In November, U.S. JOLTS job openings significantly exceeded expectations, reaching a six-month high, while voluntary resignations fell again

美國 11 月 JOLTS 職位空缺 809.8 萬人,自主離職率降至 1.9%,創下疫情初期以來的最低。裁員人數相對保持在低位。招聘速度有所放緩,達到 2020 年 4 月以來的最低。分析稱,美國就業市場似乎處於更好的狀態,疊加近幾個月通脹一直很頑固,降低了人們對今年美聯儲將進一步降息幅度的預期。

美國勞工統計局週二公佈報告顯示,美國 11 月 JOLTS 職位空缺突破 800 萬大關,大幅超預期,超過了媒體調查的所有經濟學家的估計,創下六個月新高。本次 JOLTS 數據主要受商業服務業增長的推動,而其他行業對工人的需求則喜憂參半。

美國 11 月 JOLTS 職位空缺 809.8 萬人,預期 774 萬人,10 月前值從 774.4 萬人上修至 780 萬人。11 月的職位空缺延續了 10 月的反彈態勢。此前 9 月 JOLTS 職位空缺意外大跌,當時創下三年多新低。

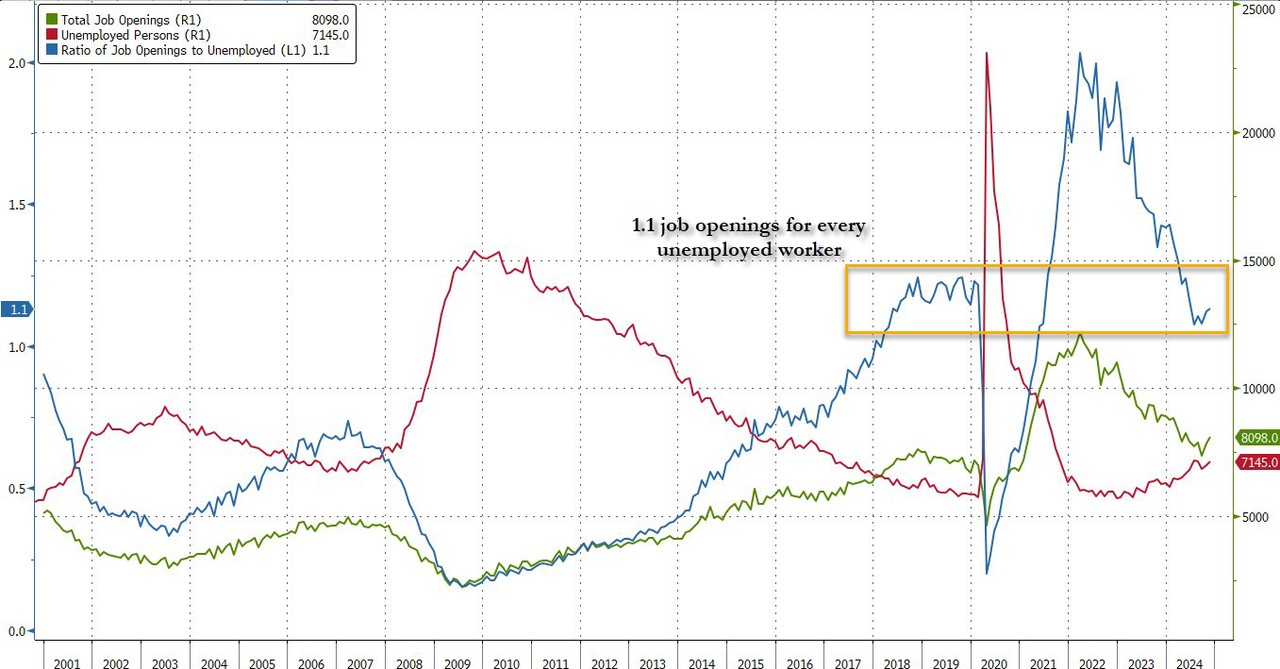

自 2022 年 3 月創下 1218 萬人的紀錄以來,由於美聯儲大幅加息導致需求放緩,JOLTS 職位空缺在大部分時間裏大體呈現下降的態勢。近幾個月伴隨着美聯儲降息,JOLTS 數據出現反彈。

分行業來看,JOLTS 就業崗位的增加幾乎完全是由專業和商業服務以及金融和保險業的職位空缺所帶動的。其中,專業和商業服務接近兩年來的最高水平。與此同時,住宿和餐飲服務以及製造業的職位空缺減少了。

11 月職位空缺與失業人數之比為 1.1,較 10 月略有增加,該比例是美聯儲高度關注的。2022 年 3 月時這一比例創下超過 2 的紀錄水平。該比例在新冠疫情前為 1.2,目前已經略低於疫情前的水平。

11 月自主離職率降至 1.9%,創下疫情初期以來的最低水平,且各行業離職率都處於低位。自主離職人數跌至 306.5 萬人,創四年來新低。自主離職的人數越高,表明勞動力市場越緊張,工人們有信心離開目前的工作以尋求更好的機會,反之亦然。當前意味着越來越多的人對自己找到新工作的能力失去了信心。

裁員人數相對保持在較低水平不變。

招聘速度有所放緩,達到 2020 年 4 月以來的最低水平。11 月招聘數下滑 12.5 萬人,跌至 526.9 萬人。

伴隨着美國勞動力市場的降温,相關數據甚至超過通脹,成為市場最關注的經濟數據,政策制定者和投資者以此評估是否釋放了更多美國經濟軟着陸的信號。去年 9 月以來,美聯儲逐步降低利率,希望避免美國勞動力市場的進一步疲軟。

近期職位空缺數量的上升,打破了近三年來的下行趨勢。現在來看,美國就業市場似乎處於更好的狀態,疊加近幾個月通脹一直很頑固,降低了人們對今年美聯儲將進一步降息幅度的預期。

在 12 月的美聯儲 FOMC 會議上,美聯儲主席鮑威爾表示,美國勞動力市場正在降温,但正在以漸進和有序的方式降温,他暗示美聯儲的重點已穩固地迴歸到通脹上。美聯儲 12 月會議的紀要將於週三公佈。

JOLTS 報告是美國財長耶倫在擔任美聯儲主席時最看重的勞動力指標之一。該指標也是美聯儲高度關注的勞動力市場數據。不過需要注意的是,一些經濟學家質疑 JOLTS 統計數據的可靠性,因為當前該調查的回覆率很低,大約是幾年前的一半。招聘網站 Indeed 發佈的類似指數顯示,11 月份的職位空缺數量略有增加。

JOLTS 數據通常比非農就業數據滯後一個月。本週五,美國將公佈重磅的 12 月非農就業報告。市場預計非農就業數據將顯示僱主在 12 月的招聘放緩,但仍處於健康的水平,失業率可能保持在 4.2%。

與 JOLTS 職位空缺同時公佈的還有美國 ISM 服務業 PMI,該數據也顯著超預期。好於預期的兩大重磅數據公佈後:

- 交易員不再全面押注美聯儲將於 7 月之前降息。

- 標普 500 指數轉跌,納指跌 0.5%。

- 美國 10 年期國債收益率拉昇超 3 個基點,刷新日高至 4.67% 上方,日內漲超 4 個基點;兩年期美債收益率短線反彈 3 個基點,至 4.31%,整體漲 3.5 個基點。

- 現貨黃金下挫 3 美元,回落至 2650 美元/盎司下方,整體漲幅不足 0.5%。