Eurozone December CPI rebounds to 2.4%, European Central Bank's interest rate cut pace may remain unchanged

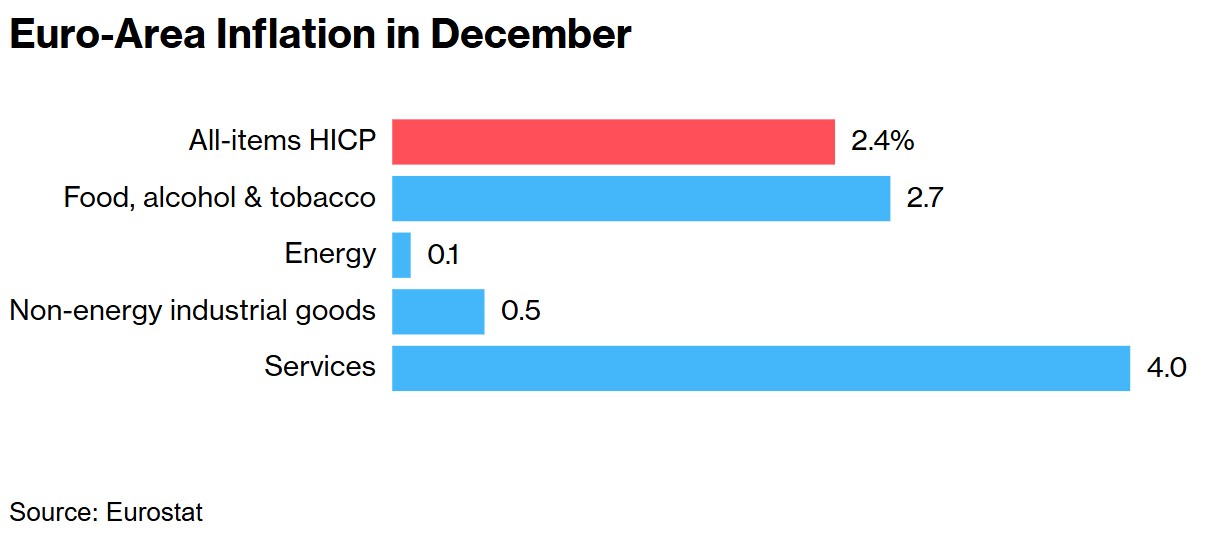

The Eurozone's December CPI rose by 2.4% year-on-year, up from 2.2% in November, mainly driven by energy costs. Despite the rebound in inflation, the European Central Bank's pace of interest rate cuts may remain unchanged, with expectations of a continued reduction of 100 basis points this year. The core inflation rate is 2.7%, and service prices have slightly increased to 4%. Price increases in Germany and Spain exceeded expectations, while France fell below expectations. Regarding the interest rate cut strategy, most support a gradual reduction, but some members believe that the option for a larger cut should be retained

According to the Zhitong Finance APP, inflation in the Eurozone is accelerating, with December's CPI rising 2.4% year-on-year, up from 2.2% in November, primarily driven by energy costs. This data supports the European Central Bank's gradual interest rate reduction policy but does not completely change its stance on interest rate policy. Despite the rebound in inflation, the bond market reacted mildly, and expectations for rate cuts remained stable.

