Tencent plummeted 7%, South African major shareholder "fled" a day in advance

Tencent: The U.S. Department of Defense has listed our company as a Chinese military enterprise, which is a mistake! Yesterday, Tencent's major shareholder Naspers reduced its holdings by 367,000 shares, supposedly to sell off before the bad news

Tencent's Hong Kong stock plummeted by over 7% today:

According to documents from the Hong Kong Stock Exchange, Tencent Holdings repurchased 3.93 million shares for HKD 1.5 billion on January 7. The previous repurchase amount was generally around HKD 700 million.

Just yesterday (January 6), Tencent's major shareholder Naspers' subsidiary Prosus reduced its holdings by 367,000 shares, reportedly to sell off before negative news, at an average price of HKD 409.7318, involving HKD 150 million, reducing its stake from 24.01% to 23.99%.

Additionally, on January 7, the Hong Kong stock market saw a net purchase of HKD 12.904 billion from northbound trading, with Tencent receiving a net purchase of HKD 13.994 billion, making it the stock with the highest net purchase. Tencent was listed by the U.S. Department of Defense on the CMC list, but the company stated that it has no impact on its business. Morningstar believes Tencent has a chance to be removed from the list. SMIC and China Mobile received net purchases of HKD 730 million and HKD 442 million, respectively, with analysts optimistic about their future performance.

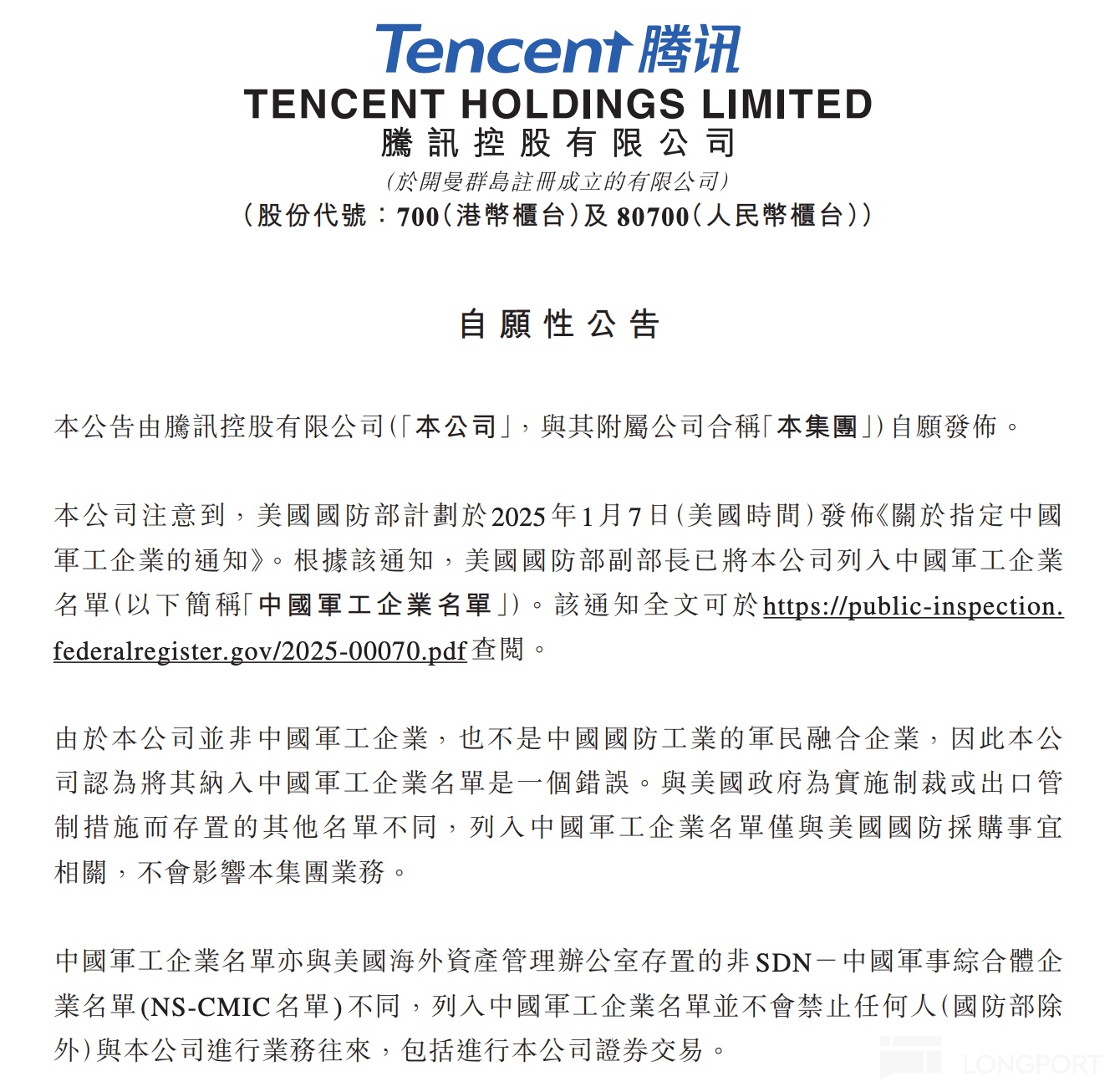

On January 7, Tencent Holdings announced that the company noted the U.S. Department of Defense plans to issue a notice on January 7, 2025 (U.S. time) regarding the designation of Chinese military enterprises. According to the notice, the Deputy Secretary of Defense has included the company on the list of Chinese military enterprises. Since the company is neither a Chinese military enterprise nor a military-civilian integration enterprise of the Chinese defense industry, the company believes that its inclusion on the list of Chinese military enterprises is an error.

Citigroup released a research report reiterating its "Buy" rating for Tencent Holdings, viewing the stock price pullback as a good opportunity to increase purchases, with a target price of HKD 573 unchanged. Tencent's stock price in after-hours trading and the stock price of major shareholder Prosus fell by over 7% to 8% during U.S. market trading hours due to recent media reports.

The bank continued to state that investors are usually more sensitive, so Tencent's stock price may be dragged down in the short term, but it believes the overall growth outlook and business fundamentals remain unchanged. Citigroup stated that it understands the market's panic reaction but also believes that being included on the list does not necessarily mean there is sufficient evidence to confirm it as the correct decision. The bank believes Tencent will strive to cooperate with the U.S. Department of Defense to resolve any misunderstandings and noted that several companies successfully removed themselves from the list after providing effective explanations last year