Can the small-cap stocks in the US market that have underperformed for four years turn the tide in 2025?

I'm PortAI, I can summarize articles.

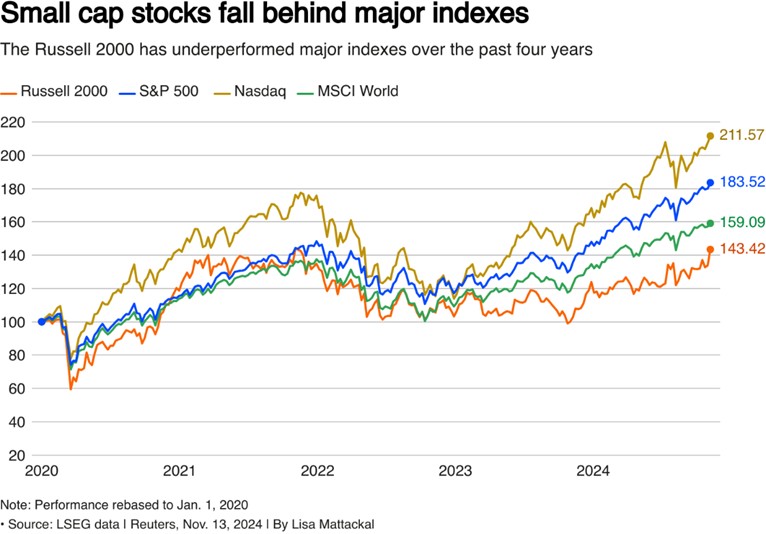

自 2020 年以来,以罗素 2000 为代表的美股小盘股表现不佳,涨幅仅为 43.2%,远低于 MSCI 世界指数的 59.09%、标普 500 的 83.52% 和纳斯达克的 111.57%。小盘股在四年内跑输标普 500 指数 40 个百分点,纳斯达克接近 70 个百分点。市场对特朗普当选后的小盘股行情有所期待,导致罗素 2000 指数在 11 月出现强劲反弹。

回顾 2020 年至今,以罗素 2000 为代表的美股小盘持续跑输市场。根据行情,2020 年至今涨幅看:

小盘的 Russell 2000,涨幅 43.2%。

MSCI World:涨 59.09%。

标普 500:涨 83.52%。

纳斯达克:涨 111.57%。

四年时间,美股小盘跑输标普 500 指数 40 个百分点,跑输纳斯达克接近 70 个百分点。

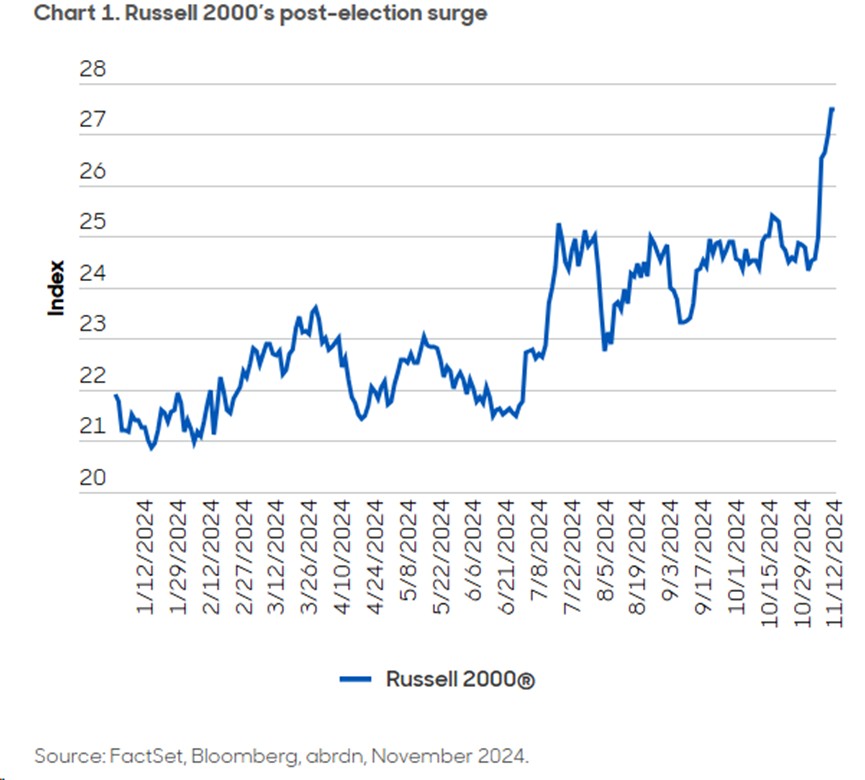

而随着特朗普的上台,市场预期美股小盘会有一波行情,因此可以看到 11 月特朗普当选美国总统之后,美股小盘股迎来一波抢跑,罗素 2000 指数在 11 月迎来一波强势上涨。