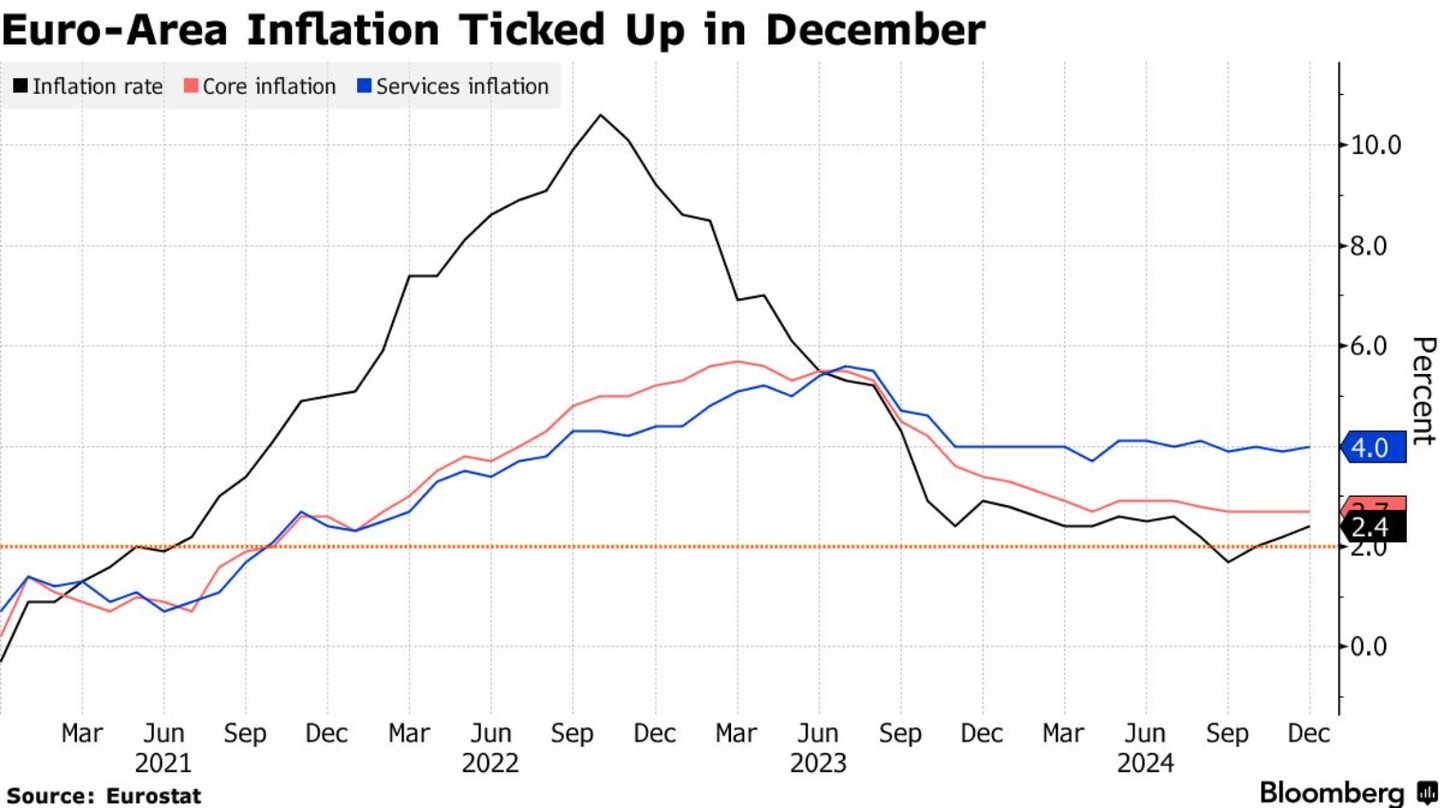

Specifically, the rise in inflation in December was mainly driven by the first increase in energy costs since July. Meanwhile, the core inflation rate, excluding volatile components, stood at 2.7%, and the price increase in the service sector also slightly rose to 4%.

Figure 1

The European Central Bank has previously warned multiple times that the rebound in inflation is not unexpected, and Bloomberg's economic forecast indicates that the inflation rate will remain at 2.4% in January.

After the data was released, the yield on Germany's two-year government bonds slightly fell to 2.18%, just below the previous day's high, with bets on the European Central Bank's rate cut expectations remaining stable.

Bloomberg's Chief European Economist Jamie Rush pointed out that most of the increase comes from the base effect of fuel prices, and the overall situation remains deflationary, with expectations that the European Central Bank will continue to cut rates by 100 basis points this year.

