The best-performing major assets in 2024: Bitcoin, gold, US stocks, and Chinese long-term bonds

華泰固收表示,2024 年表現領先的資產包括比特幣、黃金、美股和中國長債,表現落後的資產包括國內商品、歐元和原油。從行業和個股層面來看,領先資產背後藴含着 AI 科技產業鏈、中國的情緒消費鏈條、不確定性環境下避險資產等長期趨勢的變化。

核心觀點

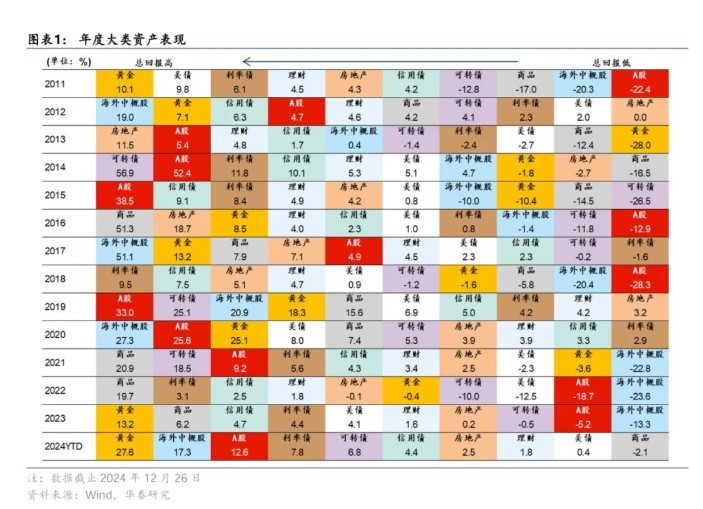

2024 年以來,美國資產 “例外論”、時代主題強化以及全球資金頻繁輪動是驅動大類資產價格的三大核心因素。在不確定環境下,確定性和成長性成為了稀缺資產。資產表現來看,2024 年市場延續的主線在於 “尋找確定性”,宏觀因素諸如美聯儲降息、美國大選、中國政策博弈的懸念逐一落地,對投資操作的精細度、靈活度要求更高。大類資產層面,2024 年表現領先的資產包括比特幣、黃金、美股和中國長債,表現落後的資產包括國內商品、歐元和原油。從行業和個股層面來看,領先資產背後藴含着 AI 科技產業鏈、中國的情緒消費鏈條、不確定性環境下避險資產等長期趨勢的變化。

正文

大類資產之年終盤點

2024 年迎來尾聲,我們對各類資產表現進行年終盤點。全球資金快速輪動,國際地緣局勢動盪的環境下,確定性和成長性成為了稀缺資產,表現為強勢的黃金、屢創新高的美股 AI,突破了傳統的估值框架。機構行為來看,市場定價權也幾經易手,投資者的靈活度和配置能力凸顯差異,被動和靈活資金受青睞。回顧過去的一年,我們發現資產表現背後藴含着深刻的時代主線,金融市場見證奇蹟的同時,也不乏有趣現象。

首先,宏觀環境來看,全球經濟都處於深刻的轉型期,錯位特徵明顯。

美國經濟展現出韌性,大選之後政策不確定性增加,關注點在於經濟增長和通脹的再平衡。

中國經濟呈現低通脹的特徵,穩增長政策持續發力下尾部風險有所降低。

日本出現再通脹跡象,日央行成為全球降息潮的逆行者,政壇動盪增加。

歐洲面臨競爭力危機,經濟修復彈性存在制約。

值得一提的是,西班牙成為一眾發達國家中表現最好的經濟體,其積極推動結構性改革,實現經濟長期發展。經濟學人整理了 2024 年 37 個主要是發達國家的五個經濟和金融指標的數據,包括 GDP、股市表現、核心通脹率、失業率和政府赤字。然後根據各經濟體的表現進行排名,西班牙位居首位,其經濟增長和就業增速均超過美國。產業結構方面,從傳統的製造業轉向重視服務業發展,通過旅遊經濟拉動增長。外交方面,對移民保持開放的政策,並且積極開展招商引資的工作。因此,發達的旅遊業和移民就業增長對本地房價有推動作用,投資和生產也對內部經濟增長有支持。

資產表現來看,2024 年市場延續的主線在於 “尋找確定性”,宏觀因素諸如美聯儲降息、美國大選、中國政策博弈的懸念逐一落地,對投資操作的精細度、靈活度要求更高。2024 年全球資產輪動背後藴含的核心邏輯是:

