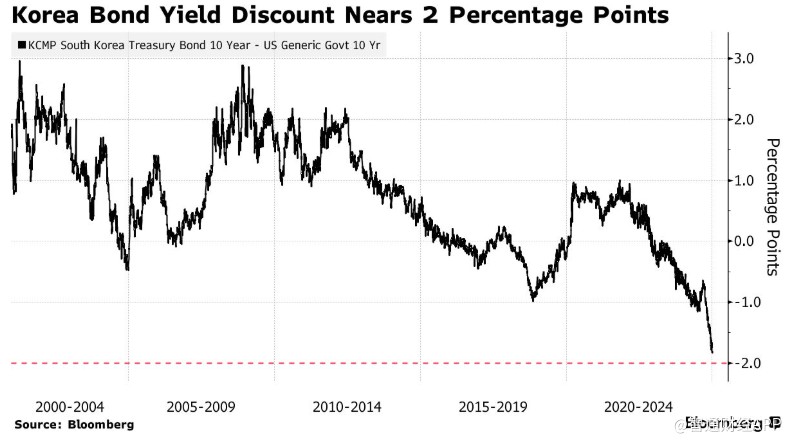

The Korea-U.S. bond yield spread is approaching 200 basis points, adding insult to injury for the Korean won

I'm PortAI, I can summarize articles.

韓國國債相對於美國國債的收益率已跌至歷史低點,導致韓元承受更大壓力。當前 10 年期國債利差擴大至約 190 個基點,分析師預計將超過 200 個基點。自去年中以來,因經濟不景氣,韓國債券收益率持續下滑,尤其在去年 11 月央行降息後加速。韓元在過去三個月下跌超過 7%,成為亞洲表現最差的貨幣。

智通財經 APP 獲悉,韓國國債相對於美國國債的收益率已連續跌至歷史低點,給已經受到政治危機打擊的韓元帶來進一步壓力。韓國 10 年期國債與美國 10 年期國債的收益率之差本週擴大至約 190 個基點,一些分析師認為,考慮到潛在的動態,利差將超過 200 個基點。自去年年中以來,由於經濟不景氣,韓國債券收益率一直在下滑,在去年 11 月韓國央行意外降息後,收益率下降速度加快。

韓美債券利差接近 200 個基點

韓華投資證券公司分析師 Kim Sungsoo 表示:“2025 年韓國經濟沒有特別有利的因素,韓國央行已經重申了其靈活性,預計將繼續降低利率。韓國債券收益率也將繼續下降。”

韓國基準 10 年期國債收益率週二收於 2.79%,低於去年 4 月創下的 3.71% 高點。週二,美國 10 年期國債收益率收於 4.685%。

韓國國債收益率折價擴大隻是損害韓元的一個因素。由於去年 12 月初的戒嚴令事件,韓元在過去三個月裏下跌了 7% 以上,是亞洲表現最差的貨幣。

大信證券分析師 Kong Dongrak 表示,韓國 10 年期國債與美國國債的收益率差距可能會繼續擴大,達到 200 個基點左右。不過,他表示,隨着美國國債收益率過度上升,在某個時候利差應該會再次開始收窄。