Broadcom Inc. (NASDAQ:AVGO) Director Justine Page Sells 800 Shares

Broadcom Inc. (NASDAQ:AVGO) Director Justine Page sold 800 shares of the company's stock on August 14th for $245,968 at an average price of $307.46. Post-sale, Page holds 23,782 shares, a 3.25% decrease in their position. This transaction was disclosed to the SEC. Page had previously sold shares on July 14th and June 16th at lower prices. Broadcom's stock opened at $306.34, with a market cap of $1.44 trillion and a P/E ratio of 114.73. The company reported strong earnings, beating estimates, and recently announced a quarterly dividend.

Broadcom Inc. (NASDAQ:AVGO - Get Free Report) Director Justine Page sold 800 shares of the stock in a transaction on Thursday, August 14th. The stock was sold at an average price of $307.46, for a total transaction of $245,968.00. Following the sale, the director owned 23,782 shares of the company's stock, valued at approximately $7,312,013.72. This represents a 3.25% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link.

Broadcom Inc. (NASDAQ:AVGO - Get Free Report) Director Justine Page sold 800 shares of the stock in a transaction on Thursday, August 14th. The stock was sold at an average price of $307.46, for a total transaction of $245,968.00. Following the sale, the director owned 23,782 shares of the company's stock, valued at approximately $7,312,013.72. This represents a 3.25% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link.

- Why Arista's Blowout Q2 Is Good News for Chip-Giant Broadcom

Justine Page also recently made the following trade(s):

- On Monday, July 14th, Justine Page sold 800 shares of Broadcom stock. The stock was sold at an average price of $274.30, for a total transaction of $219,440.00.

- On Monday, July 14th, Justine Page sold 800 shares of Broadcom stock. The stock was sold at an average price of $274.30, for a total transaction of $219,440.00.

- On Monday, June 16th, Justine Page sold 800 shares of Broadcom stock. The stock was sold at an average price of $250.35, for a total transaction of $200,280.00.

Broadcom Stock Performance

NASDAQ:AVGO opened at $306.34 on Friday. The company has a current ratio of 1.08, a quick ratio of 0.98 and a debt-to-equity ratio of 0.89. The firm has a 50-day moving average price of $278.27 and a two-hundred day moving average price of $229.63. Broadcom Inc. has a twelve month low of $134.90 and a twelve month high of $317.35. The company has a market capitalization of $1.44 trillion, a P/E ratio of 114.73, a price-to-earnings-growth ratio of 2.21 and a beta of 1.15.

- Arista Networks: Cashing In as the Tollbooth for AI Traffic

Broadcom (NASDAQ:AVGO - Get Free Report) last posted its earnings results on Thursday, June 5th. The semiconductor manufacturer reported $1.58 earnings per share for the quarter, beating the consensus estimate of $1.57 by $0.01. Broadcom had a net margin of 22.64% and a return on equity of 35.49%. The firm had revenue of $15 billion during the quarter, compared to the consensus estimate of $14.98 billion. During the same period last year, the firm posted $10.96 EPS. The firm's revenue for the quarter was up 20.2% on a year-over-year basis. As a group, research analysts expect that Broadcom Inc. will post 5.38 earnings per share for the current fiscal year.

Broadcom Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Monday, June 30th. Shareholders of record on Friday, June 20th were issued a dividend of $0.59 per share. This represents a $2.36 annualized dividend and a yield of 0.8%. The ex-dividend date was Friday, June 20th. Broadcom's dividend payout ratio (DPR) is 88.39%.

Hedge Funds Weigh In On Broadcom

- 3 Companies That Will Profit From Trump's Semiconductor Tariffs

Hedge funds have recently added to or reduced their stakes in the business. Banco Bilbao Vizcaya Argentaria S.A. boosted its position in shares of Broadcom by 3.8% in the fourth quarter. Banco Bilbao Vizcaya Argentaria S.A. now owns 515,388 shares of the semiconductor manufacturer's stock worth $120,070,000 after acquiring an additional 18,845 shares during the last quarter. PARUS FINANCE UK Ltd boosted its position in shares of Broadcom by 175.3% in the first quarter. PARUS FINANCE UK Ltd now owns 100,578 shares of the semiconductor manufacturer's stock worth $16,840,000 after acquiring an additional 64,038 shares during the last quarter. Nebula Research & Development LLC boosted its position in shares of Broadcom by 1,100.8% in the fourth quarter. Nebula Research & Development LLC now owns 15,707 shares of the semiconductor manufacturer's stock worth $3,642,000 after acquiring an additional 14,399 shares during the last quarter. Keener Financial Planning LLC boosted its position in shares of Broadcom by 34.8% in the first quarter. Keener Financial Planning LLC now owns 890 shares of the semiconductor manufacturer's stock worth $149,000 after acquiring an additional 230 shares during the last quarter. Finally, Diversify Wealth Management LLC boosted its position in shares of Broadcom by 5.6% in the first quarter. Diversify Wealth Management LLC now owns 38,016 shares of the semiconductor manufacturer's stock worth $6,365,000 after acquiring an additional 2,016 shares during the last quarter. 76.43% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several analysts have recently commented on AVGO shares. Benchmark raised their target price on shares of Broadcom from $255.00 to $315.00 and gave the stock a "buy" rating in a research note on Friday, June 6th. Oppenheimer raised their target price on shares of Broadcom from $265.00 to $305.00 and gave the stock an "outperform" rating in a research note on Tuesday, July 15th. Wall Street Zen cut shares of Broadcom from a "buy" rating to a "hold" rating in a research note on Saturday, August 9th. Citigroup raised their target price on shares of Broadcom from $285.00 to $315.00 and gave the stock a "buy" rating in a research note on Monday, July 7th. Finally, JPMorgan Chase & Co. raised their target price on shares of Broadcom from $250.00 to $325.00 and gave the stock an "overweight" rating in a research note on Friday, June 6th. Two investment analysts have rated the stock with a hold rating, twenty-six have issued a buy rating and three have issued a strong buy rating to the stock. According to MarketBeat, the stock currently has an average rating of "Buy" and an average target price of $295.96.

