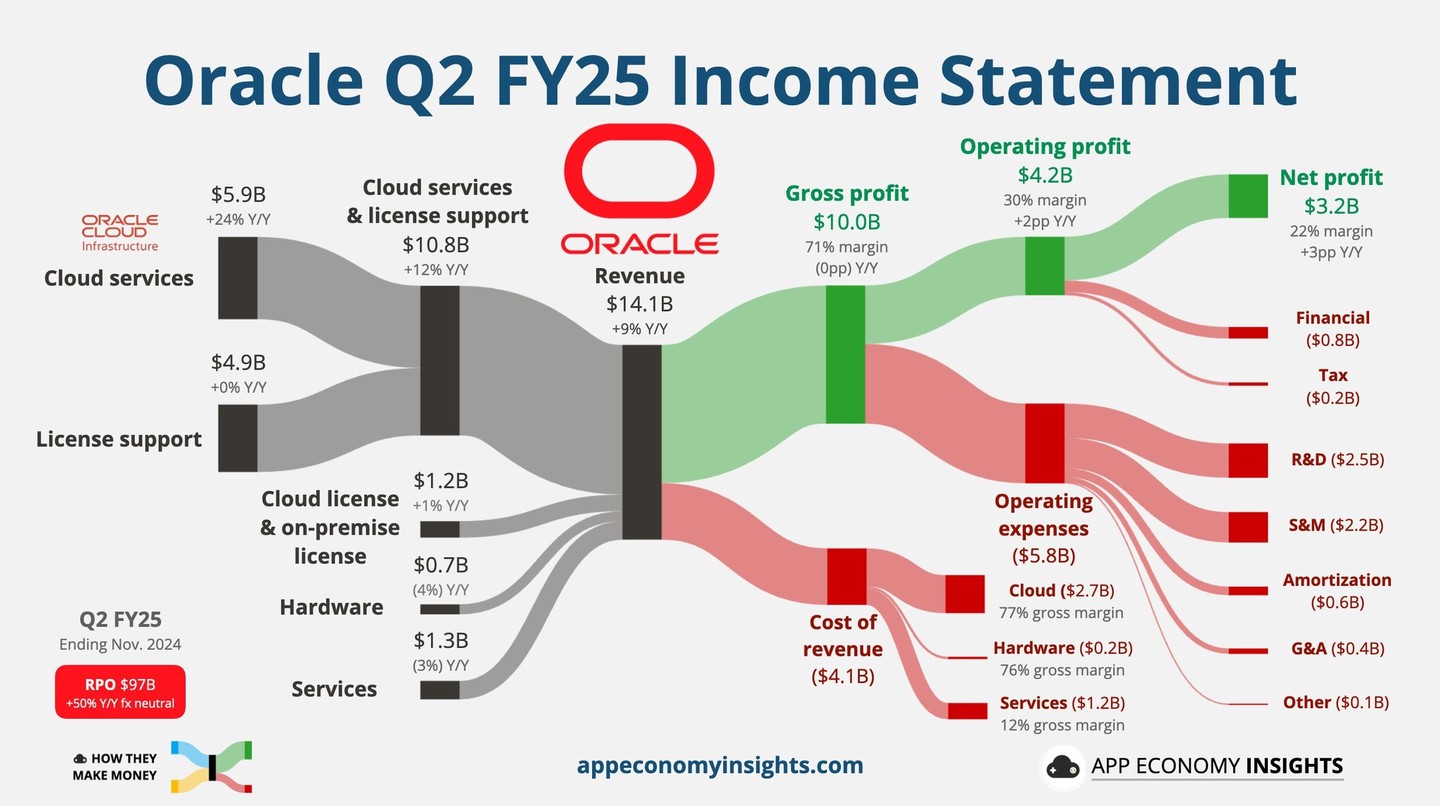

營收:二季度營業收入同比增長 9% 至 140.6 億美元,分析師預期 141.2 億美元,上一財季同比增長 7%。

EPS:二季度非 GAAP 口徑下調整後每股收益(EPS)為 1.47 美元,同比增長 9.7%,分析師預期 1.48 美元,上一財季同比增長 17%。

營業利潤:二季度調整後營業利潤約為 61.0 億美元,同比增長 10.1%,分析師預期 61.3 億美元,上一財季同比增長 14%。

營業利潤率:二季度調整後營業利潤率為 43%,持平一年前水平和上一財季水平,分析師預期 43.3%。

2)分項業務數據:

