Deutsche Bank: U.S. Treasury yields may rise another 40 basis points

Deutsche Bank AG believes that the sell-off of U.S. Treasuries is not yet fully over. If the term premium returns to the average level of 2004-2013, the yield on 10-year U.S. Treasuries should rise by about 40 basis points. However, the end of the U.S. Treasury sell-off is approaching, and there is limited room for further declines in the future

Despite the extreme sell-off, the pain in the U.S. Treasury market may not be over yet.

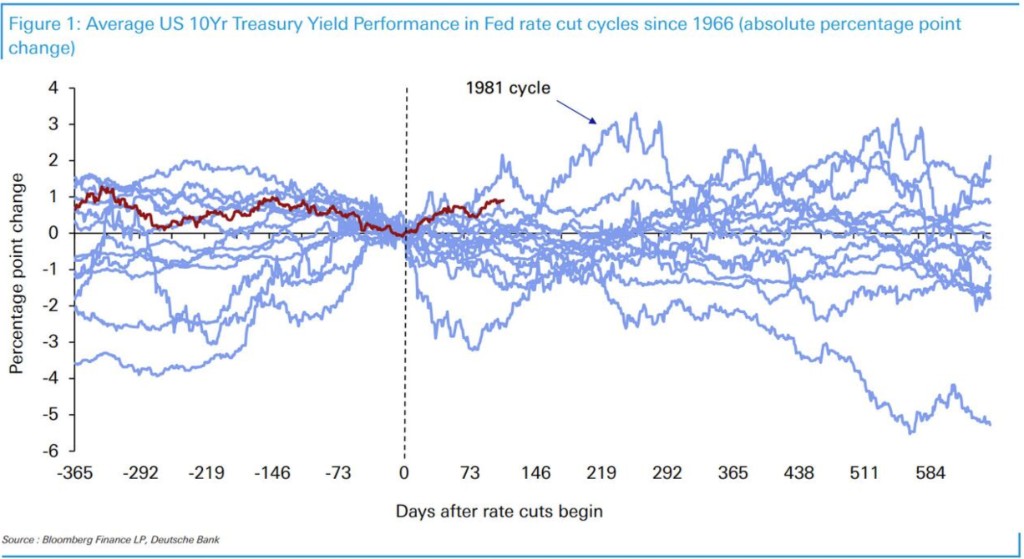

On Wednesday, January 8, a chart released by Deutsche Bank showed that since the Federal Reserve began cutting interest rates in mid-September last year, the yield on the 10-year U.S. Treasury has risen by 91 basis points.

This is the second worst performance for the 10-year U.S. Treasury in the 14 easing cycles of the Federal Reserve since 1966—only behind 1981, when the Federal Reserve's policy was highly volatile, and interest rates were at the tail end of Chairman Volcker's inflation suppression policy.

Before Christmas, Deutsche Bank analyst Francis Yared discussed the current repricing of U.S. Treasury rates. Yared stated that this process is likely aimed at adjusting the rate pricing to a neutral range of 3.75%-4%, and he also expects that the Federal Reserve will maintain rates above this neutral level in 2025.

Yared believes that this repricing process is essentially complete, but the global term premia (the extra return investors require to compensate for the risks of holding long-term bonds) remains too low, which is related to the supply of government bonds and inflation expectations.

However, over the past year, term premia have remained within a narrow and historically low range, so a significant rise cannot be guaranteed.

Yared pointed out that if term premia return to the average level from 2004 to 2013, the yield on the 10-year U.S. Treasury should rise by about 40 basis points.

Therefore, Yared believes that although the current sell-off in the U.S. Treasury market seems "somewhat extreme," the sell-off is not completely over, as term premia remain too low and may need to rise further. However, the good news is that the end of the U.S. Treasury sell-off is approaching, and there is limited room for future declines.