Check Out Our Latest Stock Analysis on Broadcom

Broadcom Company Profile

(Get Free Report)

Broadcom Inc designs, develops, and supplies various semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor based devices and analog III-V based products worldwide. The company operates in two segments, Semiconductor Solutions and Infrastructure Software.

See Also

- Five stocks we like better than Broadcom

- Why Understanding Call Option Volume is Essential to Successful Options Trading

- MarketBeat Week in Review – 08/11 - 08/15

- Where to Find Earnings Call Transcripts

- 3 Restaurant Stocks That Will Outperform in Q3 and Q4

- Asset Allocation Strategies in Volatile Markets

- The Midstream Energy Play That Keeps Powering Higher

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].

Insider Buying or Selling at Broadcom?

Sign-up to receive InsiderTrades.com's daily insider buying and selling report for Broadcom and related companies.

From Our Partners

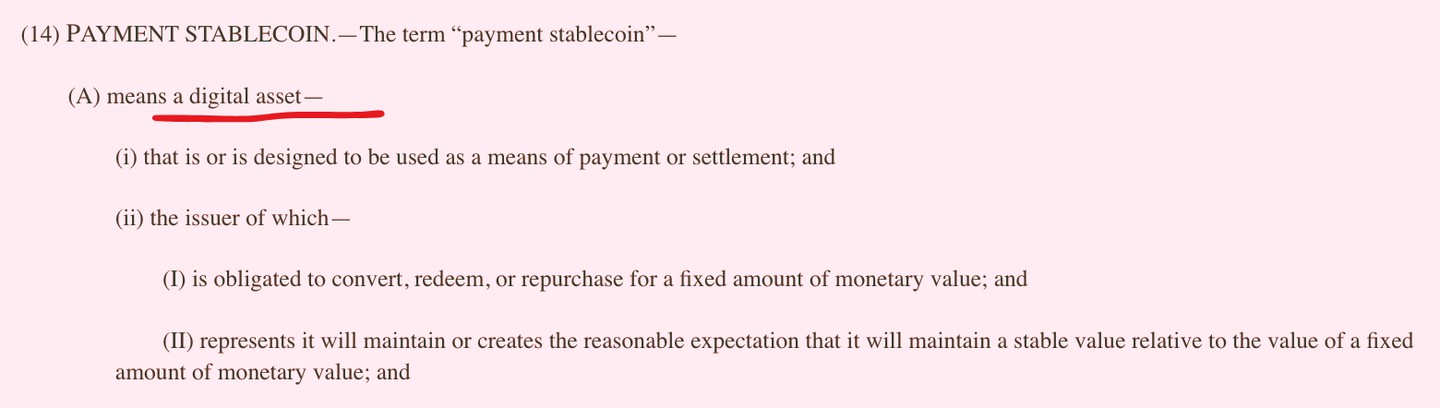

GENIUS Act: Cancel Your Money?

A new law called the GENIUS Act could quietly trigger the most radical shift in American finance in decades. B...

Priority Gold

Musk’s Project Colossus could mint millionaires

I predict this single breakthrough could make Elon the world’s first trillionaire — and mint more new milliona...

Brownstone Research

Genesis 14:13-17 [HIDDEN MEANING?]

A mysterious Bible verse from Genesis may hold the key to unlocking what one expert calls an “American birthri...

Paradigm Press

BREAKING: The House just passed 3 pro-crypto bills!

THREE pro-crypto bills just passed the House! Now, experts believe altcoin season is officially here.

Crypto 101 Media

Cover all your expenses with just $118,000 invested?

Generate up to $5,000/month with 10X less money? That's what every financial advisor tells you. But I just ...

Investors Alley

Market Panic: Trump Just Dropped a Bomb on Your Stocks

tock Market Panic: Trump Just Dropped a Bomb on Your Stocks The market is in freefall—and Trump's new tarif...

American Alternative

Everyone’s watching Nvidia right now. Here’s why I’m excited.

So, unless you’ve been living under a rock, you probably saw the news… Nvidia just signed a $7 BILLION deal...

Timothy Sykes

The $7 company helping Nvidia build the world’s first trillion-dollar robot …

Michael Robinson has been at the forefront of the technology market for over 40 years. Spotting some profit...

Weiss Ratings