Morgan Stanley assesses the impact of California wildfires: rising inflation, softening employment numbers and retail sales

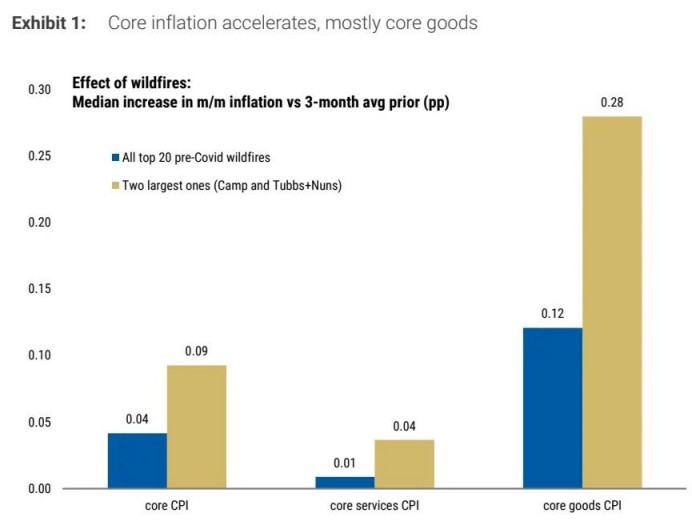

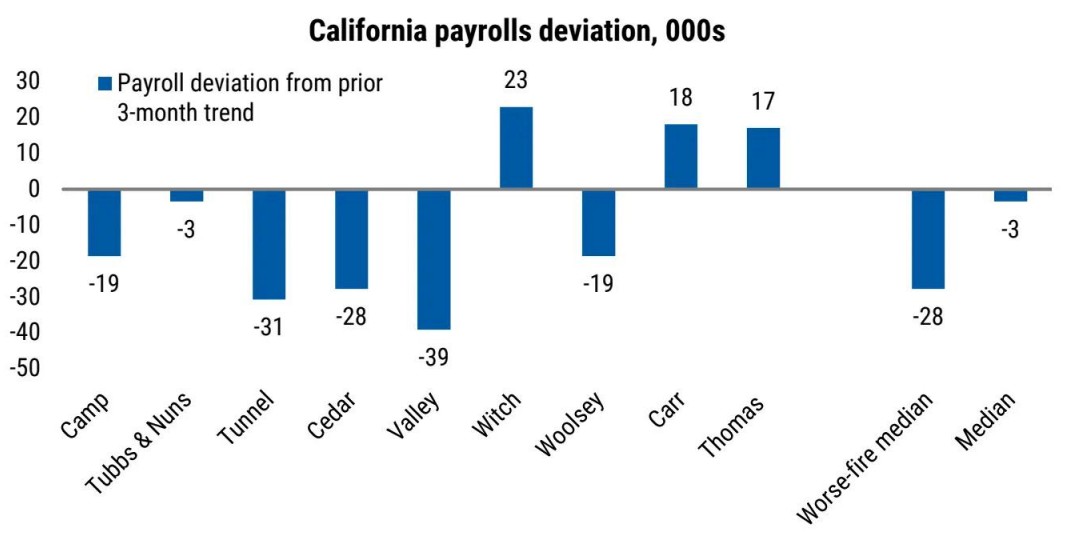

Morgan Stanley assesses the impact of California wildfires, expecting it to lead to an increase in core commodity prices, a slowdown in job growth, and weaker retail sales. The analysis indicates that the wildfires will cause core CPI month-on-month inflation to rise by 4 to 9 basis points, with employment numbers potentially decreasing by 20,000 to 40,000 in January. Overall and core retail sales may fall below trend after the fires, with historical data showing varying degrees of impact

Zhitong Finance has learned that the wildfires in California, USA, are still not extinguished, and the current wildfires are expected to be the most destructive in American history. Morgan Stanley stated that past data indicates that the impact is expected to be a rise in core commodity prices, a slowdown in job growth, and potentially weaker retail sales.

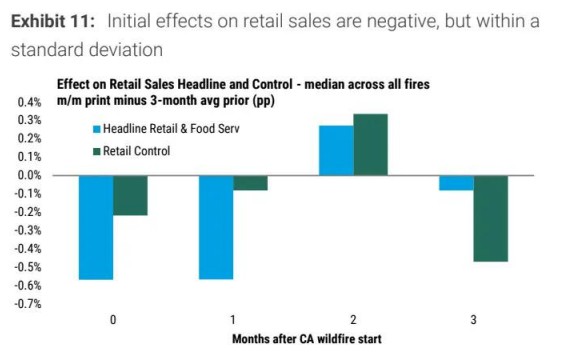

Overall, Morgan Stanley expects that after the wildfires, driven by car prices, core CPI month-on-month inflation will rise by 4 to 9 basis points; and it is anticipated that California's employment numbers in January will be dragged down by 20,000 to 40,000. Overall and core retail sales may initially decline compared to trends, but historical data is noisy.

Recently, Goldman Sachs economists also released a related report, predicting that the number of new non-farm jobs in the January employment report will decrease by about 15,000-25,000. This prediction is partly based on the fact that currently only about 0.5% of California's population is under evacuation orders or warnings.

The Los Angeles wildfires continue, and since the fire started on January 7, the estimated losses have been increasing. The situation remains unstable, as it is still unknown when the fire will be finally controlled. The Palisades fire may rank second among the buildings burned in history, with current estimates of about 12,000.

Morgan Stanley analysts draw the following three conclusions based on historical data:

- Morgan Stanley stated that the impact of the wildfires on core CPI month-on-month ranges from 4 basis points to 9 basis points, with this acceleration primarily driven by used and new cars, and in severely damaged cases, this acceleration can last for at least three months.

- Morgan Stanley noted that the drag on employment numbers is typical but uncertain. During past wildfire events, California's employment numbers fluctuated between a low of 39,000 and a high of 23,000, with a historical average decline of 30,000. The number of unemployment claims has not provided much guidance on the scale of the employment gap. Morgan Stanley expects that the recent fires will reduce California's employment numbers in January by 20,000-40,000.

- Morgan Stanley pointed out that the impact of fire months on overall and core retail sales may be negative, but the data is noisy. At the median level, overall and core retail sales are below trend in the month after the fire and one month later, but the impact is within one standard deviation. Moreover, historically, there is no surge in building materials and car sales after the fires.