Upwork (NASDAQ:UPWK) CAO Olivier Marie Sells 1,686 Shares

Upwork Inc. CAO Olivier Marie sold 1,686 shares of the company's stock on August 19th for $23,401.68, reducing his ownership by 69.27%. Following the sale, he holds 748 shares valued at approximately $10,382.24. This transaction is part of a series of recent sales by Marie. Upwork's stock opened at $14.79, with a market cap of $1.96 billion and a P/E ratio of 8.50. The company reported earnings of $0.35 per share, exceeding estimates, and has seen significant institutional investment activity.

Upwork Inc. (NASDAQ:UPWK - Get Free Report) CAO Olivier Marie sold 1,686 shares of the firm's stock in a transaction on Tuesday, August 19th. The stock was sold at an average price of $13.88, for a total transaction of $23,401.68. Following the completion of the sale, the chief accounting officer owned 748 shares in the company, valued at approximately $10,382.24. The trade was a 69.27% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link.

Upwork Inc. (NASDAQ:UPWK - Get Free Report) CAO Olivier Marie sold 1,686 shares of the firm's stock in a transaction on Tuesday, August 19th. The stock was sold at an average price of $13.88, for a total transaction of $23,401.68. Following the completion of the sale, the chief accounting officer owned 748 shares in the company, valued at approximately $10,382.24. The trade was a 69.27% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link.

- Upwork's Earnings Beat Fuels Stock Rally—Is Freelancing Booming?

Olivier Marie also recently made the following trade(s):

- On Monday, August 18th, Olivier Marie sold 941 shares of Upwork stock. The stock was sold at an average price of $13.84, for a total transaction of $13,023.44.

- On Thursday, August 14th, Olivier Marie sold 1,294 shares of Upwork stock. The stock was sold at an average price of $14.00, for a total transaction of $18,116.00.

- On Monday, June 23rd, Olivier Marie sold 1,842 shares of Upwork stock. The stock was sold at an average price of $13.24, for a total transaction of $24,388.08.

- On Friday, June 20th, Olivier Marie sold 748 shares of Upwork stock. The stock was sold at an average price of $13.24, for a total transaction of $9,903.52.

- On Wednesday, June 18th, Olivier Marie sold 1,879 shares of Upwork stock. The stock was sold at an average price of $13.50, for a total transaction of $25,366.50.

Upwork Stock Up 4.2%

UPWK opened at $14.79 on Friday. Upwork Inc. has a fifty-two week low of $8.90 and a fifty-two week high of $18.14. The company has a debt-to-equity ratio of 0.59, a current ratio of 3.36 and a quick ratio of 3.36. The firm's fifty day moving average price is $13.30 and its two-hundred day moving average price is $14.14. The company has a market capitalization of $1.96 billion, a P/E ratio of 8.50 and a beta of 1.38.

- 3 Top Stocks Crushing Q3 Earnings With Strong 2024 Guidance

Upwork (NASDAQ:UPWK - Get Free Report) last posted its quarterly earnings results on Wednesday, August 6th. The company reported $0.35 earnings per share for the quarter, topping analysts' consensus estimates of $0.26 by $0.09. Upwork had a net margin of 31.75% and a return on equity of 44.83%. The firm had revenue of $194.94 million for the quarter, compared to the consensus estimate of $187.56 million. During the same quarter in the previous year, the company earned $0.26 earnings per share. The business's revenue was up .9% compared to the same quarter last year. On average, analysts anticipate that Upwork Inc. will post 0.84 EPS for the current year.

