The demand for weight loss drugs drags down Eli Lilly's Q4 performance, which may be worse than expected, while revenue guidance exceeds expectations; stock price once fell nearly 9% | Earnings report insights

Eli Lilly released a performance report showing that Q4 revenue forecasts fell short of expectations. The company explained that the demand for weight loss drugs grew less than anticipated, and insufficient inventory levels at the end of the year affected performance. This marks the second consecutive quarter where the company failed to meet sales targets due to forecasting errors. Analysts stated that the market has extremely high growth expectations for Eli Lilly, leaving little room for error. Although Eli Lilly is optimistic about achieving revenue of $58 billion to $61 billion in 2025, exceeding market expectations, the stock price fell nearly 9% in early trading on Tuesday

On January 14th, Tuesday Eastern Time, American pharmaceutical giant Eli Lilly released its full-year performance expectations for 2024 and guidance for 2025.

According to the company's announcement, Eli Lilly expects 2024 revenue to reach approximately $45 billion, a year-on-year increase of 32%. This growth is primarily attributed to the strong performance of its diabetes and weight loss medications, as well as good results from its oncology, immunology, and neuroscience drugs.

Eli Lilly also expects fourth-quarter revenue for 2024 to be around $13.5 billion, a year-on-year increase of 45%, but below the average analyst expectation of $14 billion.

Among these, the company's blockbuster diabetes drug Mounjaro is expected to generate about $3.5 billion in fourth-quarter revenue, falling short of the market expectation of $4.4 billion. Another weight loss drug, Zepbound, is expected to generate about $1.9 billion in fourth-quarter revenue, also missing the analyst expectation of $2.2 billion.

Despite the short-term performance being slightly weak, Eli Lilly remains optimistic about its prospects for 2025. The company expects full-year revenue for 2025 to reach between $58 billion and $61 billion, higher than the average analyst expectation of $58.72 billion.

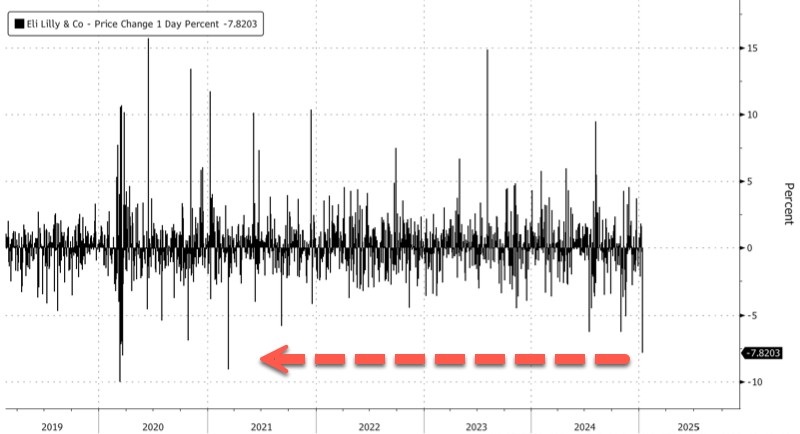

After the announcement, Eli Lilly's stock price fell nearly 8.6% in early trading on Tuesday.

Eli Lilly's stock price fell over 9% in early trading, marking the largest intraday drop since March 2021.

Eli Lilly's stock price fell over 9% in early trading, marking the largest intraday drop since March 2021.

Eli Lilly Predicts Misses for Two Consecutive Quarters

Eli Lilly's Q4 revenue forecast fell short of expectations, marking the second consecutive quarter that the company failed to accurately estimate market demand for its popular weight loss and diabetes drugs.

Thanks to the rising demand for weight loss among Americans, over the past two years, the demand for Eli Lilly's weight loss and diabetes drugs Zepbound and Mounjaro has surged. To meet this demand, Eli Lilly invested over $20 billion to ramp up production. However, the problem arose as the current supply of drugs exceeded what the company initially believed to be the actual market demand.

Company CFO Lucas Herrmann Monta stated at the JPMorgan Healthcare Conference on Tuesday: “I think this is mainly due to inaccurate forecasting, rather than an issue with market demand itself.”

Regarding the reasons for the Q4 revenue falling short of expectations, Eli Lilly explained:

“Although the U.S. GLP-1 receptor agonist market grew by 45% compared to the same period last year, our previous expectation was that growth in this quarter would be faster. Additionally, year-end channel inventory was lower than expected, and these factors affected our fourth-quarter performance.”

Typically, Eli Lilly's inventory would see a slight increase at year-end. However, Monta pointed out that the inventory level in the fourth quarter was basically flat compared to the previous three months. This marks the second consecutive quarter that Eli Lilly attributed its sales falling short of expectations to inventory management issues. This situation has raised market concerns about the company's overall sales growth expectations.

Bloomberg Industry Research analyst John Murphy pointed out:

"Everyone has very high growth expectations for Eli Lilly, so any small misstep in sales will be magnified, and they have almost no room for error."

Eli Lilly remains optimistic about its growth prospects for 2025 and has pointed out future performance growth drivers. The company stated that Mounjaro and Zepbound showed strong sales growth momentum in the fourth quarter, and this trend is expected to continue into 2025.

Eli Lilly plans to ramp up production capacity in the first half of 2025, expecting the salable doses of GLP-1 drugs to increase by at least 60% compared to the first half of 2024. Additionally, the company anticipates new drug launches in 2025, including Jaypirca, Ebglyss, Omvoh, and Kisunla, which will contribute to revenue growth