How far can AI glasses go?

AI 眼鏡經過多輪驗證,已展現成功範式。產品定價在 1-3,000 元,未來有降本空間。智能眼鏡接入大模型,提供新交互方式和應用場景。Meta、百度等品牌已發佈產品,預計三星、蘋果等也將推出。AI 眼鏡在基礎功能、SoC、存儲和光學顯示等方面有優化空間,未來 3-5 年有望實現快速發展。

摘要

產品歷經多輪驗證,AI 眼鏡已出現成功範式。1)定價:價格親民,後續仍有降本空間。全球 AI 眼鏡品牌陸續發佈多款產品,定價基本處於 1-3,000 元區間,能夠向用户提供較低的嘗試成本。此外,我們看好未來 SoC 等核心器件的降本機會,打開下沉市場,吸引用户購買;2)交互及應用:我們認為智能眼鏡接入大模型提供全新交互方式,同時,大模型提供了更多應用場景,有望打造全場景生活助手,提供全新硬件體驗。3)品牌:目前已有 Meta、百度、Rokid 和 Xreal 等 AI 眼鏡產品發佈,我們預計三星、蘋果、字節及小米等大廠均有相關產品規劃,產品有望在未來 1-2 年上市。我們認為新終端需要全球頭部公司進行消費者教育,完成市場推廣,並吸引更多應用開發者入場實現生態豐富。回顧過去 ARVR 多輪產業發展,我們認為目前 AI 眼鏡的成功範式已現,行業有望迎快速發展階段。

AI 眼鏡仍有較大優化空間,產品形態豐富有望推動出貨增長。1)基礎功能:我們認為未來 AI 眼鏡有望通過超薄夾層鏡片設計,解決用户定製化屈光度的解決方案,以及通過電致變色技術實現墨鏡佩戴的適配度提升,助力 AI 眼鏡實現並優化眼鏡基礎功能。2)SoC:根據目前產品的 BOM 拆解,SoC 佔據較高的成本,我們看好未來國產芯片有望陸續發佈,提供更高性價比的芯片解決方案,在續航及成本等方面升級。3)存儲:我們看好未來智能眼鏡功能豐富,有望推動存儲規格提升,並隨着出貨量增長,我們測算未來存儲市場有望實現百億美元市場增量。4)光學顯示:中長期來看,我們認為光學顯示是 AI 眼鏡的關鍵升級之一,隨着光波導及 Micro LED 等核心器件成熟,全球頭部品牌有望率先推出搭載顯示的 AI 眼鏡(AR 眼鏡),進一步豐富應用場景,並通過顯示功能完成信息交互及反饋,優化使用體驗。綜上,我們認為未來 3-5 年 AI 眼鏡有望在基礎功能、SoC、存儲及顯示等領域實現持續升級,改善用户體驗,豐富應用場景,帶動產品整體出貨增長。