Institutional Inflows and Outflows

A number of institutional investors have recently made changes to their positions in UPWK. Elevation Point Wealth Partners LLC bought a new position in shares of Upwork in the second quarter valued at about $30,000. LRI Investments LLC raised its holdings in shares of Upwork by 415.9% in the second quarter. LRI Investments LLC now owns 2,528 shares of the company's stock valued at $34,000 after buying an additional 2,038 shares during the last quarter. EMC Capital Management bought a new position in shares of Upwork in the second quarter valued at about $45,000. EverSource Wealth Advisors LLC raised its holdings in shares of Upwork by 19,361.1% in the second quarter. EverSource Wealth Advisors LLC now owns 3,503 shares of the company's stock valued at $47,000 after buying an additional 3,485 shares during the last quarter. Finally, IFP Advisors Inc raised its holdings in shares of Upwork by 3,492.8% in the first quarter. IFP Advisors Inc now owns 3,988 shares of the company's stock valued at $52,000 after buying an additional 3,877 shares during the last quarter. 77.71% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

- Upwork Fortifies Profitability Plan With Raised Q3 Forecasts

A number of equities research analysts have weighed in on the stock. Wall Street Zen downgraded shares of Upwork from a "strong-buy" rating to a "buy" rating in a research note on Saturday, August 9th. JMP Securities lifted their price objective on Upwork from $18.00 to $20.00 and gave the company a "market outperform" rating in a report on Friday, May 16th. Royal Bank Of Canada reissued a "sector perform" rating and set a $18.00 price objective on shares of Upwork in a report on Monday, June 2nd. Needham & Company LLC reissued a "buy" rating and set a $19.00 price objective on shares of Upwork in a report on Tuesday, May 6th. Finally, Citigroup reissued an "outperform" rating on shares of Upwork in a report on Friday, May 16th. Eight investment analysts have rated the stock with a Buy rating and four have assigned a Hold rating to the company. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $18.67.

Get Our Latest Stock Report on UPWK

About Upwork

(Get Free Report)

Upwork Inc, together with its subsidiaries, operates a work marketplace that connects businesses with various independent professionals and agencies in the United States, India, the Philippines, and internationally. The company's work marketplace provides access to talent with various skills across a range of categories, including administrative support, sales and marketing, design and creative, and customer service, as well as web, mobile, and software development.

Featured Stories

- Five stocks we like better than Upwork

- What is the MACD Indicator and How to Use it in Your Trading

- Can Identity Security Fuel CrowdStrike’s Next Growth Phase?

- What Are Dividend Challengers?

- Broadcom Named in Apple’s $100B U.S. Investment Plan

- 3 Healthcare Dividend Stocks to Buy

- 3 Reasons Salesforce Is a Bargain Right Now

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].

Insider Buying or Selling at Upwork?

Sign-up to receive InsiderTrades.com's daily insider buying and selling report for Upwork and related companies.

From Our Partners

One tiny company just cracked Google’s $19B problem

Google’s AI-powered search could cost $20 billion a year in electricity—nearly half its profits. But new resea...

True Market Insiders

[No Brainer Gold Play]: “Show me a better investment.”

A Historic Gold Announcement Is About to Rock Wall Street? For months, sharp-eyed analysts have watched the...

Golden Portfolio

US attacks China, September 30?

The White House just ordered more than 400 government agencies to prepare for the next phase of America’s econ...

Stansberry Research

I trusted Trump and got screwed

Porter Stansberry says he got one thing wrong—and now millions of Americans could pay the price. After warning...

Porter & Company

Everyone’s watching Nvidia right now. Here’s why I’m excited.

So, unless you’ve been living under a rock, you probably saw the news… Nvidia just signed a $7 BILLION deal...

Timothy Sykes

But this $20 American company could control the secret

The "Impossible" Chip That Runs on Pure Light Google's quantum computer shocked the world... but China DEMO...

The Oxford Club

Generate up to $5,000/month with 10X less money?

The secret to retiring without a million-dollar nest egg. I'm talking about generating enough monthly inco...

Investors Alley

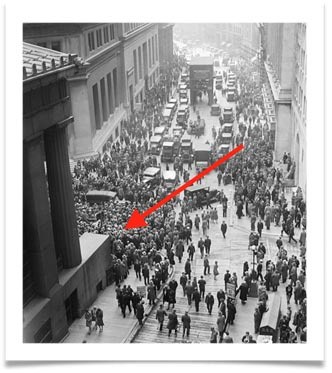

Take a look at this picture ...

A strange investment secret — discovered just a few short weeks before this image was taken — correctly predic...

Weiss Ratings