1、美國資產 “例外論”:高利率環境下美國基本面維持韌性,美股近兩年持續獨佔領漲地位;

2、時代主題強化:全球大選年疊加地緣擾動頻繁,時代背景對資產價格的影響發酵,黃金錶現搶眼,而 AI 主題在一年多 “狂奔” 後開始向縱深發展,相關產業鏈牛股頻出。

3、全球資金輪動頻繁:不同資產間估值差距擴大,全球資金頻繁輪動和高低切換,無論是國別之間(日印/中國),還是風格之間(美股大/小盤、國內成長/紅利)。

大類資產層面,2024 年表現領先的資產包括:

1)比特幣:多數時期是 risk on 資產,主要定價去法幣化屬性 + 特朗普上台後監管放鬆 + 嚴格的供給約束,美國等發達國家對加密貨幣接受度更高;

2)黃金:主要是 risk off 資產,驅動因素為國際局勢動盪 + 美國降息週期 + 發達國家債務持續性問題帶來美元貨幣體系的擔憂 + 新興市場央行購金,黃金價格屢創新高;

3)美國的股票:高利率環境下美國基本面維持韌性,美股也成為近兩年持續領漲的資產,背後是 AI 科技革命帶來的企業盈利增長 + 軟着落降息潮的雙輪驅動,過程中籌碼擁擠階段會經歷短暫的調整;

4)中國的長債:價格信號弱 + 地產下行週期 + 貨幣政策寬鬆 + 機構配置壓力大,國內利率持續下行,久期策略獲得高資本利得。

全年表現落後的資產包括:

1)國內商品:房地產市場延續降温趨勢,供需矛盾持續加劇,商品市場更多交易現實,國內黑色系商品回調明顯;

2)歐元:歐洲基本面復甦節奏明顯弱於美國,德國等財政整肅,存在尾部風險,比差邏輯下歐元偏弱運行。

3)原油:需求端受制於高利率環境缺乏有力驅動,供給端有 OPEC 以及美國潛在的增產壓力,疊加特朗普交易,成為偏弱勢品種。

從行業和個股層面來看,領先資產背後藴含着長期趨勢的變化:

1)AI 科技產業鏈:ChatGPT 問世後的第二年,交易從狂熱逐漸迴歸理性,但是其普及速度遠超歷史上其他技術革命,具備平台優勢的大型科技企業和特定垂直領域有壁壘的企業仍有明顯優勢。AI 科技革命引發各公司的 “軍備競賽”,算力需求指數級增長,硬件生產商 “賣鏟人” 英偉達受益明顯,2024 年至今漲幅達到 179%。此外,AI 硬件向上遊的電力等基礎設施和下游的軟件擴散,提供基礎設施服務的 Vistra 電力公司年初至今上漲超 270%。美國 Mag7 年初至今已錄得 70% 漲幅,領漲美股,做多美國科技股成為 24 年市場最為追捧也是最為擁擠的交易主線。國內映射包括寒武紀(近漲幅超 380%)以及近期 AI 應用 “豆包” 概念等。

2)中國的情緒消費鏈條:消費景氣度有所下行的環境下,情緒消費、悦己消費、粉絲經濟等細分賽道有優勢和壁壘的市場空間增長強勢。雖然傳統消費需求持續低迷,但是以 “穀子經濟” 為代表的悦己消費快速發展,“穀子商品” 立足二次元 IP,產生較高的附加值,市場空間高速增長。其中,泡泡瑪特作為優勢行業的龍頭公司,三季度營收同比 2023 年增長 120%~125%,且業績連續多個季度超市場預期,全年股價上漲超過 300%。

3)不確定性環境下的避險資產:過去兩年的市場主線在於尋找確定性,高股息類資產比如貴金屬、銀行股等,成為利率下行與低風險偏好下的佔優資產,尋求的是業績的確定性。全年來看,銀行板塊漲幅超過 40%,較滬深 300 超額收益近 20 個百分點,在各行業中位居前列。一方面或在於銀行板塊風險收益特徵更優,獲得了險資等低風險偏好資金的青睞,另一方面在於銀行經營相對穩健,通過撥備調整可以平滑業績,實現 10% 的 ROE 以及正的利潤增長,在缺少市場主線行情下,成為避險資金的配置抓手。

本文作者:華泰固收張繼強、何穎雯,來源:華泰證券固收研究,原文標題:《【華泰資產配置】周度覆盤:大類資產之年終盤點》

張繼強 S0570518110002 研究員

何穎雯 S0570522090002 研究員