正文

AI+ 眼鏡有望打造下一個移動終端

AI 眼鏡或成多模態大模型最優解

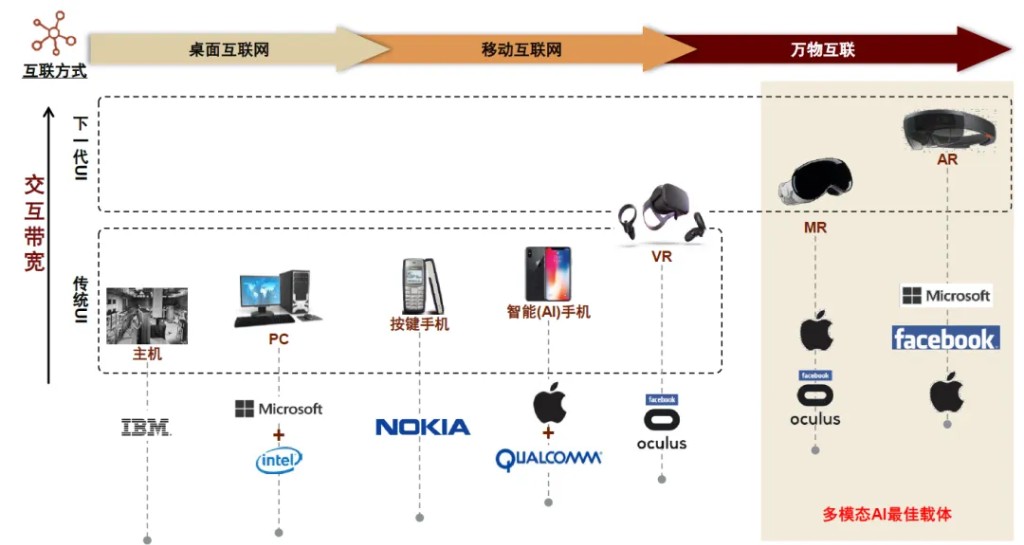

AI 眼鏡適配多模態大模型,有望引領行業創新趨勢。隨着 ChatGPT-4o 及豆包視覺模型發佈,多模態 AI 加速落地,語音、視頻及圖片等交互方式有望刷新市場對於 AI 能力認知。我們認為 AI/AR 眼鏡產品具備透視能力,同時,設備搭載攝像頭、麥克風及揚聲器等多種傳感器,可實現素材實時獲取,並語音或顯示完成交互,有望成為多模態 AI 終端的更優選。

2024 年 AI 眼鏡品牌百花齊放,2025 預計將有更多大廠入局。從而實現多模態 AI 升級,全球多個消費電子終端品牌均發佈相關產品,推動 AI 眼鏡市場關注度持續提升。展望未來,我們預計 2025-26 年有更多消費電子頭部品牌均有望推出相關產品,持續加碼 AI 眼鏡終端,有望打造下一代 AI 智能穿戴。

圖表 1:消費電子終端升級趨勢回顧及展望

圖表 2:2024-2026 年 AI/AR 眼鏡發佈匯總(部分)

滲透空間較大,AI 眼鏡未來增速可期

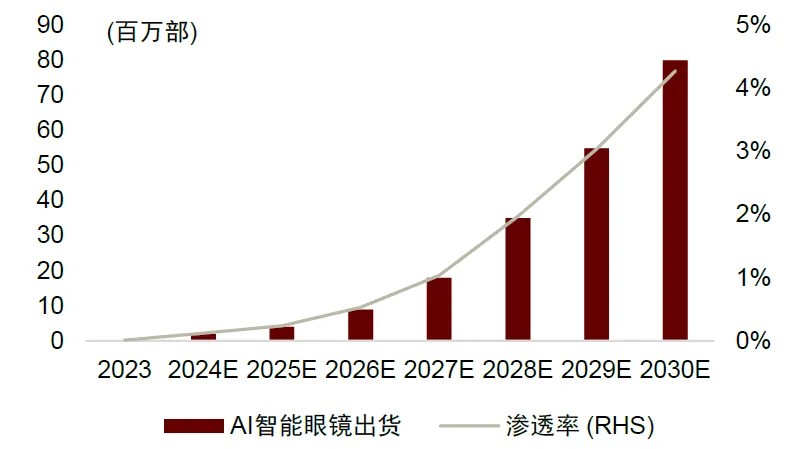

2030 年 AI 智能眼鏡出貨有望達到 8,000 萬部。我們認為隨着智能眼鏡功能豐富,未來有望增加屈光度調節、變色等功能,有望逐步替代傳統近視眼鏡及墨鏡市場,同時,疊加原材料成本下降,有望推動滲透率加速提升,根據 Wellsenn 測算,2030 年全球 AI 智能眼鏡出貨有望達到 8,000 萬部,滲透率約為 4.3%。

圖表 3:AI 眼鏡出貨量及滲透率

為什麼是 AI 眼鏡?

產品形態經過多輪驗證及反饋

ARVR 歷經多款產品形態打磨,智能眼鏡或為最優解。自 2010 年起,市場對 ARVR 關注度持續提升,並有蘋果、微軟、Meta、三星、Google 和字節等科技大廠入局,以及 Magic Leap、Xreal 和 Rokid 等初創公司崛起。我們認為產品形態歷經多輪更迭及功能創新,目前 ARVR 產品形態的成功範式已較為明晰,我們看好智能眼鏡有望推動 ARVR 行業加速發展。

