乐观情绪洋溢,华尔街没有人认为股市在 2025 年会下跌

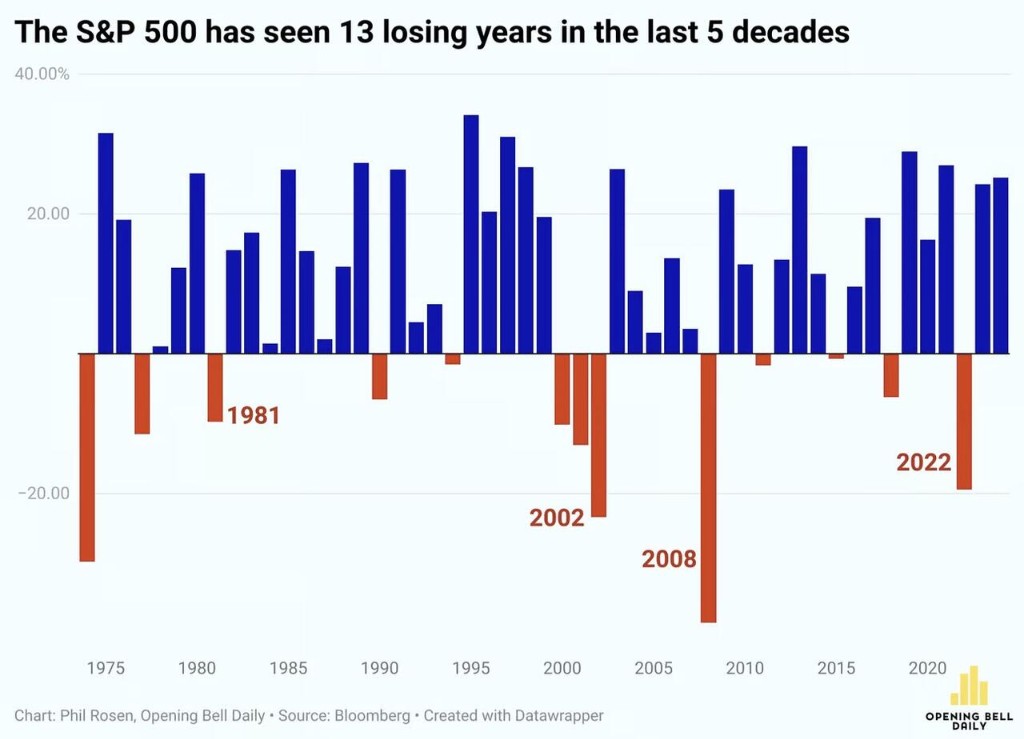

In the past few decades, Wall Street has never predicted that U.S. stocks would decline in the following year. Even the most pessimistic annual forecasts believed that the stock market would see slight growth. Over the past 50 years, the S&P 500 has had 13 years of declines

As the New Year approaches, Wall Street is generally optimistic about the performance of U.S. stocks next year.

As of December 30, the annual return of the S&P 500 index reached 24.54%, expected to close for the second consecutive year with an increase of over 20%, and has cumulatively risen 66% since the low in October 2022.

