Has the MSTR strategy failed? Buying coins for eight consecutive weeks, the stock price keeps falling

MicroStrategy has purchased Bitcoin for eight consecutive weeks, accumulating an increase of 19,418 coins. The market has expressed concerns about its leverage strategy, and the MSTR stock price has fallen by 20.18% in the past 30 days

Is MSTR's leveraged strategy for buying coins no longer feasible?

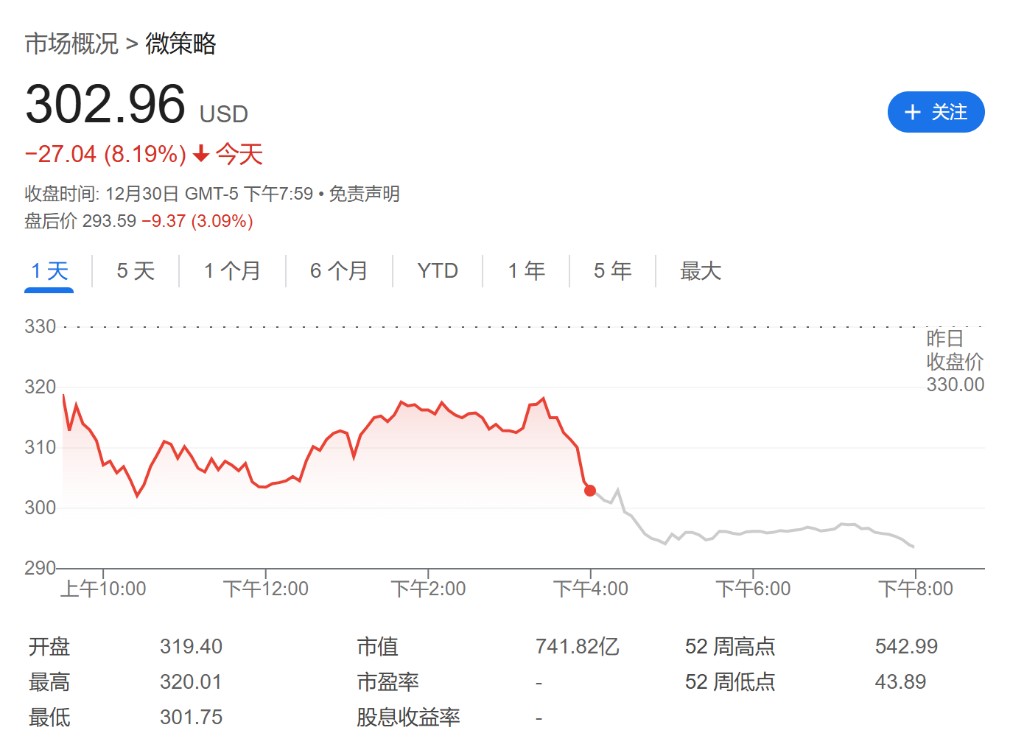

Recently, MSTR has continued to buy coins. On December 30, MicroStrategy (MSTR) purchased Bitcoin for $209 million, but subsequently, its stock price plummeted over 8%, raising concerns in the market about its high-leverage operations.

On Monday, MSTR opened at $318.89, and within just one hour, the stock price dropped by 5.3%. As of the time of writing, the after-hours stock price further declined to $293.

According to company filings, MicroStrategy recently sold 592,987 shares of stock to fund this Bitcoin acquisition. Since October 31, the company has purchased Bitcoin for eight consecutive weeks, accumulating a total of 19,418 Bitcoins.

Trading resource platform The Kobeissi Letter indicated that the market is concerned about MicroStrategy's proposal to increase authorized shares by 10 billion. Through a combination of convertible notes and debt issuance, MSTR has become highly leveraged. The company must issue more debt or stock to continue its Bitcoin buying spree.

"However, if the increase in authorized shares is approved, the company's total shares could surge from 330 million to 10.33 billion."

MicroStrategy's stock price declines, raising market concerns about its leverage strategy

Although MSTR's stock price has dropped 20.18% in the past 30 days, it has still risen 342.15% year-to-date.

Felix Hartmann, founder of Hartmann Capital, predicts that in the long run, MicroStrategy's stock price "will ultimately crash, but most short sellers will time it wrong and incur losses." He also stated:

"In five years, MSTR will first become one of the top five companies by market capitalization, and then eventually go bankrupt. We are still in the early stages."

Joe Burnett, head of market research at Unchained, referred to MicroStrategy's current strategy as "super Bitcoinization." He stated that the company is increasing its Bitcoin per share holdings through high-premium trading. Burnett further explained:

“High premiums allow them to sell stock at prices above net asset value, purchase more Bitcoin, reduce leverage, and further increase the number of Bitcoins per share.”

It is worth noting that MicroStrategy was added to the Nasdaq-100 Index on December 23, meaning it has become one of the 100 largest companies by market capitalization on Nasdaq.

The speed of Bitcoin acquisitions is "much faster than initially expected"

Last week, according to a preliminary proxy statement filed with the SEC, MicroStrategy is seeking shareholder approval to increase the number of authorized Class A common stock and preferred stock. This will provide more financial support for the company, which has transformed from a software manufacturer to a Bitcoin accumulator MicroStrategy pointed out in its document that the company's pace of Bitcoin acquisition is "much faster than initially expected."

Since announcing plans to raise $21 billion through the issuance of stocks and bonds at the end of October last year, MicroStrategy has begun an aggressive Bitcoin acquisition campaign. So far, MicroStrategy has issued approximately $13 billion in stocks and $3 billion in convertible bonds under this plan, and has used all of these funds to purchase Bitcoin.

Currently, MicroStrategy has become the world's largest corporate holder of Bitcoin, holding approximately 439,000 Bitcoins, valued at around $42 billion, accounting for more than 2% of the total Bitcoin supply globally.

Sean McNulty, head of trading at Arbelos Markets liquidity provider, stated:

"The market has a forward-looking attitude towards MicroStrategy's Bitcoin purchases, which has been the biggest reason for the previous market rally. Keeping an eye on MicroStrategy's developments has now become part of my daily work."