Insider Selling: LivePerson, Inc. (NASDAQ:LPSN) Major Shareholder Sells 706,991 Shares of Stock

LivePerson, Inc. 的主要股東 Vector Capital Management, L.P. 出售了 706,991 股,價格為每股 1.02 美元,總計 721,130.82 美元,標誌着其持股比例下降了 6.49%。出售後,他們持有 10,192,465 股,估值約為 1040 萬美元。其他銷售包括 252,776 股,價格為 0.98 美元,以及 955,412 股,價格為 0.99 美元。該股票開盤價為 0.99 美元,市值為 9261 萬美元。分析師最近將該股票評級從 “持有” 下調至 “賣出”

LivePerson, Inc.(納斯達克代碼:LPSN - 獲取免費報告)主要股東 Vector Capital Management, L.P 於 8 月 12 日星期二出售了 706,991 股該股票。股票的平均售價為 1.02 美元,總交易額為 721,130.82 美元。交易後,內部人士在公司持有 10,192,465 股,估值約為 10,396,314.30 美元。這代表他們對該股票的持有量減少了 6.49%。該交易已在向美國證券交易委員會(SEC)的備案中披露,相關信息可通過此鏈接查看。持有公司至少 10% 股份的主要股東需向 SEC 披露其買賣情況。

Vector Capital Management, L.P 最近還進行了以下交易:

- 8 月 14 日星期四,Vector Capital Management, L.P 出售了 252,776 股 LivePerson 股票。股票的平均售價為 0.98 美元,總交易額為 247,720.48 美元。

- 8 月 13 日星期三,Vector Capital Management, L.P 出售了 955,412 股 LivePerson 股票。股票的平均售價為 0.99 美元,總交易額為 945,857.88 美元。

LivePerson 價格表現

LPSN 股票在星期五開盤價為 0.99 美元。該公司的 50 日移動平均線為 0.94 美元,200 日移動平均線為 0.93 美元。公司市值為 9261 萬美元,市盈率為-0.49,貝塔值為 1.61。LivePerson, Inc.的 12 個月低點為 0.61 美元,12 個月高點為 2.08 美元。

機構投資者對 LivePerson 的看法

一些機構投資者和對沖基金最近對 LPSN 的持倉進行了調整。Two Sigma Advisers LP 在第四季度將其在 LivePerson 的持股增加了 42.0%。Two Sigma Advisers LP 現在持有 906,027 股該科技公司的股票,價值 1,377,000 美元,此前在上個季度購買了 267,827 股。XTX Topco Ltd 在第二季度購買了 LivePerson 的新股份,價值約 246,000 美元。Bridgeway Capital Management LLC 在第四季度購買了 LivePerson 的新股份,價值約 152,000 美元。Point72 Asia Singapore Pte. Ltd.在第四季度將其在 LivePerson 的持倉增加了 146.1%。Point72 Asia Singapore Pte. Ltd.現在持有 73,794 股該科技公司的股票,價值 112,000 美元,此前在上個季度購買了 43,804 股。最後,Raymond James Financial Inc.在第四季度購買了 LivePerson 的新股份,價值約 66,000 美元。79.83% 的股票由對沖基金和其他機構投資者持有。

分析師設定新目標價

LPSN 已成為幾份研究分析師報告的主題。Wall Street Zen 在週六的一份研究報告中將 LivePerson 的股票評級從 “持有” 下調至 “賣出”。Needham & Company LLC 在 5 月 8 日星期四的一份研究報告中重申了對 LivePerson 的 “持有” 評級。

查看我們關於 LivePerson 的最新股票報告

關於 LivePerson

(獲取免費報告)

LivePerson, Inc.從事對話式人工智能。它使品牌能夠利用對話雲的智能引擎,通過一套集成的移動和在線商業消息技術與消費者連接。該公司提供對話雲,一個企業級數字客户對話平台,使企業和消費者能夠通過對話渠道(如語音、應用內和移動消息)進行連接。

精選故事

- 我們更看好的五隻股票比 LivePerson 更好

- 如何交易便士股票:逐步指南

- MarketBeat 週迴顧 – 08/11 - 08/15

- 大盤股定義及如何投資

- 3 只餐飲股票將在第三季度和第四季度表現優於大盤

- 最大的股票虧損者 - 今天最大的百分比下跌者

- 持續上漲的中游能源投資

此即時新聞提醒由敍事科學技術和來自 InsiderTrades.com 的金融數據生成,以便為讀者提供最快和最準確的報道。此故事在發佈前已由 InsiderTrades.com 的編輯團隊審核。如對該故事有任何問題或意見,請發送至 [email protected].

