Nimrata Hunt Sells 7,143 Shares of IDEXX Laboratories, Inc. (NASDAQ:IDXX) Stock

Nimrata Hunt, EVP of IDEXX Laboratories, Inc. (NASDAQ:IDXX), sold 7,143 shares at an average price of $630.43, totaling $4,503,161.49, marking a 28.40% decrease in her ownership. Post-sale, she holds 18,007 shares valued at approximately $11.35 million. The transaction was disclosed to the SEC. IDEXX's stock opened at $658.06, with a market cap of $52.64 billion and a P/E ratio of 54.79. The company reported $3.63 EPS for the last quarter, exceeding estimates, with revenue up 10.6% year-over-year.

IDEXX Laboratories, Inc. (NASDAQ:IDXX - Get Free Report) EVP Nimrata Hunt sold 7,143 shares of the business's stock in a transaction on Wednesday, August 6th. The shares were sold at an average price of $630.43, for a total transaction of $4,503,161.49. Following the completion of the sale, the executive vice president directly owned 18,007 shares in the company, valued at $11,352,153.01. This trade represents a 28.40% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website.

IDEXX Laboratories, Inc. (NASDAQ:IDXX - Get Free Report) EVP Nimrata Hunt sold 7,143 shares of the business's stock in a transaction on Wednesday, August 6th. The shares were sold at an average price of $630.43, for a total transaction of $4,503,161.49. Following the completion of the sale, the executive vice president directly owned 18,007 shares in the company, valued at $11,352,153.01. This trade represents a 28.40% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website.

IDEXX Laboratories Stock Up 1.2%

- Bullish or Bearish? Vetting Animal Health Care Stocks

IDXX stock opened at $658.06 on Friday. The company has a debt-to-equity ratio of 0.31, a current ratio of 1.11 and a quick ratio of 0.81. The stock has a market capitalization of $52.64 billion, a price-to-earnings ratio of 54.79, a PEG ratio of 4.20 and a beta of 1.49. The business's fifty day moving average price is $545.23 and its two-hundred day moving average price is $479.32. IDEXX Laboratories, Inc. has a fifty-two week low of $356.14 and a fifty-two week high of $688.12.

IDEXX Laboratories (NASDAQ:IDXX - Get Free Report) last released its quarterly earnings data on Monday, August 4th. The company reported $3.63 earnings per share for the quarter, beating the consensus estimate of $3.28 by $0.35. The business had revenue of $1.11 billion for the quarter, compared to analyst estimates of $1.06 billion. IDEXX Laboratories had a return on equity of 64.42% and a net margin of 24.41%. IDEXX Laboratories's revenue was up 10.6% compared to the same quarter last year. During the same period last year, the firm posted $2.44 earnings per share. On average, equities analysts anticipate that IDEXX Laboratories, Inc. will post 11.93 earnings per share for the current year.

Institutional Investors Weigh In On IDEXX Laboratories

A number of hedge funds have recently added to or reduced their stakes in IDXX. Rockefeller Capital Management L.P. boosted its position in IDEXX Laboratories by 6.6% in the second quarter. Rockefeller Capital Management L.P. now owns 54,826 shares of the company's stock worth $29,406,000 after purchasing an additional 3,400 shares during the last quarter. Citizens Financial Group Inc. RI boosted its position in IDEXX Laboratories by 53.1% in the second quarter. Citizens Financial Group Inc. RI now owns 1,608 shares of the company's stock worth $863,000 after purchasing an additional 558 shares during the last quarter. Jensen Investment Management Inc. lifted its position in shares of IDEXX Laboratories by 27.1% during the 2nd quarter. Jensen Investment Management Inc. now owns 10,410 shares of the company's stock valued at $5,583,000 after buying an additional 2,220 shares during the last quarter. Cetera Investment Advisers lifted its position in shares of IDEXX Laboratories by 6.3% during the 2nd quarter. Cetera Investment Advisers now owns 20,643 shares of the company's stock valued at $11,072,000 after buying an additional 1,223 shares during the last quarter. Finally, Creative Planning lifted its position in shares of IDEXX Laboratories by 11.7% during the 2nd quarter. Creative Planning now owns 29,068 shares of the company's stock valued at $15,590,000 after buying an additional 3,052 shares during the last quarter. 87.84% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

Several equities research analysts have recently commented on IDXX shares. Leerink Partners boosted their target price on shares of IDEXX Laboratories from $580.00 to $600.00 and gave the company an "outperform" rating in a research note on Thursday, July 17th. Stifel Nicolaus set a $640.00 target price on shares of IDEXX Laboratories in a research note on Monday. JPMorgan Chase & Co. upped their price target on shares of IDEXX Laboratories from $550.00 to $675.00 and gave the stock an "overweight" rating in a research report on Monday, August 4th. Jefferies Financial Group initiated coverage on shares of IDEXX Laboratories in a research report on Tuesday, July 1st. They set a "buy" rating and a $625.00 price target on the stock. Finally, BTIG Research upped their price target on shares of IDEXX Laboratories from $545.00 to $785.00 and gave the stock a "buy" rating in a research report on Tuesday. Three investment analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $623.56.