圖表 4:ARVR 歷經多輪產品驗證及客户反饋

AI 眼鏡輕便易上手,打造 Always-On 智能終端體驗

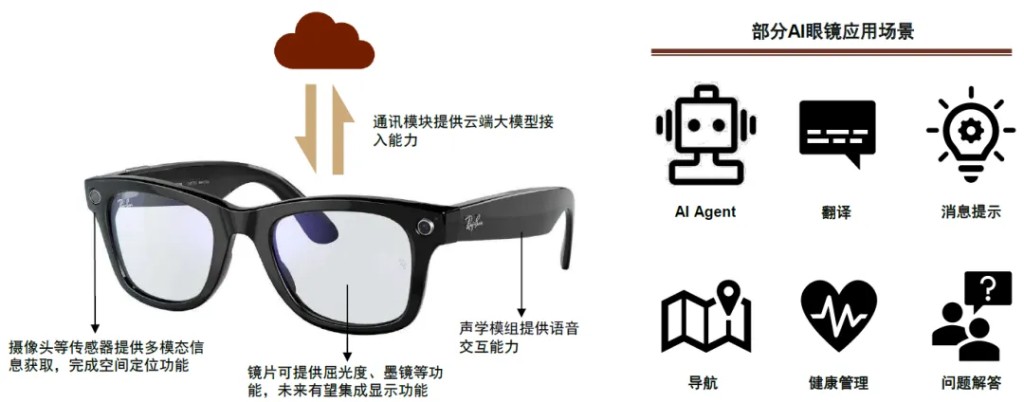

功能簡潔,用户學習成本較低。以 Meta-Rayban 眼鏡為例,AI 眼鏡以傳統眼鏡為基礎,增加攝像頭、聲學及 AI 大模型接入等功能,成為 AI 智能眼鏡。產品功能主要以視頻及圖片拍攝和語音交互,我們認為功能較為簡單易於用户使用,並以手機等傳統終端為支點,通過藍牙連接,能夠將後續複雜操作及素材放在傳統終端。

大模型賦能新終端,應用場景覆蓋全面。我們認為接入大模型推動 AI 眼鏡功能豐富,實現應用場景全覆蓋,未來隨着國內大模型成熟,有望加速推動終端出貨增長。

圖表 5:AI 眼鏡功能簡潔,應用場景豐富

後續降本空間較大,產品有望持續下沉

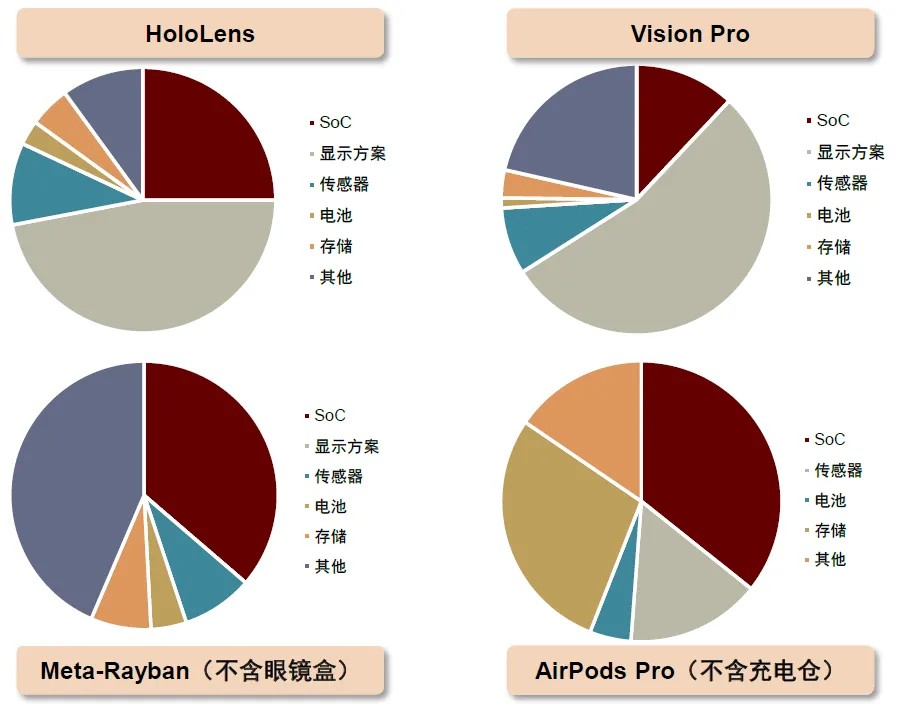

智能眼鏡與 TWS 的成本結構類似,降本後推動產品下沉。回顧 TWS 成長曆史,我們認為由蘋果 AirPods 引領行業標準後,核心元器件快速降本是推動產品出貨增長的關鍵因素之一。與 TWS 類似,智能眼鏡中成本佔比較高的主要為 SoC、存儲及 PCB 等相關產品。我們看好上述零部件未來有更多國內供應商切入,通過定製化、低成本產品替代目前高通 AR1 等高端芯片,有望推動智能眼鏡成本下降,並帶動產品價格下沉,或將推動出貨量持續增長。

圖表 6:ARVR BOM 對比(2024)

如何看待未來 AI 眼鏡產品發展趨勢?

