Mag 7 is no longer fresh, let's learn about MAGA 7

"MAGA 7" refers to the seven stocks that had a market value exceeding $15 billion on November 5 and have seen the largest price increases since Trump won the election. These include AppLovin, Robinhood, MicroStrategy, Tesla, Ubiquiti, Coinbase, and Williams-Sonoma

In recent years, "Mag 7" stocks have dominated the market, but with Trump's return to the White House, a new batch of stocks has become the new favorites of traders, achieving significant gains after the presidential election.

"MAGA 7" refers to the seven stocks with a market capitalization exceeding $15 billion as of November 5, which have seen the largest price increases since Trump won the election. These companies are either directly or indirectly related to Trump and his government policies, or have risen due to the bullish market trend.

The rise of MAGA 7 reflects the market's expectations for Trump’s government policies, particularly in the cryptocurrency and technology sectors. Next, let's get to know these new stars known as "MAGA 7."

AppLovin: AI-Driven Advertising Giant

Since Trump won the election, AppLovin Corp.'s stock price has increased by 107.3%, reaching a market capitalization of $114.9 billion. The company's AI-driven advertising recommendation engine AXON has performed exceptionally well, coupled with the initial success of its e-commerce pilot projects, driving the stock price surge.

Benchmark analyst Mike Hickey believes that AppLovin's expansion into new areas such as e-commerce and connected TV will be a significant driver of future revenue growth and profit expansion.

Robinhood: Beneficiary of Cryptocurrency Trading

On election night, Robinhood Markets reported its most active trading night ever. Since the presidential election, its stock price has risen by 92.9%, with market capitalization increasing from $22.06 billion to $42.56 billion.

Mizuho Securities analyst Dan Dolev stated:

"A government that is more friendly to cryptocurrencies and a less stringent regulatory attitude could drive faster adoption of Bitcoin, and we expect this will lead to increased cryptocurrency trading activity levels among a broader user base."

MicroStrategy: Winner of Bitcoin Bets

MicroStrategy, as a business software company and cryptocurrency investor, is also one of the winners of MAGA Seven. Trump's campaign promise to establish a strategic Bitcoin reserve has driven MicroStrategy's stock price up by 74.1%, with a market capitalization of $97.73 billion.

The company has consistently viewed Bitcoin as a primary reserve asset and is actively expanding its Bitcoin holdings, with a new round of capital raising further enhancing its strength.

Tesla: The Only Dual Superstar

Tesla is the only company that belongs to both Mag7 and MAGA 7. CEO Elon Musk has a close relationship with Trump and has been appointed as the co-head of the new "Department of Government Efficiency."

Musk supported Trump's presidential campaign last year, donating about $200 million to the campaign and attending several rallies with Trump. This drove Tesla's stock price up by 69.6%, increasing its market value to as high as $1.37 trillion.

