特朗普 2.0 引发通胀担忧 交易员看淡今年美国债市前景

Due to the impact of Trump's policies, traders hold a pessimistic outlook on the U.S. bond market. Strong economic data and the Republican Party, led by Trump, winning the elections have weakened the treasury market, with the yield on the 10-year U.S. Treasury rising to nearly 4.6%. Concerns about inflation and optimism about economic growth have led to fluctuations in interest rates. Investors are cautious about a rebound in the bond market, expecting the Federal Reserve to keep interest rates unchanged before June

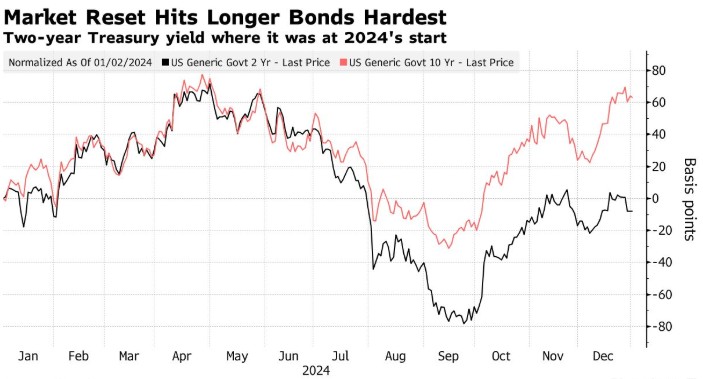

Zhitong Finance has learned that with a series of strong economic data, the Republican Party led by Trump achieving a significant victory in the elections, and the cautious attitude of Federal Reserve officials prompting investors to readjust their expectations for Federal Reserve policy, the U.S. Treasury market is weak. The adjustment in interest rate expectations has the greatest impact on long-term bonds, with the yield on the 10-year U.S. Treasury rising to nearly 4.6%, about a full percentage point higher than the level when the Federal Reserve first began cutting rates in September last year. The impact on the 2-year U.S. Treasury is relatively small, reflecting investors' shift towards short-term securities that are anchored by Federal Reserve policy rates and less affected by changes in longer-term prospects.

The resilience of the U.S. economy and Trump's tax cuts and tariff policies are putting pressure on U.S. Treasuries. Priya Misra, a portfolio manager at JP Morgan Asset Management, stated, "The market has many concerns about inflation (tariffs, fiscal stimulus, immigration) and some optimism about economic growth (fiscal stimulus, deregulation), which explains the fluctuations in interest rates over the past few months."

The pessimistic outlook for the bond market marks a shift compared to early 2024, when many on Wall Street expected a robust year of growth for the bond market once the Federal Reserve began to pull rates back from their highest levels in over 20 years. However, these expectations have proven unrealistic, leaving investors hesitant to bet on a rebound in the bond market amid ongoing economic growth. Meanwhile, Trump's tax cuts and tariff plans may increase fiscal stimulus and raise import prices, thereby exacerbating inflationary pressures. The increase in deficits will also raise the supply of U.S. Treasuries.

Jack McIntyre, a portfolio manager at Brandywine Global Investment Management, stated that holding shorter-term bonds "is a good practice at the moment." He said, "It's best to remain vigilant even if yields have risen a lot before you see economic pain."

Currently, futures traders expect the Federal Reserve may keep rates unchanged until June and may only cut rates by 50 basis points throughout 2025.

Bloomberg strategist Ven Ram stated that Trump's remarks will stimulate the selling of U.S. Treasuries, and any surge in yields may be limited to 30 basis points, keeping yields below 5%.

Due to the market closure on Thursday in memory of former U.S. President Jimmy Carter, the market will see a test of demand in a series of U.S. Treasury auctions starting on Monday. This auction will include new 10-year and 30-year U.S. Treasuries. Additionally, on Friday, the U.S. Department of Labor will release the monthly non-farm payroll report; economists expect 160,000 new jobs to be added in December, a slight slowdown from 227,000 in the previous month JP Morgan's Misra said that considering the yields have risen so much, a greater-than-expected slowdown in job growth could lead to a rebound in bond prices. She pointed out that weak data will trigger discussions about a rate cut by the Federal Reserve in March