Insider Selling: Telephone and Data Systems, Inc. (NYSE:TDS) CFO Sells 58,452 Shares of Stock

电话和数据系统公司首席财务官维基·L·维拉克雷斯出售了 58,452 股股票,平均价格为 38.56 美元,总计 2,253,909.12 美元,持股比例减少了 68.57%。出售后,她持有 26,788 股,价值约为 1,032,945.28 美元。此次出售已向美国证券交易委员会(SEC)披露。该公司最近报告的季度每股收益为(0.05 美元),未达到预期,收入为 11.9 亿美元。季度股息为 0.04 美元,将于 9 月 30 日支付给在 9 月 15 日登记的股东

电话和数据系统公司(NYSE:TDS - 获取免费报告)首席财务官维基·L·维拉克雷兹于 8 月 15 日星期五出售了 58,452 股公司股票。股票的平均售价为 38.56 美元,总交易额为 2,253,909.12 美元。交易完成后,首席财务官持有 26,788 股公司股票,价值约为 1,032,945.28 美元。这笔交易代表了他们持股比例的 68.57% 的减少。该出售在向 SEC 提交的文件中披露,文件可通过此链接获取。

电话和数据系统股价下跌 0.8%

- 2 只中型电信股票提供优越回报

TDS 的股票在星期五开盘价为 38.51 美元。该公司的速动比率为 1.55,流动比率为 1.78,债务与股本比率为 0.85。电话和数据系统公司过去 12 个月的最低价为 20.04 美元,最高价为 42.74 美元。该股票的市值为 43.9 亿美元,市盈率为-39.70,贝塔值为 0.54。该公司的 50 日简单移动平均线为 36.92 美元,200 日简单移动平均线为 36.26 美元。

电话和数据系统(NYSE:TDS - 获取免费报告)最近于 8 月 11 日星期一公布了季度财报。这家无线通信提供商报告每股收益(EPS)为-0.05 美元,低于分析师一致预期的-0.01 美元,差距为-0.04 美元。该季度的收入为 11.9 亿美元,而分析师预期为 11.7 亿美元。电话和数据系统的净利润率为-0.85%,股本回报率为 0.92%。与去年同期相比,公司的收入下降了 5.7%。在去年同期,该公司每股收益为-0.13 美元。研究分析师平均预计电话和数据系统公司今年将发布-0.31 美元的每股收益。

电话和数据系统分红公告

- 市场对过剩库存的反应...但现在是否被低估?

该公司还最近宣布了季度分红,将于 9 月 30 日星期二支付。9 月 15 日星期一的股东将获得 0.04 美元的分红。除息日为 9 月 15 日星期一。这相当于年化 0.16 美元的分红,收益率为 0.4%。电话和数据系统的派息比率目前为-16.49%。

华尔街分析师预测增长

一些研究分析师最近对 TDS 股票发布了报告。华尔街 Zen 在 8 月 9 日星期六的报告中将电话和数据系统的股票评级从 “持有” 下调至 “卖出”。雷蒙德·詹姆斯金融公司在周二的报告中将电话和数据系统的目标价从 49.00 美元上调至 50.00 美元,并给予该股票 “跑赢大盘” 的评级。最后,摩根大通在周二的研究报告中将电话和数据系统的目标价从 53.00 美元上调至 54.00 美元,并给予该公司 “增持” 的评级。

- 这 11 只股票将在 5 年内成为分红之王。

查看我们最新的电话和数据系统股票报告

对电话和数据系统的对冲基金看法

几家对冲基金最近调整了对该股票的持有。Federated Hermes Inc.在第四季度获得了电话和数据系统的新头寸,价值 56,000 美元。蒙特利尔银行在第四季度将其在电话和数据系统的持仓增加了 5.5%。蒙特利尔银行现在拥有 42,642 股无线通信提供商的股票,价值 1,455,000 美元,此前在上个季度又增持了 2,241 股。雷蒙德·詹姆斯金融公司在第四季度获得了电话和数据系统的新头寸,价值约为 5,619,000 美元。斯特林资本管理公司在第四季度将其在电话和数据系统的股份增加了 33.7%。斯特林资本管理公司现在拥有 11,238 股无线通信提供商的股票,价值 383,000 美元,此前在此期间又购买了 2,835 股。最后,Summit Investment Advisors Inc.在第四季度将其在电话和数据系统的股份增加了 4.9%。Summit Investment Advisors Inc.现在拥有 10,319 股无线通信提供商的股票,价值 352,000 美元,此前在上个季度又购买了 482 股。机构投资者和对冲基金持有该公司 80.00% 的股份。

电话和数据系统公司简介

(获取免费报告)

