BWX Technologies, Inc. (NYSE:BWXT) CEO Sells $4,475,000.00 in Stock

BWX Technologies, Inc. 首席執行官 Rex D. Geveden 於 8 月 6 日出售了 25,000 股公司股票,交易金額為 4,475,000 美元,減少了 11.23% 的持股比例。交易後,他持有 197,594 股,估值約為 3537 萬美元。該股票開盤價為 179.24 美元,市值為 163.8 億美元。公司報告上個季度每股收益為 1.02 美元,超出預期,並宣佈季度股息為 0.25 美元,將於 9 月 5 日支付。分析師對該股票的評級不一,普遍評級為 “適度買入”,目標價為 142.37 美元

BWX Technologies, Inc.(紐約證券交易所代碼:BWXT - 獲取免費報告)首席執行官 Rex D. Geveden 於 8 月 6 日星期三出售了 25,000 股 BWX Technologies 股票。股票的平均售價為 179.00 美元,總價值為 4,475,000.00 美元。交易完成後,首席執行官在公司持有 197,594 股,價值為 35,369,326 美元。這筆交易代表其持股減少了 11.23%。該交易已在與證券交易委員會的法律文件中披露,您可以通過此鏈接訪問。

BWX Technologies 價格表現

- 特朗普下令進行核能改革:這三隻股票將受益

BWXT 股票在星期五開盤價為 179.24 美元。該公司的債務與股本比率為 1.28,流動比率為 1.69,速動比率為 1.91。該公司的市值為 163.8 億美元,市盈率為 56.01,市盈增長比率為 4.20,貝塔值為 0.73。BWX Technologies, Inc.的 50 日移動平均線為 143.78 美元,200 日移動平均線為 119.53 美元。BWX Technologies, Inc.的 1 年最低價為 84.21 美元,1 年最高價為 189.25 美元。

BWX Technologies(紐約證券交易所代碼:BWXT - 獲取免費報告)最近於 8 月 4 日星期一發布了其財報。該科技公司報告本季度每股收益為 1.02 美元,超出市場共識預期的 0.79 美元,超出幅度為 0.23 美元。BWX Technologies 的股本回報率為 30.61%,淨利潤率為 10.28%。該公司本季度的收入為 7.64 億美元,而分析師預期為 7.08 億美元。去年同期,該公司每股收益為 0.82 美元。該公司的季度收入同比增長 12.1%。分析師預計 BWX Technologies, Inc.在當前財政年度將發佈每股收益 3.23 美元。

BWX Technologies 宣佈分紅

- 為什麼這些核能股票可能會超越太陽能和風能股票

該公司還最近宣佈了一項季度分紅,將於 9 月 5 日星期五支付。8 月 18 日星期一的股東將獲得 0.25 美元的分紅。這代表着 1.00 美元的年化分紅和 0.6% 的分紅收益率。除息日期為 8 月 18 日星期一。BWX Technologies 的分紅支付比率(DPR)為 31.25%。

分析師評級變動

BWXT 成為多家研究分析師報告的主題。CLSA 在 5 月 27 日星期二的研究報告中重申了 “跑贏大盤” 的評級,並將 BWX Technologies 的目標價設定為 177.60 美元(之前為 153.00 美元)。Truist Financial 在星期二的研究報告中將 BWX Technologies 的目標價設定為 145.00 美元,並給予該股票 “持有” 評級。華爾街 Zen 在星期六的研究報告中將 BWX Technologies 的評級從 “買入” 下調至 “持有”。德意志銀行在 7 月 8 日星期二的研究報告中重申了 “持有” 評級,並將 BWX Technologies 的目標價設定為 150.00 美元(之前為 119.00 美元)。最後,Maxim Group 在星期三的研究報告中重申了 BWX Technologies 的 “持有” 評級。一位分析師給予該股票 “賣出” 評級,四位分析師給予 “持有” 評級,四位分析師給予 “買入” 評級,一位分析師給予 “強烈買入” 評級。根據 MarketBeat 的數據,BWX Technologies 目前的共識評級為 “適度買入”,共識目標價為 142.37 美元。

- 國防承包商股票解析及投資指南

查看我們對 BWX Technologies 的最新股票分析

機構資金流入和流出

幾家對沖基金和其他機構投資者最近修改了對該股票的持有。Creative Financial Designs Inc. ADV 在第二季度將其在 BWX Technologies 的持股增加了 250.0%。Creative Financial Designs Inc. ADV 目前持有 175 股該科技公司的股票,價值 25,000 美元,在此期間又購買了 125 股。Hantz Financial Services Inc.在第二季度將其在 BWX Technologies 的持股增加了 861.9%。Hantz Financial Services Inc.目前持有 202 股該科技公司的股票,價值 29,000 美元,在上個季度又購買了 181 股。Stone House Investment Management LLC 在第一季度獲得了 BWX Technologies 的新頭寸,價值 31,000 美元。Compass Financial Services Inc 在第一季度獲得了 BWX Technologies 的新頭寸,價值 33,000 美元。最後,Ameriflex Group Inc.在第四季度獲得了 BWX Technologies 的新頭寸,價值 34,000 美元。目前 94.39% 的股票由對沖基金和其他機構投資者持有。

