先科电子预计将报告更高的第二季度收益;在收益电话会议之前,这些最准确的分析师已修订了预测

Semtech Corporation (NASDAQ:SMTC) is set to report Q2 earnings on Aug. 25, with expectations of 40 cents per share, up from 11 cents last year. Projected revenue is $256.06 million, compared to $215.35 million a year prior. Analysts have revised their ratings, with Stifel maintaining a Buy and raising the price target to $54, while Morgan Stanley increased theirs to $43. Other analysts also reiterated Buy ratings with varying price targets, reflecting positive sentiment ahead of the earnings call.

Semtech Corporation (NASDAQ:SMTC) will release financial results for the second quarter after the closing bell on Monday, Aug. 25.

Analysts expect the Camarillo, California-based company to report quarterly earnings at 40 cents per share, up from 11 cents per share in the year-ago period. Semtech projects to report quarterly revenue at $256.06 million, compared to $215.35 million a year earlier, according to data from Benzinga Pro.

On May 27, Semtech posted better-than-expected first-quarter results.

Semtech shares rose 1.9% to close at $49.39 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

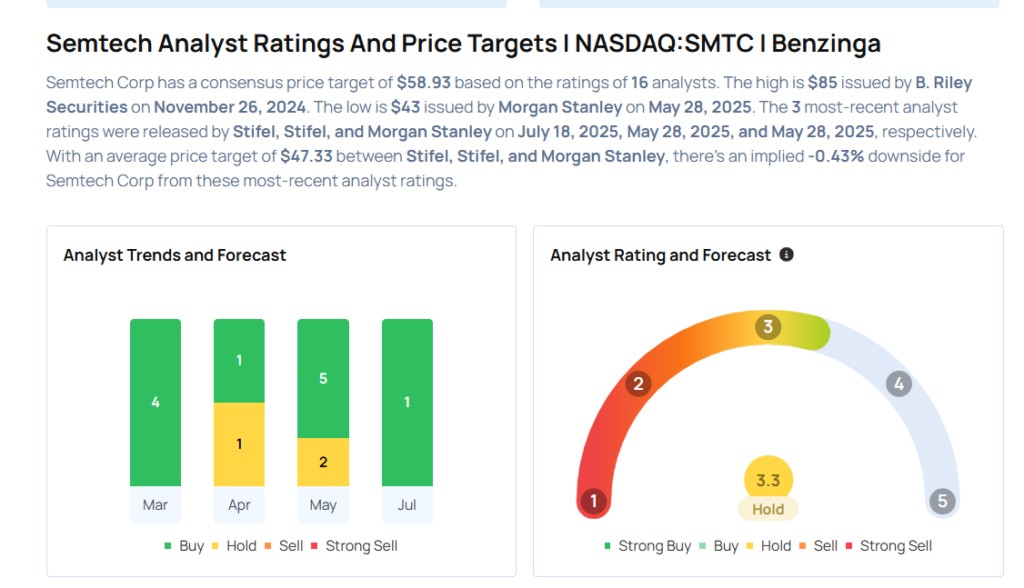

- Stifel analyst Tore Svanberg maintained a Buy rating and increased the price target from $45 to $54 on July 18, 2025. This analyst has an accuracy rate of 79%.

- Morgan Stanley analyst Joseph Moore maintained an Equal-Weight rating and increased the price target from $40 to $43 on May 28, 2025. This analyst has an accuracy rate of 74%.

- Benchmark analyst Cody Acree reiterated a Buy rating with a price target of $68 on May 28, 2025. This analyst has an accuracy rate of 81%.

- Needham analyst Quinn Bolton reiterated a Buy rating with a price target of $54 on May 28, 2025. This analyst has an accuracy rate of 83%.

- Piper Sandler analyst Harsh Kumar reiterated an Overweight rating and slashed the price target from $75 to $55 on Feb. 10, 2025. This analyst has an accuracy rate of 83%.

Considering buying SMTC stock? Here’s what analysts think:

Read This Next:

- Top 2 Financial Stocks You May Want To Dump In Q3

Photo via Shutterstock