輕量化 AI 眼鏡成為發展趨勢,未來疊加顯示功能有望成為獨立終端。當前,AI 眼鏡雖然僅具備語音交互及攝像等功能,但體積輕便且價格親民,用户購買意願較強,疊加產品設計較為時尚,亦有裝飾功能,為目前 AR 眼鏡主流產品。展望未來,我們認為在 3-5 年時間,輕量化 AI 眼鏡仍將成為行業發展主要趨勢。隨着光學等核心器件成本下降,我們認為顯示等功能有望逐步豐富,以實現更為全面的獨立 AI 交互終端。

圖表 7:AI/AR 眼鏡發展趨勢展望

處方鏡片解決用户痛點,電致變色提供墨鏡方案

智能眼鏡或以傳統眼鏡用户為首選切入點,屈光度矯正需求較為明確。我們認為目前智能眼鏡的潛在用户仍主要以傳統屈光度矯正或墨鏡用户為主。展望未來,我們認為智能眼鏡的處方鏡片供應鏈或將參與產業鏈供應,通過超薄鏡片貼合解決用户屈光度調節需求,再將產品送至下游完成組裝,最終以成品方式發送給消費者。

電致變色提供智能眼鏡墨鏡解決方案,相關技術佈局成熟。我們認為墨鏡是除視力矯正眼鏡外的重要功能,傳統眼鏡更多采用特定顏色鏡片並配合鍍膜等工藝實現墨鏡效果。隨着電致變色技術成熟,已有 Xreal Air 等產品搭載相關功能,我們看好未來電致變色有望在智能眼鏡滲透,從而解決用户墨鏡需求,吸引用户購買,推動智能眼鏡滲透率提升。

SoC 成本佔比較高,升級趨勢明確

主控芯片的價值量佔主板成本超 60% 且為主要升級方向。根據 Wellsenn XR 的拆機報告,雷朋 Meta 眼鏡主板電子物料約 88.5 美金,其中高通主控 AR1+ 套片(含 WiFI 及電源管理芯片)總價 58 美金左右,佔比為 62%。此外,從升級趨勢來看,我們認為 SoC 的性能提升、功耗優化也是目前的主要芯片技術升級方向,旨在解決產品目前功能偏簡單、續航時間不足的瓶頸,我們認為 SoC 未來在 BOM 中的價值量佔比有望繼續提升。

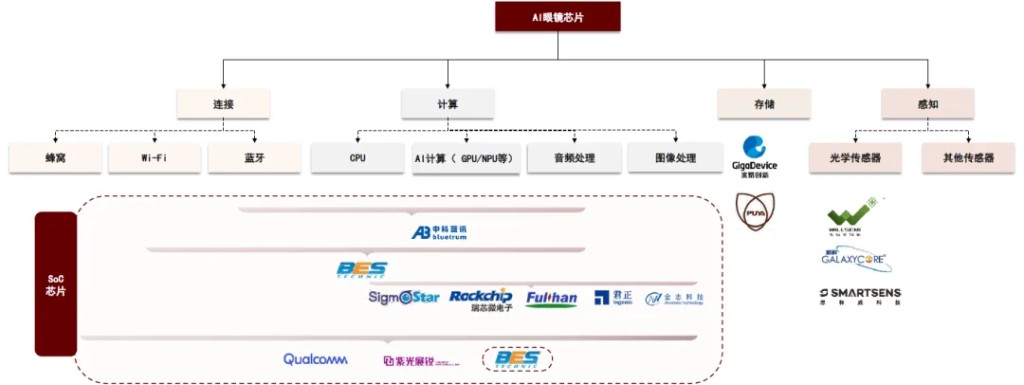

AI 眼鏡 SoC 可以簡單理解為智能耳機芯片 +ISP 芯片。SoC 作為系統級的芯片,由眾多的功能模塊組成,不同場景對 SoC 芯片提出差異化需求。AI 眼鏡作為可穿戴設備,由於端側算力和功耗受限,我們認為未來較長時間內無法運行本地模型。此外,網絡連接不流暢、續航時間長等問題目前很大程度上影響了用户體驗。因此我們認為 AI 眼鏡主控芯片 AI 算力需求較低,更側重連接和低功耗能力。此外,由於 AI 眼鏡相較於傳統智能音頻眼鏡增加了攝像頭,而隨着視頻理解模型的發展和成熟,我們認為多模態的交互成為 AI 眼鏡的標配,因此圖像處理(ISP)能力也至關重要。