關於 BWX Technologies

(獲取免費報告)

BWX Technologies, Inc.及其子公司在美國、加拿大及國際上製造和銷售核組件。它通過兩個部門運營,分別是政府業務和商業業務。政府業務部門設計和製造海軍核組件、反應堆和核燃料;進行製造活動;並向海軍和商業航運客户提供專有和唯一來源的閥門、管道和配件。

推薦故事

- 五隻我們更看好的股票超過 BWX Technologies

- 每股收益計算器:如何計算 EPS

- Airbnb 超出收益預期,但增長故事正在失去高度

- 什麼是道瓊斯狗策略?概述和示例

- Netflix 多頭與空頭:誰在這次回調中獲勝?

- 投資汽車股票

- Viasat:為什麼一大筆現金讓空頭們四處逃竄

此即時新聞提醒由敍述科學技術和來自 InsiderTrades.com 的金融數據生成,以便為讀者提供最快和最準確的報道。此故事在發佈前已由 InsiderTrades.com 的編輯團隊審核。如對該故事有任何問題或意見,請發送電子郵件至 [email protected]。

BWX Technologies 的內部買賣情況?

註冊以接收 InsiderTrades.com 關於 BWX Technologies 及相關公司的每日內部買賣報告。

來自我們的合作伙伴

你的加密財富藍圖

在你的日曆上標記 8 月 12 日。27 位加密領域最成功的思想家即將揭示一切……

Crypto 101 Media

特朗普的國家噩夢來臨

Porter Stansberry 和 Jeff Brown 表示,美國新的國家緊急狀態已經開始——這可能會引發……

Porter & Company

隱藏在《創世紀》中的秘密……

“這片土地我將賜給你……”——《創世紀》中的一段 4000 年前的台詞可能是解鎖 150 萬億美金的關鍵……

Paradigm Press

曾在 1.10 美元時推薦 Nvidia 的人現在説買這個……

在 2004 年,有人幾乎在所有人知道 Nvidia 之前就推薦了它。現在,這位同樣的人表示有一家公司……

The Oxford Club

埃隆的社保秘密炸彈

致所有 1963 年 4 月 16 日之前出生的美國人:特朗普是否剛剛給了重新做社保的綠燈……

Banyan Hill Publishing

幾乎瞬間的加密收入

你想如何收集每天在加密市場中交易的 40 億美元的一小部分?……

Awesomely, LLC

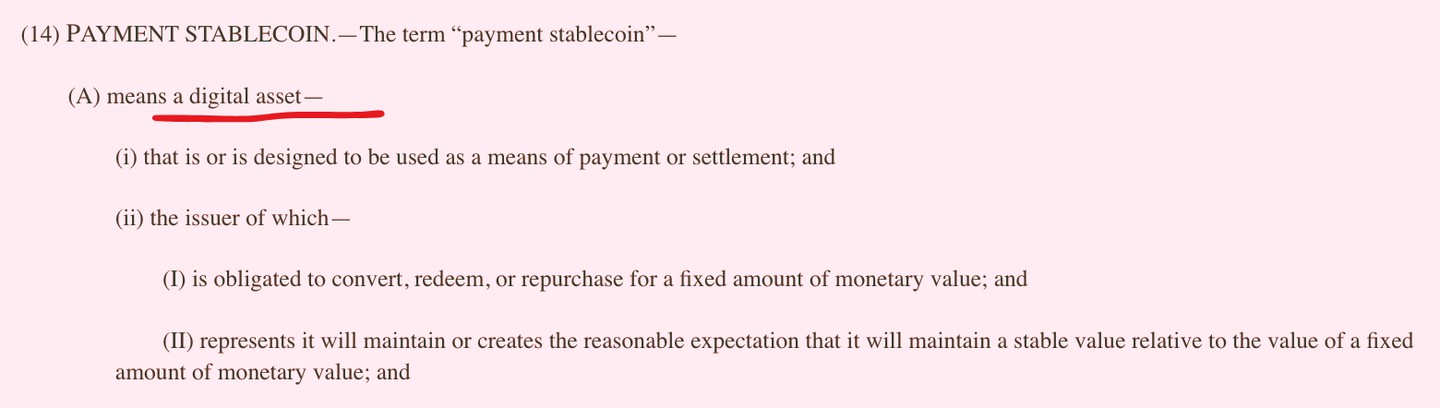

GENIUS 法案:取消你的資金?

一項名為 GENIUS 法案的新法律可能會悄然引發美國金融數十年來最激進的轉變。

Priority Gold

機器人革命已經到來……而一隻 7 美元的股票可能會因此騰飛。

華盛頓正在醖釀重大事件。根據我的研究,特朗普總統的一項行政命令可能會……

Weiss Ratings