Nikita Shah Sells 71,694 Shares of Amneal Pharmaceuticals, Inc. (NASDAQ:AMRX) Stock

Amneal Pharmaceuticals 的執行副總裁 Nikita Shah 出售了 71,694 股,每股售價為 9.29 美元,總計 666,037.26 美元,減少了 21.15% 的持股比例。出售後,他持有 267,235 股,價值約 248 萬美元。此交易已向美國證券交易委員會(SEC)披露。Shah 之前曾以每股 9.04 美元的價格出售了 50,000 股。Amneal 的股票開盤價為 9.45 美元,市值為 29.6 億美元。分析師一致給予 “買入” 評級,平均目標價為 11.60 美元

Amneal Pharmaceuticals, Inc.(納斯達克代碼:AMRX - 獲取免費報告)執行副總裁 Nikita Shah 於 8 月 14 日星期四出售了 71,694 股公司股票。股票以平均價格 9.29 美元出售,總交易額為 666,037.26 美元。交易完成後,該執行副總裁在公司持有 267,235 股,估值約為 2,482,613.15 美元。這代表其持股減少了 21.15%。此次出售在向美國證券交易委員會(SEC)的備案中披露,相關文件可通過此鏈接訪問。

- 購買 Teva Pharmaceuticals 股票的 6 個理由

Nikita Shah 最近還進行了以下交易:

- 8 月 12 日星期二,Nikita Shah 出售了 50,000 股 Amneal Pharmaceuticals 股票。股票以平均價格 9.04 美元出售,總交易額為 452,000.00 美元。

Amneal Pharmaceuticals 股票上漲 0.6%

AMRX 的股票在星期五開盤價為 9.45 美元。該公司的市值為 29.6 億美元,市盈率為 945.95,貝塔值為 1.11。該公司的 50 日移動平均線為 8.21 美元,200 日移動平均線為 7.98 美元。Amneal Pharmaceuticals, Inc.的 52 周最低價為 6.68 美元,52 周最高價為 9.59 美元。

Amneal Pharmaceuticals(納斯達克代碼:AMRX - 獲取免費報告)最近在 8 月 5 日星期二發佈了季度財報。公司報告該季度每股收益為 0.23 美元,超出市場共識預期的 0.17 美元,超出幅度為 0.06 美元。Amneal Pharmaceuticals 的股本回報率為負的 189.49%,淨利潤率為 0.12%。作為一個整體,研究分析師預計 Amneal Pharmaceuticals, Inc.在當前財政年度將發佈每股收益 0.53 美元。

機構投資者對 Amneal Pharmaceuticals 的看法

一些大型投資者最近調整了對該公司的持股。先鋒集團(Vanguard Group Inc.)在第一季度增持了 Amneal Pharmaceuticals 的股份,增幅為 6.2%。先鋒集團目前持有 15,762,727 股公司股票,價值 132,092,000 美元,此前在該期間內又購買了 920,758 股。Rubric Capital Management LP 在第二季度增持了 Amneal Pharmaceuticals 的股份,增幅為 9.1%。Rubric Capital Management LP 目前持有 11,710,332 股公司股票,價值 94,737,000 美元,此前在該期間內又購買了 974,355 股。Dimensional Fund Advisors LP 在第四季度增持了 Amneal Pharmaceuticals 的股份,增幅為 5.9%。Dimensional Fund Advisors LP 目前持有 4,991,702 股公司股票,價值 39,531,000 美元,此前在該期間內又購買了 278,653 股。Nantahala Capital Management LLC 在第二季度增持了 Amneal Pharmaceuticals 的股份,增幅為 14.7%。Nantahala Capital Management LLC 目前持有 4,367,438 股公司股票,價值 35,333,000 美元,此前在該期間內又購買了 558,877 股。最後,Geode Capital Management LLC 在第四季度增持了 Amneal Pharmaceuticals 的股份,增幅為 0.7%。Geode Capital Management LLC 目前持有 3,813,207 股公司股票,價值 30,207,000 美元,此前在該期間內又購買了 26,536 股。對沖基金和其他機構投資者持有該公司 31.82% 的股份。

分析師設定新的價格目標

幾位股票分析師最近對該股票發表了看法。高盛集團(Goldman Sachs Group)在 6 月 6 日星期五的一份研究報告中開始覆蓋 Amneal Pharmaceuticals 的股票。他們給予該股票 “買入” 評級,並設定 12.00 美元的價格目標。華爾街 Zen 在 5 月 13 日星期二的一份研究報告中將 Amneal Pharmaceuticals 的股票評級從 “強力買入” 下調至 “買入”。六位分析師對該股票給予了買入評級,根據 MarketBeat.com 的數據,該公司目前的共識評級為 “買入”,平均價格目標為 11.60 美元。

閲讀我們關於 Amneal Pharmaceuticals 的最新股票報告

關於 Amneal Pharmaceuticals

(獲取免費報告)

Amneal Pharmaceuticals, Inc.及其子公司在全球範圍內開發、製造、營銷和分銷仿製藥、注射劑、生物類似藥和特殊品牌藥品。該公司通過三個部門運營:仿製藥、特殊藥品和 AvKARE。仿製藥部門提供即釋和緩釋口服固體、粉末、液體、無菌注射劑、鼻用噴霧劑、吸入和呼吸、生物類似藥、眼科、薄膜、透皮貼片和外用產品。

進一步閲讀

- 我們更看好的五隻股票比 Amneal Pharmaceuticals 更好

- 股票市場行業:它們是什麼,有多少個?

