The internal divisions within the Bank of Japan are severe, and a rate hike in January is still possible?

考慮到日元持續貶值會帶來通脹壓力,日本央行多位高官在 12 月會議紀要中表達了加息的必要性。

日本央行下月仍有可能加息,但謹慎的觀點佔據多數。

上週,日本央行宣佈保持利率不變,但根據週五公佈的會議紀要摘要,內部對於下一步行動的時機存在激烈討論。

有成員支持明年 1 月加息,也有成員主張等待更長時間以觀察工資趨勢,和特朗普領導下的美國經濟走向。一位成員表示:

"央行可能會在不久的將來決定提高政策利率,但目前有必要保持耐心,直到美國經濟的不確定性消除。"

1 月加息仍有可能,但謹慎觀點仍佔多數

雖然央行行長植田和男最近的謹慎言論降低了市場的加息預期,但會議紀要顯示,1 月加息仍在考慮範圍內。

多位成員表達了加息的必要性。一位成員指出:

"考慮到日元貶值可能會推高基礎通脹,有必要預先調整貨幣寬鬆程度。"

另一位成員認為央行已處於"應該稍微鬆開貨幣寬鬆加速器"的階段。

然而,謹慎觀點仍佔據多數。一位成員表示:

"有必要通過數據確認國內外經濟改善的進展,因此央行暫時維持當前貨幣政策是適當的。"

另一種觀點認為,由於進口價格保持穩定,日元套利交易頭寸並未過度積累,目前上行通脹風險不足以要求加息。

路透社在本月早些時候進行的一項民意調查顯示,所有受訪者都預計,日本央行將在 3 月底前將利率上調至 0.50%。日本央行將於 1 月 23 日至 24 日召開下一次利率政策會議。

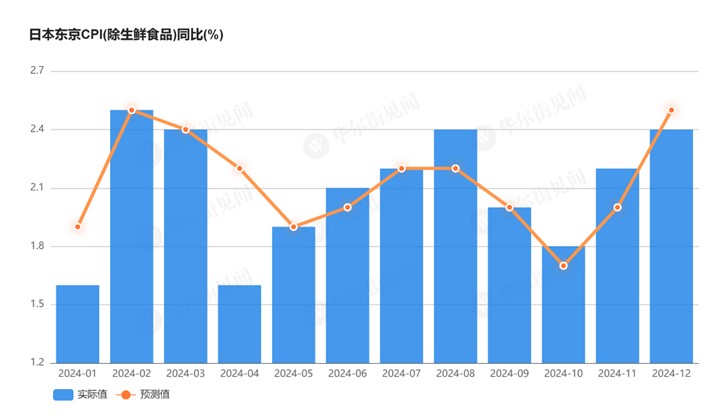

通脹數據支持加息論調

根據週五公佈的政府報告,讓日本 12 月 CPI 同比加速至 2.4%,顯示通脹壓力持續。日本全國核心 CPI 已連續兩年半保持在央行 2% 目標水平或以上。

隔夜掉期市場顯示,1 月加息的概率為 42%,3 月前加息的概率達到 72%。

會議紀要中有一種觀點提到,日本的政治形勢是央行密切關注的因素。許多經濟學家認為,央行本月未採取行動是出於對政治反彈的擔憂,因為石破茂首相的少數派政府正在努力與反對黨通過常規預算和税收改革。