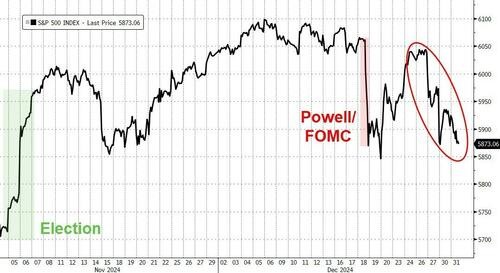

Rare "four consecutive declines" to close, is it bad news for the US stock market?

Despite rising over 20% for the year, the performance of U.S. stocks in closing out this remarkable year was not very impressive. The S&P 500 index ended the year with four consecutive days of decline, a situation that has not occurred since 1966. Goldman Sachs derivatives trader Brian Garrett believes that the performance in the last two weeks of this year was not as strong as expected, with short positions increasing trading volume, technical factors dominating, liquidity being challenged, and a healthy pullback in risk appetite just beginning (with increased short positions and decreased net long positions, etc.)

Despite rising over 20% for the year, the performance of U.S. stocks in closing this remarkable year is not very impressive.

The S&P 500 index ended the year with four consecutive days of decline, a situation that has not occurred since 1966.

Goldman Sachs derivatives trader Brian Garrett believes:

The performance in the last two weeks of this year has not been as strong as expected, with short positions increasing trading volume, technical factors dominating, liquidity being challenged, and a healthy pullback in risk appetite just beginning (with increased short positions and decreased net long positions, etc.).