- MarketBeat 週迴顧 – 08/11 - 08/15

- 如何繪製斐波那契價格拐點水平

- 3 只餐飲股票將在第三季度和第四季度表現優於大盤

- 3 只國防股票將受益於軍事支出增加

- 繼續上漲的中游能源投資

此即時新聞提醒由敍述科學技術和來自 InsiderTrades.com 的金融數據生成,以便為讀者提供最快和最準確的報道。此故事在發佈前經過 InsiderTrades.com 編輯團隊的審核。如對該故事有任何問題或意見,請發送至 [email protected].

Amneal Pharmaceuticals 的內部買賣情況?

註冊以接收 InsiderTrades.com 關於 Amneal Pharmaceuticals 及相關公司的每日內部買賣報告。

來自我們的合作伙伴

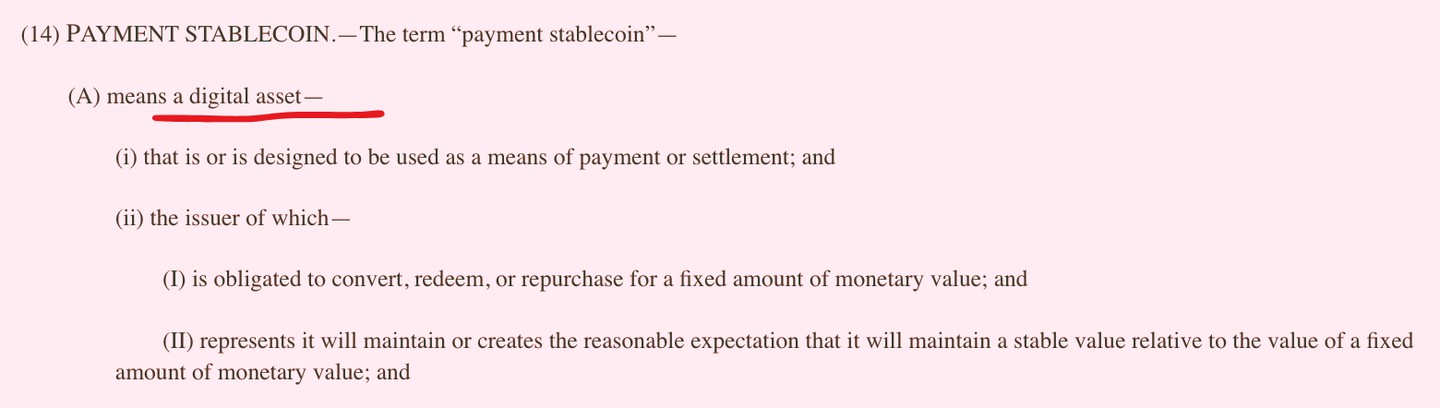

GENIUS 法案:取消你的資金?

一項名為 GENIUS 法案的新法律可能會悄然引發美國金融史上數十年來最激進的轉變。

Priority Gold

馬斯克的巨人計劃可能會造就百萬富翁

我預測這一單一突破可能會讓埃隆成為世界首位萬億富翁——並造就更多新的百萬富翁...

布朗斯通研究

創世紀 14:13-17 [隱藏的含義?]

創世紀中的一段神秘經文可能藴含着解鎖某位專家所稱的 “美國出生權” 的關鍵...

範式出版社

突發消息:眾議院剛剛通過了三項支持加密貨幣的法案!

三項支持加密貨幣的法案剛剛通過眾議院!現在,專家們認為山寨幣季節正式來臨。

加密貨幣 101 媒體

僅需投資 118,000 美元就能覆蓋所有開支?

用少 10 倍的錢每月賺取高達 5,000 美元?這就是每位財務顧問告訴你的。但我只是...

投資者小巷

市場恐慌:特朗普剛剛對你的股票投下了一顆炸彈

股市恐慌:特朗普剛剛對你的股票投下了一顆炸彈,市場正在自由下跌——特朗普的新關税...

美國替代投資

每個人都在關注英偉達。這裏是我興奮的原因。

所以,除非你一直生活在岩石下,否則你可能已經看到新聞... 英偉達剛剛簽署了一項價值 70 億美元的交易...

蒂莫西·賽克斯

這家價值 7 美元的公司正在幫助英偉達打造世界首個萬億美元機器人...

邁克爾·羅賓遜在科技市場上已經活躍了 40 多年,發現了一些利潤...

韋斯評級