Forecasting The Future: 13 Analyst Projections For Lyft

過去三個月,13 位分析師對 Lyft(納斯達克代碼:LYFT)進行了評估,結果顯示出混合的情緒。12 個月的平均目標價為 15.77 美元,比 16.62 美元下降了 5.11%。主要分析師的行動包括富國銀行將目標價上調至 16.00 美元,而 Susquehanna 則將其下調至 14.00 美元。Lyft 的財務健康狀況顯示其市值低於行業平均水平,收入增長率為 10.61%,淨利潤率為 2.54%。該公司在債務管理方面面臨挑戰,債務與股本比率為 1.05,而股本回報率為 5.13%

在最近三個月中,13 位分析師分享了他們對 Lyft(納斯達克:LYFT)的評估,表達了看漲和看跌的不同觀點。

下表提供了他們最近評級的快照,展示了情緒在過去 30 天內的演變,並與前幾個月進行了比較。

| 看漲 | 稍微看漲 | 無所謂 | 稍微看跌 | 看跌 | |

|---|---|---|---|---|---|

| 總評級 | 1 | 2 | 10 | 0 | 0 |

| 過去 30 天 | 0 | 0 | 1 | 0 | 0 |

| 1 個月前 | 0 | 1 | 4 | 0 | 0 |

| 2 個月前 | 0 | 1 | 3 | 0 | 0 |

| 3 個月前 | 1 | 0 | 2 | 0 | 0 |

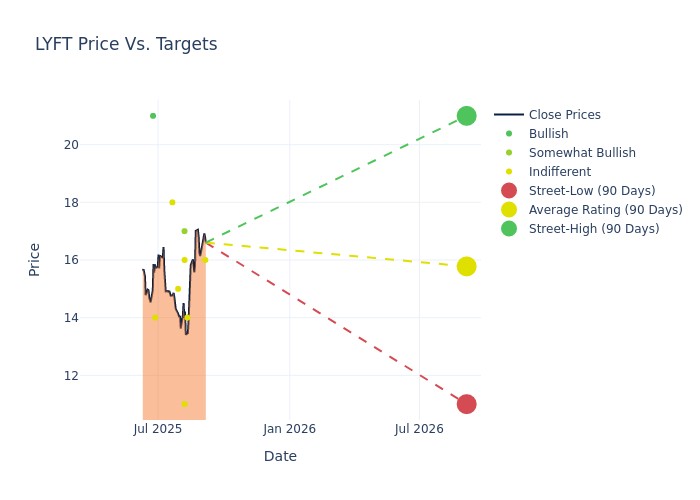

在對 12 個月價格目標的評估中,分析師揭示了對 Lyft 的見解,呈現出平均目標為 15.77 美元,最高估計為 21.00 美元,最低估計為 11.00 美元。當前的平均值比之前的平均價格目標 16.62 美元下降了 5.11%。