Get Our Latest Analysis on IDEXX Laboratories

About IDEXX Laboratories

(Get Free Report)

IDEXX Laboratories, Inc develops, manufactures, and distributes products primarily for the companion animal veterinary, livestock and poultry, dairy, and water testing markets in Africa, the Asia Pacific, Canada, Europe, Latin America, and internationally. The company operates through three segments: Companion Animal Group; Water Quality Products; and Livestock, Poultry and Dairy.

Recommended Stories

- Five stocks we like better than IDEXX Laboratories

- Why Understanding Call Option Volume is Essential to Successful Options Trading

- Airbnb Beats Earnings, But the Growth Story Is Losing Altitude

- Buy P&G Now, Before It Sets A New All-Time High

- Netflix Bulls vs. Bears: Who Wins This Pullback?

- Best ESG Stocks: 11 Best Stocks for ESG Investing

- Viasat: Why a Wall of Cash Has Shorts Running for Cover

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].

Insider Buying or Selling at IDEXX Laboratories?

Sign-up to receive InsiderTrades.com's daily insider buying and selling report for IDEXX Laboratories and related companies.

From Our Partners

Your blueprint for crypto wealth

Mark August 12th on your calendar. 27 of crypto's most successful minds are about to reveal everything…

Crypto 101 Media

Trump’s national nightmare is here

Porter Stansberry and Jeff Brown say a new U.S. national emergency is already underway — and it could trigger ...

Porter & Company

HIDDEN IN THE BOOK OF GENESIS…

“This land I will give to you…” — a 4,000-year-old line from Genesis may hold the key to unlocking a $150 tril...

Paradigm Press

Man Who Called Nvidia at $1.10 Says Buy This Now...

In 2004, one man called Nvidia before just about anyone knew it existed. Now, this same guy says a new comp...

The Oxford Club

Elon’s Secret Social Security Bombshell

To All Americans Born Before April 16th, 1963: Did Trump Just Give The Green Light To Radically RE-DO Social S...

Banyan Hill Publishing

Crypto Income (almost instantly)

How would you like to collect a small percentage of the $4 billion changing hands daily in the crypto market? ...

Awesomely, LLC

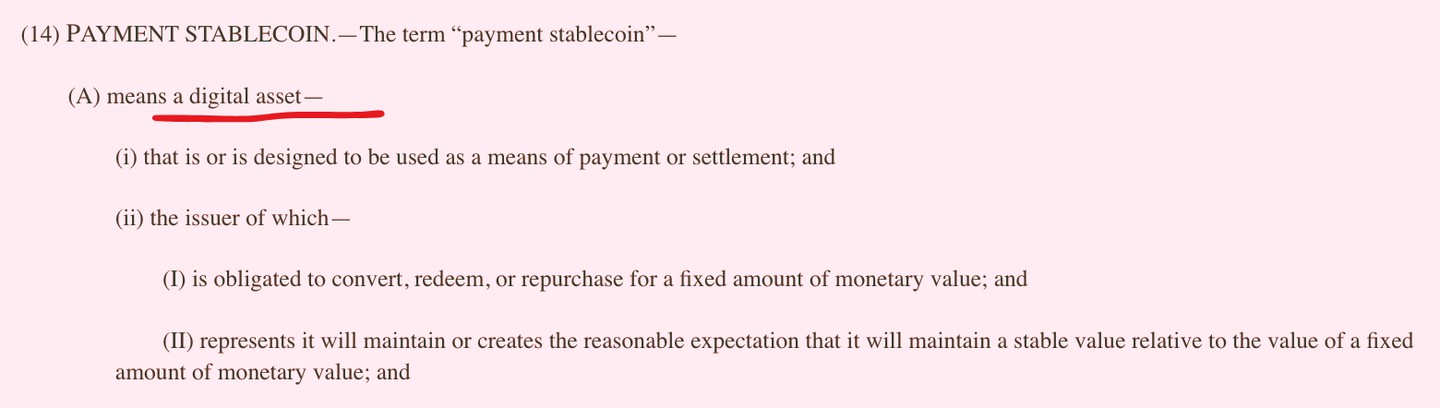

GENIUS Act: Cancel Your Money?

A new law called the GENIUS Act could quietly trigger the most radical shift in American finance in decades. B...

Priority Gold

The Robotics Revolution has arrived … and one $7 stock could take off as a result.

Something big is brewing in Washington. According to my research, an executive order from President Trump c...

Weiss Ratings