加密新贵 Bullish 获德国 BaFin MiCA 牌照 抢占欧盟加密合规运营先机

Bullish 在監管領域取得重要進展,其德國子公司獲得德國聯邦金融監管局(BaFin)頒發的牌照,依據歐盟《加密資產市場監管條例》(MiCAR)運營。這使 Bullish 能夠在歐盟合規環境下滿足對數字資產交易的需求。Bullish 的 IPO 表現出色,首日股價上漲 83%,市值達到 73 億美元,顯示出其在加密市場的強勁實力和合規承諾。

智通財經 APP 獲悉,Bullish(BLSH.US) 本週在監管領域取得關鍵進展——其德國子公司依據歐盟《加密資產市場監管條例》(MiCAR) 獲得德國聯邦金融監管局 (BaFin) 頒發的牌照,此舉將助力該公司把握歐洲機構對合規數字資產交易需求的增長機遇。

該牌照賦予 Bullish 在歐盟全境受監管環境下運營的資格,有效回應了市場對合規性與安全性的核心關切。公司總部位於法蘭克福 (歐洲央行所在地),嚴格遵循歐盟最高金融標準,凸顯其合規承諾。

Bullish Exchange 總裁 Chris Tyrer 指出,歐洲作為全球第二大加密資產經濟體,機構對受監管、透明交易場所的需求正快速攀升。

Bullish 的多元硬實力:萬億交易量、IPO 首日漲 83%、持幣 2.4 萬枚

據瞭解,Bullish 的 IPO 成績單足以讓市場側目:首發一口氣募得 11 億美元,首日股價上漲 83%。這家 2021 年才誕生的加密交易所,累計成交量已突破 1.25 萬億美元,如今市值站穩 73 億美元——即便股價較高點回撤逾五成,話題熱度依舊不減。

作為特朗普政府加密友好政策下又一家上市數字資產企業,Bullish 緊隨 Circle(CRCL.US) 與 Galaxy Digital(GLXY.US) 的步伐,其戰略由前紐約證券交易所總裁 Tom Farley 領銜,並獲 Peter Thiel 支持——Farley 早在 2015 年比特幣價格不足 1000 美元時,便將紐交所資產負債表投入 Coinbase(COIN.US),其對區塊鏈潛力的長期信念為 Bullish 注入可信度。

值得一提的是,Bullish 商業模式呈現多元化特徵:覆蓋交易所運營、CoinDesk 數據服務及基於訂閲的流動性產品,且不發行自有數字資產或構建公鏈,避免與機構客户產生利益衝突,這一策略使其在競爭中脱穎而出。

此外,該公司具體運營數據亮眼:2025 年至今日均現貨交易量 25 億美元,衍生品日交易量達 2.48 億美元;CoinDesk 月度用户規模 1070 萬,為超 410 億美元資產管理規模提供基準數據。

財務方面,2024 年實現 8000 萬美元淨收入,2025 年第一季度雖淨虧損 3.49 億美元,但調整後 EBITDA 仍保持 1300 萬美元正數,公司金庫還囤着逾 24,000 枚比特幣,既是對加密長週期的押注,也是一把隨幣價起伏的雙刃劍。

估值方面,據普遍預期顯示,該公司收入預計將從 2025 年的 2.4 億美元增長至 2027 年的 3.61 億美元,其調整後每股收益也將從 2025 年的 0.11 美元提升至 2027 年的 0.85 美元。

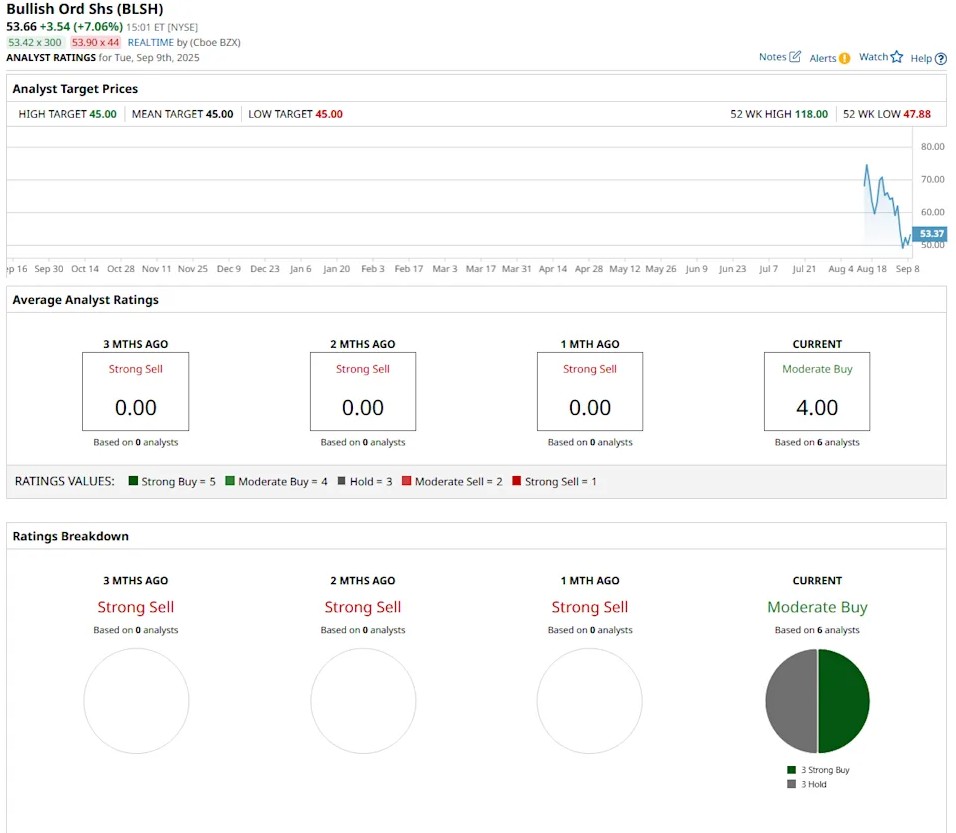

目前跟蹤 Bullish 股票的六位分析師一致給予該股 “中等買入” 評級,並設定 12 個月目標價為 45 美元,這意味着相較於當前股價水平,該股可能存在約 16% 的潛在下跌空間。

這些預測與分析共同勾勒出 Bullish 在加密貨幣市場中的增長軌跡及市場預期,既反映了其業務擴張的潛力,也揭示了當前估值與未來目標之間的差距。