雲服務和許可支持:二季度雲服務和許可支持業務營收 108.06 億美元,同比增長 12.1%,上一財季同比增長 10.2%。

雲許可和本地許可:二季度雲許可和本地許可業務營收 11.95 億美元,同比增長 1.4%,上一財季同比增長 7%。

雲服務:雲服務和許可支持業務中,二季度雲服務的總營收為 59 億美元,同比增長 24.3%,分析師預期 60 億美元,上一財季同比增長 21%;其中,雲應用(SAAS)營收為 35 億美元,分析師預期 35.8 億美元,雲基礎設施(IAAS)業務 OCI 的營收為 24 億美元,分析師預期 24.2 億美元。

3)業績指引:

營收:三季度營收同比增長 7% 至 9%,中值約為 143 億美元,分析師預期 146.5 億美元。

EPS:三季度調整後 EPS 為 1.50 至 1.54 美元,分析師預期 1.57 美元。

財報公佈後,本週一收跌近 0.7% 的甲骨文股價盤後跌幅迅速擴大,盤後一度跌超 9%。彭博行業研究的分析師 Anurag Rana 評論稱,也許投資者期待的是大幅超出預期的業績,但實際並非如此。加拿大皇家銀行資本市場的分析師 Rishi Jaluria 稱,二季度是一個 “好壞參半的季度,與過高的預期背道而馳。”

二季度營收和盈利增長低於預期 三季度指引超預期放緩

財報顯示,二季度甲骨文的總營收相比上一財季加快增長,同比增速 9% 高於上一財季的 7%,處於公司增長指引區間 8% 到 10% 的中段,但還略低於分析師預期。二季度 EPS 盈利增長放緩,同比增速不足 10%,不到上一財季同比增速 17% 的六成,放緩程度略超出分析師預期。

截至二季度末,甲骨文衡量訂單的指標剩餘履約義務(RPO)為 970 億美元,同比增長 50%,增速較上一財季的 53% 略有放緩,較上一財季創單季紀錄新高的 990 億美元回落約 2%。

業績指引方面,甲骨文預計的營收和 EPS 表現均遜於分析師預期。甲骨文預期,三季度營收將同比增長 7% 至 9%,也就是説,可能增速持平一年前的增速 7%,也可能略高於這一增速。即使是三季度的最高指引增速也不過才持平二季度水平。

按照 EPS 指引區間計算,甲骨文三季度的調整後 EPS 料將同比增長 6.4% 至 9.2%,即使是指引區間高端的增速也低於二季度的增速 9.7%。

二季度甲骨文雲基礎設施收入增長 52% 預計本財年雲計算收入超 250 億美元

甲骨文 CEO Safra Catz 在公佈財報時透露,預計 2025 財年的雲計算收入應該會超過 250 億美元。這一預期和華爾街預計的 251 億美元大體一致。

Catz 還在公佈二季度財報時表示,創紀錄的 AI 需求推動甲骨文的雲基礎設施收入當季增長 52%,增長率遠高於其他大規模雲基礎設施領域的競爭對手。在基礎設施業務中,AI 基礎設施增長驚人,GPU 消耗量增長了 336%。甲骨文當季交付了全球最大、速度最快的 AI 超級計算機,規模可擴大至 6.5 萬塊英偉達 H200 GPU。

甲骨文董事長兼首席技術官 Larry Ellison 表示,甲骨文的雲基礎設施訓練了全球幾個最重要的生成式 AI 模型,因為甲骨文的雲比其他雲更快、更便宜。甲骨文剛剛與 Meta 簽署了協議,供 Meta 使用甲骨文的 AI 雲基礎設施,並與甲骨文合作開發基於 Meta Llama 模型的 AI 代理。

今年 9 月甲骨文上調了下一財季的營收指引,預計 2026 財年公司營收將至少達到 660 億美元,較此前的指引上調 65 億美元,超出當時分析師預期均值 645 億美元。同時甲骨文預計,2029 財年營收至少 1040 億美元,這意味着三年內收入增長近 58%。

當時華爾街見聞提到,上調營收指引是甲骨文雲基礎設施業務 OCI 增長前景的樂觀信號。以數據庫軟件聞名的甲骨文目前致力於在 OCI 領域的擴張。甲骨文通過出租算力和存儲與亞馬遜、微軟和谷歌母公司 Alphabet 競爭。