Insider Buying: Generation Income Properties (NASDAQ:GIPR) CEO Buys 20,200 Shares of Stock

Generation Income Properties 首席執行官 David Sobelman 以每股 1.02 美元的價格購買了 20,200 股公司股票,總計 20,604 美元。這次收購使他的持股比例增加了 10.99%,使他的總股份達到 203,998 股,價值約 208,078 美元。該公司的股票開盤價為 0.9445 美元,市值為 514 萬美元。最近,Gator Capital Management 將其在公司的持股比例提高了 12%。Generation Income Properties 專注於零售、辦公和工業領域的房地產投資

Generation Income Properties, Inc.(納斯達克代碼:GIPR - 獲取免費報告)首席執行官 David Sobelman 於 8 月 21 日星期四購買了 20,200 股該股票。該股票的平均購買成本為每股 1.02 美元,總交易額為 20,604.00 美元。完成購買後,首席執行官直接持有 203,998 股公司股票,價值 208,077.96 美元。這代表了他們持股比例的 10.99% 的增長。此次收購已在向證券交易委員會提交的文件中披露,相關文件可通過此超鏈接訪問。

Generation Income Properties 股價上漲 5.6%

GIPR 的股票在週五開盤價為 0.9445 美元。該公司的 50 日簡單移動平均線為 1.30 美元,200 日簡單移動平均線為 1.50 美元。該公司的市值為 514 萬美元,市盈率為-0.50,貝塔值為-0.07。該公司的債務與股本比率為 20.28,流動比率為 0.16,速動比率為 0.29。Generation Income Properties, Inc.的 1 年最低價為 0.7806 美元,1 年最高價為 2.71 美元。

Generation Income Properties(納斯達克代碼:GIPR - 獲取免費報告)最近一次公佈財報是在 8 月 15 日星期五。該公司報告本季度每股收益為(0.63 美元),低於分析師一致預期的(0.43 美元)0.20 美元。該季度的收入為 243 萬美元,而分析師預期為 238 萬美元。Generation Income Properties 的淨利潤率為-105.40%,股本回報率為-247.43%。

機構資金流入和流出

一家對沖基金最近增加了對 Generation Income Properties 股票的持股。根據其最近向 SEC 提交的 13F 表格,Gator Capital Management LLC 在第二季度將其在 Generation Income Properties, Inc.(納斯達克代碼:GIPR - 免費報告)中的持股增加了 12.0%。該機構投資者在本季度增持了 24,443 股後,持有 228,643 股公司的股票。Gator Capital Management LLC 在最近一個季度末持有的 Generation Income Properties 股票價值 334,000 美元,佔該公司股票的 4.20%。20.72% 的股票由對沖基金和其他機構投資者持有。

關於 Generation Income Properties

(獲取免費報告)

Generation Income Properties, Inc.位於佛羅里達州坦帕,是一家內部管理的房地產投資信託,旨在直接和共同收購和擁有專注於零售、辦公和工業淨租賃物業的房地產投資,主要集中在高密度人口的子市場。

精選故事

- 五隻我們更看好的股票,勝過 Generation Income Properties

- 澳大利亞證券交易所(ASX)是什麼

- 身份安全能否推動 CrowdStrike 的下一個增長階段?

- 在 52 周高點盈利交易股票

- 博通被納入蘋果 1000 億美元的美國投資計劃

- 如何投資科技股及值得考慮的頂級科技股

- Salesforce 為何現在是個便宜的選擇

此即時新聞提醒由敍述科學技術和來自 InsiderTrades.com 的金融數據生成,以便為讀者提供最快和最準確的報道。此故事在發佈前已由 InsiderTrades.com 的編輯團隊審核。如對該故事有任何問題或意見,請發送至 [email protected].

Generation Income Properties 的內部買賣情況?

註冊接收 InsiderTrades.com 關於 Generation Income Properties 及相關公司的每日內部買賣報告。

來自我們的合作伙伴

一家小公司剛剛解決了谷歌 190 億美元的問題

谷歌的人工智能搜索每年可能花費 200 億美元電費——幾乎是其利潤的一半。但新的研究...

真正的市場內部人士

[毫無疑問的黃金投資]: “給我一個更好的投資。”

一項歷史性的黃金公告即將震撼華爾街?幾個月來,敏鋭的分析師一直在關注...

黃金投資組合

美國將在 9 月 30 日對中國採取行動?

白宮剛剛命令超過 400 個政府機構為美國經濟的下一個階段做好準備...

Stansberry Research

我信任特朗普卻遭受損失

Porter Stansberry 表示他犯了一個錯誤——現在數百萬美國人可能要為此付出代價。在警告之後...

Porter & Company

每個人都在關注英偉達。這裏是我興奮的原因。

所以,除非你一直生活在岩石下,否則你可能已經看到了這個消息……英偉達剛剛簽署了一項價值 70 億美元的交易...

Timothy Sykes

但這家 20 美元的美國公司可能掌握着秘密

“不可能” 的芯片,純光運行,谷歌的量子計算機震驚了世界……但中國的 DEMO...

牛津俱樂部

每月生成高達 $5,000,所需資金少 10 倍?

退休而不需要百萬美元的養老金的秘密。我説的是生成足夠的每月收入...

投資者小巷

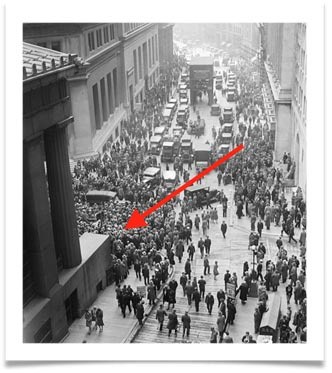

看看這張圖片...

一個奇怪的投資秘密——在這張圖片拍攝前的幾周內發現——正確預測了...

韋斯評級