电话和数据系统公司是一家电信公司,在美国提供通信服务。它通过两个部门运营:UScellular 和 TDS Telecom。该公司为消费者、商业和政府客户提供无线解决方案,包括一系列连接的物联网(IoT)解决方案,以及用于监控和控制、业务自动化/运营、通信、车队和资产管理、智能水解决方案、私有蜂窝网络和定制的端到端物联网解决方案的软件应用;无线优先服务和质量优先及优先选项;智能手机和其他手机、平板电脑、可穿戴设备、移动热点、固定无线家庭互联网和物联网设备;以及配件,如手机壳、屏幕保护膜、充电器和存储卡,以及消费电子产品,包括音频、家庭自动化和网络产品。

进一步阅读

- 五只我们更看好的股票,胜过电话和数据系统

- 3 只超市股票证明它们仍然是必需品

- MarketBeat 周回顾 – 08/11 - 08/15

- 如何在 7 个步骤中投资大麻股票

- 3 只餐饮股票将在第三季度和第四季度表现优于大盘

- Roth IRA 计算器:计算您的潜在回报

- 持续上涨的中游能源投资

这条即时新闻提醒是由叙事科学技术和来自 InsiderTrades.com 的金融数据生成的,旨在为读者提供最快和最准确的报道。此故事在发布前已由 InsiderTrades.com 的编辑团队审核。请将有关此故事的任何问题或评论发送至 [email protected].

电话和数据系统的内部买入或卖出?

注册接收 InsiderTrades.com 关于电话和数据系统及相关公司的每日内部买入和卖出报告。

来自我们的合作伙伴

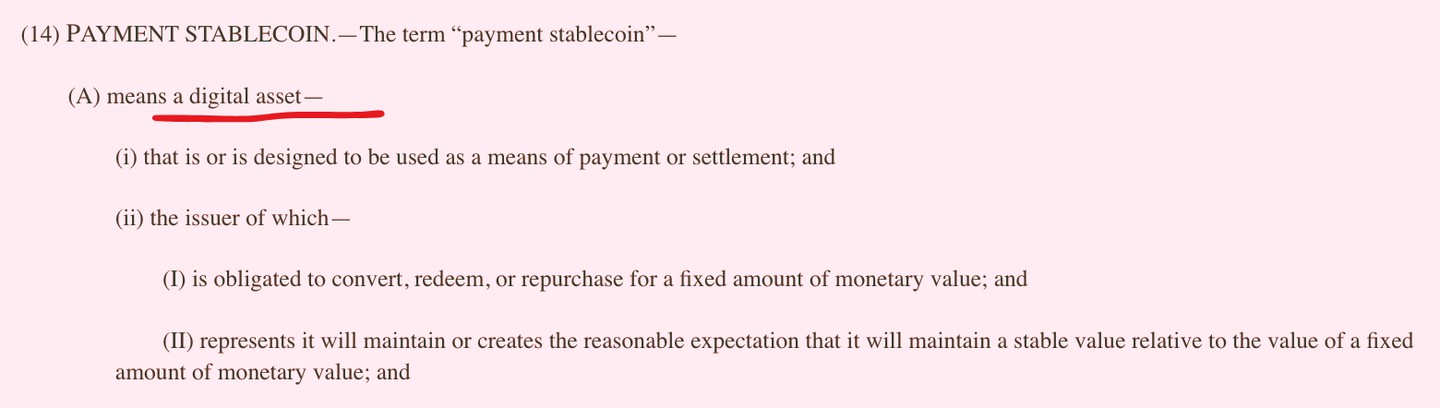

GENIUS 法案:取消你的资金?

一项名为 GENIUS 法案的新法律可能会悄然引发美国金融数十年来最激进的转变。B...

优先黄金

马斯克的巨人计划可能会造就百万富翁

我预测这一单一突破可能会让埃隆成为世界首位万亿富翁——并造就更多新的百万富翁...

布朗斯通研究

创世纪 14:13-17 [隐藏含义?]

创世纪中的一段神秘经文可能蕴含着解锁某位专家所称的 “美国出生权” 的关键...

范式出版社

仅需投资 118,000 美元就能覆盖所有开支?

每月产生高达 5,000 美元的收益,资金却少 10 倍?这就是每位财务顾问告诉你的。但我刚刚...

投资者小巷

市场恐慌:特朗普刚刚对你的股票投下炸弹

股市恐慌:特朗普刚刚对你的股票投下炸弹,市场正在自由下跌——特朗普的新关税...

美国另类投资

现在每个人都在关注 Nvidia。这就是我兴奋的原因。

所以,除非你一直生活在岩石下,否则你可能已经看到新闻……Nvidia 刚刚签署了一项价值 70 亿美元的协议...

蒂莫西·赛克斯

这家价值 7 美元的公司正在帮助 Nvidia 打造世界首个万亿美元机器人……

迈克尔·罗宾逊在科技市场上已经活跃了 40 多年。发现一些利润...

韦斯评级

突发新闻:众议院刚刚通过了三项支持加密货币的法案!

三项支持加密货币的法案刚刚通过众议院!现在,专家们认为山寨币季节正式来临。

加密 101 媒体