Nektar Therapeutics (NASDAQ:NKTR) Insider Mark Andrew Wilson Sells 676 Shares

Nektar Therapeutics 的內部人士 Mark Andrew Wilson 以每股 26.59 美元的價格出售了 676 股,總計 17,974.84 美元,導致其持股比例減少 3.22%。出售後,他持有 20,312 股,價值 540,096.08 美元。該交易已向美國證券交易委員會(SEC)披露。Nektar 的股票開盤價為 28.00 美元,市值為 5.3256 億美元,市盈率為 -3.18。公司報告的季度每股收益為(2.95 美元),超出預期,收入為 1,118 萬美元。分析師對該股給予中性買入評級,平均目標價為 88.33 美元

Nektar Therapeutics(納斯達克代碼:NKTR - 獲取免費報告)內部人士 Mark Andrew Wilson 於 8 月 19 日(星期二)出售了 676 股公司股票,交易價格為每股平均 26.59 美元,總價值為 17,974.84 美元。出售後,該內部人士在公司持有 20,312 股,價值 540,096.08 美元。此次交易使其持股減少了 3.22%。該出售在向美國證券交易委員會(SEC)提交的法律文件中披露,文件可通過此鏈接查看。

Nektar Therapeutics 股票表現

- 3 只具有爆炸性增長趨勢的生物科技股票

NKTR 股票在週五開盤價為 28.00 美元。Nektar Therapeutics 的 52 周最低價為 6.45 美元,52 周最高價為 37.38 美元。該公司的市值為 5.3256 億美元,市盈率為-3.18,貝塔值為 0.95。該股票的 50 日簡單移動平均線為 22.50 美元,200 日簡單移動平均線為 14.96 美元。

Nektar Therapeutics(納斯達克代碼:NKTR - 獲取免費報告)最近於 8 月 7 日(星期四)發佈了其財報。這家生物製藥公司報告本季度每股收益(EPS)為-2.95 美元,超出分析師一致預期的-3.13 美元,超出幅度為 0.18 美元。Nektar Therapeutics 的股本回報率為-631.43%,淨利潤率為-163.17%。該公司本季度的收入為 1118 萬美元,而一致預期為 942 萬美元。整體來看,股票分析師預測 Nektar Therapeutics 在當前年度的每股收益為-0.72 美元。

對 Nektar Therapeutics 的對沖基金看法

- 生物科技催化劑警報:NKTR、CDTX 和 WGS 大幅上漲

幾家對沖基金最近買入和賣出了該公司的股票。摩根大通在第四季度將其在 Nektar Therapeutics 的持倉增加了 29.5%。摩根大通目前持有 1,182,995 股該生物製藥公司的股票,價值 1,100,000 美元,此前在上個季度又購買了 269,695 股。富國銀行在第四季度將其在 Nektar Therapeutics 的持股增加了 26.5%。富國銀行目前持有 108,975 股該生物製藥公司的股票,價值 101,000 美元,此前在上個季度又收購了 22,822 股。文藝復興科技公司在第四季度將其在 Nektar Therapeutics 的股份增加了 17.5%。文藝復興科技公司目前持有 3,910,786 股該生物製藥公司的股票,價值 3,637,000 美元,此前在上個季度又購買了 583,153 股。XTX Topco Ltd 在第四季度將其在 Nektar Therapeutics 的股份增加了 595.8%。XTX Topco Ltd 目前持有 244,701 股該生物製藥公司的股票,價值 228,000 美元,此前在上個季度又購買了 209,531 股。最後,Harvest Investment Services LLC 在第四季度收購了 Nektar Therapeutics 的新股份,價值約 27,000 美元。機構投資者和對沖基金持有該公司 75.88% 的股票。

