Samsung Fire & Marine Insurance's third-largest shareholder exits, Midea announces entry into the insurance industry

“家電巨頭” 正意圖擴大金融版圖。 日前,三星財產保險(中國)有限公司(下稱 “三星財險”)公告公司股權…

“家電巨頭” 正意圖擴大金融版圖。

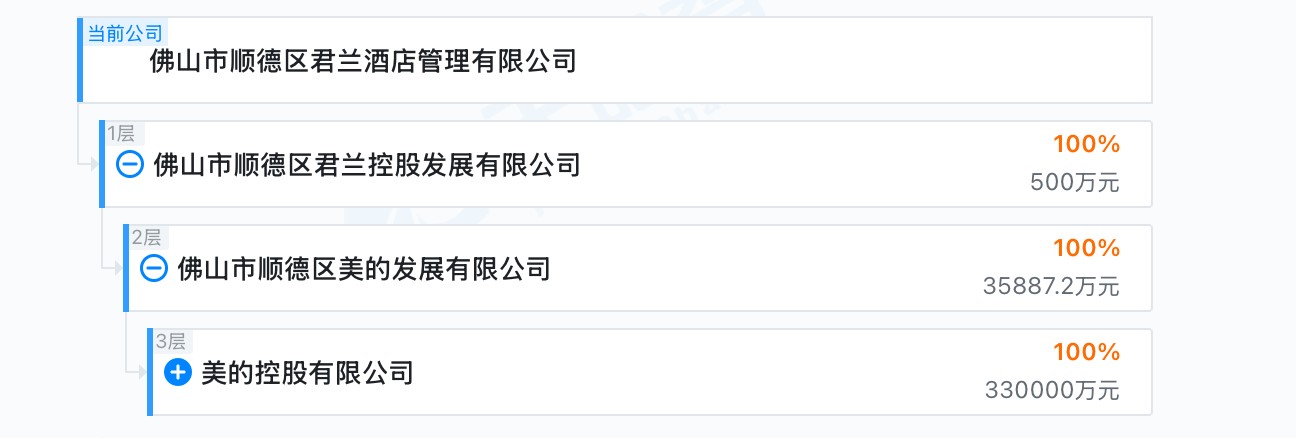

日前,三星財產保險(中國)有限公司(下稱 “三星財險”)公告公司股權變更,披露其第三大股東宇星科技發展(深圳)有限公司(下稱 “宇星科技”)擬清倉手中 11.5% 股權,由新股東佛山市順德區君蘭酒店管理有限公司(下稱 “君蘭酒店”)接手。

股權穿透結果顯示,君蘭酒店的幕後持有者,正是美的集團大股東美的控股。

相較於同業的海爾,“美的系” 在金融領域的佈局稍顯保守,此前雖參股一家銀行,但在證券、保險、信託、消費金融等領域未有涉足。

2014 年,美的集團與下屬子公司美的集團財務共同出資 8.1 億元參與順德農商行定增,直至如今,“美的系” 仍以 9.69% 的持股比例穩坐該行第一大股東席位;

美的集團入股 5 年後,順德農商行曾向證監會申報深主板 IPO、後平移至深交所審核,至 2025 年 7 月,該行在排隊 6 年無果後已主動撤回 IPO 申請。

2018 年後,市場頻有美的集團進軍消費金融的消息流出,美的金融也曾招聘消費金融副總經理,職責範圍包括制定消金公司(籌備)發展戰略並組織執行;

但截至目前,美的集團仍未能拿到融資槓桿更高的消金牌照,只有美的小貸、重慶美的小貸、寧波美的小貸 3 張小貸牌照。

值得一提的是,“美的系” 此前涉足金融領域,均通過美的集團及旗下公司持股;但此次入股三星財險,則是通過美的控股旗下公司進入。

上述股權變更仍待監管機構批准,若美的獲准進入,三星財險的股東實力也將再有增厚。

三星財險前身可追溯至 1995 年設立的韓國三星火災海上保險北京代表處;

2005 年,該代表處完成改制,成為中國首家外資獨資產險公司;

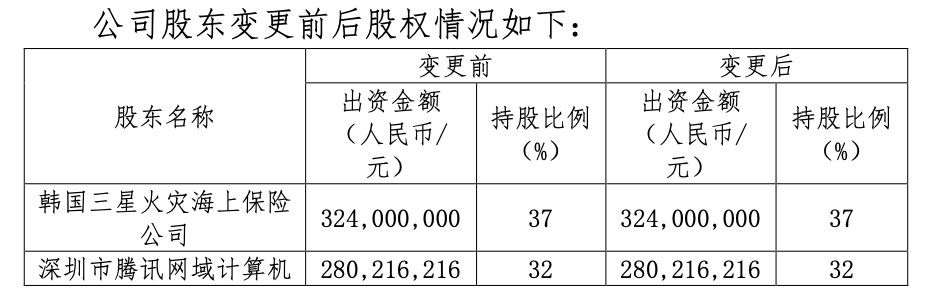

2022 年,三星財險引入騰訊等 5 家新股東完成合資轉型。

三星財險現任董事長任匯川履職前,就身具平安集團高管與騰訊高級顧問雙重履歷;總經理李浩則擁有長達 30 年的保險從業經驗,任職於平安旗下多家子公司。

增資後,韓國三星火災海上保險持股比例維持在 37%,為第一大股東;深圳市騰訊網域計算機網絡持股 32%,為第二大股東;君蘭酒店與曼巴特(張家港)投資發展各持股 11.50%,並列第三大股東。

上半年,三星財險錄得保費收入 12.98 億元、淨利潤 0.69 億元,兩項數據均呈現大幅增長;截至二季度末,核心、綜合償付能力充足率分別為 685.36%、692.92%,遠高於監管要求。