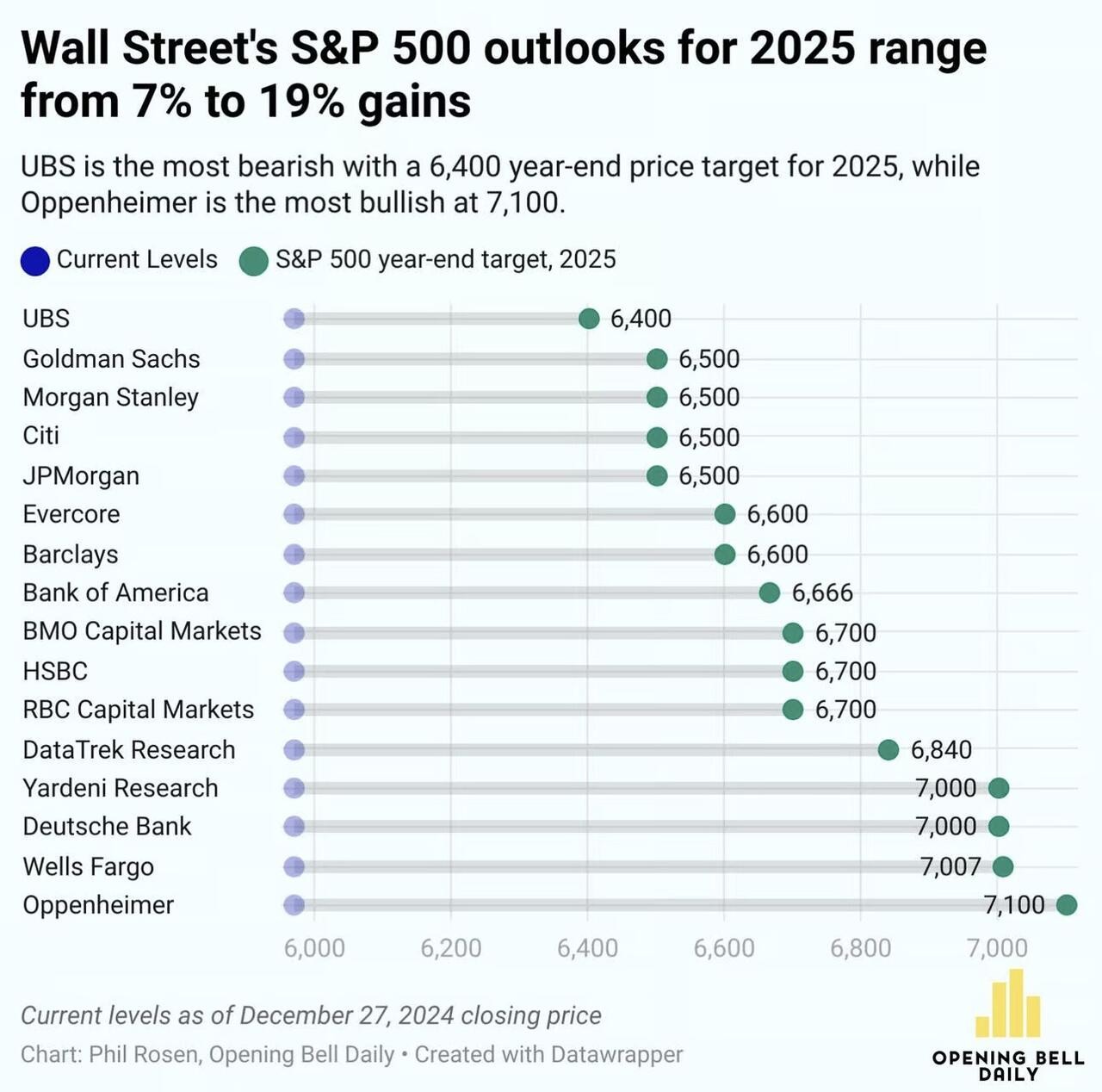

Wall Street predicts that this upward trend is likely to continue into next year. "Opening Bell Daily" compiled forecasts from 16 Wall Street investment banks and found that every investment bank predicts that U.S. stocks will continue to rise next year, with the S&P 500 index expected to cumulatively increase by 7%-19%.

Among the target prices given by various firms, UBS predicts a year-end target price of 6,400 points for the S&P 500 in 2025, which is the most pessimistic, while Oppenheimer is the most optimistic, providing a target price of 7,100 points.

It is worth noting that over the past few decades, Wall Street has never predicted that U.S. stocks would decline in the following year; even the least optimistic annual forecasts have suggested that the stock market would experience slight growth. In the past 50 years, the S&P 500 index has recorded declines in 13 years.

However, according to data from Bespoke Investment Group, the target prices predicted over the past twenty-four years have actually deviated by an average of 14%.

Carol Schleif, Chief Market Strategist at BMO Private Wealth, stated:

"We believe that 2025 will once again see a year of healthy returns in the stock market, but as investors reassess any signals from the Federal Reserve and we begin to analyze the policies of the new administration, particularly regarding tariffs and taxes, market volatility will also increase."