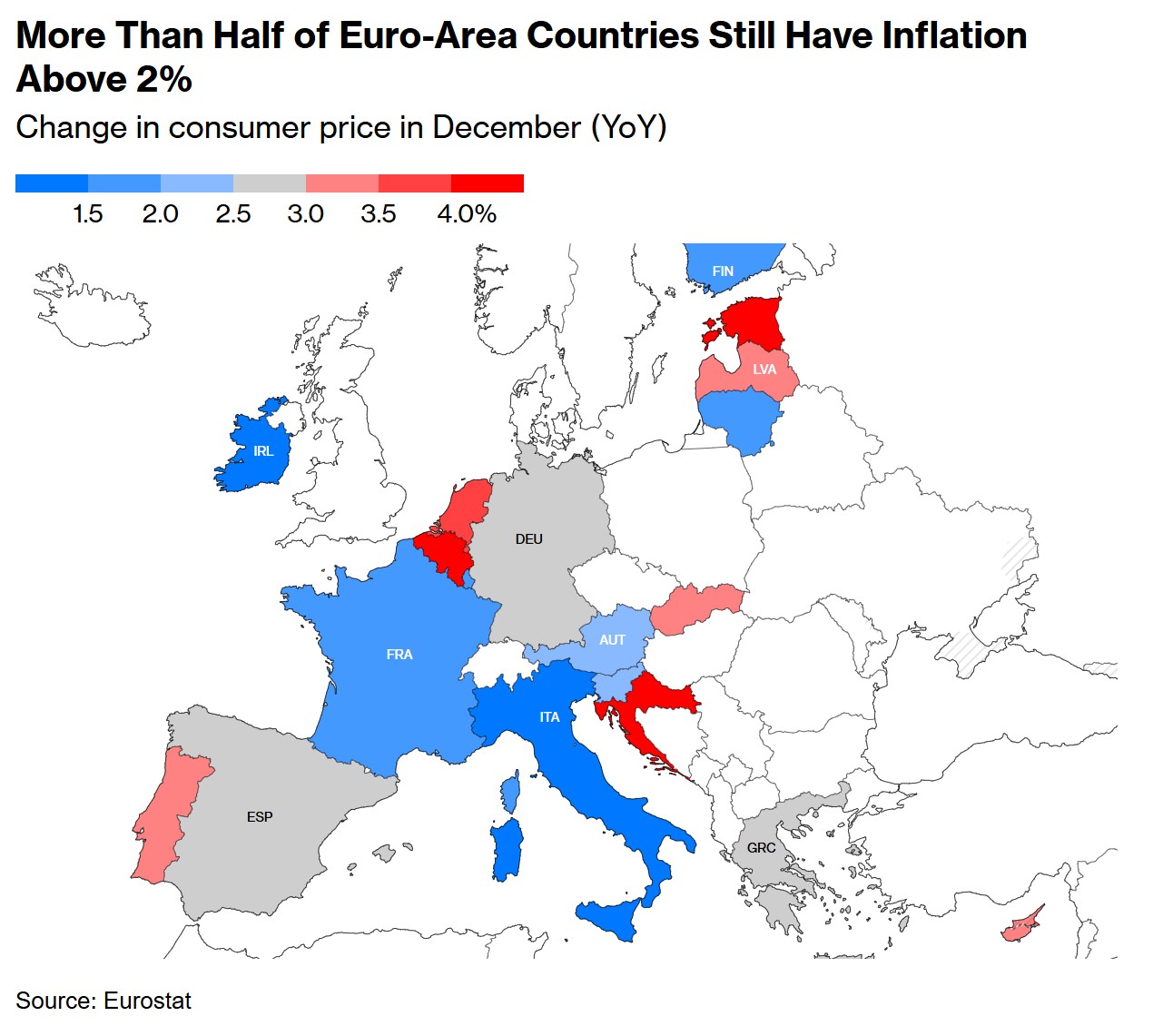

Additionally, recent reports from various countries show that price increases in Germany and Spain exceeded expectations, while France fell short, and Italy unexpectedly slowed down. A report from the European Central Bank also indicated that consumer inflation expectations rose in November.

Despite the rebound in inflation, European Central Bank officials still plan to continue lowering borrowing costs, with a 3% deposit rate seen as a factor restricting economic activity.

Figure 2

In terms of the rate cut strategy, most support a "gradual" reduction, meaning a quarter-point cut each time. However, a few members of the governing council, including François Villeroy de Galhau, the Governor of the Bank of France, insist that the option for larger cuts must be retained.

Although last year's inflation rate fell below 2%, this was mainly due to the statistical effects of significant fluctuations in energy costs in recent years. As these effects gradually fade, the overall inflation rate may temporarily rebound. However, concerns about service sector inflation remain.

For more than a year, the service sector inflation rate has hovered around 4%, primarily due to rising wages, which play a larger role in the service sector than in other industries. The European Central Bank believes this situation will not last. Wage growth for workers slowed in the third quarter, and early indicators show that the labor market is softening

Figure 3

It is worth noting that the rise in energy prices may not be the last time, as the consumption rate of natural gas reserves in Europe is faster than at any time in the past seven years due to increased heating demand from colder weather.

At the same time, the incoming U.S. President Trump plans to impose widespread trade tariffs, which could impact the Eurozone economy, and the effect on inflation depends on various factors.

In this regard, Klaas Knot, the President of the Dutch Central Bank, warned that if Trump fulfills his promise, Chinese goods may enter Europe at lower prices, exacerbating Europe's deflationary dilemma.

In summary, inflation in the Eurozone accelerated in December, primarily driven by energy costs, but the overall economic environment still faces deflationary pressures. The European Central Bank plans to continue cutting interest rates to stimulate the economy, but the rise in energy prices and the uncertainty of trade tariff policies add variables to the Eurozone economic outlook