解讀分析師評級:詳細分析

對最近分析師行動的分析揭示了金融專家對 Lyft 的看法。以下總結展示了關鍵分析師、他們的最近評估以及對評級和價格目標的調整。

| 分析師 | 分析師公司 | 採取的行動 | 評級 | 當前價格目標 | 之前價格目標 |

|---|---|---|---|---|---|

| Ken Gawrelski | 富國銀行 | 上調 | 持平 | $16.00 | $15.00 |

| Shyam Patil | Susquehanna | 下調 | 中性 | $14.00 | $18.00 |

| Ken Gawrelski | 富國銀行 | 上調 | 持平 | $15.00 | $14.00 |

| George Gianarikas | Canaccord Genuity | 下調 | 持有 | $11.00 | $14.00 |

| Chad Larkin | Oppenheimer | 下調 | 超過市場 | $17.00 | $20.00 |

| Brian Pitz | BMO 資本 | 上調 | 市場表現 | $16.00 | $15.00 |

| Stephen Ju | 瑞銀 | 上調 | 中性 | $15.00 | $14.00 |

| Nikhil Devnani | Bernstein | 上調 | 市場表現 | $18.00 | $16.00 |

| Chad Larkin | Oppenheimer | 上調 | 超過市場 | $20.00 | $17.00 |

| Ken Gawrelski | 富國銀行 | 上調 | 持平 | $14.00 | $13.00 |

| George Gianarikas | Canaccord Genuity | 下調 | 持有 | $14.00 | $22.00 |

| George Gianarikas | 花旗集團 | 下調 | 持有 | $14.00 | $22.00 |

| John Blackledge | TD Cowen | 上調 | 買入 | $21.00 | $16.00 |

關鍵見解:

- 採取的行動: 分析師對市場條件和公司表現的變化作出反應,頻繁更新他們的建議。無論是 “維持”、“上調” 還是 “下調” 他們的立場,反映了他們對 Lyft 最近發展的反應。這些信息提供了分析師對公司當前狀態的看法快照。

- 評級: 分析師提供定性評估,從 “超過市場” 到 “低於市場”。這些評級反映了對 Lyft 相對於更廣泛市場表現的預期。

- 價格目標: 分析師提供對 Lyft 股票未來價值的估計。這種比較揭示了分析師預期隨時間變化的趨勢。

通過理解這些分析師評估及相關財務指標,捕捉 Lyft 市場地位的寶貴見解。保持信息靈通,利用我們的評級表做出戰略決策。

隨時瞭解 Lyft 分析師評級。

深入瞭解 Lyft 的背景

Lyft 是美國和加拿大第二大共享出行服務提供商,通過 Lyft 應用連接乘客和司機。成立於 2013 年,自 2019 年上市以來,Lyft 提供多種私人車輛出行服務,包括傳統私人出行、共享出行和豪華出行。除了共享出行,Lyft 還進入了自行車和滑板車共享市場,為用户提供多模式交通選擇。

關鍵指標:Lyft 的財務健康狀況

市值分析: 該公司的市值水平較低,低於行業平均水平。這表明其相對於同行的規模較小。

收入增長: 在過去的 3 個月中,Lyft 表現積極,截至 2025 年 6 月 30 日實現了 10.61% 的收入增長率。這反映了公司營業收入的顯著增加。與同行相比,該公司的增長率低於工業部門同行的平均水平。

淨利潤率: Lyft 的淨利潤率低於行業平均水平,表明在維持強勁盈利能力方面面臨挑戰。淨利潤率為 2.54%,公司可能在有效成本管理方面面臨困難。

股本回報率(ROE): 該公司的 ROE 表現突出,超過行業平均水平。ROE 為 5.13%,展示了公司對股本資本的有效利用。

資產回報率(ROA): Lyft 的 ROA 低於行業平均水平,表明在有效利用資產方面面臨挑戰。ROA 為 0.73%,公司可能在從資產中產生最佳回報方面面臨困難。

債務管理: 該公司在債務管理方面面臨挑戰,債務與股本比率高於行業平均水平。比率為 1.05,由於財務風險增加,需謹慎對待。

分析師評級:它們是什麼?

在銀行和金融系統領域,分析師專注於特定股票或定義行業的報告。他們的工作包括參加公司電話會議和會議,研究公司財務報表,並與內部人士溝通,以發佈股票的 “分析師評級”。分析師通常每季度評估和評級每隻股票一次。

一些分析師還提供有助於決策的指標預測,如收益、收入和增長估計,以進一步指導如何處理某些股票。需要記住的是,儘管股票和行業分析師是專家,但他們也是人,只能將自己的信念預測給交易者。

分析師現在推薦哪些股票?

Benzinga Edge 讓您即時訪問所有主要的分析師升級、降級和價格目標。按準確性、上漲潛力等進行排序。點擊這裏以領先市場。

本文由 Benzinga 的自動內容引擎生成,並由編輯審核。