Additional upward momentum? MicroStrategy plans to sell more shares to raise funds for purchasing Bitcoin

MicroStrategy 计划通过增发股票筹资以继续增持比特币,寻求股东批准增加 A 类普通股和优先股的授权股数。尽管比特币及其他加密货币价格下跌,市场对 MicroStrategy 的比特币购买行为仍持乐观态度。公司自去年以来已发行约 130 亿美元股票和 30 亿美元可转换债券,成为全球最大的企业比特币持有者,持有约 43.9 万枚比特币。

加密货币巨头 MicroStrategy 近日宣布,计划通过增发股票的方式继续增持比特币。

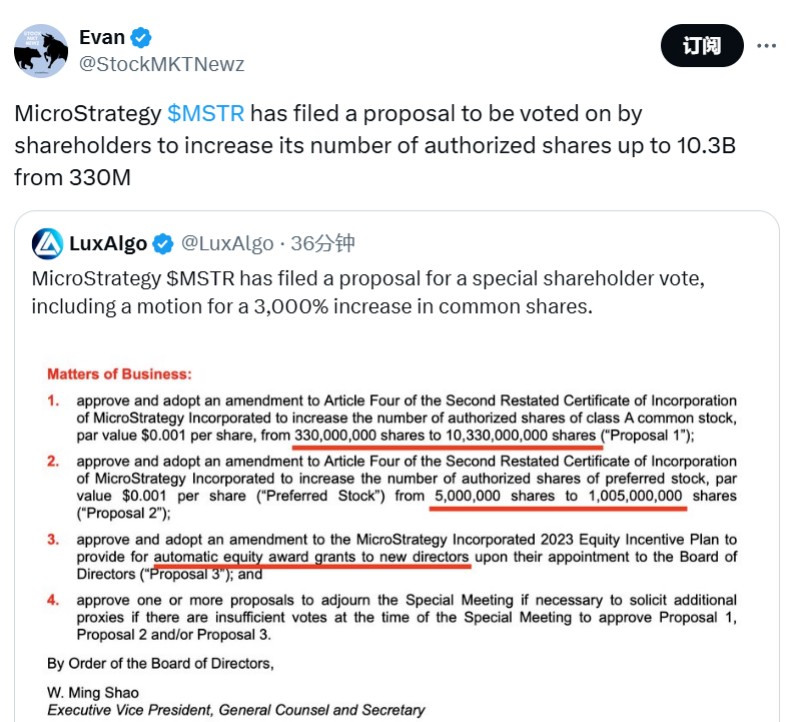

根据公司周一晚些时候提交给 SEC 的初步委托书,MicroStrategy 正寻求股东批准,希望增加 A 类普通股和优先股的授权股数。这将为这家从软件制造商转型为比特币积累者的公司提供更多资金支持。

MSTR 拟大幅增发股票

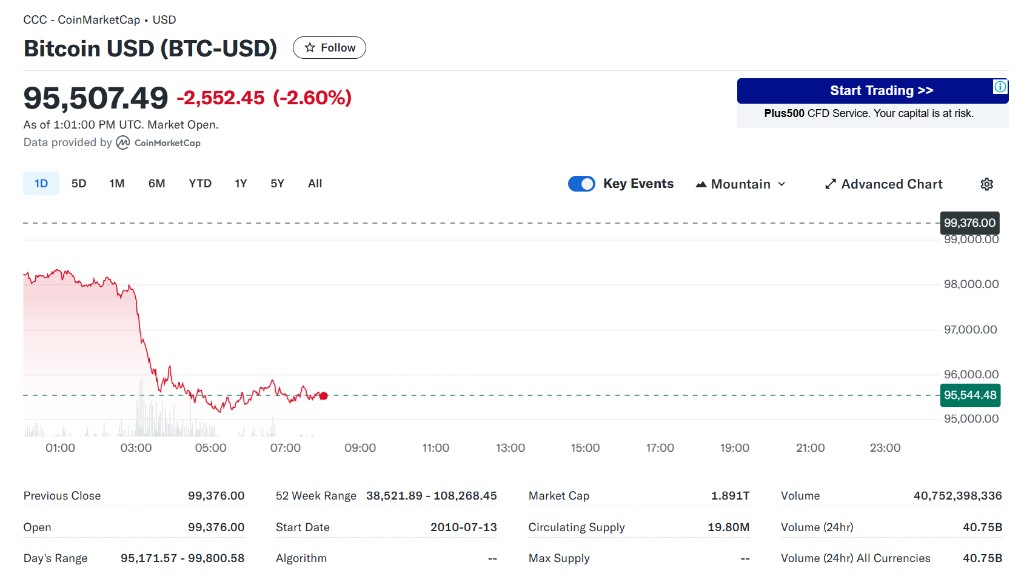

周四,比特币价格下跌了约 2.6%。与此同时,包括以太坊、Solana 和狗狗币等其他加密货币的综合指数也下跌了约 3%。

Arbelos Markets 流动性提供商交易主管 Sean McNulty 表示:

“市场对 MicroStrategy 的比特币购买行为持前瞻性态度,这是此前市场上涨的最大原因。现在关注 MicroStrategy 的动态已经成为了我日常工作的一部分。”

一些交易员对未来几天的市场波动表示担忧。创纪录的 430 亿美元未平仓合约将在 Deribit 衍生品交易所到期,其中包括价值 139.5 亿美元的比特币期权和 37.7 亿美元的以太坊期权。McNulty 预测:

“做市商可能会解除其对冲和空头比特币头寸,这可能会导致市场出现剧烈波动。”

MicroStrategy 的雄心

MicroStrategy 在文件中指出,公司的比特币收购速度 “比最初预期要快得多”。

自去年 10 月底宣布计划以增发股票和债券筹集 210 亿美元资金,MicroStrategy 就开始了积极的比特币收购行动。迄今为止,MicroStrategy 已根据这一计划发行了约 130 亿美元的股票和 30 亿美元的可转换债券,并将这些资金全部用于购买比特币。

目前,MicroStrategy 已经成为全球最大的企业比特币持有者,持有约 43.9 万枚比特币,市值约为 420 亿美元,占全球比特币总量的 2% 以上。

值得注意的是,MicroStrategy 未来的股票增发可能将进一步稀释现有股东的持股比例。目前,该公司已发行约 2.23 亿股 A 类普通股,完全稀释后的股份约为 2.6 亿股。如果此次增发计划顺利实施,MicroStrategy 明年的流通股数量可能接近其 3.3 亿股的授权上限。

MicroStrategy 首席执行官 Michael Saylor 长期以来以推动比特币投资而闻名。分析认为,此次大幅增加增发股票数量的计划,显示出他希望将 MicroStrategy 打造成比特币市场的 “绝对领导者” 的雄心。

风险提示及免责条款

市场有风险,投资需谨慎。本文不构成个人投资建议,也未考虑到个别用户特殊的投资目标、财务状况或需要。用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。