Quietly, the Federal Reserve has given more attention to this "new" inflation indicator

包括美聯儲主席鮑威爾在內的美聯儲高級官員們,越來越多地關注一個並非廣為人知的通脹指標——個人消費支出價格指數的基於市場版本,該指標不包括一系列服務業數據,這部分服務業的數據收集者無法直接測量價格、必須進行估算。當前該指標更接近美聯儲 2% 的通脹目標,可能表明進一步降息的門檻比市場預期的要低。

包括美聯儲主席鮑威爾在內的美聯儲高級官員們,越來越多地關注一個並非廣為人知的、相對模糊的價格指標——基於市場的通脹,並將其作為對美國通脹前景保持信心的理由。

基於市場的通脹指標不包括一系列服務業數據,這部分服務業的數據收集者無法直接測量價格、必須進行估算。具體來説,個人消費支出價格指數的基於市場版本排除了幾個政府統計人員必須估算或推斷的項目,因為他們無法觀察消費者為這些服務實際支付的價格:

其中,投資組合管理和投資建議是未被納入的重要項目,這些項目主要跟蹤美股,這意味着最近幾個月的美股上漲在美聯儲最青睞的 PCE 通脹項下被認為推高了通脹,而新指標不會這樣顯示。

此外,幾種類型的保險也未被納入。例如,一個旨在反映機動車和其他交通保險成本的類別在 11 月同比上漲了 6.5%,部分反映了 2021 年和 2022 年初汽車價格飆升後的追趕性通脹。

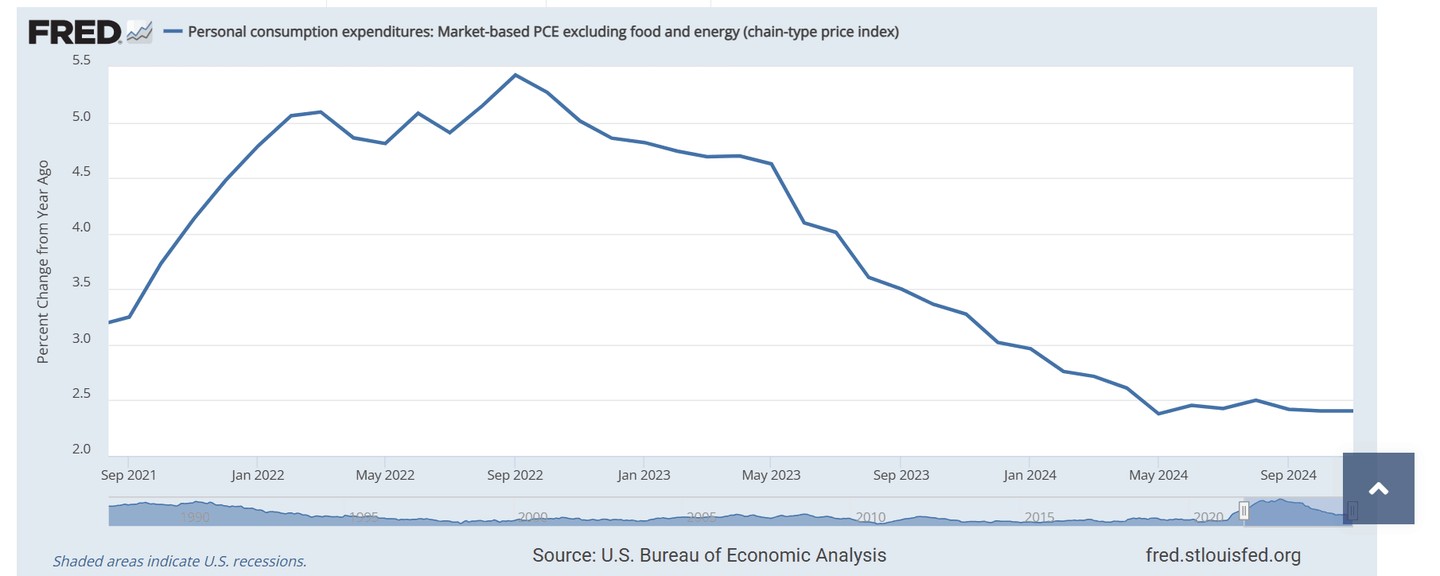

基於市場的通脹指標最近幾個月展現的美國通脹形勢,與其它重要的通脹數據體現的趨勢並不相同。例如,美聯儲首選的通脹指標在 11 月加速至 2.8%,但基於市場的通脹指標自去年 5 月以來基本保持在約 2.4% 的水平。

由於美國通脹展現出的粘性,當前投資者對美聯儲在 2025 年降息的預期變得悲觀,美債收益率持續上升。在本週公佈了超預期的 ISM 服務業 PMI 和 JOLTS 職位空缺兩大重磅經濟數據後,交易員已不再全面押注美聯儲將於 7 月之前降息。

彭博社分析稱,基於市場的通脹指標和核心 PCE 等更常用的通脹指標之間的區別,值得關注。儘管美聯儲官員們已經表明,在再次降低利率之前,他們需要看到更多通脹接近 2% 目標的進展,但官員們近來數次提及通脹的替代指標,且該指標更接近美聯儲 2% 的通脹目標,可能表明進一步降息的門檻實際上是更低的。

本週,美聯儲當紅票委、理事沃勒預計,通脹將繼續降温,他在演講中闡述了關注基於市場的通脹指標的理由,並表示支持今年進一步降息:

2024 年的通脹在很大程度上是由估算價格的上漲所驅動的,例如住房服務和非市場服務,這些價格是估算的而不是直接觀察到的,我認為它們對經濟中所有商品和服務的供需平衡的指導作用不太可靠。

鮑威爾在此前 12 月 18 日的新聞發佈會上也提到了 “非市場服務” 等項目,是近期通脹上升的一個因素。美聯儲理事 Adriana Kugler 在 1 月 3 日的 CNBC 採訪中也有類似表態。本週三公佈的美聯儲 12 月會議紀要顯示,許多政策制定者與沃勒的上述觀點一致。

彭博首席美國經濟學家 Anna Wong 表示,放棄推斷類項目的理由是,它們實際上沒有前瞻性的預測信號來指示通脹的走向。對於上述保險成本類通脹,Wong 指出,從個人的角度來看,這種通脹是真實的,但從美聯儲的角度來看,他們會仔細研究它。

昨日報道稱,特朗普的顧問正在考慮如何重塑美聯儲領導層。特朗普的顧問們還開始起草 2026 年 5 月接替美聯儲主席鮑威爾的潛在繼任者名單,他們將主要關注現任美聯儲官員對利率的評論,進而在候選人中進行增減。