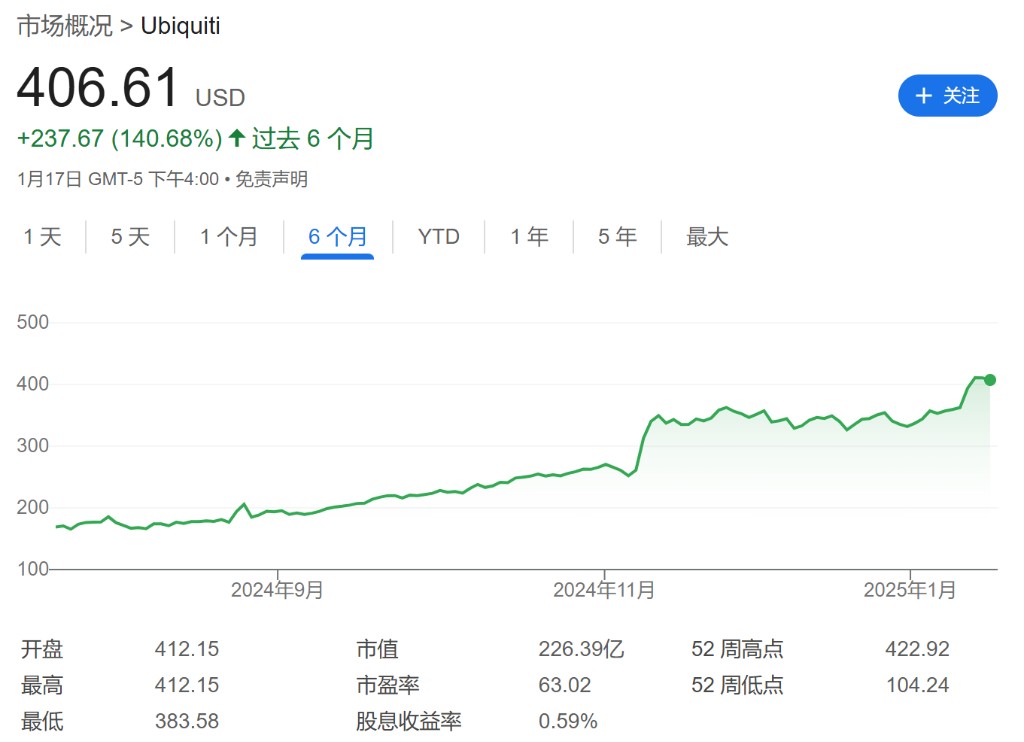

Ubiquiti: The Dark Horse of Network Technology

Ubiquiti Inc.'s stock price has soared by 224.04% over the past 12 months, rising 56% since the election. The company has set revenue records for two consecutive fiscal quarters.

The company's performance has caught the attention of analysts. BWS Financial recently raised its target price for Ubiquiti from $385 to $440, citing that the performance in the December quarter may exceed expectations. Analyst Hamed Khorsand wrote:

“Ubiquiti has provided the exact timing for product launches, which should improve order rates for the year.”

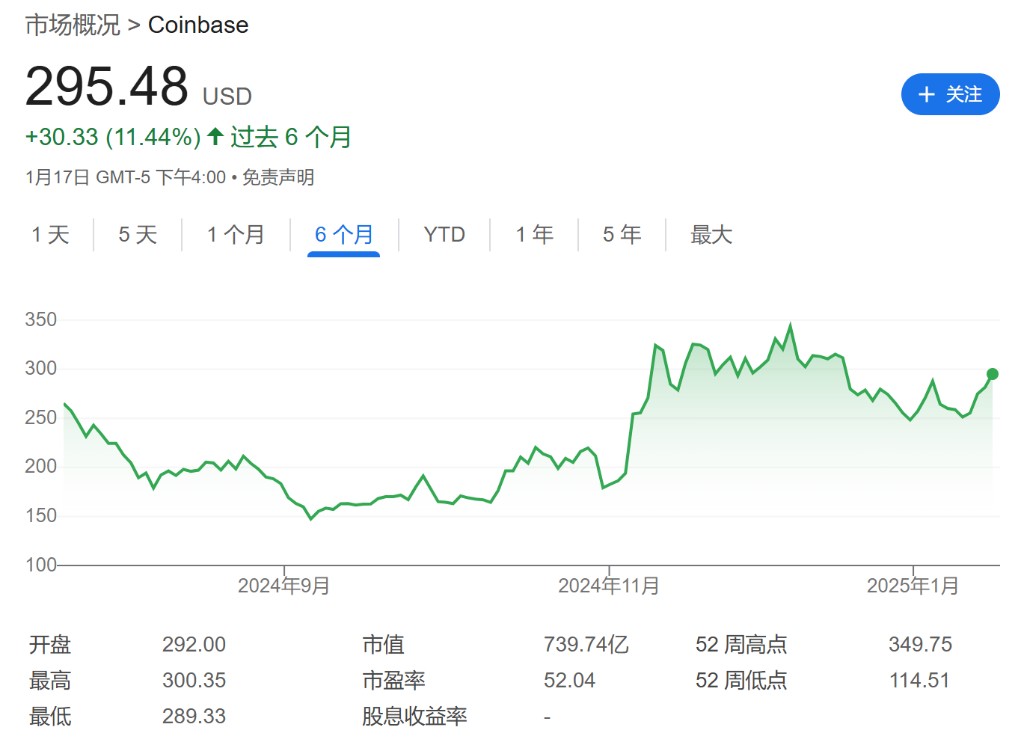

Coinbase: The Leader in Cryptocurrency Trading

Coinbase Global Inc. is expected to benefit from the Trump administration's cryptocurrency strategy. Since November 5, Coinbase's stock price has risen by 52.3%, with a market value of $73.97 billion.