分析師設定新目標價

多家研究分析師對該公司發佈了報告。BTIG Research 將 Nektar Therapeutics 的目標價從 60.00 美元上調至 100.00 美元,並在 6 月 24 日的報告中給予該公司 “買入” 評級。B. Riley 將 Nektar Therapeutics 的目標價從 60.00 美元上調至 85.00 美元,並在 7 月 8 日的報告中給予該公司 “買入” 評級。William Blair 在 5 月 12 日的報告中重申了對 Nektar Therapeutics 股票的 “市場表現” 評級。HC Wainwright 在 6 月 24 日的研究報告中將 Nektar Therapeutics 的目標價上調至 120.00 美元,並給予該公司 “買入” 評級。最後,華爾街 Zen 在 5 月 14 日的研究報告中將 Nektar Therapeutics 的評級從 “持有” 下調至 “賣出”。六位股票研究分析師對該股票給予 “買入” 評級,一位分析師給予 “持有” 評級。根據 MarketBeat.com 的數據,該公司目前的平均評級為 “適度買入”,平均目標價為 88.33 美元。

- Nektar 因藥物試驗數據上漲 157%——還能再漲嗎?

查看我們對 NKTR 的最新分析

關於 Nektar Therapeutics

(獲取免費報告)

Nektar Therapeutics 是一家生物製藥公司,專注於在美國及國際上發現和開發免疫治療領域的藥物。該公司正在開發 rezpegaldesleukin,這是一種細胞因子 Treg 刺激劑,目前正在進行系統性紅斑狼瘡和潰瘍性結腸炎的二期臨牀試驗,以及針對特應性皮炎和銀屑病的二期 b 臨牀試驗;以及 NKTR-255,這是一種 IL-15 受體激動劑,目前正在進行一項一階段臨牀試驗,以增強免疫系統對抗癌症的自然能力。

進一步閲讀

- 五隻我們更看好的股票超過 Nektar Therapeutics

- 賣空 - 利與弊

- 身份安全能否推動 CrowdStrike 的下一個增長階段?

- 什麼是分紅成就者?簡介

- 博通被納入蘋果 1000 億美元的美國投資計劃

- 為什麼這些公司被認為是藍籌股?

- 3 個理由説明 Salesforce 現在是個便宜的選擇

此即時新聞提醒由敍述科學技術和來自 InsiderTrades.com 的金融數據生成,以便為讀者提供最快和最準確的報道。此故事在發佈前已由 InsiderTrades.com 的編輯團隊審核。如對該故事有任何問題或意見,請發送至 [email protected].

Nektar Therapeutics 的內部買入或賣出情況?

註冊以接收 InsiderTrades.com 關於 Nektar Therapeutics 及相關公司的每日內部買入和賣出報告。

來自我們的合作伙伴

一家小公司剛剛解決了谷歌 190 億美元的問題

谷歌的人工智能搜索每年可能耗費 200 億美元的電力——幾乎是其利潤的一半。但新的研究...

真正的市場內部人士

[顯而易見的黃金投資]: “給我一個更好的投資。”

一項歷史性的黃金公告即將震撼華爾街?幾個月來,敏鋭的分析師們一直在關注...

黃金投資組合

美國在 9 月 30 日對中國發動攻擊?

白宮剛剛命令超過 400 個政府機構為美國經濟的下一個階段做好準備...

斯坦斯貝里研究

我信任特朗普卻被坑了

波特·斯坦斯貝里説他錯了一件事——現在數百萬美國人可能要為此付出代價。在警告後...

波特與公司

現在每個人都在關注英偉達。這就是我興奮的原因。

所以,除非你一直生活在岩石下,否則你可能已經看到新聞… 英偉達剛剛簽署了一項價值 70 億美元的交易...

蒂莫西·賽克斯

但這家 20 美元的美國公司可能掌控着秘密

“不可能” 的芯片,純光運行 谷歌的量子計算機震驚了世界...但中國的演示...

牛津俱樂部

每月生成高達 5000 美元,資金少 10 倍?

退休而不需要百萬美元的秘密。我説的是產生足夠的每月收入...

投資者小巷

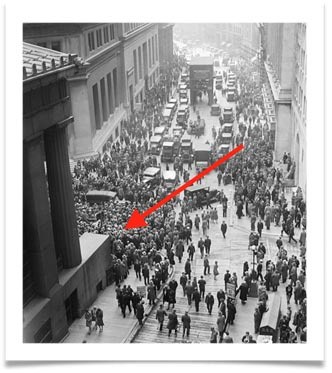

看看這張圖片...

一個奇怪的投資秘密——在這張圖片拍攝前幾周發現——正確預測了...

韋斯評級