LivePerson 的內部買賣情況?

註冊以接收 InsiderTrades.com 關於 LivePerson 及相關公司的每日內部買賣報告。

來自我們的合作伙伴

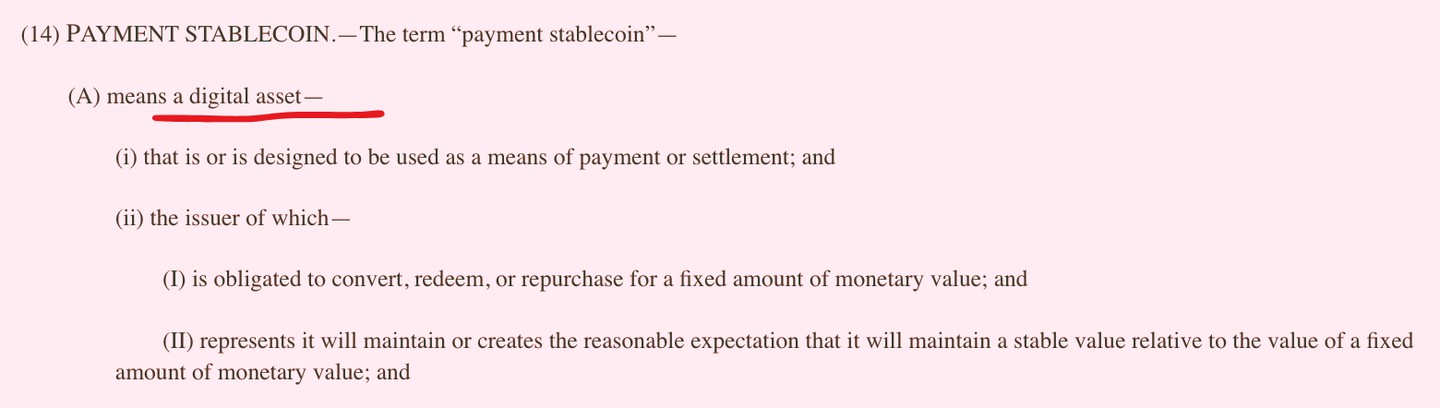

GENIUS 法案:取消你的資金?

一項名為 GENIUS 法案的新法律可能會悄然引發美國金融數十年來最激進的轉變。

Priority Gold

馬斯克的巨人計劃可能會造就百萬富翁

我預測這一單一突破可能使埃隆成為世界首位萬億富翁,並造就更多新百萬富翁。

Brownstone Research

創世紀 14:13-17 [隱藏含義?]

創世紀中的一段神秘經文可能揭示了一個專家所稱的 “美國出生權” 的關鍵。

Paradigm Press

突發新聞:眾議院剛剛通過了三項支持加密貨幣的法案!

三項支持加密貨幣的法案剛剛通過眾議院!現在,專家們認為山寨幣季節正式來臨。

Crypto 101 Media

僅需投資 118,000 美元就能覆蓋所有開支?

用少 10 倍的錢每月賺取高達 5,000 美元?這就是每位財務顧問告訴你的。但我只是...

Investors Alley

市場恐慌:特朗普剛剛對你的股票投下了一顆炸彈

股市恐慌:特朗普剛剛對你的股票投下了一顆炸彈,市場正在自由下跌——特朗普的新關税...

American Alternative

現在每個人都在關注 Nvidia。這就是我興奮的原因。

所以,除非你一直生活在岩石下,否則你可能已經看到了新聞……Nvidia 剛剛簽署了一項價值 70 億美元的交易...

Timothy Sykes

這家價值 70 億美元的公司正在幫助 Nvidia 打造世界首個萬億美元機器人……

Michael Robinson 在科技市場前沿工作了超過 40 年,發現了一些利潤...

Weiss Ratings