我們看好國產 SoC 公司在未來 2 年內逐步完成國產替代,主要由於以下原因:

(1)底層技術能力角度來看,國產 SoC 各有優勢,性價比和功耗成為最大突破口

作為穿戴類產品,輕量級的 AI 眼鏡不需要手機那樣極致的功能,需要性能、續航和性價比各方面比較均衡的芯片。我們看到智能耳機芯片 +ISP 芯片的組合形式或成為第一代國產方案的主流。即使採用兩顆芯片,我們認為國產方案在性價比上也具備足夠的競爭力。我們看好國產廠商的下一代產品也能提供高度集成的芯片方案。

圖表 8:AI 眼鏡芯片供應商佈局梳理

(2)產品定義來看,國產龍頭芯片更具定製化,場景複用性強

目前我們對比了高通 AR1,紫光展鋭 W517 和恆玄 BES2800 三款芯片。從下表數據可以看出,儘管高通 AR1 擁有強大的性能但面向輕量級的 AI 眼鏡應用顯得有些冗餘,比如高通 AR1 提供單眼 160 萬像素的顯示能力而 AI 眼鏡大多不需要顯示功能,WIFI7 的使用在手機和路由器領域尚未普及目前也不具備廣泛使用的條件。紫光展鋭 W517 是四年前的老產品,前期主要使用在手錶等領域,恆玄在智能眼鏡上的佈局更為積極。

圖表 9:AI 眼鏡主流芯片方案對比

(3)下游來看,國內有互聯網、安卓手機品牌的大客户優勢

大模型賦能端側硬件生態,國內互聯網廠商比海外互聯網巨頭更積極地佈局硬件生態。上游我們有日益成熟的國產多模態大模型,中游我們有各種各樣、滿足各種複雜度、各種功能需求的 SoC 芯片和強大的模組、組裝產業鏈,下游我們有早已緊密合作的終端品牌客户優勢。我們認為在創新終端興起時,國產龍頭 SoC 公司也有和終端客户提早進入預研的先發優勢。

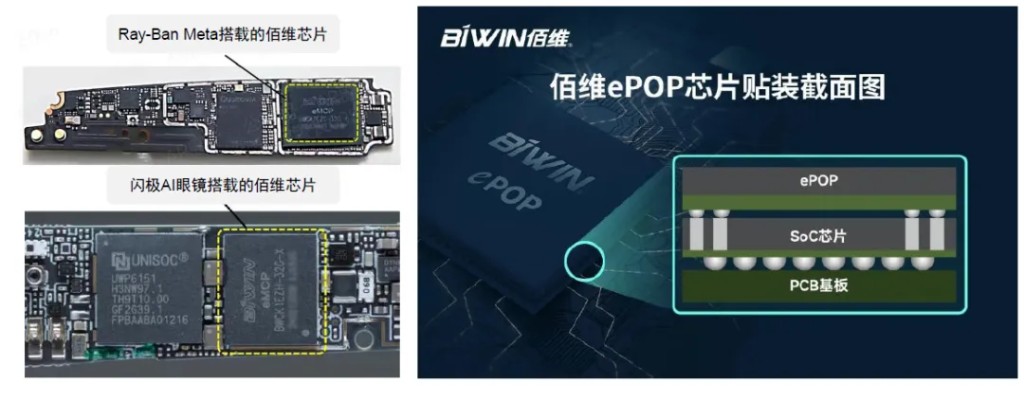

眼鏡功能豐富提升存儲規格,出貨增長帶來增量空間

存儲芯片是 AI 眼鏡中價值量僅次於主控芯片的半導體器件。從目前已經上市的 Ray-Ban Meta 眼鏡、閃極 AI 拍拍鏡兩款 “爆款” 產品來看,它們均採用了佰維存儲的ePOP 芯片。ePOP(embedded Package on Package)為 NAND Flash 和 LPDDR 二合一的存儲器產品,廣泛應用於對芯片尺寸有嚴苛要求的智能終端,尤其智能穿戴設備領域。

圖表 10:AI 眼鏡拆機 & ePoP 封裝

當前 AI 眼鏡存儲主要採用 2GB DRAM+32GB NAND Flash 的組合形式,我們認為未來隨着 AI 眼鏡功能更加豐富,對存儲的需求也將更大。以 Ray-Ban 眼鏡為例,2021 年發佈的一代產品採用 512MB LPDDR3+4GB eMMC 的存儲形式,2023 年的二代產品已經升級至 2GB LPDDR4X+32GB eMMC,有明顯提升趨勢。我們認為,隨着 AI 眼鏡在攝像、音頻乃至本地 AI 等方面性能的提升,未來單機存儲價值量將進一步提升。