Raymond James analyst Patrick O'Shaughnessy wrote in a recent report:

“With a significant re-acceleration in trading volume and a substantial rise in cryptocurrency valuations, Coinbase has improved post-election. The Trump administration has signaled a more favorable regulatory environment for the crypto space, clearly reviving the long-dormant crypto animal spirits.”

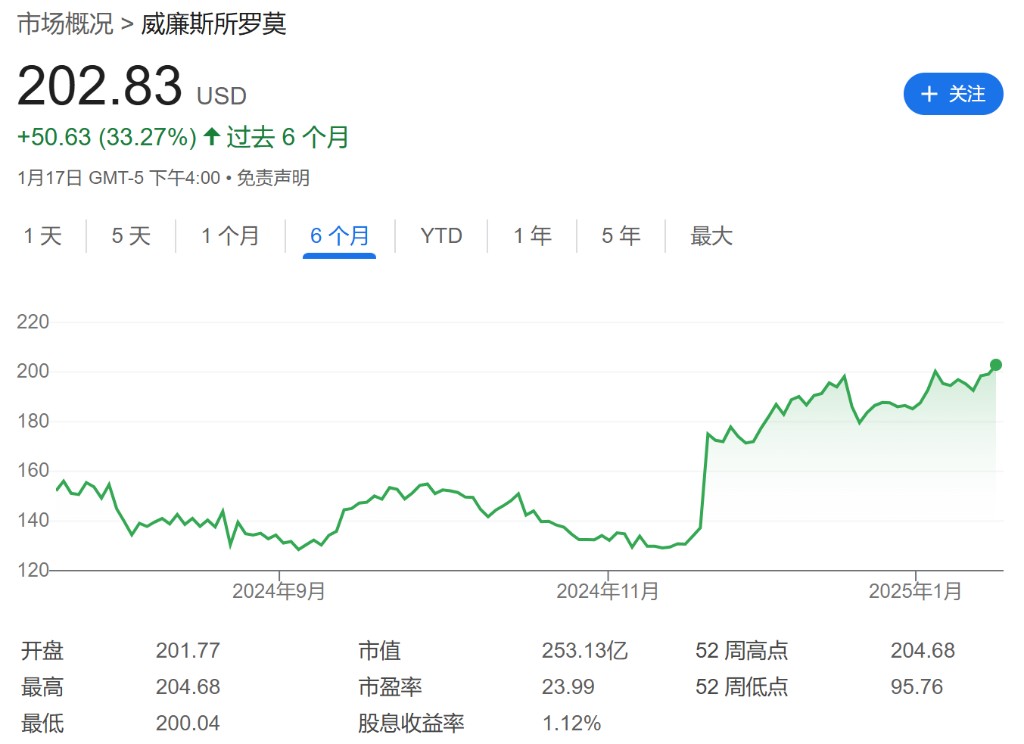

Williams-Sonoma: The Unexpected Winner

Although Williams-Sonoma Inc. cannot be described as a "Trump concept stock," the stock price of this home goods retailer has been hitting historical highs since the presidential election. The company's stock price has risen by 50.4% since November 5, with a market value of $24.97 billion

In the recent third-quarter earnings conference call, CEO Laura Alber stated that the company's strategy of focusing on restoring growth, enhancing customer service, and driving revenue is working.

Morgan Stanley recently raised its target price for Williams-Sonoma to $170, citing the company's stable revenue and continued strong profit margins. Morgan Stanley analyst Simeon Gutman stated that this indicates Williams-Sonoma's deliveries are in line with the company's plans