圖表 11:Ray-Ban 眼鏡存儲方案演變歷史

我們測算當前 AI 眼鏡對存儲的需求可能在千萬美元級別,未來幾年內有望隨着 AI 眼鏡銷量突破千萬副,市場規模達到億美元量級。中長期如果 AI 眼鏡銷量突破億副量級,我們認為其對存儲市場的拉動將訂單達到大幾十億美元量級甚至突破百億美元量級。我們認為憑藉供應鏈、性價比等優勢,中國大陸企業的份額有望逐步提升。

圖表 12:AI 眼鏡對全球存儲市場拉動測算

智能眼鏡未來有望增加顯示方案,側重光學創新

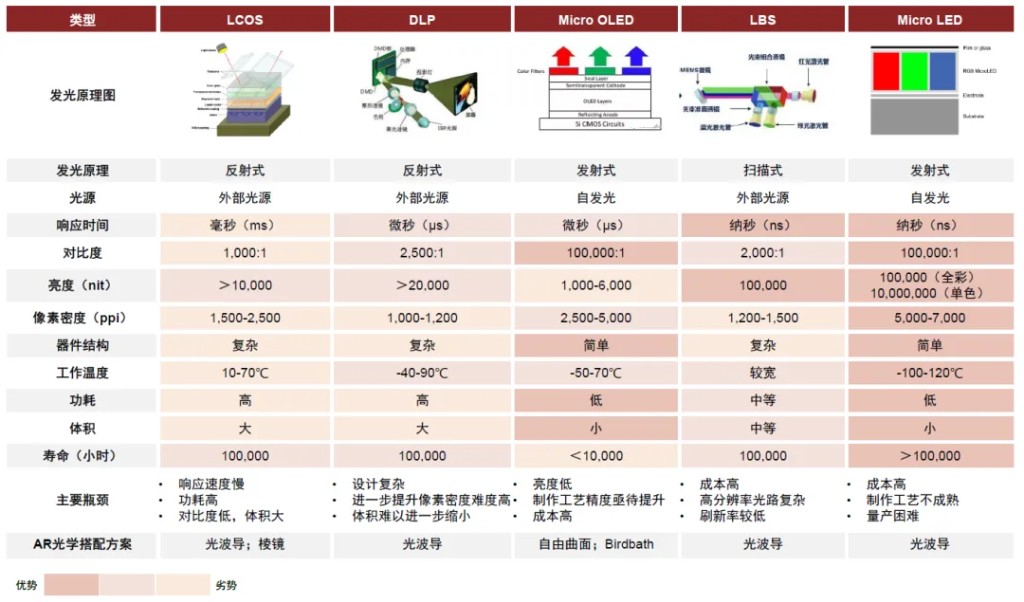

光波導鏡片是 AI 眼鏡未來發展趨勢。目前市場上比較成熟的光學成像方案包括稜鏡、離軸反射、自由曲面、Birdbath 以及光波導方案。展望未來,我們認為光波導可以解決視場角與產品體積之間的矛盾,並且在減少設備體積和重量的同時,形態上更接近傳統眼鏡設計,符合 AI 眼鏡特點。因此,我們看好光波導發展潛力,未來有望在行業巨頭及初創公司配合下實現量產,並助力 AI 眼鏡產品增加顯示功能。

圖表 13:AR 光學顯示方案對比

圖表 14:光波導工藝路徑對比

Micro LED 體積優勢明顯,搭配光波導有望成為 AI 眼鏡顯示解決方案。市場當前已提出的 AR 光源方案主要有 LCOS(Liquid Crystal on Silicon)、DLP(Digital Light Processing)、LBS(Laser Beam Scanning)、Micro OLED 以及 Micro LED 方案。我們認為體積輕便是 AI 眼鏡的重要優勢之一,Micro LED 在體積、功耗、亮度和壽命等方面均有明顯優勢,較為適配 AI 眼鏡,我們看好未來在成本下降後,有望搭配光波導成為 AI 眼鏡顯示解決方案。

圖表 15:AR 光學成像方案對比

本文作者:李澄寧 S0080522050003、臧若晨 S0080522070018 等,文章來源:中金點睛,原文標題:《中金 | ARVR 系列#7:AI 眼鏡能走多遠?》